Expectations for a Swift Recovery Depend A Lot on If You’ve Been Shielded from the Downturn

What you need to know:

- Americans are split on how fast the economy will recover once restrictions are lifted, with about half predicting a speedy return to normal and another half forecasting a slower pickup.

- Historically high unemployment rates have little bearing on consumer confidence levels overall, underscoring that many believe that the current situation is temporary and will quickly correct to course once the economy restarts.

- Unemployment is dampening some expectations, with unemployed Americans less optimistic about the future of the economy. States where unemployment numbers rose the most are least optimistic about a quick rebound once restrictions lift.

Deep Dive:

It’s a period of economic instability unprecedented in modern American history. Since the lockdown began, more than 41 million Americans have filed for unemployment. Businesses are shuttered or teetering on the brink of insolvency. With economic pressures mounting, the nation is taking the calculated risk of opening up again, state by state, ready or not.

Despite the instability still swirling around them, many Americans are optimistic about the future. While views on the state of the economy, jobs, and investments in the Ipsos Consumer Confidence Index dropped precipitously during the rocky last two months, expectations for the future stayed remarkably stable.

Those undampened expectations underscore that Americans are split on the question of how fast the economy will bounce back once governments ease restrictions. Nearly half believe that the economy will quickly rebound, while the other half believe we are in for a slow recovery, at 48% and 46% respectively, according to the most recent Ipsos weekly U.S. consumer confidence data.

This discrepancy between unprecedented levels of economic disruption and confidence in a better future suggests that many Americans believe that the current situation is temporary, and that once restrictions are lifted, jobs and the economy will come roaring back. Ipsos/Washington Post polling shows that 77% of those who have lost their jobs believe that they will be rehired by their former employer.

Optimism about the economy generally follows certain demographic lines, an analysis of Ipsos consumer confidence data shows. Partisan differences in expectation stand out the most distinctly, with Republicans holding much higher expectations for a quick recovery than Democrats. There are some regional and gender differences as well, with comparatively more men than women, and more Americans living in the South and West, looking forward to a quick economic rebound.

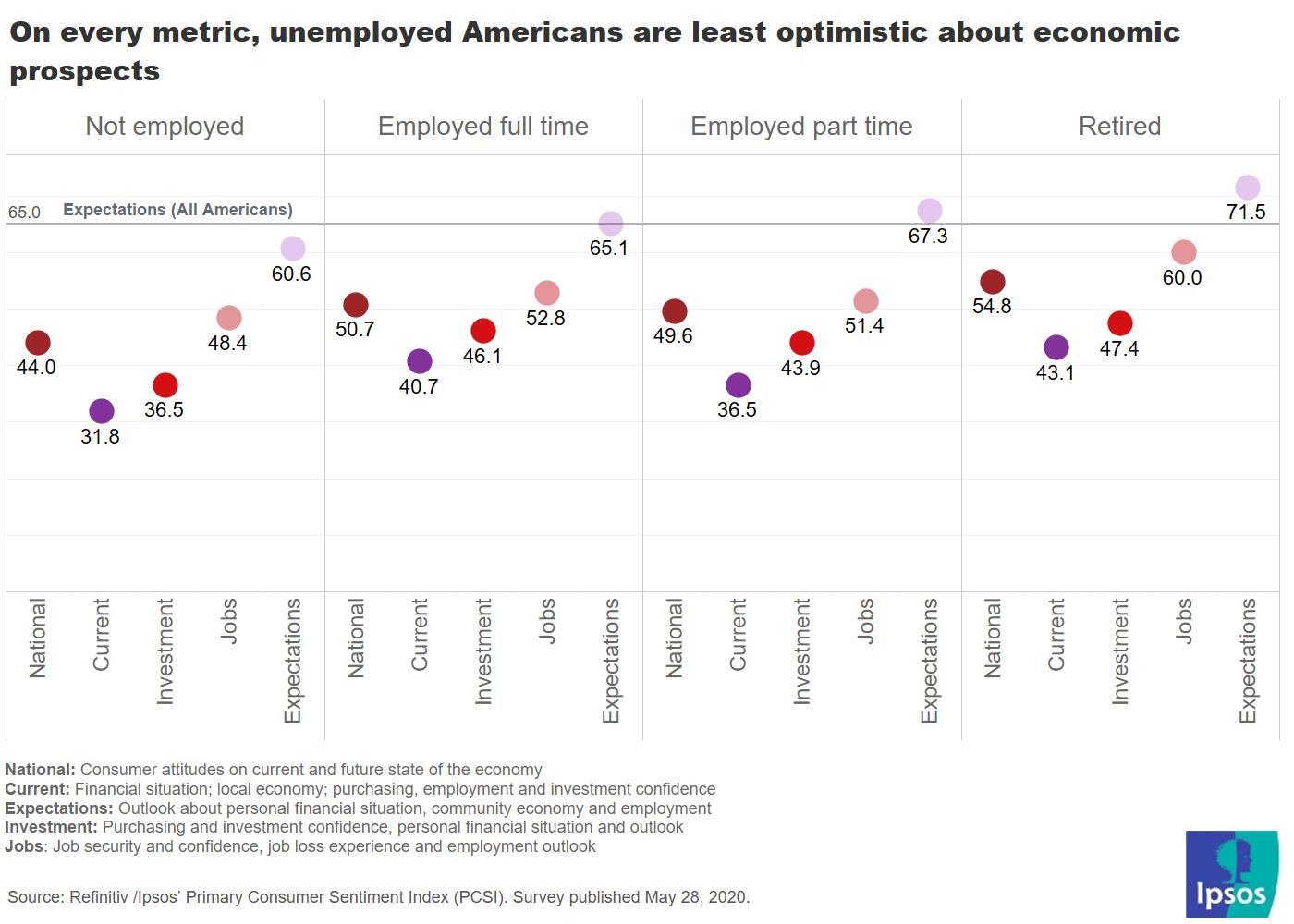

In other areas, optimism is less robust. Unemployed Americans are less confident about their economic prospects on every measure, from jobs and investments, to their expectations for the future and that of the U.S. economy. Ipsos has been tracking monthly consumer confidence indices worldwide since 2002, with weekly tracking initiated in the United States in early March to follow the impact of the spread of the virus.

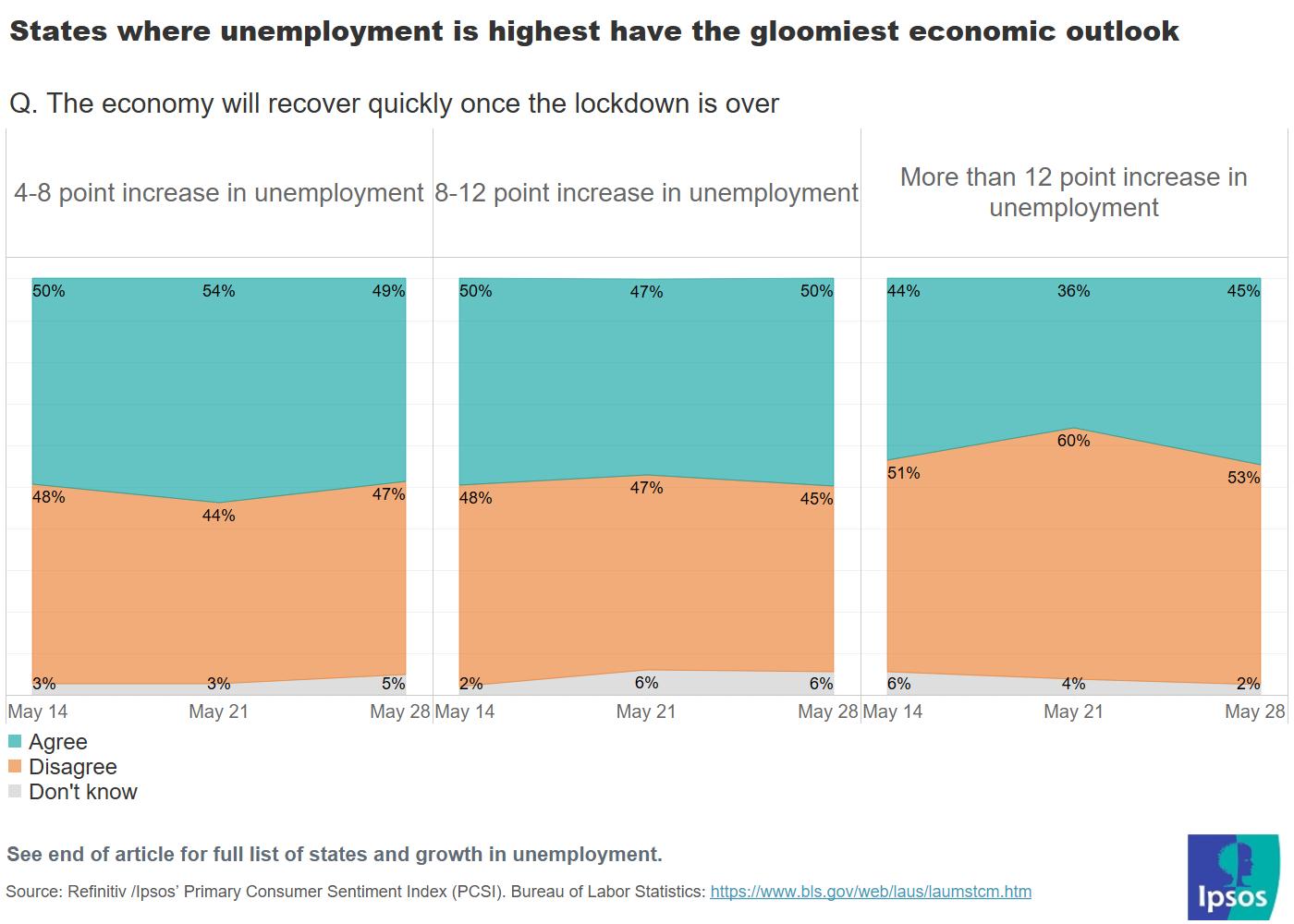

As we’ve seen elsewhere, the pandemic has had an uneven impact on Americans, coloring perceptions and creating stressors for some groups more than others. This is underscored at the state level, where high unemployment levels are dragging down hopes for a quick rebound.

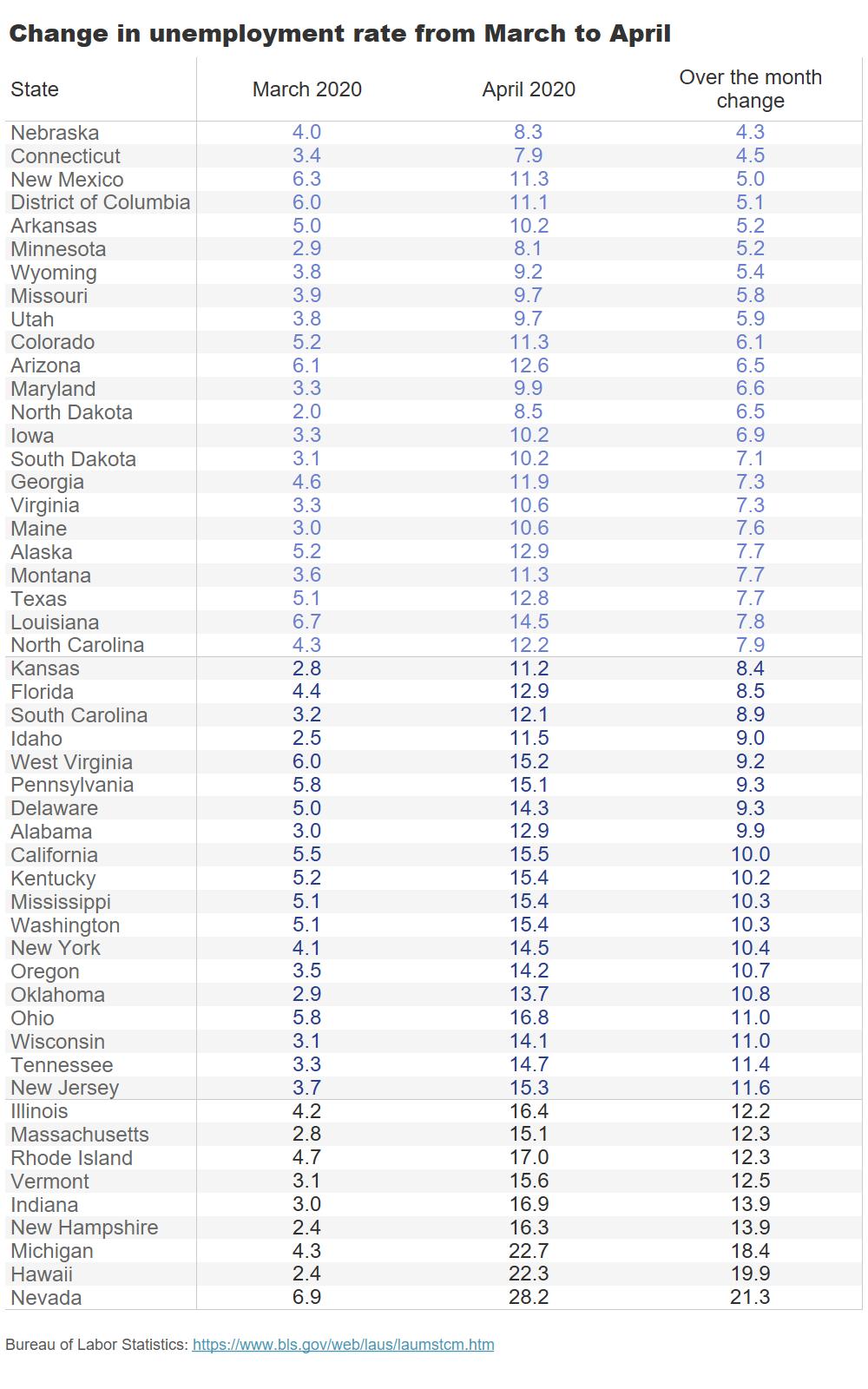

Some states saw unemployment numbers rise by as much as 12 points or more from March to April, according to federal data. The pandemic has been particularly harsh for states like Nevada, Hawaii and Michigan, where approximately one in four are now unemployed. Unsurprisingly, states with the most drastic increase in unemployment are least likely to think the economy will bounce back quickly.

Given all the uncertainties around the future trajectory of the virus, hopes for a quick recovery might prove to be ephemeral. Or, as Cliff Young, president of Ipsos Public Affairs puts it, Americans may be falling prey to an “irrational exuberance.” Differing expectations also underscore how much the individual experience can color perceptions. Job loss is tempering expectations for those who have directly experienced it, while those who have emerged unscathed so far are more hopeful.

Economic forecasts tend to side with those who predict a slower recovery. Many experts do not anticipate a rapid return to normal, or a V-shaped recovery. With social distancing measures still at least partially in force in many areas and people generally more cautious about spending, the underlying economy will likely take some time before it fully bounces back to where it was in February, forecasting a slower, U-shaped recovery.

Much depends on the future trajectory of the virus and how soon a vaccine is developed. If there is a resurgence of the virus, economic recovery could be bumpier. Meanwhile, a vaccine will likely be necessary before people feel safe resuming activities that require gathering en masse, like flying or going to sports games. For now, all signs suggest that a full return to pre-coronavirus activities and spending is a long way off.

Economists also warn that the hoped-for return to old jobs might not become a reality for all workers. With permanent business closures, bankruptcies, and fewer people going to live events or traveling, entire sections of the economy could be weakened for a while.

The end result? There will likely be fewer jobs to go around for some time to come, with economists at the Becker Friedman Institute for Economics at the University of Chicago estimating that 42% of recent layoffs could result in a permanent job loss.

Federal Reserve Chair Jerome Powell offered some cautious optimism in a recent 60 Minutes interview, saying that while recovery might be slow, the situation will improve over time. “In the long run, and even in the medium run, you wouldn't want to bet against the American economy…” The Federal Reserve isn’t making any exact predictions though, with Powell cautioning that it is impossible to know just when the economy will pick back up fully.

“[The recovery] could stretch through the end of next year. We really don't know.”

As business picks up again bit by bit, the following weeks and months will be the ultimate test of whether optimism or pessimism will win out. For the millions who have lost their jobs, a lot is riding on this question.