Automotive purchase intention driven by COVID-19 social distancing concerns

The COVID-19 pandemic struck the world with both swiftness and might. No industry has been immune to its impact, including the automotive sector. Despite forecasts predicting a decline in light passenger vehicle sales for the year (25- 30% in the U.S. and 20 – 25% globally), there is some potential good news on the horizon for the auto industry. In Ipsos’ newly released, and now available, COVID-19 Impact on Auto Global Study, certain pre COVID-19 vehicle intenders express more interest in buying a vehicle once the crisis is over so perhaps the decline won’t be as significant. And, driving their interest is something directly related to the pandemic – their personal safety or protection.

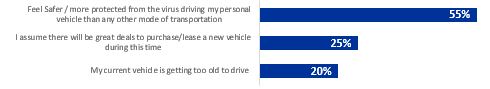

For those wanting to purchase a vehicle post-pandemic, the motivating factor was the same across the board. Consumers in the U.S., China, EURO5 and Brazil all gave the reason of feeling safer and more protected as their driving force.

Top reasons to maintain/increase purchase interest

n=2,784, globally all countries combined

Which of the following are reasons why your purchase intentions have increased or remained the same?

Safety in automotive decision making has always been an important factor, but clearly this is a shift towards safety by social distancing instead of sharing crowded public transportation. This key insight into the consumer mind should play heavily in upcoming and future automotive marketing messages.

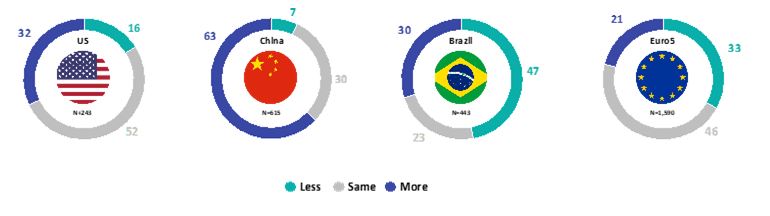

The Ipsos study revealed that Americans remain optimistic, despite the economic uncertainty ahead. Almost one third of pre COVID-19 US vehicle intenders stated they are more likely to purchase a vehicle once the COVID-19 outbreak is over compared to less than 20% showing a reduced interest to purchase. Chinese consumers also appear to be optimistic, with over half stating they are more likely to purchase a vehicle. This optimism does not extend to Brazil or EURO5 (UK, France, Germany, Italy and Spain). Consumers there expressed more reservation and are less likely to purchase.

Purchase vehicle intention impact after COVID-19 outbreak

n=2,891

Q. After the coronavirus or COVID-19 outbreak, how have your plans to purchase or lease a vehicle been affected? Among Pre COVID-19 planned vehicle intenders per country.

The Ipsos study also uncovered a financial concern as the top reason consumers in the U.S., China, Brazil and EURO5 would decrease their purchase interest globally. Different incentives provided by the auto manufacturers including 0% financing, deferred payments and protection against job loss will help alleviate this concern.

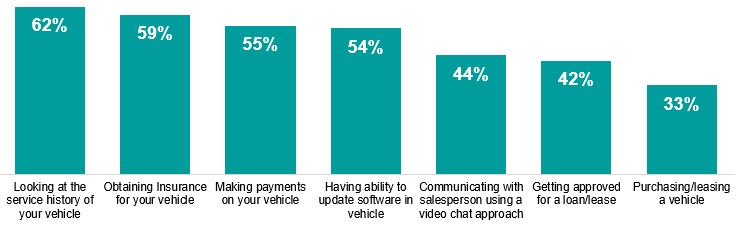

Another shift the automotive industry should be making immediately is towards developing and expanding its virtual and digital shopping options. If consumers cannot come to the dealership, the dealership must come to them, and provide a life-like experience for consumers to test and enjoy. This virtual shopping experience is something the automotive industry has been experimenting with, but the COVID-19 crisis has created an environment where virtual reality is the reality.

Interest in completing entirely online

n=11,000, globally all countries combined

Q. How interested would you be completing the following entirely online? % Extremely / Somewhat Interested, 4 pt scale.

John Kiser SVP Automotive & Mobility quotes “The COVID-19 pandemic will likely shift the status quo on how vehicles will be purchased, I think we will see more digital purchases, much more online / virtual shopping and less dealership visits for test drives. Auto manufactures that can quickly add a full virtual shopping process will create an advantage to capture more buyers.”

The Ipsos COVID-19 Impact on Auto Global Study will provide further insights in which automotive insiders can immediately use to capitalize on new consumer behaviors such as shift in public transportation/riding hailing usage, preferences on how to purchase a vehicle plus their expectations at a dealer to navigate the post-pandemic world.

For this survey, Ipsos interviewed a total of 11,000 adults aged 18-74 in the United States of America, China, Japan, Brazil, France, Germany, Italy, Spain, Great Britain, Russia and India. Intenders are defined as those planning to purchase or lease a vehicle in the next 18 months.

Additional data is available through a subscription of the offering, additional information is included here.