House price confidence for 2016 strong, despite dip in economic outlook

Confidence in the UK housing market remains strong, according to the latest quarterly Halifax Market Confidence Tracker (HMCT), and comes against a backdrop of cooling confidence in the wider economy.

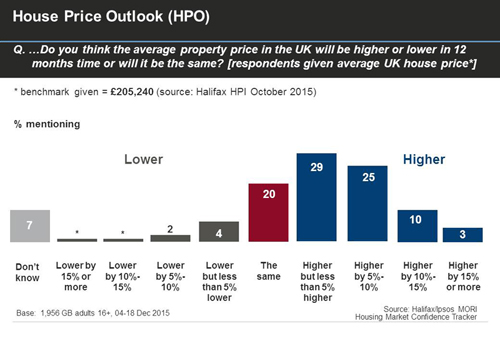

Despite declining steadily since last May, house price optimism (HPO) in the final quarter of 2015 continued to show that a majority of Britons believe that average UK property prices will be higher rather than lower 12 months from now (+61 compared to +63 in September 2015, and +68 in May 2015). Over three in ten Britons (13%) predict the average UK property price to rise by 15% or more.

In contrast, the number of people who believe Britain’s general economic condition will improve over the next 12 months (EOI) has dropped more sharply during the same period (-1 in December 2015, compared to +26 in April/May 2015).

In the December wave of the tracker, just under seven in ten Britons (67%) said they expect a rise in the average UK property price over the next 12 months. This compares to 6% who expecting a fall, mirroring the findings in September’s survey wave (where 68% said ‘higher’ and 5% said ‘lower’).

Buying sentiment also remained stable between the September and December 2015 survey waves: over half of Britons (54%) said in December that the next 12 months will be a good time to buy. This figure was 53% in September 2015, and 56% one year previously (December 2014).

The proportion saying the next 12 months will be a good time to sell increased three percentage points to 55% in December, from 52% in September 2015. This leaves positive selling sentiment at the levels seen one year previously (55% said ‘good time to sell’ in December 2014), but lower than the mid-year 2015 ‘high’ on this measure, of 60% in May 2015.

Regionally, positive buying sentiment is lower in London than among Britons overall, with 44% of Londoners saying they thought the next 12 months would be a good time to buy, compared with 74% saying the same in Scotland, and 57% in North England (54% of Britons says this overall).

When asked whether they think the next 12 months will be a good or a bad time to sell, however, Londoners’ views mirror those of Britons overall, and regional differences are smaller. Just over half of Londoners (55%) said it will be a good time to sell, the same as the proportion of Britons overall who say this. 49% say ‘good time to sell’ in North England, 52% say this in the Midlands, 54% in Scotland and 57% in Wales.

At the same time, there has been a marked fall in the proportion of Britons who expect mortgage and savings interest rates to be higher in 12 months’ time. Exactly half of Britons (50%) expect mortgage interest rates to be higher, compared to 58% who said this in September 2015. Less than a third of Britons (28%) expect interest rates for savings accounts to be higher in 12 months’ time – seven percentage points lower than in September 2015 (when this figure was 35%). And less than a quarter Britons (23%) expect an increase in both mortgage and savings interest rates, a six percentage point decrease from when this was asked in September 2015.

Technical note

Ipsos interviewed 1,956 British adults aged 16+ face-to-face, between 4th – 18th December 2015 (974 adults for mortgage and savings interest rate questions). Data have been weighted to the known population profile.