Amid the uncertainty of the pandemic, the S of ESG is coming under greater scrutiny

Actions on E, S and G in tandem remain essential to corporate reputation

Companies’ role in creating shared value

Companies are increasingly assessed on the extent to which they bring ‘net benefits’ to society. Especially among the financial community and the media there is a focus on ESG: companies’ performance on Environmental, Social and Governance (ESG) issues that come with doing business. Not just because you ultimately shoot yourself in the foot if you run out of the natural resources you need, treat your staff unfairly, or become wound up in corruption scandals. No, also because doing the right thing has BECOME a source of value creation. Not least, this is because we – ‘the public’, consumers and employees – pay more attention to what companies do or stand for than we did a decade ago – be that their efforts to increase staff diversity & inclusion, meeting net zero goals, or paying their fair share of taxes.

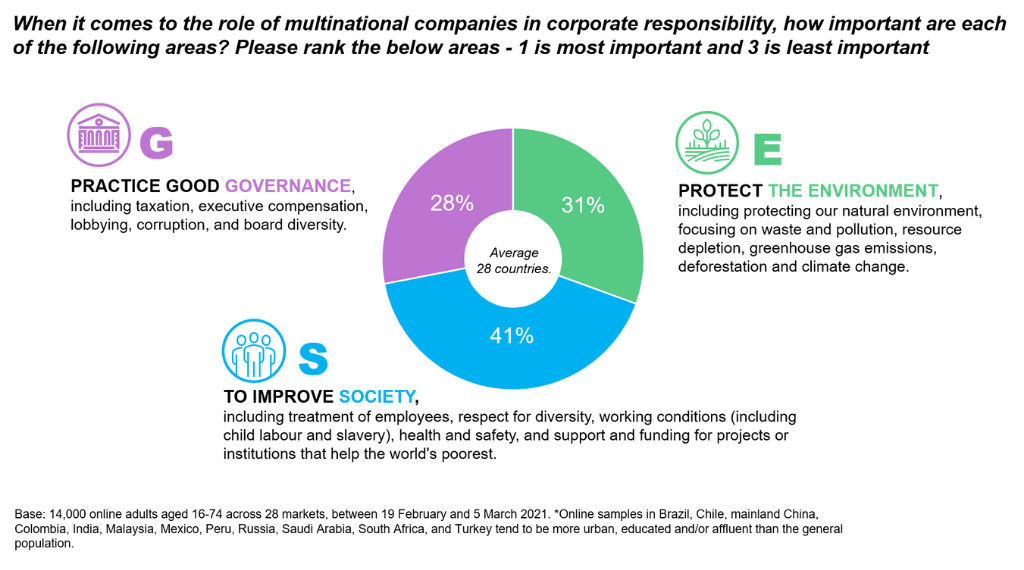

In March 2021 Ipsos asked consumers across 28 markets to rank ESG priorities for multinationals. While all three aspects, ‘E’, ‘S’ and ‘G’, were seen as important, improving society (S) came out as the top priority, with 41% of the votes globally. Protecting the environment (E) followed at 31%, almost on equal footing with practicing good governance (G, 28%).

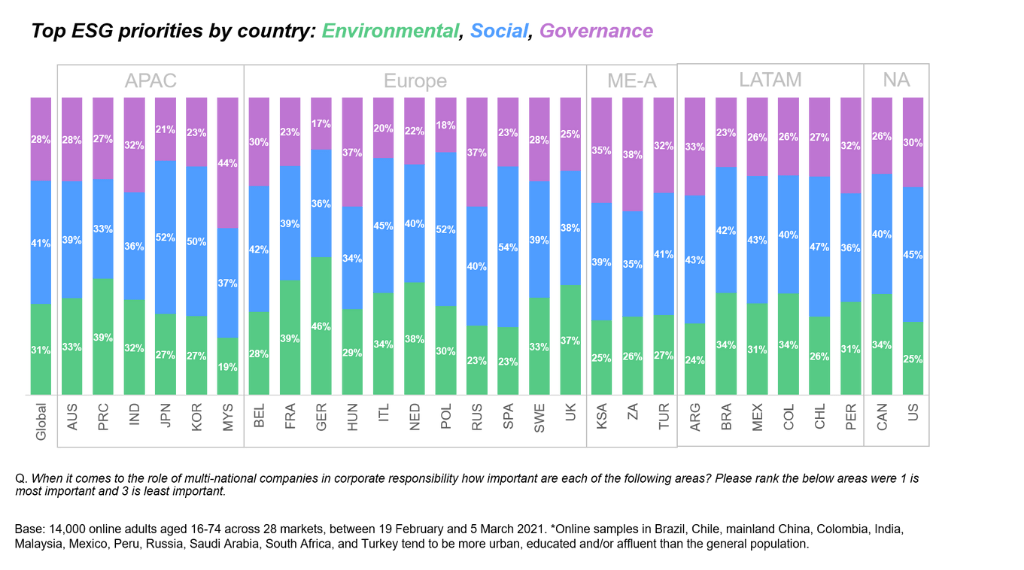

In 22 out of the 28 countries surveyed, improving society received the most picks as the top priority, with a majority of the vote share in Spain (54%), Poland (52%), Japan (52%) and Korea (50%).

In 22 out of the 28 countries surveyed, improving society received the most picks as the top priority, with a majority of the vote share in Spain (54%), Poland (52%), Japan (52%) and Korea (50%).

These findings are not surprising in the context of COVID-19. Health & safety precautions in the workplace, as well as a desire for job security amid economic uncertainty, have, for many, become necessary concerns.

These findings are not surprising in the context of COVID-19. Health & safety precautions in the workplace, as well as a desire for job security amid economic uncertainty, have, for many, become necessary concerns.

How should companies engage with the ‘S’?

Given the increased focus on the role of companies to contribute socially, where should they focus their efforts on the ‘S’ pillar of ESG?

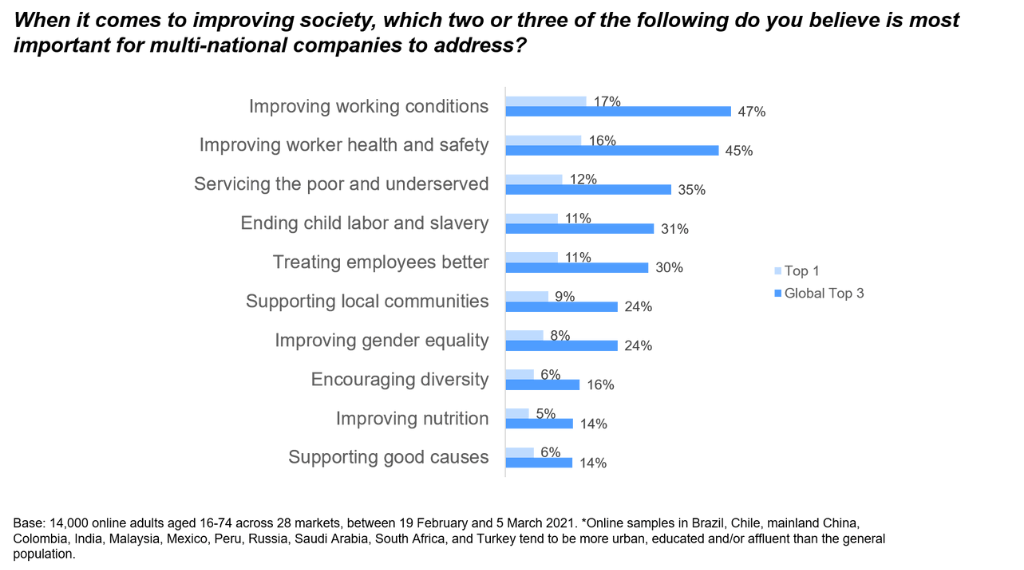

Looking at which societal issues people want multinationals to address, our survey shows that improving working conditions and worker health & safety come top. This is true across all regions, from Europe to APAC, to Middle East-Africa, to LATAM through to North America. Potentially contributing here are new COVID-related concerns about ventilation, social distancing, face masks at work etc., on top of existing issues.

Despite ample attention across (social) media for issues around gender equality and diversity, these topics came out lower down the list. Again, this holds true when looking in detail at the answers from people across different parts of the world.

It’s impossible to give a blank slate answer to how companies can best create shared value on ‘S’. The priorities in the eyes of consumers listed above, give an idea. But what that means for each individual business is something that needs careful consideration. That’s why it’s so important for companies to engage with their stakeholders on these issues. Employees who feel their employer looks after them, will be more willing to go the extra mile: a ‘give’ for the ‘get’. Local communities who see that companies take their interests at heart, will be more open to dialogue and working together to create mutual benefits. Etcetera.

Ipsos advises businesses on how they should address ESG challenges and helps them to define, manage and communicate their priorities. A relevant example to multinationals is our advice on how to frame “benefits” of ESG strategies to consumers. As people aren’t driven by sustainability claims alone to take action (as they often feel they are doing enough already), it is most effective to couple these to an extra incentive personal to them. So instead of saying: “switch to renewable energy to reduce your carbon footprint” position this as “switch to renewable energy will save you money AND help you reduce your footprint”.

Finally, what’s left to say is that, as I have said before, investments in ESG issues should be financially responsible and prudent in their own right, giving shareholders a return on investment. Ultimately, genuine progress on ESG will help to protect companies’ social licence to operate and bolster their reputation.

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)

![[Webinar] KEYS: THE MIDDLE CLASS: In Crisis?](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/middle-class-family-dinner-food-carousel.webp?itok=iD1QyX8n)

![[Webinar] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/list_item_image/public/2025-09/image/minisite/keys0925.png?itok=3oAiYcxm)