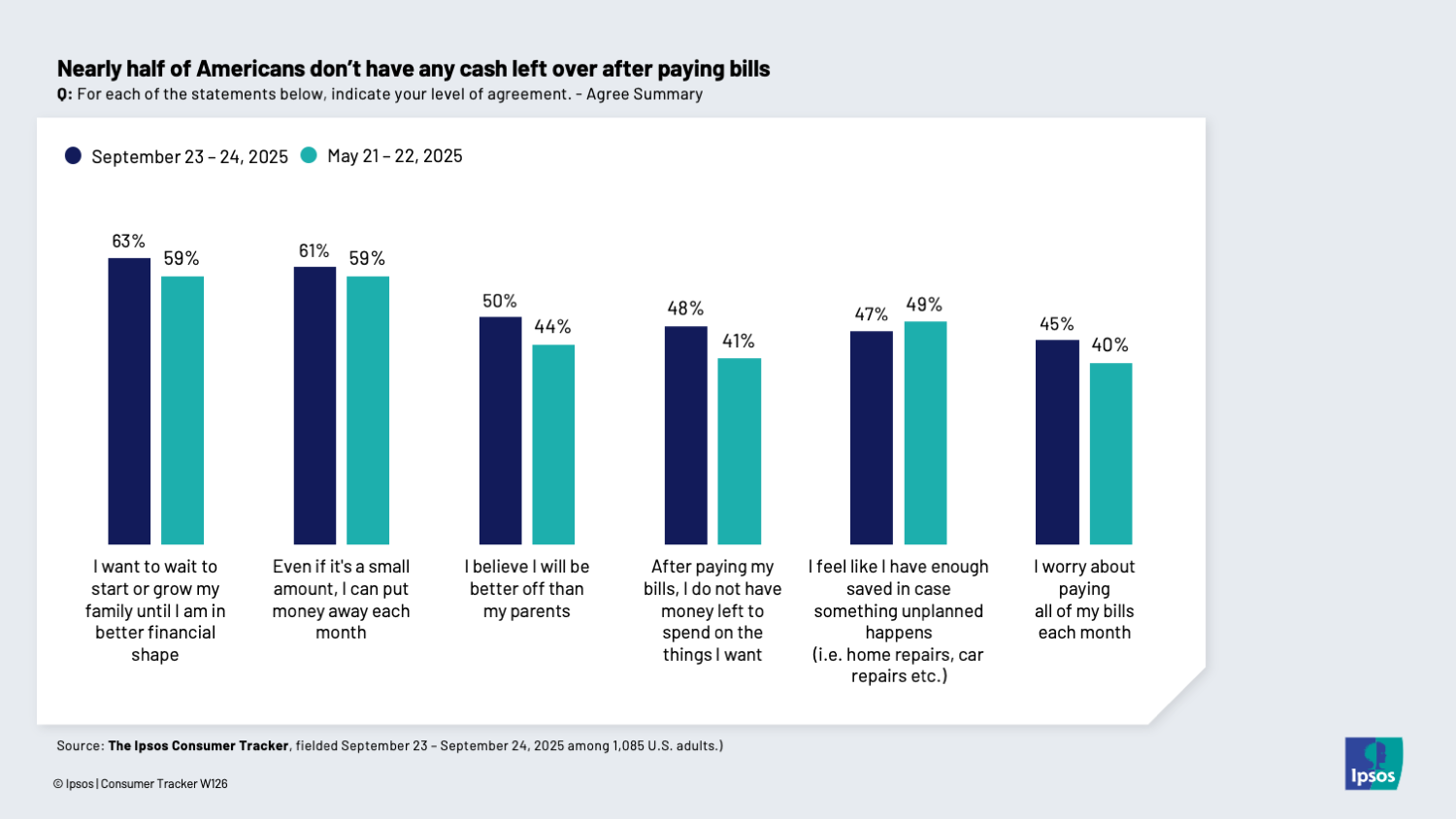

Nearly half of Americans don’t have any cash left over after paying bills

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked about Americans' ability to pay their bills: It’s never a bad idea to check in on the consumers and their cash flow.

What we found: The number of Americans who say that they don’t have any money left over after paying their bills is up 7 points from May to 48%, which ties a high not seen since August of 2022, when inflation rates were in the middle of their steep post-pandemic climb.

Consider what this data means: For at least half of Americans, the household budget is actually zero-sum. That means your competitive set isn’t narrowed to others who offer something similar to your product or service. For half of Americans, your competitive set is literally everything: housing, entertainment, food, utilities, childcare, healthcare, etc. If costs go up in one of those areas cuts have to be made in other areas.

More insights from this wave of the Ipsos Consumer Tracker:

Americans are stressed but also hopeful. Here's why both are possible.

The more we know about artificial sweeteners, the less we want to consume them

Americans' views on the role of government are shifting

The Ipsos Vibe Check: Here's how Americans feel about the government this week

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?