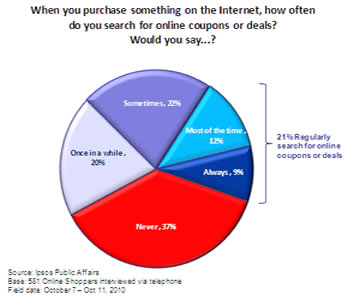

63% of Online Shoppers Search for Coupons or Deals at Least Once in a While When Shopping Online

(Click to enlarge image)

(Click to enlarge image)

- Frequent online shoppers (or those who make purchases at least weekly) are more likely than those who make online purchases less frequently to search for online coupons and deals regularly (30% vs. 19%.)

- While frequent shoppers are more likely to search for coupons and deals, still one in four (26%) report they never search for such discounts when buying online. However, a considerably larger proportion (39%) of less frequent online shoppers (those who make online purchases monthly or less often), report that they never search for online coupons or deals.

- Online shoppers residing in the South (14%) are more likely to always look for deals when making online purchases than are those from the Midwest (5%) and the West (4%). Conversely, those who reside in the Northeast (49%) are more likely to never look for coupons than those who live in the South (31%).

Black Friday and Cyber Monday Shopping

Over one in three (37%) online shoppers are planning to shop on Black Friday; among them, half (18% among all online shoppers), plan to do at least part of their shopping online; including 10% who plan to shop both online and in stores and 8% who plan to shop primarily online. Six in ten (60%) are not planning to shop on Black Friday, and 19% plan to shop primarily in stores.

Among all online shoppers interviewed, 18% are planning to shop on Cyber Monday; however, a similar proportion are not sure (18%), and 60% say they do not plan to do so. Among those who are planning to shop on Cyber Monday, just over half are planning to visit a deal or coupon website (57%), while 43% of them are not.

Holiday Shopping

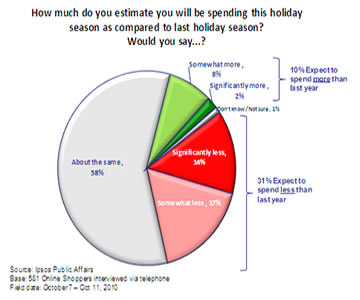

The study also explored if shoppers expect to increase or decrease how much they spend this holiday season compared to last year. Results show that most online shoppers (58%) believe they will spend about the same this upcoming holiday season; while one in ten (10%) say they will spend more this year. In contrast, close to one in three (31%) believe they will spend less than last year - including 14% who say they will spend significantly less.

(Click to enlarge image)

(Click to enlarge image)

Some segments are more likely than others to say they expect to spend more this holiday season than they did last year:

- Online shoppers that search for deals and coupons regularly (17%) are more likely to say they plan to spend more this year than are those who do not search for coupons and deals or do so only sporadically (8%).

- Women (13%) are also more likely than men (7%) to say they will spend more.

Online AND Store Shopping

Most online shoppers (57%) are planning to shop both online and in stores this holiday season while about one third (32%) say they are only planning to shop in stores. Five percent say they plan to do all their shopping online, and the same proportion does not plan to shop in stores or online.

Men (63%) are more likely to say they plan to shop both online and in stores this holiday season than do women (52%). On the other hand, women are more likely than men to say they plan to shop only in stores (37% vs. 27%).

In addition, online shoppers with a household income over $75,000 are more likely to shop both online and in stores (72%) than are those with an income between $25,000 and $75,000 (57%), and those with a household income under $25,000 (38%).

In contrast, those with an income under $25,000 are more likely to shop in stores only (53%) than are those with an income between $25,000 and $75,000 (32%) and those with an income of $75,000 or more (22%).

These are some of the findings of an Ipsos poll conducted October 7-11, 2010. For the survey, a nationally representative sample of 1,000 randomly-selected adults aged 18 and over residing in the U.S. was interviewed via Ipsos' U.S. Telephone Express omnibus - including 581 adults who have made a purchase online at least a few times a year. With a sample of this size, the results are considered accurate within 1773.1 percentage points when it comes to the entire sample, and 1774.1 when referring to online shoppers, 19 times out of 20, of what they would have been had the entire population of adults in the U.S. been polled. The margin of error will be larger within regions and for other sub-groupings of the survey population. These data were weighted to ensure the sample's regional and age/gender composition reflects that of the actual U.S. population according to data from the U.S. Census Bureau.

For more information on this news release, please contact: Julio C Franco Senior Research Manager Ipsos Public Affairs New York, NY 646-313-6117 [email protected]

About Ipsos

Ipsos is a leading global survey-based market research company, owned and managed by research professionals that helps interpret, simulate, and anticipate the needs and responses of consumers, customers, and citizens around the world. Member companies assess market potential and interpret market trends to develop and test emergent or existing products or services, and build brands. They also test advertising and study audience responses to various media, and measure public opinion around the globe.

They help clients create long-term relationships with their customers, stakeholders or other constituencies. Ipsos member companies offer expertise in advertising, customer loyalty, marketing, media, and public affairs research, as well as forecasting, modeling, and consulting and offers a full line of custom, syndicated, omnibus, panel, and online research products and services, guided by industry experts and bolstered by advanced analytics and methodologies. The company was founded in 1975 and has been publicly traded since 1999. In 2009, Ipsos generated global revenues of e943.7 million ($1.33 billion U.S.).

Visit www.ipsos-na.com to learn more about Ipsos offerings and capabilities.