House prices: what do the public think will happen next?

‘Subdued’, ‘treading water’ and ‘modest deterioration’ are some of the more typical descriptions by experts of house prices at the moment based on indicators such as the Halifax’s House Price Index (HPI). October’s HPI was published on Tuesday and recorded an average price of £158,426, an annual change of -1.7%. Looking ahead, the Halifax’s housing economist Martin Ellis expects prices to remain “around current levels” over the coming months.

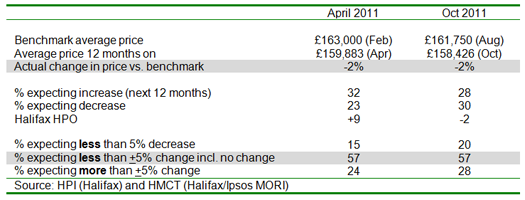

What consumers think is going to happen about prices is important in any market, and in the housing market it can condition buying and selling behaviour. Now, more Britons expect the average house price to rise rather than fall over the next 12 months according to last month’s survey of consumer confidence conducted by Ipsos for the Halifax. Having been given August’s average house price of £160,256 as a benchmark, 35% expect this average to rise, 20% expect it to fall. The House Price Outlook (HPO) of +15 compares to +7 in January 2012 and -2 a year ago. While this is not the bullishness of previous years – in the early 2000s, for example, it was not unusual to find approaching 70% expecting price rises1 – it is still striking because it comes against a backdrop of sustained economic pessimism; +15 contrasts sharply with other consumer confidence indices including Ipsos’s Economic Optimism Index which currently stands at -14 (coming after improved GDP figures).2 The HPO is currently +13 and +25 respectively among owner-occupiers and prospective consumers in the housing market i.e. those who say they are looking to upsize, downsize, buy for the first time or contribute to a relative buying property in the next year. Small movements are the expectation with two-thirds of the public expecting change in the order of between +5% and -5% including 35% who think prices will remain unchanged over the next 12 months.A circumspect sentiment has been apparent since the start of our time series for the Halifax and, on the evidence of the first two measures, the early signs are that most consumers (whether active or passive), are correctly expecting the small changes in house prices which are actually being seen. While the April 2011 HPO was +9 and October’s was -2, in both cases 57% expected sub-5% changes which did indeed occur.

Still, in both cases at least a quarter anticipated larger changes than actually occurred and the proportion actually getting the correct direction and scale of change was 15% and 20% in April and October 2011 respectively. Now, 15% expect a rise of over 5% in the average house price over the next 12 months. But there are other important price-related findings in our tracking surveys for the Halifax. Firstly, people are unremittingly negative about selling; across our six surveys, and regardless of HPO, the proportion considering the next 12 months to be a bad time to sell has averaged 73%; the strong anti-selling sentiment is even prevalent among those thinking prices will rise. Secondly, the biggest perceived barriers to buying are not prices but job security and deposit-raising. On the evidence of this early analysis, it would seem that the public’s expectations on house prices are fairly realistic for the most part; most people foresee no change or modest, single digit rises or falls. It remains to be seen though how quickly the public adjust to any future variability in price movements should they happen, and whether any improvement in perceptions of the economic outlook push price expectations further upwards.

- Ben Marshall is Research Director, Housing, planning and development. Follow Ben on Twitter @BenM_IM

Notes 1. Source: Halifax Homebuyer Survey 2000. 2. The monthly Economic Optimism Index is based on the Q: “Do you think the general economic condition of the country will improve, stay the same or get worse over the next 12 months?”