Ipsos Cost of Living Monitor 2025

Key findings:

More people feel they are doing financially better. 37% say they are doing financially well/alright, up from 33% at the end of 2024. Australia (+10pp), Great Britain and Thailand (both +6pp) have seen the biggest improvements in people living well.

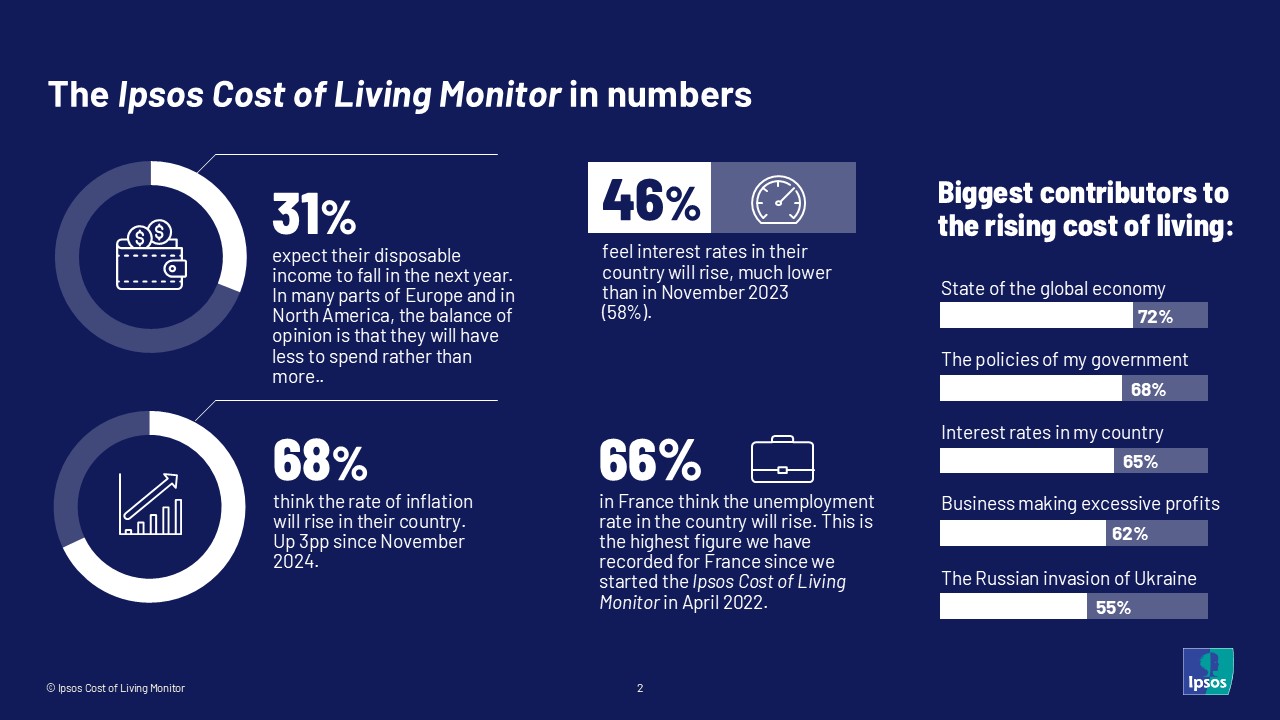

Europeans and North Americans think they will have less money to spend. Across 30 countries, 30% think they will have more disposable income in the next 12 months, while 31% think they will have less.

Worries about inflation grow. 68% across 30 countries think the rate of inflation in their country will rise in the next year. This is 6pp higher than it was in November 2024.

Many think their country is in recession. 42% of people think their country is in recession, compared to 30% who do not think this to be the case.

The Ipsos Cost of Living Monitor in numbers:

Here are five things we have learned about how people’s attitudes to the cost of living and their own economy has changed in the last 12 months.

1. More are doing financially better in the last 12 months

For some countries, it feels like things have turned a corner in the last 12 months. While inflation started to fall in many countries in 2023, it has taken some time for people to be more satisfied with the situation. On average across 30 countries, 37% say they are living comfortably/doing alright, while 32% are just getting by and 27% struggling.

In Australia, where inflation and interest rates have come down in the 12 months, we see that the proportion who say they are comfortable/doing alright is up 11 percentage points (pp) since autumn last year. Forty-seven per cent say this is the case, the highest level since April 2023.

In Great Britain, we see a similar trend. In November 2024, 45% said they were financially comfortable/alright, this is now up to 51%. Since we started tracking perceptions of inflation and cost of living in April 2022, this is the highest level of comfort Brits have reported.

In Indonesia, things are going in the other direction. 2025 has been a year of economic turmoil for Indonesians and since last autumn, we have seen the proportion who are comfortable/alright fall by 7pp to 31%. People are not only worried about their finances but the country’s as well. Sixty-three per cent think the country is already in recession. Before last month, those who thought the country’s economy was in good shape had fallen 38pp since December 2024. In October, we saw an improvement in optimism (up 12pp to 40%) following the government’s new economic plans.

2. While some are feeling comfortable now, the future is less positive

On average across the 30 countries surveyed, feelings are mixed about what the future holds. As many think their disposable income will rise, as think it will fall. The same think it will stay the same. However, when we look at this on a country level, things are less equal.

Many in Europe and in English-speaking countries are feeling relatively positive about their current financial situation. However, these same countries do not think that it will stay good.

Many of these countries are more likely to think their disposable income will fall in the next year than rise. Even somewhere like the Netherlands, the country where people are most content with their finances, 35% think their disposable income will fall in the next year.

This is the same in Sweden. While 57% are doing financially well/alright, a growing proportion of Swedes think 2026 will see things get worse. Twenty-five per cent in November 2024 expected their disposable income to fall in the following 12 months, in the autumn of 2025, this has risen to 31%. Those who think their standard of living will fall has risen from 18% to 29%.

People in France are the most likely to think they will have less money to spend after bills in the next year. Forty-four per cent think their disposable income will decline in the next year. While 41% in France think their standard of living will fall in 2026, which is up 4pp since autumn last year.

3. More think inflation rates will rise, but fewer expect interest rates to increase

There has been a jump in belief across many countries in our survey that inflation is going to rise. In the US, the proportion who think inflation will be higher in 2026 is up 14pp in the last year to 65%. Greater cost of living pressures has fed into Americans thinking that they will have less disposable income, and the standard of living will fall in the next 12 months. Coupled with this, the proportion of Americans who feel they are doing financially well/doing alright is 13pp lower than it was in April 2023.

When we look across 30 countries, 68% on average think the rate of inflation in their country is going to rise in the next year. Only 9% think it is going to fall. Despite this, expectation that inflation will go up over the next year has risen, and there is less belief that central banks will increase interest rates to control it.

On average 46% think interest rates in their country will increase. This belief is highest in South Africa and LATAM. Brazil, Mexico, Colombia and Argentina make up the rest of the top five. In Argentina, those who think inflation will increase is 10pp higher than the same period last year. In Chile and Peru, the reverse is true. In Chile, while 55% think the central bank will increase rates, this is 11pp lower than 12 months and in Peru, the figure is 14pp lower than last year at 61%.

4. Worries about unemployment are rising

On average across 30 countries, 58% say they think the number of unemployed people in their country will increase over the next year.

Indonesians are the most likely to think there will be fewer jobs in 2026. In the autumn of 2025, 83% think unemployment will rise, up from 71% in the same period last year.

This is the highest figure Indonesia has recorded on this question since we started the Ipsos Cost of Living Monitor in 2022.

France (66%), Canada (60%), and Brazil (55%) all record their highest level of belief that unemployment will rise across our previous editions.

France, Canada, Brazil and Ireland have all seen the proportion of people in their country who think there will be fewer jobs rise since last year (+8pp, +10pp, +8pp and +10pp respectively).

The figure for the United States has also risen since last year, up 12pp. Fifty-two per cent of Americans think unemployment will rise in the next year. There is little difference across the income levels in America in believing the jobless rate will increase (low and medium income both 52%, while high 51%). However, there are differences across the age groups and by political preference.

Among the under 35s, 58% expect unemployment to increase, while 46% of 35–49-year-olds and 50% of 50–74-year-olds feel the same.

Like in many areas of life in the US, there is a political split on unemployment perceptions. Thirty-four per cent of Republicans think there will be fewer jobs, while 65% of Democrats feel the same.

When we asked this question prior to the election in November 2024, the reverse was true. Then, 49% of Republicans thought the jobless rate would rise, and only 31% of Democrats felt the same.

5. Age matters when it comes to the causes of rising cost of living

The cause of the rising cost of living is seen as a global issue. Across 30 countries, on average 72% say the global economy is leading to rising prices. In 18 of the 29 countries included in both this survey and its previous edition in November 2024, the proportion of those who choose the global economy as a driver of inflation has increased.

The policies of my national government and interest rates are the next biggest contributors to inflation (68% and 65% respectively).

The perception of price gouging, the act of businesses excessively increasing prices, is strong. On average across 30 countries, 62% think businesses making excessive profits is driving inflation. This feeling has barely changed in the time we have been running this survey, despite inflation falling in many countries.

Baby Boomers are the most likely to believe corporate greed is driving a higher cost of living. Sixty-six per cent believe this to be the case, more than Gen X (61%), Millennials (62%) and Gen Z (59%). For Baby Boomers, businesses making excessive profits ranks ahead of interest rates (62%) as a driver of inflation.

In our What Worries the World surveys, which track what people consider the biggest issues in their country, European countries are the most likely to choose immigration as a concern in their country.

What we see in this year’s Ipsos Cost of Living Monitor report is that there is a correlation between those countries who are worried about immigration control and those that blame immigration for increasing the cost of living. This is especially the case in Europe and North America.

On average across 30 countries, it is those on a higher income who are more likely to see immigration as driving inflation (58%). Fifty-three per cent of middle-income and 50% of low-income people think immigration is causing the rising cost of living.