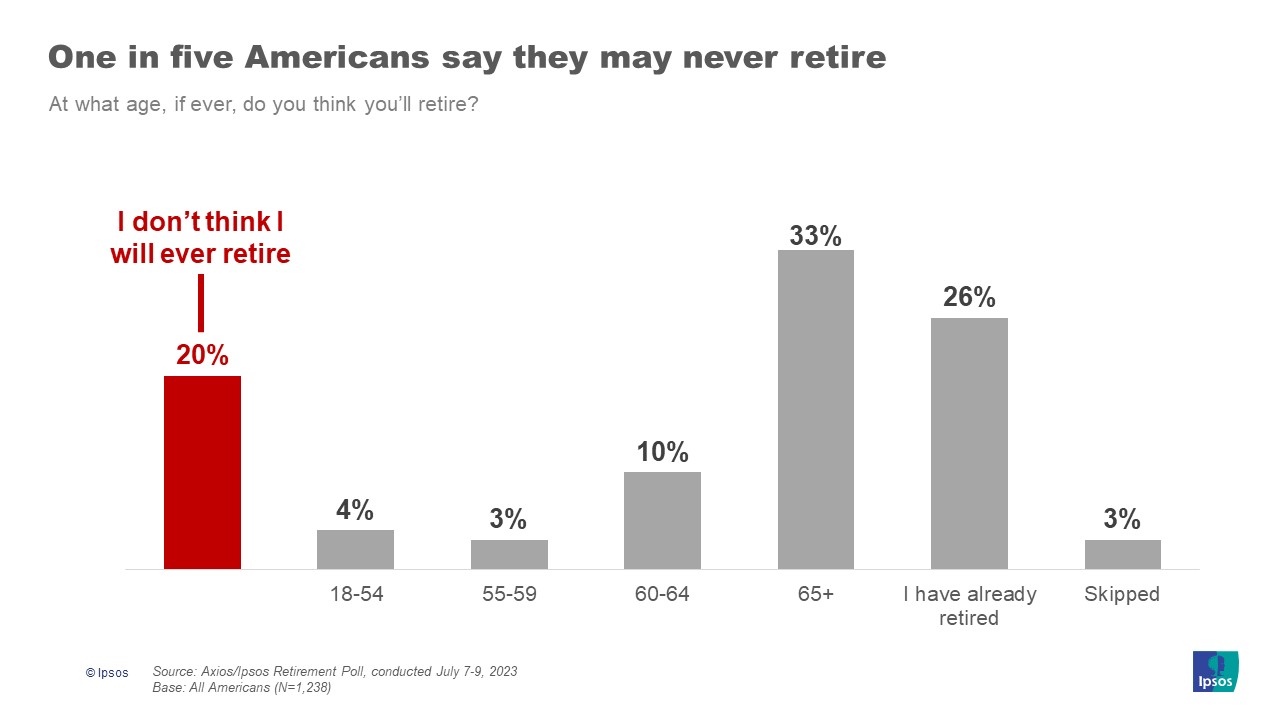

One in five don’t think they will be able to retire

Washington DC, July 20, 2023—New Axios/Ipsos polling on retirement finds that about one in five Americans believe they will never retire. Financial worries are the main reasons people feel they can’t retire. When it comes to how Americans finance retirement, few feel Social Security will cover most of their expenses. Instead, most Americans—both retired and those who aren’t—look to retirement accounts to finance this life stage. Interestingly, majorities of retired Americans lean on pensions in their retirement, while few Americans who aren’t retired plan to do the same. Likewise, many Americans report never talking to friends, family, or a financial planner about saving for retirement.

Most Americans feel that the point of working hard is to enjoy retirement and spend time with friends and family. Majorities of retirees say it’s easier to take care of their mental, emotional, and physical health after retirement, while fewer people who aren’t retired agree. Most Americans who are retired say they feel better than ever now that they’ve retired.

Detailed findings:

1. A sizeable minority of Americans believe they will never retire, with financial concerns driving this sentiment.

- One in five Americans don’t think they’ll ever retire. Among the people who don’t think they’ll ever retire, a decisive majority (70%) say that they won’t ever retire because they can’t or won’t be able to afford to retire, versus 19% of people who just don’t want to retire (an additional 10% picked ‘other’ as a response).

- Most retirees (82%) have no regrets about their retirement planning, while half of people who aren’t retired under 55 (49%) and 59% of people over 55 feel the same.

- Yet, two in five unretired Americans (40%) say they would prefer to work as long as they can and not fully retire. This is especially true for respondents over the age of 55 who have not retired.

- Americans over age 55 who haven’t retired are split on whether they will retire at the time they expected. About one third of these respondents (36%) say they will retire when they planned, about a quarter (23%) report they will have to retire later than they planned, and 40% aren’t sure if they will retire at the time they expected.

- Under half of those age 55+ who aren’t retired (44%) say they have had to change retirement plans due to economic factors out of their control.

- Given many respondents financial concerns with retirement, more than half of Americans who haven’t retired (52%) plan to move somewhere with a lower cost of living when they retire.

2. Americans are affording and financing retirement using several different tactics.

- Most Americans who aren’t retired (62%) feel that Social Security will cover less than half of their expenses.

- Over one third of Americans who aren’t retired (37%) say that Social Security will likely cover less than 25% of their expenses, with an additional one in four (24%) thinking that Social Security will cover a quarter to about half of their expenses (24%-49% of expenses).

- At the same time, just 37% of people who are retired say that Social Security covers less than half of their expenses.

- Nearly one in five retirees (19%) say that Social Security covers a quarter or less of their expenses (less than 25% of expenses), and an additional 18% of retirees report that Social Security covers a quarter to about half of their expenses (25% to 49% of expenses). Just 5% of retirees say that Social Security covers more than 100% of their expenses.

- Outside of Social Security, two-thirds of Americans who aren’t retired (66%) say they plan to rely on retirement accounts, like a 401k, 403b, or IRA. Half of Americans currently retired (50%) say they utilize retirement accounts to fund their retirement.

- Fewer Americans who aren’t retired plan to use a pension, while pensions are more common among those already retired. Three in ten respondents who aren’t retired (30%) say they will rely on a pension, while more than half of current retirees (54%) say they utilize a pension to fund their retirement.

- About two in five (41%) say they have never talked about saving for retirement with their friends, and 57% say they have never talked to a financial planner about retirement.

3. Many see and experience retirement’s positive sides, including feeling better and having an easier time taking care of their well-being.

- Most Americans who aren’t retired (63%) think they will feel better when they retire, just as 68% of retirees agree that they feel better than ever now that they’ve retired.

- Over two in three retirees (68%) agree that it’s easier to take care of their mental, emotional, and physical well-being after retirement, significantly higher than those who have not retired (60%).

- Most Americans (80%) think that the point of working hard in your adult life is to be able to have a nice retirement and spend time with family and friends (86%).

About the Study

This Axios/Ipsos poll was conducted July 7-9, 2023, by Ipsos in English using the probability-based KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,238 general population adults age 18 or older. The sample includes an oversample of 210 adults age 55 and over.

The margin of sampling error for this study is plus or minus 2.9 percentage points at the 95% confidence level, for results based on the entire sample of adults. The margin of sampling error takes into account the design effect, which was 1.08 for all respondents.

In our reporting of the findings, percentage points are rounded off to the nearest whole number. As a result, percentages in a given table column may total slightly higher or lower than 100%. In questions that permit multiple responses, columns may total substantially more than 100%, depending on the number of different responses offered by each respondent.

The survey was conducted using KnowledgePanel, the largest and most well-established online probability-based panel that is representative of the adult U.S. population. Our recruitment process employs a scientifically developed addressed-based sampling methodology using the latest Delivery Sequence File of the USPS – a database with full coverage of all delivery points in the US. Households invited to join the panel are randomly selected from all available households in the U.S. Persons in the sampled households are invited to join and participate in the panel. Those selected who do not already have internet access are provided a tablet and internet connection at no cost to the panel member. Those who join the panel and who are selected to participate in a survey are sent a unique password-protected log-in used to complete surveys online. As a result of our recruitment and sampling methodologies, samples from KnowledgePanel cover all households regardless of their phone or internet status and findings can be reported with a margin of sampling error and projected to the general population.

The data for the total sample were weighted to adjust for gender by age, race/ethnicity, education, Census region, metropolitan status, and household income. The demographic benchmarks came from the 2022 March Supplement of the Current Population Survey (CPS).

- Gender (Male, Female) by Age (18–29, 30–44, 45–59 and 60+)

- Race/Hispanic Ethnicity (White Non-Hispanic, Black Non-Hispanic, Other, Non-Hispanic, Hispanic, 2+ Races, Non-Hispanic)

- Education (Less than High School, High School, Some College, Bachelor or higher)

- Census Region (Northeast, Midwest, South, West)

- Metropolitan status (Metro, non-Metro)

- Household Income (Under $25,000, $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, $100,000-$149,999, $150,000+)

For more information on this news release, please contact:

Chris Jackson

Senior Vice President, US

Public Affairs

+1 202 420-2025

[email protected]

Annaleise Lohr Director, US

Public Affairs

[email protected]

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

Our tagline "Game Changers" sums up our ambition to help our 5,000 customers move confidently through a rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD).ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com