Shared mobility has its blueprint for the future. Can it execute?

Key Takeaways:

- Shared mobility — defined as the communal usage of transportation services — has an opportunity to capitalize on a shift in mobility preferences due to the rise of delivery services, remote work and concerns about the cost and environmental impact of personal vehicles.

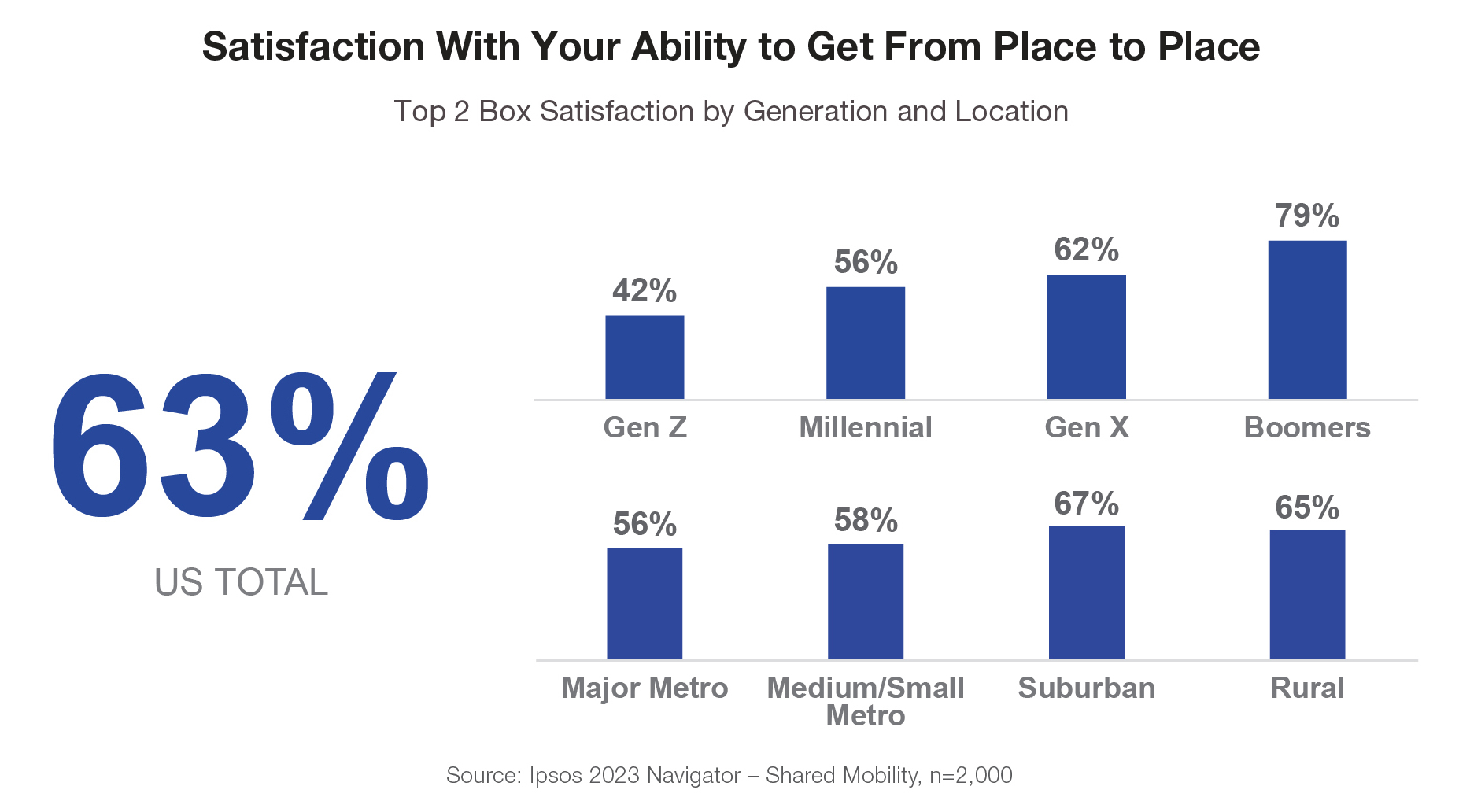

- 37% of people are dissatisfied with their current ability to get from place to place, with younger generations and urban dwellers expressing the most dissatisfaction.

- Despite being the preferred method of travel, usage and future interest in personal vehicles is declining slightly. Interest in alternative mobility modes like ride-hailing, personal bicycles, and long-distance rail travel is on the rise.

- Availability of shared mobility services and the freedom of movement personal vehicles provide are the main obstacles preventing people from considering alternative forms of transportation.

What does it take to supplant a personal vehicle?

The personal vehicle has long been established as the best way to get around in the U.S. The sprawl of American cities has harmonized with the automobile’s historical significance (all the way back to the ubiquity of the Ford Model T) and our ideals rooted in individualism and freedom, which has made it difficult for other mobility modes to emerge despite their own merits.

But there is a shift happening, one that has been latent but slowly growing over years of technological advancement and various societal events. For one, driving is becoming more situational. The rise of on-demand delivery services rooted in convenience has limited the need to use a personal vehicle to transport “things” as opposed to people. The post-pandemic shift to work from home has fewer people commuting, leading to the decline of “trip chaining” — stringing together multiple trips of different purposes and destinations in a single excursion from home or work — and altering daily mobility needs.

Add on the high cost of owning a personal vehicle and its potential harm on the environment, and this should be a prime opportunity for shared mobility services like ride-hailing and public transportation to capitalize and align their greatest advantages to the gaps personal vehicles don’t adequately address.

The current mobility landscape is hardly meeting our needs

According to our Ipsos Navigator study on Shared Mobility, only 63% of our 2,000 U.S. respondents are satisfied with their current ability to get from place to place. Younger generations and urban dwellers are driving this dissatisfaction, with a distinct split between Millennials/Gen Z & Gen X/Boomers, as well as metropolitan areas vs. suburban & rural dwellers.

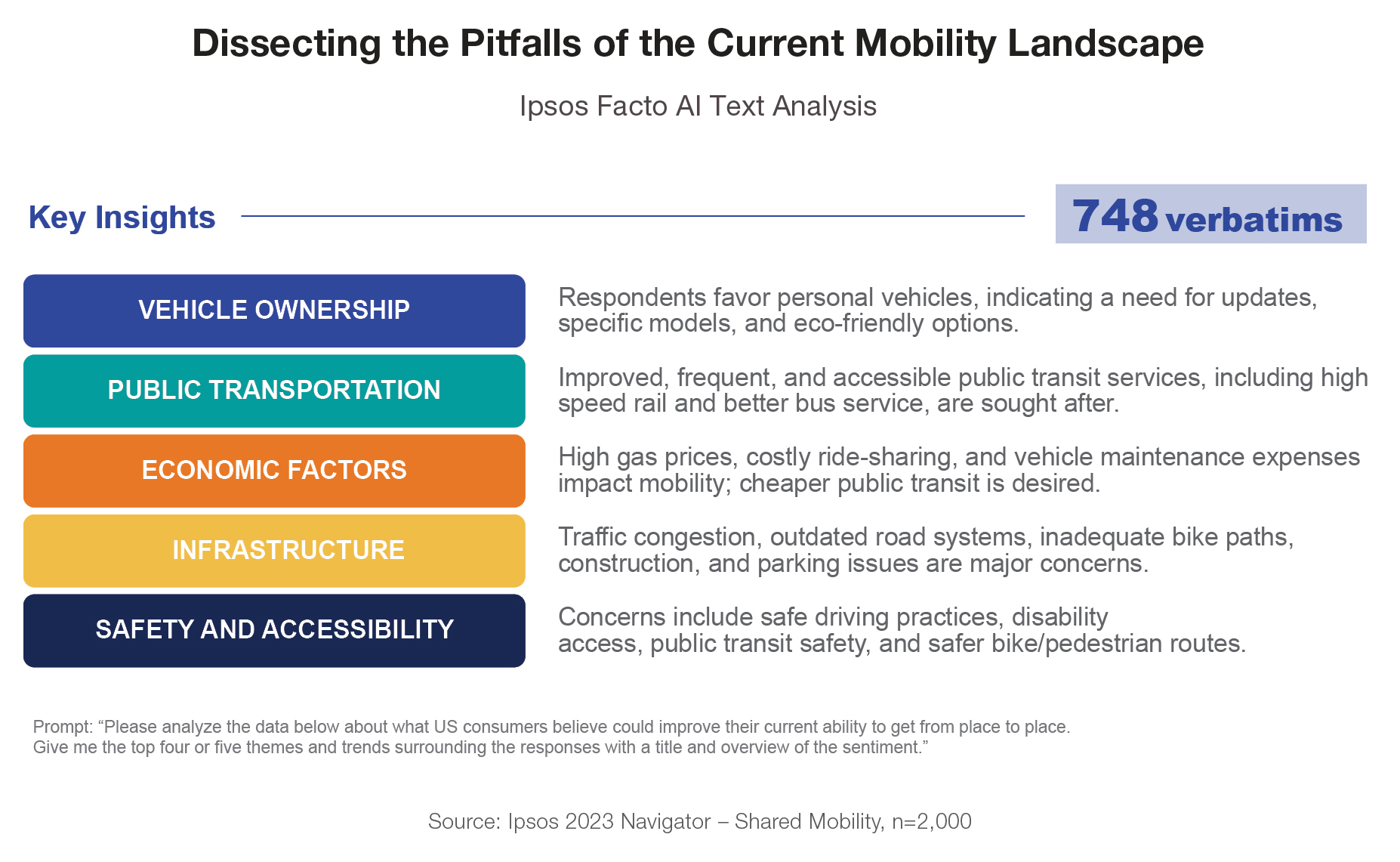

Digging deeper into the current inefficiencies and pitfalls of the current mobility landscape, we analyzed what our respondents said in their own words would improve their satisfaction, leveraging our Ipsos Facto AI tool to condense their answers into five major themes:

These gripes are not limited to just personal vehicles. Each major theme notes a concern related to personally owned transportation, public transportation, and shared mobility services. While various modes of transportation are scrutinized, it does provide a glimpse into how mobility providers can course-correct.

Personal vehicles are still king, but the cracks are beginning to show

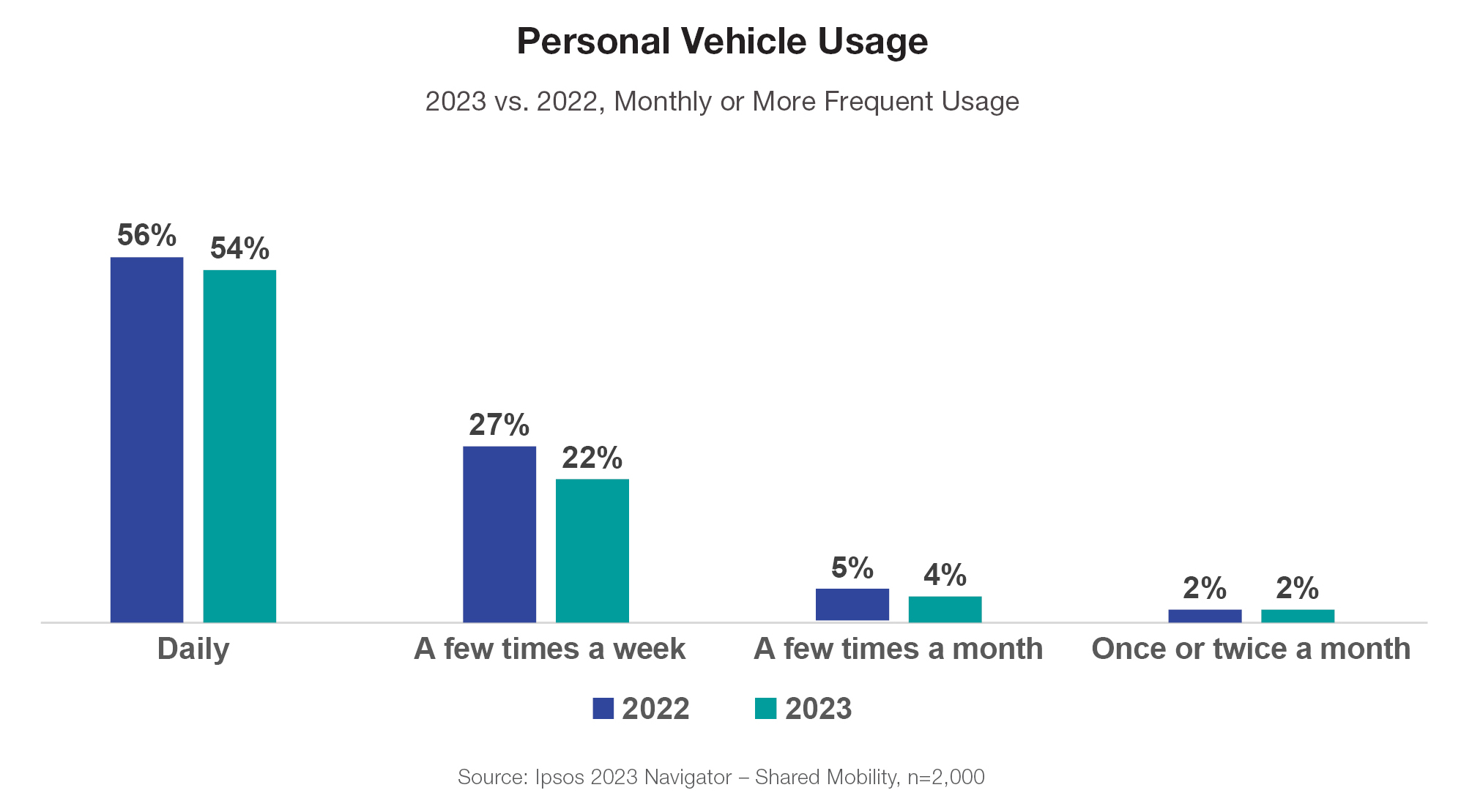

Personal vehicles still do the heavy lifting when it comes to mobility: 92% of respondents state their personal vehicle is their preferred method of travel. However, overall personal vehicle travel is down year over year, opening opportunities for other mobility solutions to carve a path.

82% say they use their personal vehicle on at least a monthly basis, down from 90% last year. And weekly usage of personal vehicles had the largest decline year over year, suggesting that those using their vehicle situationally (i.e., those without a commute) are the main subset that are changing their behavior.

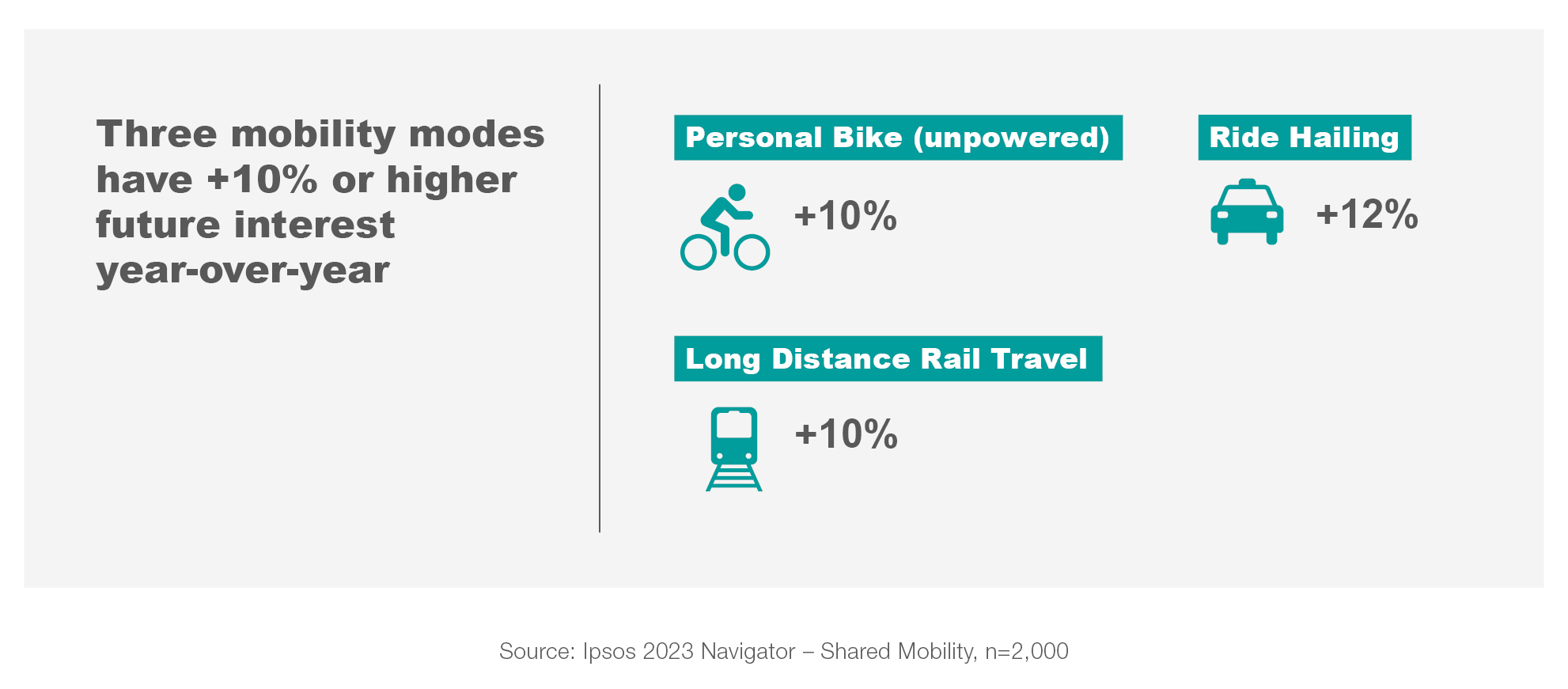

There is a corresponding decline in interest as well: 83% are interested in using a personal vehicle in the future, down from 86% in 2022. Meanwhile, nearly every other mobility mode surveyed, whether public transportation (e.g., buses, subways, etc.), shared mobility services (car sharing, scooter sharing), or personally owned alternatives to personal vehicles (e.g., e-bikes, scooters, etc.) saw increased interest year-over-year.

Most notably, there are three mobility modes with double-digit increases in interest compared to last year: ride-hailing, personal bicycle (unpowered) and long-distance rail travel.

Each of these mobility solutions serves a different need with the potential to supplant a use-case currently occupied by personal vehicles. Bikes provide short-distance travel within neighborhoods, ride-hailing has the flexibility to work within various locations and distances, and long-distance rail offers the opportunity to travel across entire regions without putting wear and tear on a personally owned vehicle.

Now, for this interest to convert to actual usage, these mobility modes must be available to consumers. Currently, alternative mobility is centralized within urban areas and can be leveraged appropriately. But as suburban areas populate further, alternative mobility must expand into those areas optimally to make this hypothetical interest into a preferred solution.

Who would actually ditch personal vehicles alongside this heightened interest in alternative mobility?

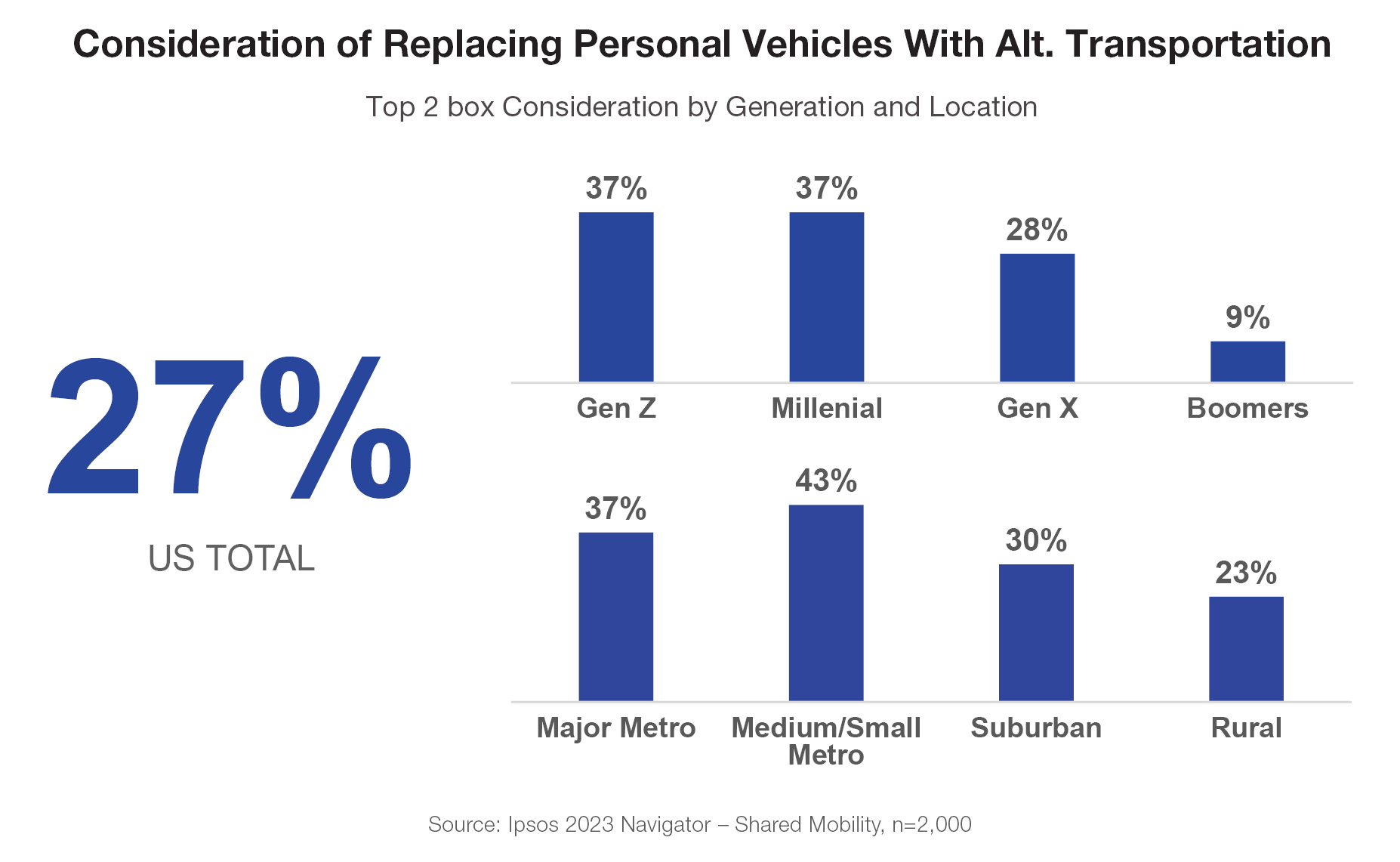

Interest in other modes of mobility is one thing, but considering these types of transportation instead of the personal vehicle is a taller order. 57% of our respondents state they are not opposed to the idea of using alternative modes of transportation instead of their personal vehicle, including 27% that are already considering it. Millennials and Gen Z are more likely to consider supplanting their personal vehicle, as are those in metro/urban environments.

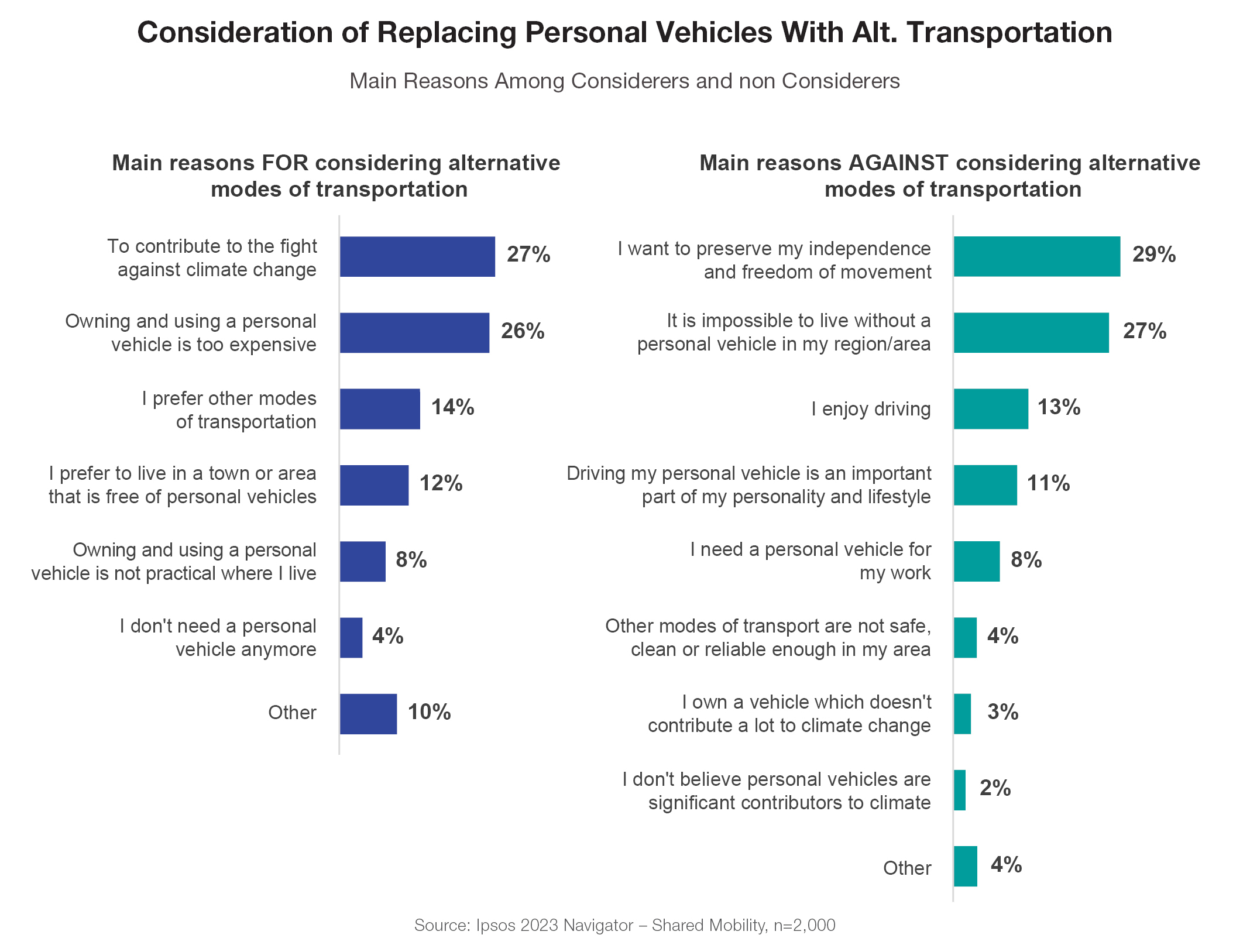

The rationale for these considerers is rooted in two main themes: cost and sustainability. Over 50% of considerers cited either their contribution against climate change or the expensive ownership and usage of a personal vehicle as their main reason of consideration. And among those 73% who are not considering alternative modes of transportation, the majority either say they want to preserve their independence and freedom of movement, or that it is impossible to live without a personal vehicle in their region or area.

This sums up why shared mobility hasn’t yet put a strong dent in personal vehicle usage. The main concepts pushing people away from personal vehicles can be, and hopefully should be, addressed in the future; not only will the emergence of electric vehicles better combat environmental concerns, but their lower cost of ownership could help ease expenses in the car market if their up-front costs can align with the internal combustion engine vehicles we buy today.

Meanwhile, these shared mobility services have often struggled to address the two main reasons against their own consideration: it is near impossible to beat the flexibility of a personal vehicle, and they have not yet made their services adequately available in locations outside city-centers. But if personal vehicle usage continues to decrease, and shared mobility companies can continue to expand beyond metro areas, the corresponding increased interest in alternative mobility suggests we may see a future where a more diverse ecosystem of mobility options, both personally owned and shared, can co-exist and optimize our means of transportation.

Ipsos has your back, measuring the past, present and future:

The mobility industry is evolving. Ipsos is closely monitoring the latest industry trends and offering solutions catered to you. We are here to deliver impactful and actionable insights to keep your brand ahead of the curve.

- Subscribe to our Navigator syndicated study to see the latest U.S. and global trends in electrification, driving technology, and shared mobility. Or reach out to be an early charter subscriber for 2024!

- New offering alongside our Navigator study, Subscribe and get access to our AutoMOTIVES qualitative insights, diving deeper into how car buyers view technology and advanced safety within their vehicle.

- For further reading about the current disruptions and events shaping the industry, read our POV focused on driving technology and how autonomous ride-hailing could steer us toward the future of cars or revisit our on demand webinar.

![[WEBINAR] Global Voices of Experience 2026](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-global-voices-experience.jpg?itok=NN6W-9Ft)

![[WEBINAR] Increasing Efficiencies in Service Delivery in the Public Sector](/sites/default/files/styles/list_item_image/public/ct/event/2025-01/feature_4.png?itok=0fa4kfCx)