Energy Outlook: Clues to the sector’s future from Ipsos Global Trends

KEY TAKEAWAYS:

- Despite the buzz around renewable energy, it still accounts for only 22% of what’s created in the U.S.

- 72% of Americans and 80% of global citizens think we’re headed for environmental disaster unless we change our habits quickly

- Change is coming in the form of less-carbon intensive practices, but the transition will take time—and there is more change on the horizon

The environmental crisis is real, and consumers are worried about it. It’s easy to look at individual sectors like energy and place the blame on coal-burning power plants, the oil industry, and gas-fueled cars. But we must face some hard truths if we’re to solve this: First, that the energy sector is actually much broader and is interwoven into everything that Americans consume and enabled by government policies (or lack thereof). Second, that innovations we hear about in the media are not the panacea we hoped they would be, due to infrastructure and economic realities. And third, that corporate, governmental or consumer action alone will not solve the sustainability issue; we must work together across areas of responsibility and political divisions to develop ambitious yet realistic solutions.

Change on the horizon

Despite the headlines and buzz around electric vehicles, solar grids, wind farms, and green energy, alternatives to fossil fuels are still a relatively small part of U.S. energy production: 22% of U.S. electricity generation is from renewable sources, according to the most recent data from the U.S. government. Solar power hasn’t taken off enough to make a dent in the country’s energy supply; part of the issue is that limited infrastructure for storing it prevents much of the energy captured from reaching end consumers. And electric vehicles, for example, are still a small portion of vehicle sales due in part to limited charging infrastructure to support them.

Innovation and change are here, but the transition to new forms of energy will not be overnight, and will not happen without challenges.

Early signals

Looking forward, it’s reasonable to expect that fossil fuels will begin to phase out more – recent EU legislation to curb them has been passed, and the EPA is proposing strict vehicle emissions standards that would move the U.S. much further toward electric vehicles over the next decade. Climate accords are being signed, we’re becoming more protective of the environment, we’re phasing out things such as single use plastics, and new innovations are emerging (such as micronuclear reactors powering campuses).

Consumers are also coming to a consensus on climate change overall—in fact, 72% of Americans and 80% of global citizens think we’re headed for environmental disaster unless we change our habits quickly, according to Ipsos’ 2023 Global Trends report. This is consistent across U.S. age groups, education levels, income and working status, and it reflects a major step change in recognizing the critical nature of the environmental crisis.

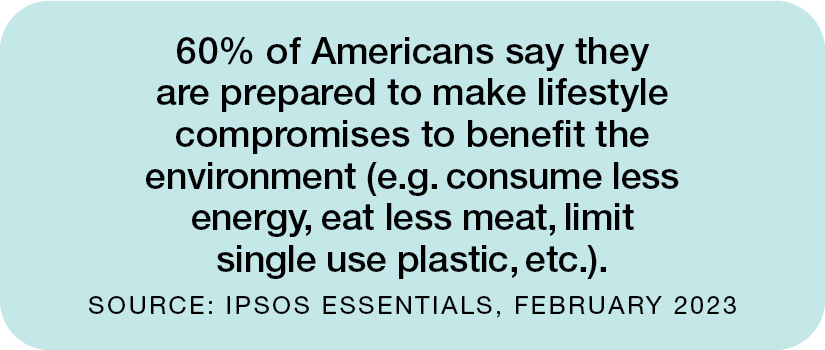

Despite this broad agreement, not all consumers are closing the say-do gap by putting their money where their beliefs are. For example, a recent Ipsos study found that while most Americans agree the environment is a concern, 31% think there is still time to act, versus 35% who think we must act now (Ipsos Essentials, February 2023). As attitudes and culture shift over time, sustainability demands will likely impact more industries in stronger ways—including the energy sector.

What comes next

So what can we expect for the energy industry in the next two to five years? Four of the macro forces from the 2023 Ipsos Global Trends can act as lenses for the future:

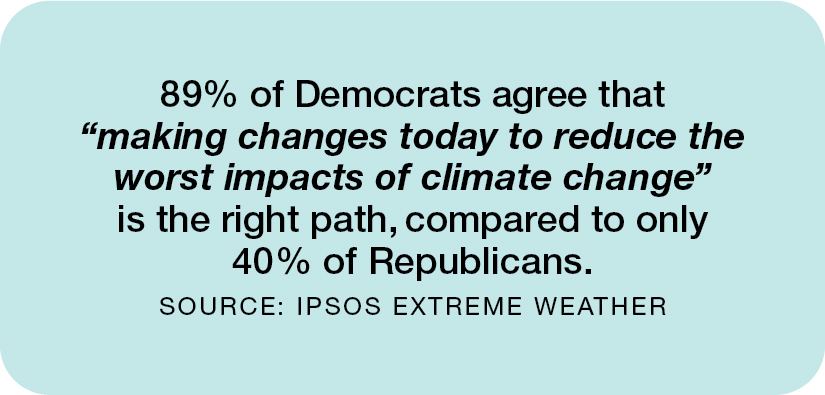

Geo-political conflicts: Energy has been front and center during the war in Ukraine, with greater focus on the impact that conflict can have on destabilizing markets far from the battlefield. Energy independence will need to be a critical component of national security moving forward, especially given extreme heat waves’ demands on the power grid. But Americans with differing political views don’t agree on a path forward.

Alternative value structures: Increasingly, what we value is changing from a focus on “me” to a focus on “we” as Americans reckon with the real-world impacts of climate change and natural disasters. This can manifest as changing specific behaviors and purchases to align with personal values, or a bigger lifestyle change such rejecting consumerist culture in favor of sustainability.

Employee power shift: Inside many organizations, employees are also pushing for leadership to make decisions that reduce their impacts on the environment. Not doing so—or worse, greenwashing—may impact recruitment and retention in a world where employees have more leverage and collective power.

Impacts of inflation: Consumers are concerned about inflation and feeling the impact of the cost-of-living crisis, which makes them more price sensitive. Despite this, Americans are becoming more open to buying brands that act responsibly to invest in the long term, even if it means spending a bit more in the short term.

We’re often asked to help businesses envision what’s likely to happen in the future, and we use tools like Ipsos Global Trends and macro forces as a starting point to broaden clients’ perspective, providing a wide-angle lens to consider what’s happening in the world around us and the potential impact on their business.

Help your teams plan for the future: Download the full report at IpsosGlobalTrends.com, and contact us to learn more about how you can leverage the tools, data and insights it contains.

![[WEBINAR] Changing Focus: How 2026 will be different for global Influentials and Company Leaders](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-0305-Influentials.jpg?itok=ZWeDU7Op)

![[WEBINAR] 2026 KEYS: Battle for Attention](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-keys-Battle-Attention_0.jpg?itok=ftV-emtI)