The Economic Pulse of the World - August 2015

Global Average of National Economic Assessment Down One Point: 41%

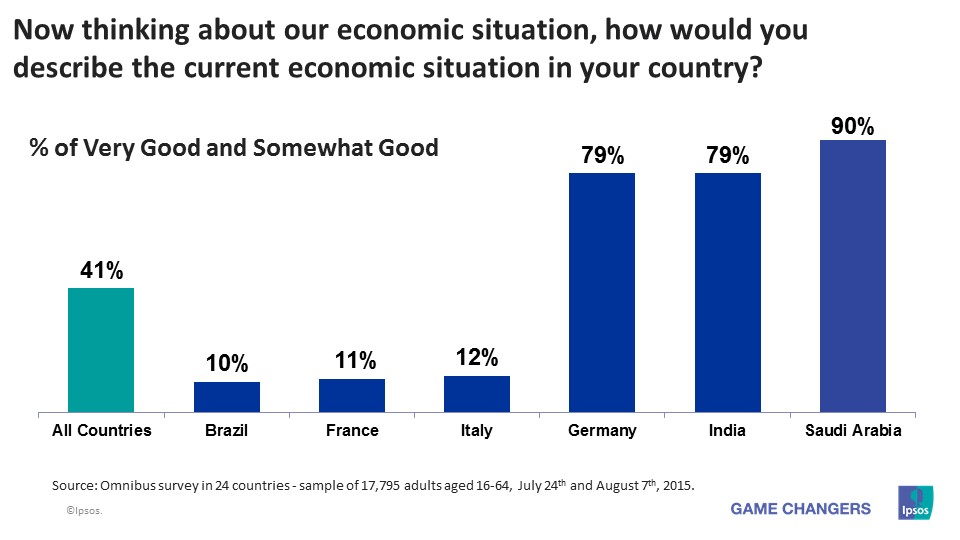

After posting positive gains for two months in a row, the average global economic assessment of national economies surveyed in 24 countries is down one point as 41% of global citizens rate their national economies to be ‘good’.

Despite experiencing a one point decline, Saudi Arabia (90%) remains at the top of the national economic assessment, followed by India (79%), Germany (79%), China (70%), Sweden (70%), and Australia (56%). Brazil (10%) has the lowest score this month, followed by France (11%), Italy (12%), South Korea (14%), Hungary (19%), Mexico (20%) and Spain (20%).

Countries with the greatest improvements in this wave: Poland (35%, +6 pts.), the United States (48%, +5 pts.), Sweden (70%, +4 pts.), South Africa (21%, +4 pts.), Spain (20%, +4 pts.), Israel (53%, +2 pts.), and Italy (12%, +2 pts.).

Countries with the greatest declines: Canada (47%, -18 pts.), Mexico (20%, -13 pts.), Japan (30%, -6 pts.), Argentina (24%, -5 pts.), India (79%, -3 pts.), China (70%, -2 pts.) and Brazil (10%, -2 pts.).

Global Average of Local Economic Assessment (31%) Up One Point

When asked to assess their local economies, 31% agree the state of the current economy in their local area is ‘good,’ on the global aggregate level. The local economic assessment is up one point since last sounding.

Saudi Arabia (65%) increases its lead in the local economic assessment, followed by Germany (58%), Israel (56%), China (53%), Sweden (53%), India (52%), and the United States (38%). On the other end of the assessment, one in 10 (11%) rate their local economy as ‘good’ in Italy, followed by France (12%), South Korea (13%), Spain (14%), Brazil (16%), Hungary (16%) and Japan (16%).

Countries with the greatest improvements in this wave: South Africa (19%, +7 pts.), Poland (24%, +6 pts.), Russia (29%, +5 pts.), Germany (58%, +4 pts.), Turkey (31%, +4 pts.), Saudi Arabia (65%, +3 pts.), the United States (38%, +3 pts.), Hungary (16%, +3 pts.), Brazil (16%, +2 pts.) and Spain (14%, +2 pts.).

Countries with the greatest declines: Canada (32%, -8 pts.), China (53%, -5 pts.), Israel (56%, -3 pts.), Japan (16%, -2 pts.), Sweden (53%, -1 pts.), India (52%, -1 pts.), Argentina (20%, -1 pts.) and France (12%, -1 pts.).

Global Average of Future Outlook for Local Economy (23%) Down One Point

The future outlook is down one point for a third consecutive month, as 23% of global citizens expect their local economy will be stronger six months from now.

Saudi Arabia (58%) regains the lead in this assessment category, followed by India (56%), Brazil (52%), China (46%), Argentina (37%), Mexico (30%), Russia (30%) and the United States (26%). For a fourth month in a row, only a small minority in France (5%) expect their local economy to be strong six months from now, followed by South Korea (9%), Hungary (10%), Israel (10%), Italy (11%), Sweden (11%) and Belgium (12%).

Countries with the greatest improvements in this wave: Russia (30%, +8 pts.), Turkey (23%, +3 pts.), South Africa (13%, +3 pts.), the United States (26%, +2 pts.), Spain (23%, +2 pts.), Argentina (37%, +1 pts.) and Poland (18%, +1 pts.).

Countries with the greatest declines: India (56%, -7 pts.), China (46%, -6 pts.), Sweden (11%, -5 pts.), Canada (13%, -3 pts.), South Korea (9%, -3 pts.), Japan (13%, -2 pts.) and Belgium (12%, -2 pts.).

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)