Worldwide slump in consumer confidence continues

Across the world, the economic outlook is on the decline. At 41.3, the Global Consumer Confidence Index in May is down 3.1 points from last month, 7.4 points compared to its pre-pandemic level of January, and two points lower than at any time since its creation in March 2010. The Global Consumer Confidence Index is the average of each of the 24 world markets’ National Indices. It is based on a monthly survey of more than 17,500 adults under the age of 75 across the 24 countries conducted on Ipsos’ Global Advisor online platform.

From last month, 20 of the 24 countries saw a drop of at least 1.5 points in their National Index. In seven countries, the National Index fell by five points or more since April: the United States (-6.0), India, Poland and Spain (-5.5), Brazil (-5.3), Mexico (-5.1), and Canada (5.0). Only in mainland China (+1.4) and South Korea (+1.1) did consumer sentiment show some improvement.

Compared to January, every single country’s National Index is down—by more than 10 points in six countries (the United States, Israel, Mexico, Canada, Australia, and Poland) and by five to 10 points in 12 other countries.

While 11 of the 24 countries surveyed had a National Index higher than 50 back in January, this is now the case in only three countries: China (63.7), Saudi Arabia (61.8), and India (50.7).

- At the other end of the spectrum, six countries now have a National Index below 35 compared to just one (Turkey) in January: Turkey and Russia (both 30.6), Japan (31.9), Italy (33.1), Spain (33.7), and South Africa (34.3).

This month’s Global index is 5.7 points lower than its historical average.

- In 20 of the 24 countries, the National Index is lower than its past 10-year average; the most striking negative differences are seen in India (-13.1), Canada (-13.0), Israel (-12.6), Australia (-11.2) Turkey (-11.1), Sweden (-10.3), and Russia (-10.0).

- The only countries where the National Index is higher than its past 10-year average are Hungary (+4.1) China (+3.0), Saudi Arabia (+1.8), and France (+1.1)

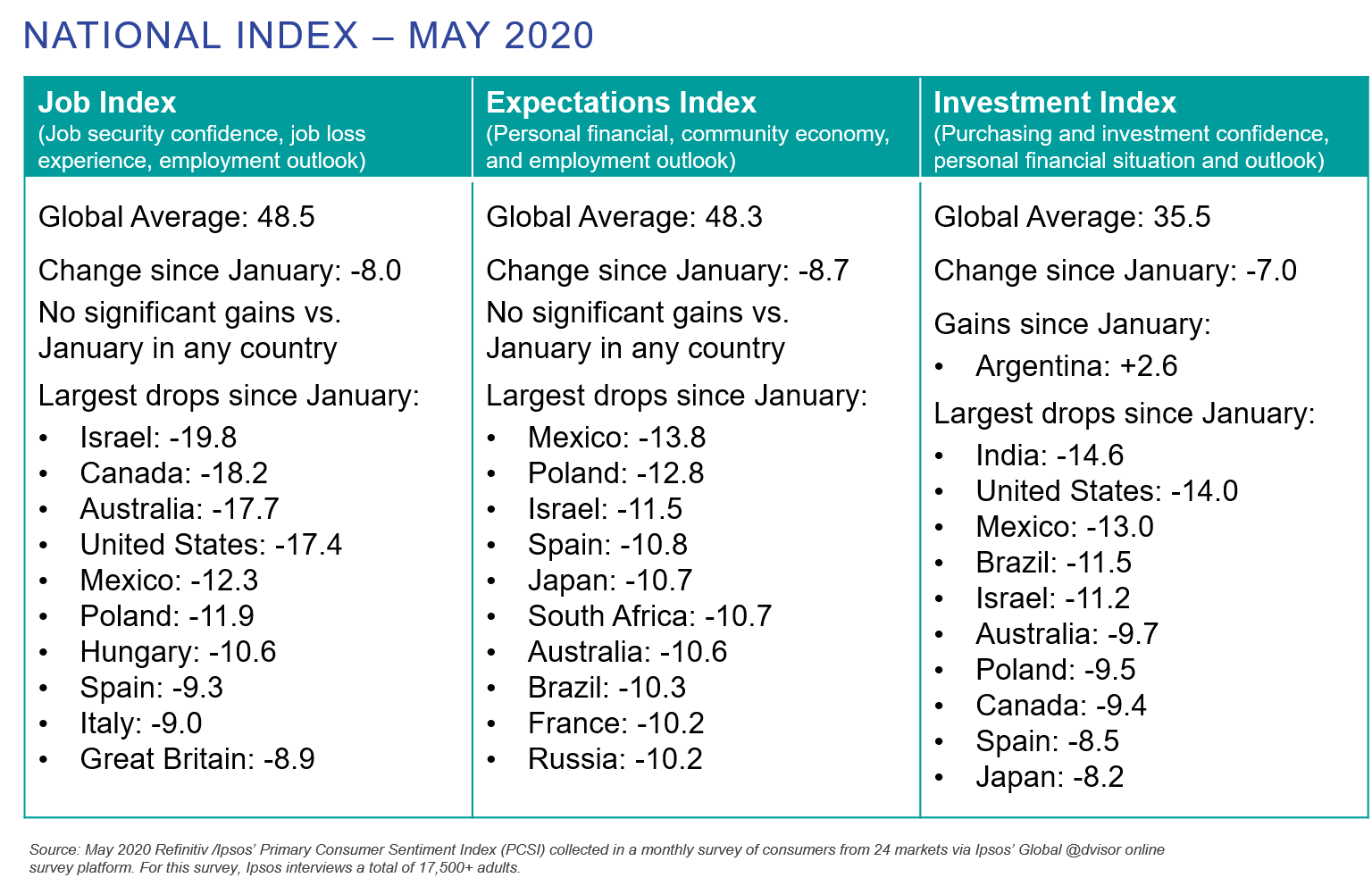

Globally, all three key sub-indices are lower than at any time since Ipsos started tracking them in 2010:

- The Jobs Index (48.5), indicative of confidence in job security and employment outlook, is nearly six points below its historical average;

- The Expectations Index (48.3), reflective of consumers’ outlook on employment, their financial situation and their local economy, which is almost nine points lower than its historical average; and

- The Investment Index (35.5), indicative of the investment climate, which is roughly five points below its historical average.

Visit our interactive portal, Consolidated Economic Indicators (IpsosGlobalIndicators.com) for graphic comparisons and trended data pertaining to the Ipsos Global Consumer Confidence Index and sub-indices—and all the questions on which they are based.