Open Banking – the great data giveaway?

Giving consumers more control over their own data can only be a good thing, right? Allowing them to choose who they share it with, what for and for how long seems an obviously positive thing to do. However, when it comes to Open Banking and the possibility of sharing financial data with many different third-party providers, we need to bear in mind that this is about people’s money and some of their most sensitive personal data.

The potential risks are high and there are many consumers who may be ill-equipped to understand the full implications of sharing their data. Regulation will do much to ensure that only reputable providers are operating in the Open Banking space, but that doesn’t fully address the potential repercussions of giving the consumer more control of their financial data.

Before considering the positions of the various potential players, it’s critical to understand how people will make decisions about data sharing. The industry can then support and educate consumers to make wise and appropriate choices. One of the key factors in consumer decision-making will be trust. People are far more likely to give permission to access their data to a provider they feel is trustworthy and will only use the data in appropriate or beneficial ways.

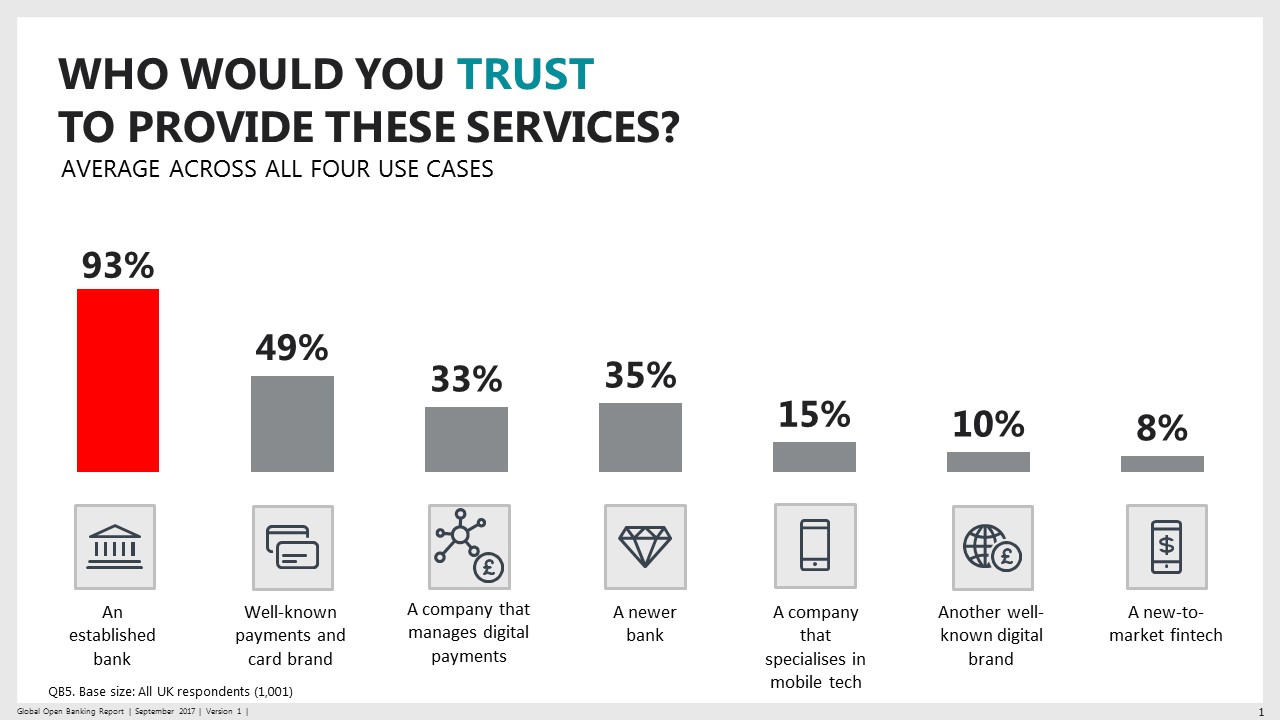

Our recent research into consumer attitudes, conducted just a few months ahead of the launch of Open Banking, offers us a snapshot of which sorts of organisations consumers are likely to trust to use their data in account information or payment initiation use cases.

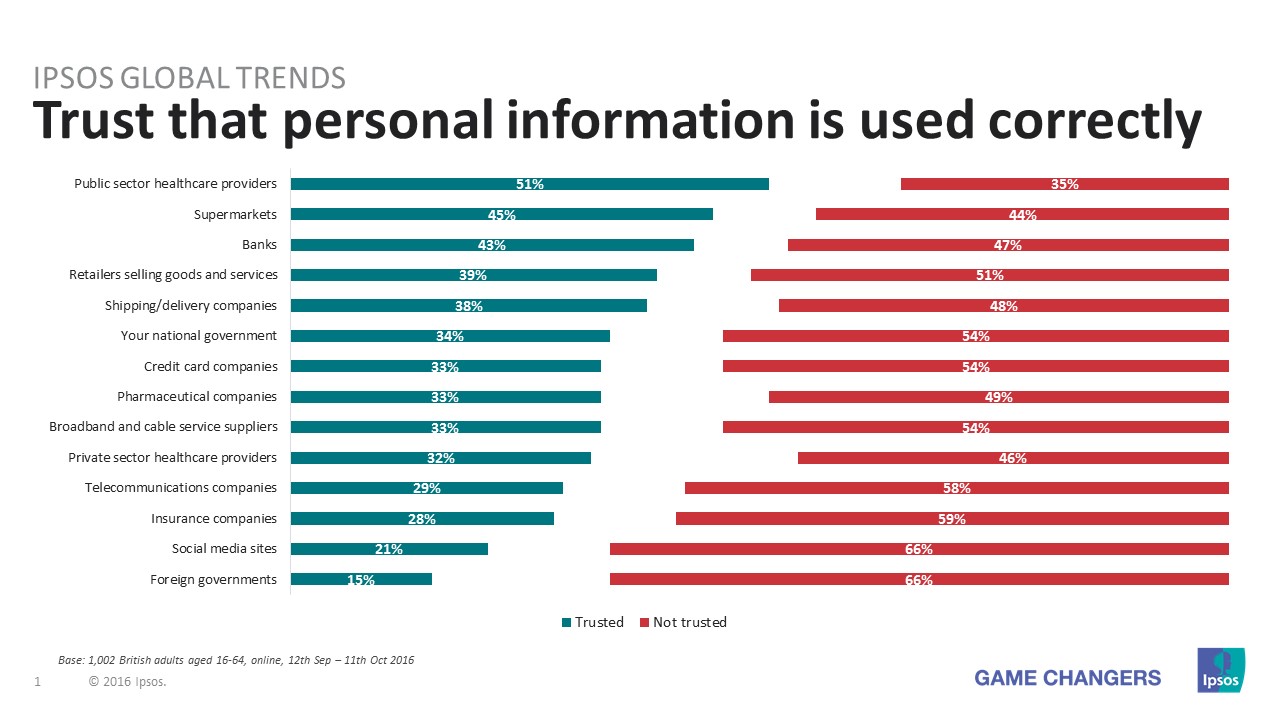

It is unsurprising that the established banks come out well ahead of the other potential provider groups. They already hold consumers’ banking data, have a good track record of keeping it secure and are seen by most people as experts in financial matters. In another study, our recent Global Trends Survey, we asked consumers about which types of organisation they trusted to use their personal information correctly. We found that banking was one of the most trusted sectors in this regard.

Consumers may not trust their banks in every aspect of their dealings with them but, when it comes to data security and Open Banking, their initial reactions around who they would trust with their data seem based on logic. Allowing ‘my bank’ to draw together information from other providers, to enhance what it already holds and better support and inform me as a result, is likely to feel quite a low-risk option for many customers. As one participant remarked in a focus group earlier this year: “Why would my bank let me do anything that isn't safe?”

This tendency to trust brands we know means that ‘well-known payments and card brands’ are the next most trustworthy group; they are already handling some aspects of ‘my finances’ and they are brands that people have been familiar with for a while. The right sorts of brand associations already exist with these organisations, which could make consumers more open to consider Open Banking enabled products and services from this group, along with other brands which already have some involvement in the world of banking or payments.

However, based on this data, we would anticipate that the established banks have a clear head start when it comes to taking advantage of the opportunities which Open Banking offers. With the benefits of an existing offer, new products from established players such as HSBC’s Beta can be trialled by customers in the safe environment of a provider they already trust. Our research suggests that many of the potential third-party providers will need to work hard to persuade consumers that they are worthy of the same level of trust as the established banks.

That said, many of the third-party providers have advantages of their own. They are unburdened by the challenges associated with legacy systems and the complex technological structures of the established banks. Many of the organisations active in the Open Banking space are recent fintech startups, bringing innovative thinking and the agility of smaller organisations. They may be able to commercialise ideas more quickly and target the types of consumers who are most open to adopting new personal finance tech. Finally, they can choose to cherry-pick opportunities and target customers. Where the established banks will be expected to offer services which address the needs of all their customers and provide comprehensive solutions, new market entrants can focus on one pain point or opportunity and finding and appealing or elegant way of addressing it.

Once new players have established a foothold with early-adopting consumers or a successful niche product, we can expect those who are more cautious to begin to give serious consideration to the services available. So, although adoption may be slow to begin with, it is down to the fintech suppliers to get visibility for their products, attract the ‘early adopters’ and establish the benefits of their offers. In a similar way, the newer banks need to sell their differentiating characteristics in order to convince consumers that they are the right people to turn to for added value services, rather than their longer-established competitors.

Our research into Open Banking over the past three years has made it clear that the most important factor in determining if consumers will share their data is whether they find the features of a particular product or service useful; the ‘If I see value, I’ll sign up’ factor. However, the role and importance of trust should not be underestimated. It’s clear that there is room for new competitors in this as-yet uncharted landscape.

While trust may take years to build, it only takes a moment to lose – if the established players stumble and the newer competitors are ready, they can fill the space and take the prize.