The Economic Pulse of the World - February 2015

Four in ten (40%) respondents around the world rate their national economies as ‘good’. Israel is very much in line with those numbers, with 36% of respondents think the same of their national economy.

Half (51%) of Israelis agree that the economy in their local area is “good” compared to the global average of 30%.

The future economic outlook is a little less optimistic as only one in ten (8%) Israel citizens expect their local economy will be stronger six months from now compared to the global average of 24%.

Maurice Kahoonay, Country Manager, Israel:

Israel’s GDP rose 2.8% in 2014, compared wi

th 3.2% in 2013 and 3.0% in 2012. GDP per capita is ~$33K and it rose 0.8% in 2014. Along with relatively high scores on macroeconomic measures (including low unemployment level) - still some uncertainty exists on the personal and micro level (reflected in “the future economic outlook”). A duality is also reflected in the relatively high sores for happiness (81%) as opposed to 22% only that report they are satisfied with how things are going in the country. Such contradictory trends might be better understood in light of the general elections to be held on March 17th - only 24 months after the latest elections in January 2013.

National economy: 36%

Local economy: 51%

Future local economy: 8%

Global Average of National Economic Assessment Down One Point: 40%

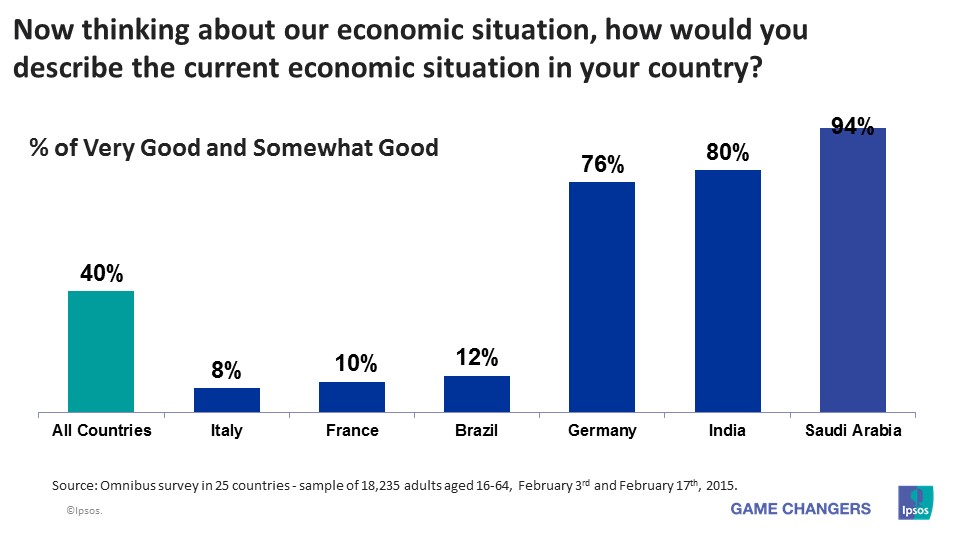

Starting the new year on a positive note, the average global economic assessment of national economies surveyed in 24 countries is down one point as 40% of global citizens rate their national economies to be ‘good’.

Saudi Arabia (94%) solidifies its position at the top of the national economic assessment, followed by India (80%), Germany (76%), Sweden (73%), China (71%), and Egypt (61%). The lowest average global economic assessment this month is in Italy (8%). Close behind are France (10%), Brazil (12%), Spain (12%), South Korea (13%) and Hungary (16%).

Countries with the greatest improvements in this wave: Saudi Arabia (94%, +7 pts.), Belgium (39%, +6 pts.), Japan (26%, +3 pts.), Argentina (24%, +3 pts.), Mexico (22%, +3 pts.), France (10%, +3 pts.), Russia (28%, +2 pts.), Sweden (73%, +1 pts.), South Africa (27%, +1 pts.) and Spain (12%, +1 pts.).

Countries with the greatest declines: China (71%, -9 pts.), Egypt (61%, -6 pts.), Germany (76%, -5 pts.), Brazil (12%, -5 pts.), Canada (59%, -4 pts), the United States (47%, -4 pts.), Australia (56%, -2 pts.) Great Britain (44%, -2 pts), Turkey (43%, -2 pts), and Poland (25%, -1 pts.).

Global Average of Local Economic Assessment (30%) Up One Point

When asked to assess their local economies, 30% agree the state of the current economy in their local area is ‘good,’ on the global aggregate level. The local economic assessment up one point since last sounding.

Saudi Arabia (68%) regains the top position in the local economic assessment average. Sweden (59%) is in the distant second, followed by China (53%), Germany (53%), Israel (51%), India (50%) and Canada (40%). Small minority assess their local economy as ‘good’ in Italy (11%) followed by Hungary (12%), South Korea (13%), Spain (13%), France (15%), Japan (15%) and Mexico (15%).

Countries with the greatest improvements in this wave: Saudi Arabia (68%, +12 pts.), Egypt (35%, +7 pts.), Sweden (59%, +5 pts.), Belgium (23%, +3 pts.), France (15%, +3 pts.), Japan (15%, +3 pts.), Spain (13%, +3 pts.), Argentina (19%, +2 pts.) and South Africa (18%, +2 pts.).

Countries with the greatest declines: China (53%, -13 pts.), Russia (22%, -7 pts.), India (50%, -6 pts.), Germany (53%, -3 pts.), Brazil (22%, -2 pts.) the United States (38%, -2 pts.), Australia (35%, -2 pts.), Poland (17%, -2 pts.) and Mexico (15%, -2 pts.).

Global Average of Future Outlook for Local Economy (24%) Down One Point

The future outlook average loses one point, as one quarter (24%) of global citizens expect their local economy will be stronger six months from now.

India (64%) remains in the lead of the future outlook assessment, followed by Saudi Arabia (60%), Brazil (51%), China (44%), Egypt (44%), Mexico (38%) and Argentina (32%). Once again, only a fistful in France (5%) expect their local economy to be strong six months from now, followed by Israel (8%), Belgium (10%), Sweden (10%), Hungary (11%), South Korea (11%), Italy (12%), Poland (12%) and Japan(14%).

Countries with the greatest improvements in this wave: Saudi Arabia (60%, +13 pts.), Mexico (38%, +5 pts.), Germany (21%, +4 pts.), Hungary (11%, +3 pts.), India (64%, +2 pts.), and Australia (17%, +2 pts.).

Countries with the greatest declines: Russia (18%, -8 pts.), China (4%, -7 pts.), Egypt (44%, -6 pts.), Brazil (51%, -4 pts.), Turkey (22%, -4 pts.), the United States (27%, -2 pts.), Great Britain (17%, -2 pts.), Italy (12%, -2 pts.) and Belgium (10%, -2 pts.).

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)

![[Webinar] KEYS: THE MIDDLE CLASS: In Crisis?](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/middle-class-family-dinner-food-carousel.webp?itok=iD1QyX8n)

![[Webinar] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/list_item_image/public/2025-09/image/minisite/keys0925.png?itok=3oAiYcxm)