Here's how inflation is affecting our shopping

Here’s what we know today from the Ipsos Coronavirus Consumer Tracker:

- Optimism is maybe ticking back up again a hair, as measured by the IPAC, Ipsos’ measure of Americans’ feelings on the endemic.

- Cases are growing more slowly which is great news. As they do, consumer desire for new protective measures and mandates if cases spike is also flat.

- The number of people saying they are “never” wearing a mask indoors jumped to 24% from 19%, continuing a rising trend which started at 14% in March.

- We really seem to have settled into our work routines with a consistent 26% working from home, an additional 18% hybrid and 56% working onsite.

Read on for data about: Inflation, inflation, gas prices and how often we are checking area case rates.

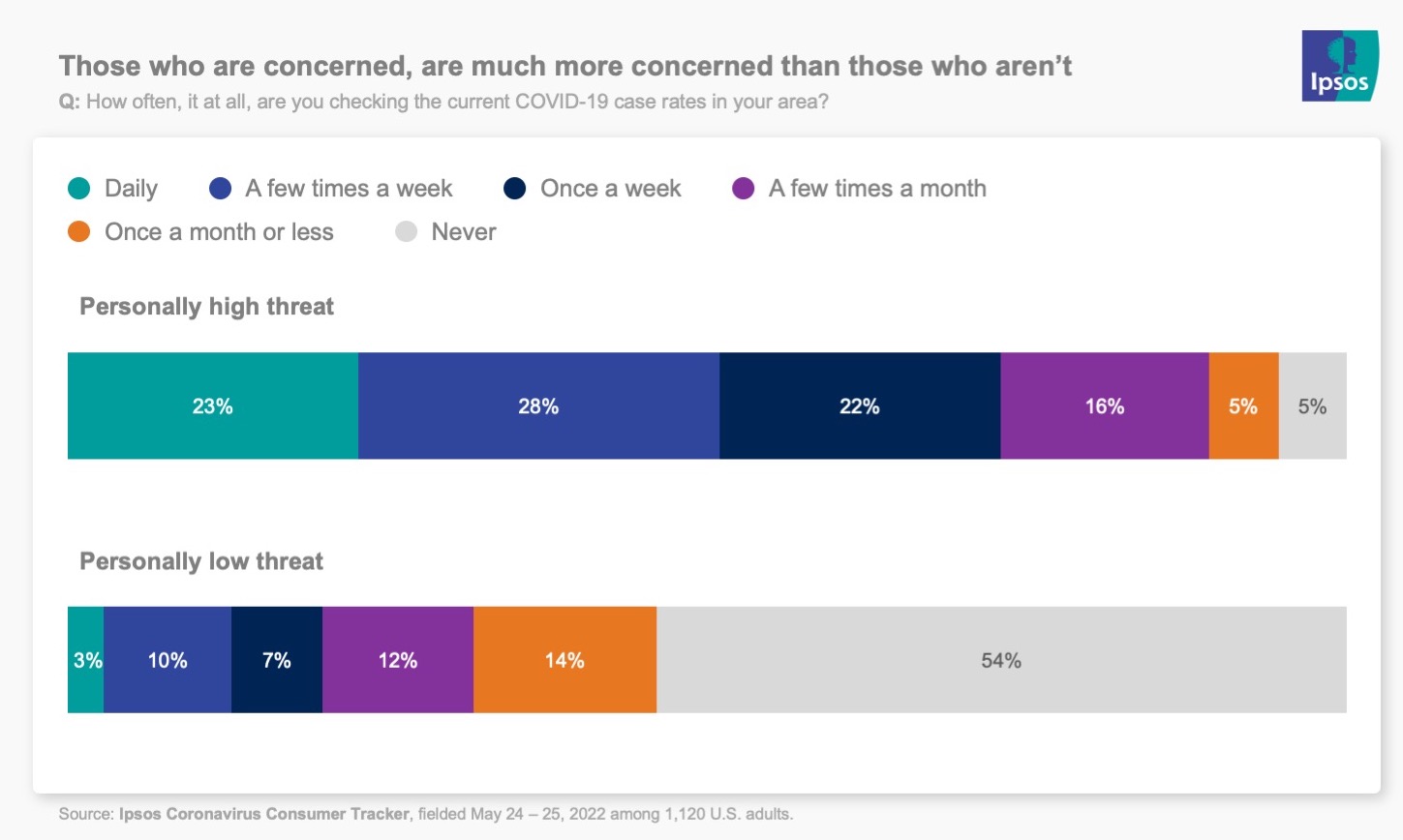

How closely are we paying attention

Why we asked: As an occupational hazard, we keep a pretty tight eye on the daily tallies, but we realize that we might be outliers.

What we found: Since early in the pandemic phase of the endemic we’re in, we’ve had a banner point in all our tracker questions about whether you personally feel highly threatened by COVID-19 or not. This is maybe the first time we’ve charted that point on a topic. Those who feel highly threatened, currently about 20% of people, are checking the rates in their area a whole lot more than the 40% or so who don’t feel personally threatened. While this isn’t surprising, the difference is really stark.

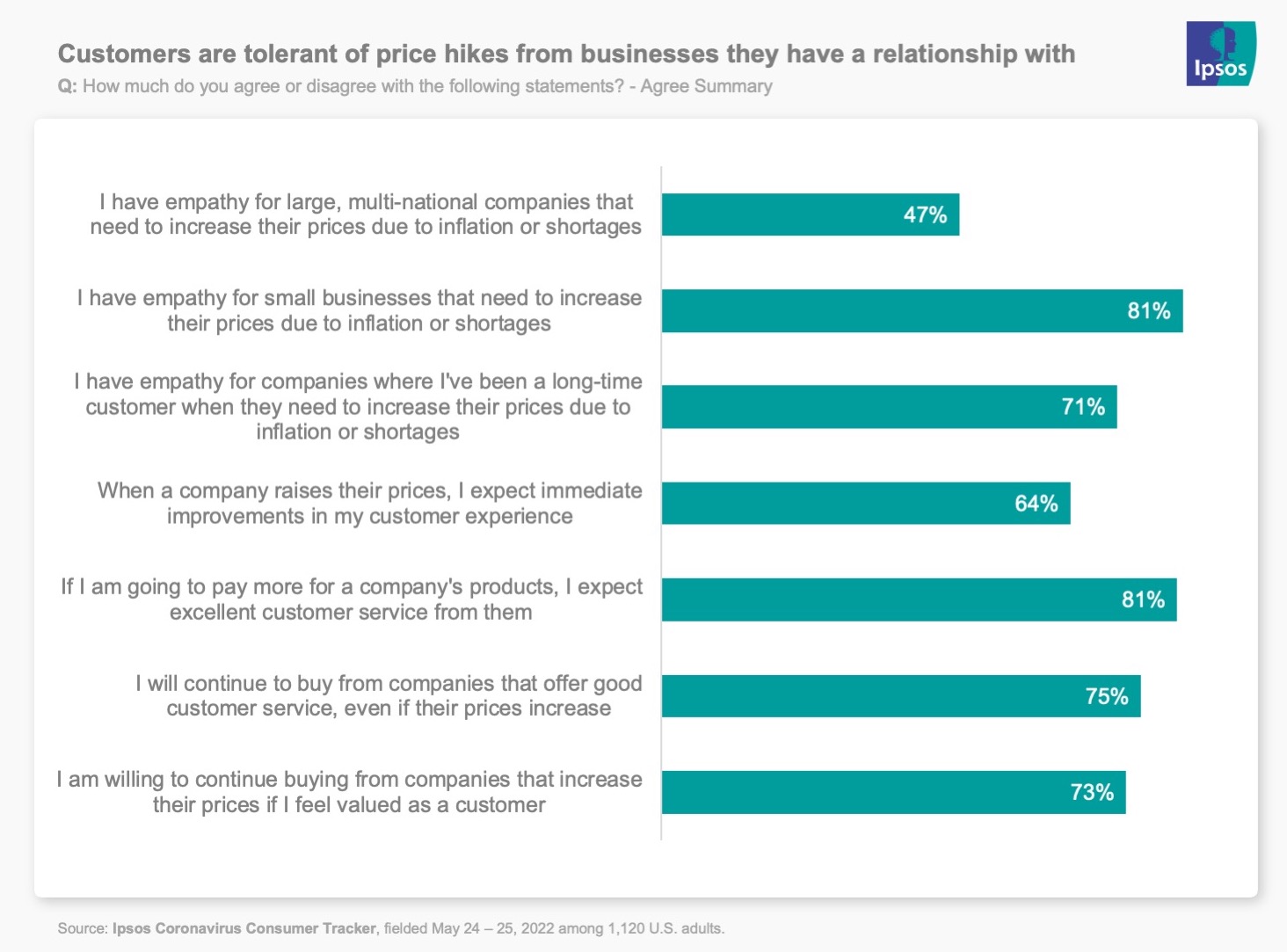

Are we willing to cut companies we like some slack on inflation?

Why we asked: What role does customer experience and loyalty play in how we react to price hikes?

What we found: Overall, we see high willingness to pay higher prices for companies where we feel valued as a customer (73%) and offer good customer service (75%). But we have expectations that go with that. If we’re paying more, we expect excellent customer service (81%) and we expect immediate improvements (64%). We have empathy for small businesses that have to raise prices (81%) but much less so for large companies (47%).

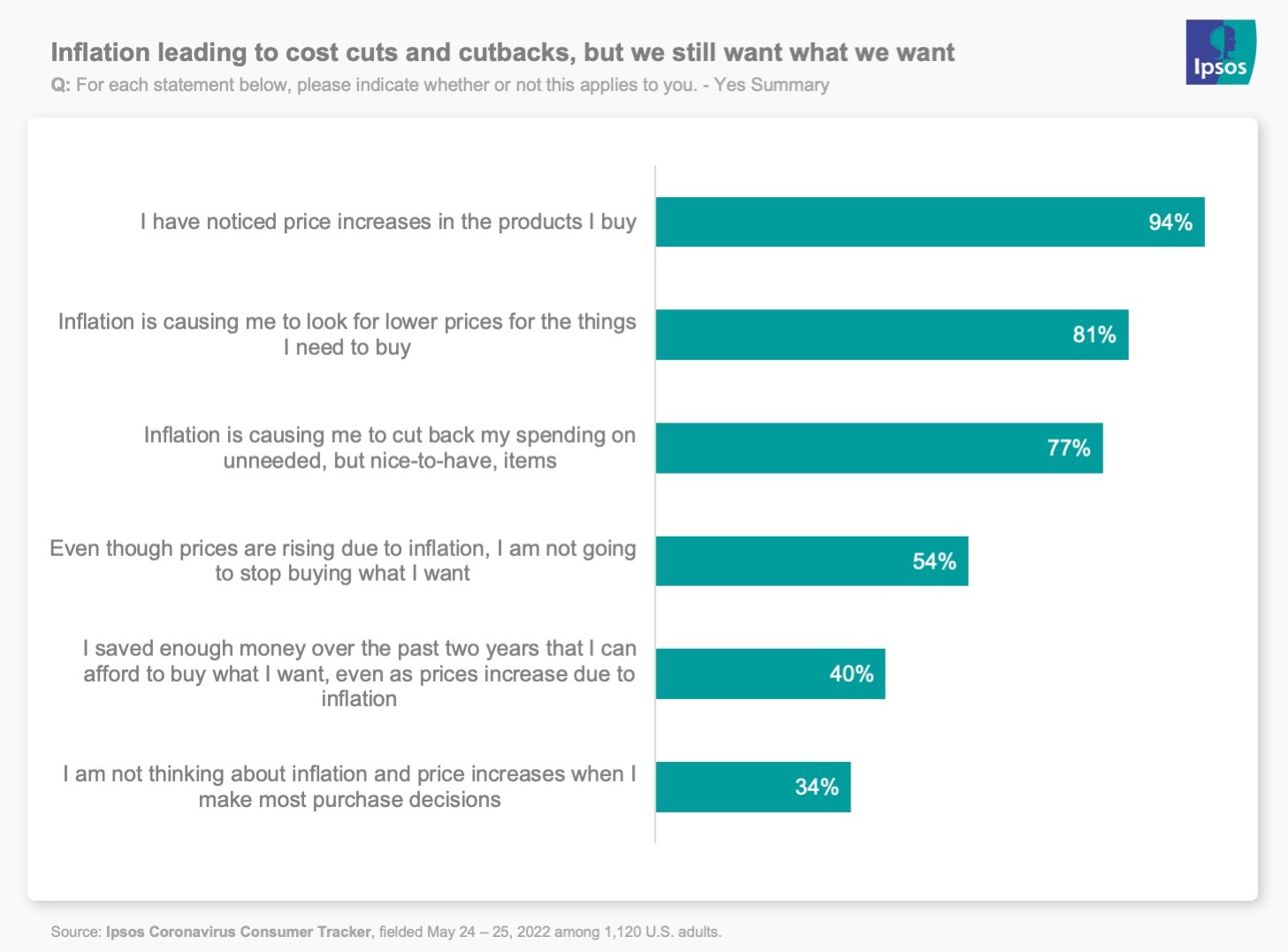

Our contradictions on inflation

Why we asked: We keep coming back to inflation in new ways to get at how customers are reacting.

What we found: Not sure how many times we’ve seen 95% as a response to a question, but that’s how many people say they have noticed prices rising with almost no variation among any demographics. Most of us (54%) say that we’re buying the stuff we want anyway (again without much shift across demos) but we’re also trying to watch prices (81%) and cut back on the nice-to-haves (77%). For the higher income brackets ($100k+), there’s a feeling (57%) that they saved enough over the past two years that they can cover the higher prices now.

What’s up with gas prices?

Why we asked: Gas prices are a specific kind of inflation we mostly all feel day-in-day-out. We drilled a little deeper into this spending category (oil pun intended).

What we found: Whoa, there’s that 95% number again – the percentage noting gas prices in their area have risen. In the West, it’s 98%. Nationwide, seven in 10 say that they are driving less and 25% say they are driving out of their way to find stations with cheaper gas. Half are just filling their tank partially instead of all at once. [Editor’s note: I totally just put $20 in the tank at a nearby station so I can later fill it up at Costco.]

Signals

Here’s what we’re reading this week that has us thinking about the future.

- The EU is contemplating a sweeping AI law (via MIT Technology Review)

- Scientists think they can break down plastic faster (via Singularity Hub)

- U.S. looking to create “friendly” supply routes (via WSJ)

![[WEBINAR] Changing Focus: How 2026 will be different for global Influentials and Company Leaders](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-0305-Influentials.jpg?itok=ZWeDU7Op)

![[WEBINAR] 2026 KEYS: Battle for Attention](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-keys-Battle-Attention_0.jpg?itok=ftV-emtI)