Want to understand Early Adopters of Generative AI?

KEY TAKEAWAYS:

- While the world debates the advantages and drawbacks of generative AI, early adopters are already digging in and trying out the technology for themselves in numerous ways.

- Even as early adopters, generative AI users have a wide array of different priorities. What users need, how they engage and how often they engage are not homogenous.

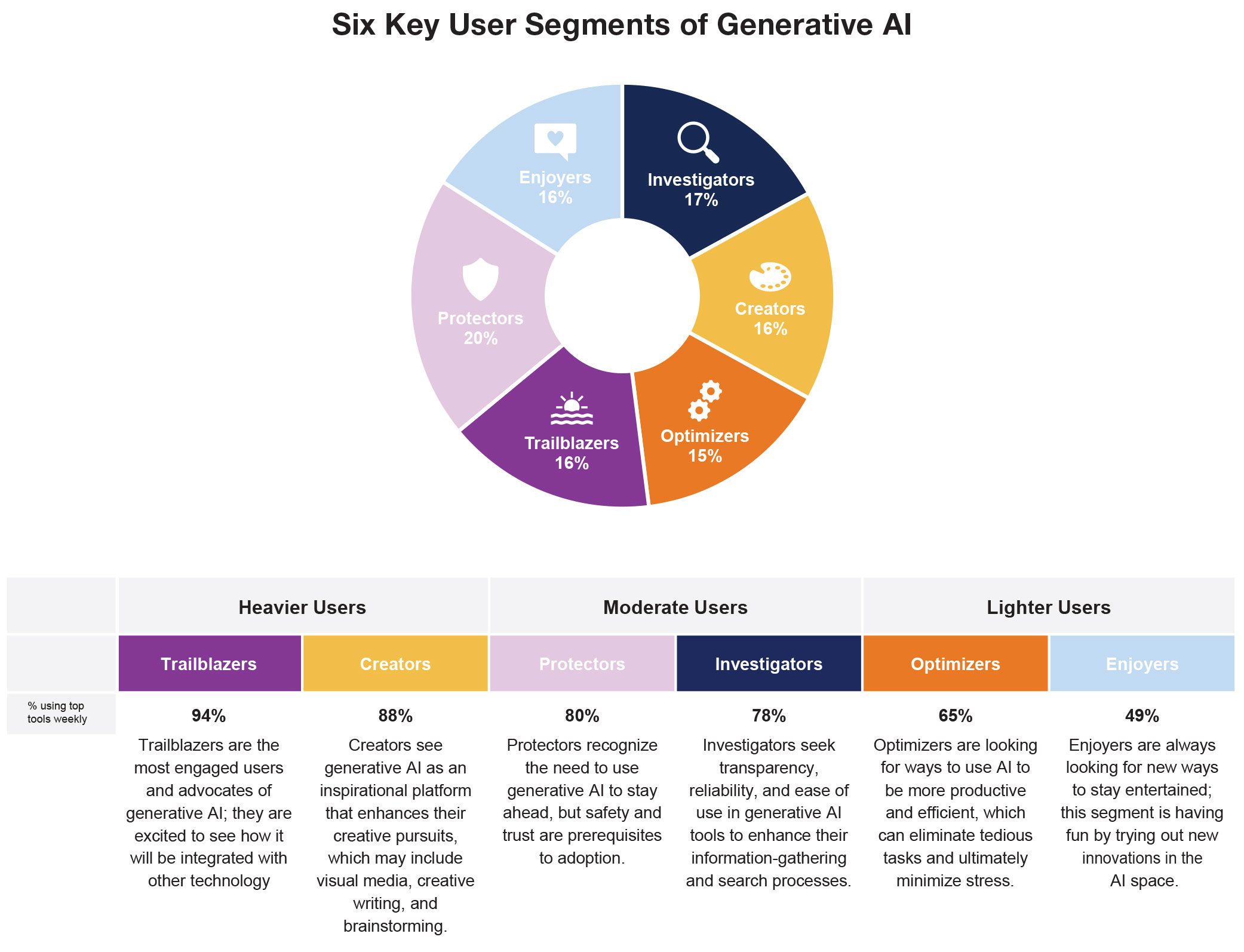

- Users can be split into six segments based on their priority needs when using generative AI tools: Investigators, Creators, Optimizers, Trailblazers, Protectors and Enjoyers.

- Understanding how different segments think about and engage with generative AI can allow companies and brands to build more useful, ethical solutions and develop relevant messaging.

Generative AI took the world by storm in late 2022, with popular chatbots quickly reaching hundreds of millions of users globally. A recent Ipsos survey found that 16%¹ of Americans reported having used a text-based or visual generative AI system, such as ChatGPT, Bing Chatbot, DALL-E, Bard, Midjourney or Stable Diffusion. As more Americans adopt these tools and AI products are integrated more deeply into consumers’ everyday lives and activities, it is important for brands to understand what users want and expect from the technology. Companies building generative AI tools should keep a pulse on this growing user base and take heed of their needs and priorities to inform their product and marketing strategies.

To gain a foundational understanding of the rapidly growing audience of generative AI early adopters, Ipsos conducted online surveys with 1,000 generative AI users in the U.S², followed by a needs-based segmentation analysis. Globally, Ipsos’s Market Strategy and Understanding team conducts hundreds of segmentation studies every year with clients across categories. Here’s what we found.

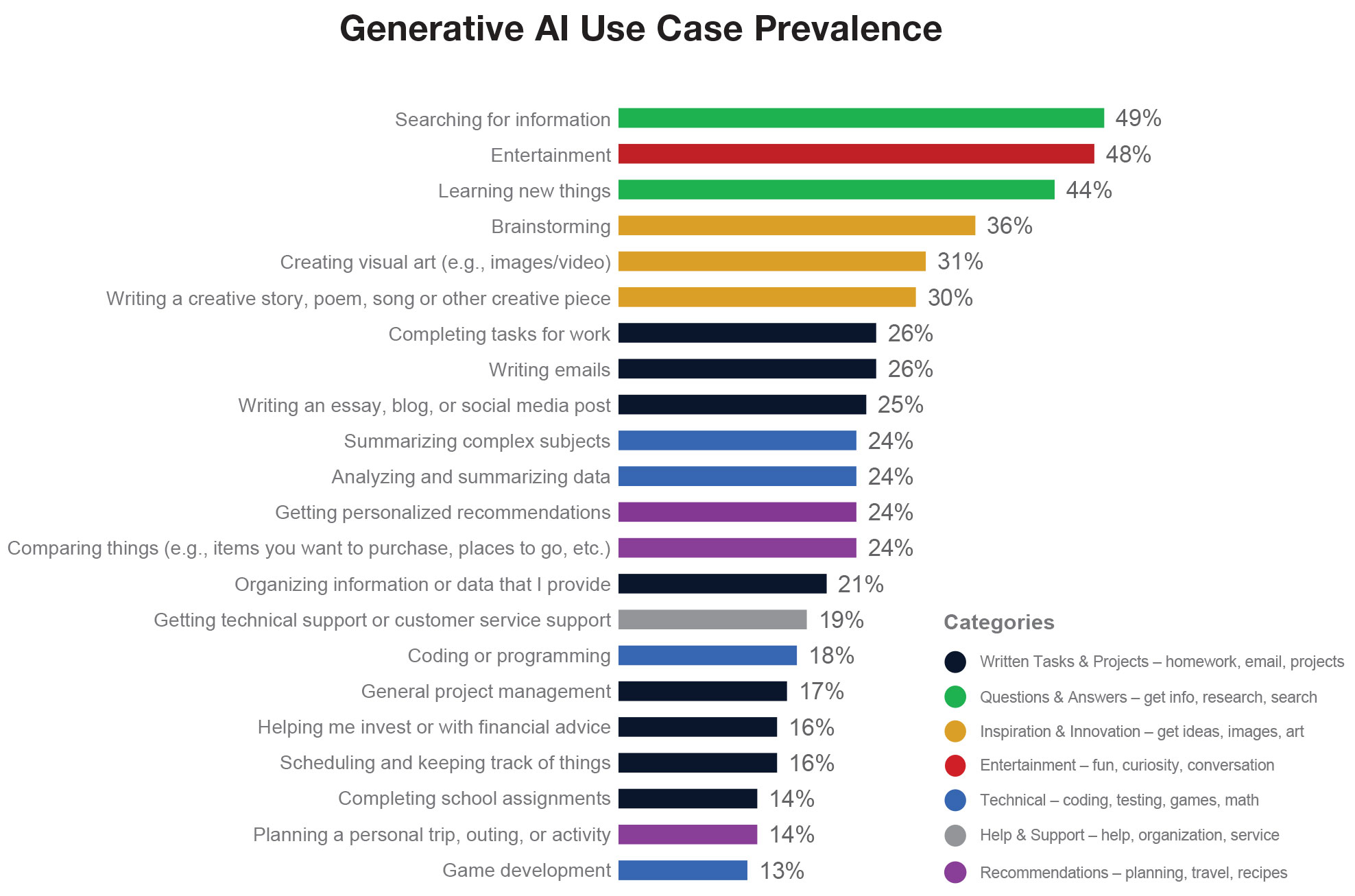

The Breadth and Depth of Generative AI Use Cases

Most commonly, users are turning to generative AI solutions to help them search for information (49%) or learn new things (44%), Ipsos data show. While prompting may be a more involved process for users than a traditional keyword search, the popularity of question-and-answer uses indicates that the more personalized “intelligent” responses are well worth it in the eyes of users.

Entertainment is also a major draw among users (48%) looking to experiment with chatbots for recreational purposes. Many are also employing generative AI for creative pursuits: brainstorming (36%), creating visual art (31%) and creative writing (30%).

Others are utilizing generative AI solutions to make them more productive and efficient while completing tasks at work (26%) and writing emails (26%). In the same vein, technical use cases like summarizing complex subjects (24%) or analyzing data (24%) indicate that there is a real desire for generative AI tools to assist with professional job functions often associated with these use cases.

The breadth and depth of these use cases paints a picture of a complex landscape where early adopters are hoping that the emerging technology can satisfy their diverse sets of needs. Fortunately, segmenting users on their needs provides a compass to help navigate this complex landscape.

Users can be split into six segments based on their priority needs when using Generative AI tools

The six segments can be broadly understood by grouping them into three levels of engagement based on how frequently they are using the most popular generative AI tools. Heavier users are comprised of Trailblazers and Creators, Moderate users include Investigators and Protectors, and Lighter users are made up of Optimizers and Enjoyers.

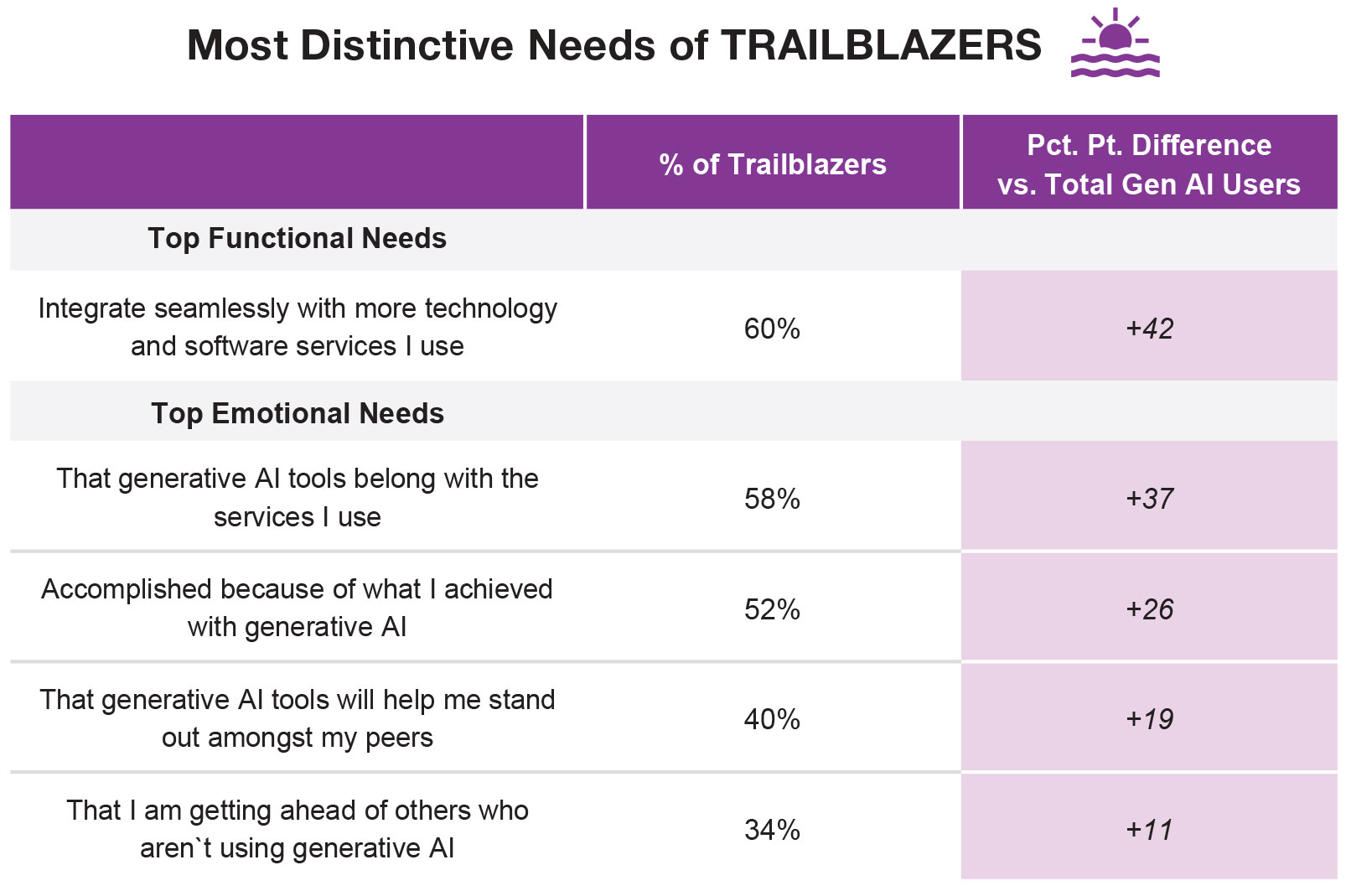

Trailblazers

Trailblazers are likely the earliest adopters of generative AI: They frequently use AI tools for a variety of tasks and see a place for them in their daily lives. These power users believe that using AI tools will put them ahead of others and help them achieve their goals. While they desire to stand out as active users of generative AI, they do not want to be the only ones to reap the benefits. Trailblazers see generative AI as the “next frontier” and are most likely to advocate for its integration in the workplace and in day-to-day life.

Product teams seeking an optimal audience to beta test and soft launch new products, product integrations and innovations should prioritize this segment.

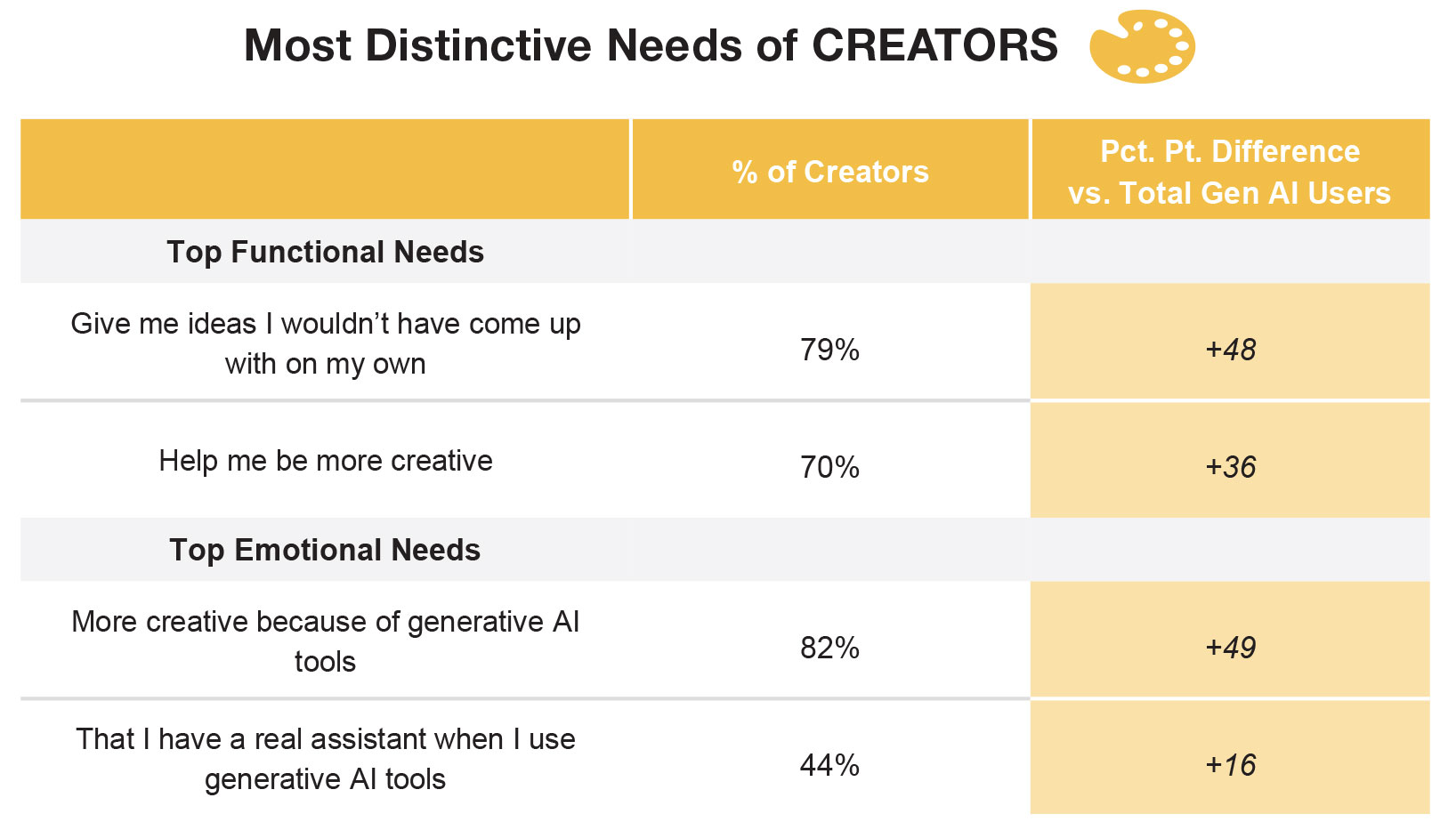

Creators

Creators also use generative AI frequently and rely on it to help them be more creative. Using generative AI often inspires them to create visual art that traditional mediums cannot capture. Though AI tools unlock artistic boundaries for Creators, they do not want to create art without caution, as they believe moderation is important for the pieces they produce. This group is likely to skew towards young adults.

Technology companies designing AI products and tools for creative use can lean into this segment and find success. Beyond the image/video generation, these users are looking at AI to inspire and assist them throughout the entire creative process across a multitude of media.

Teams looking to position their products to this segment should reaffirm their commitment to artist’s ownership of their work. AI companies who train their models on their own proprietary inputs and only use works from consented artists should be viewed more positively by this creative audience.

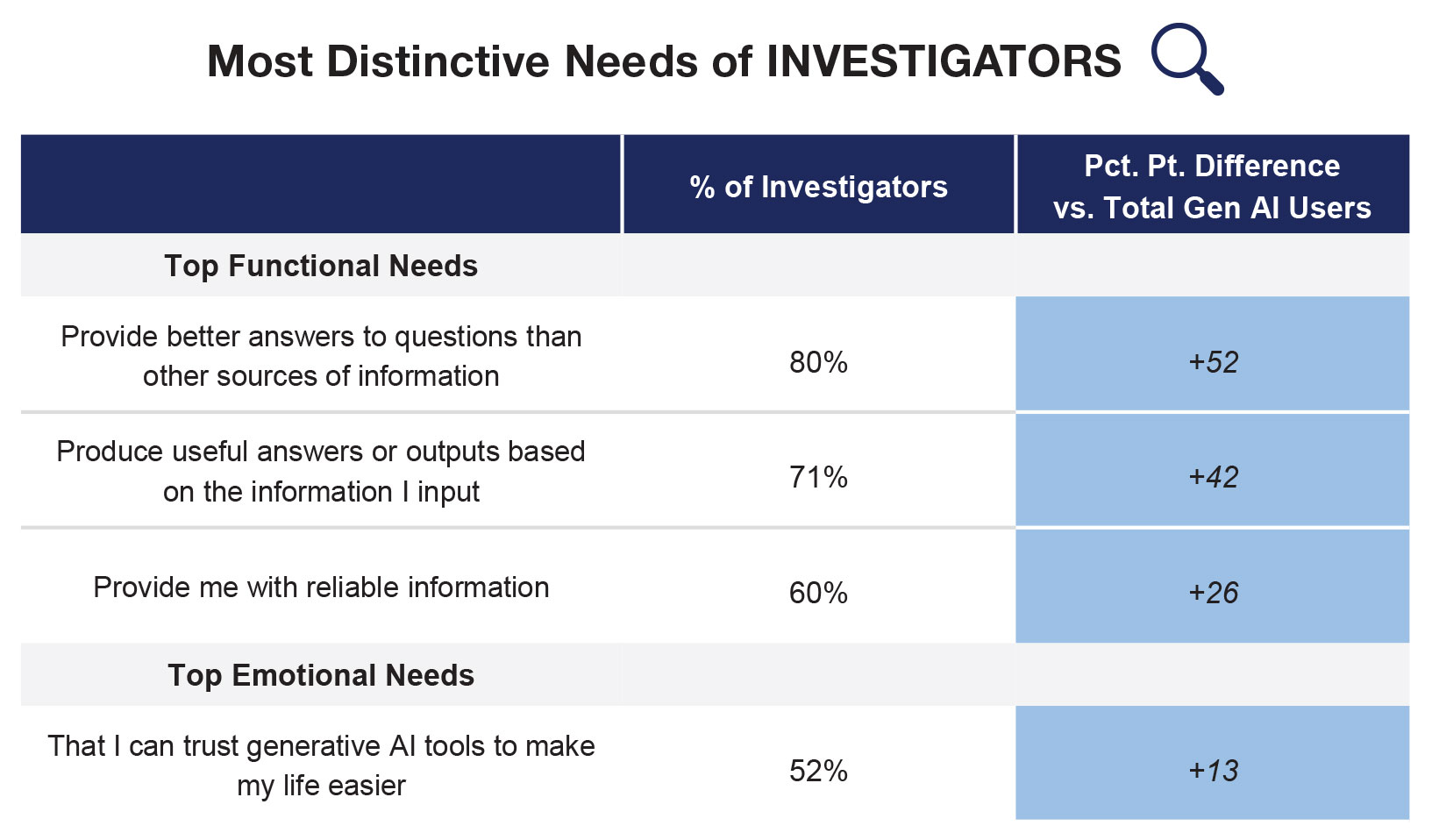

Investigators

Investigators turn to generative AI to get reliable information. They want to stay on top of things and stay informed throughout their day. That said, they value transparency around sources used to give them information and have no time for hallucinations or misinformation from the AI tools they use. What they want out of generative AI is for their lives to become easier instead of more complex when searching for information.

Companies developing generative AI services within the online search category can find product market fit with this segment. To holistically meet this segment’s needs, ensure that product design and marketing communications highlight transparency and accuracy of the generative AI models. Ensure that those who look to generative AI services to provide them with answers to their questions are provided with relevant sources cited and accuracy metrics surrounding the answers they receive.

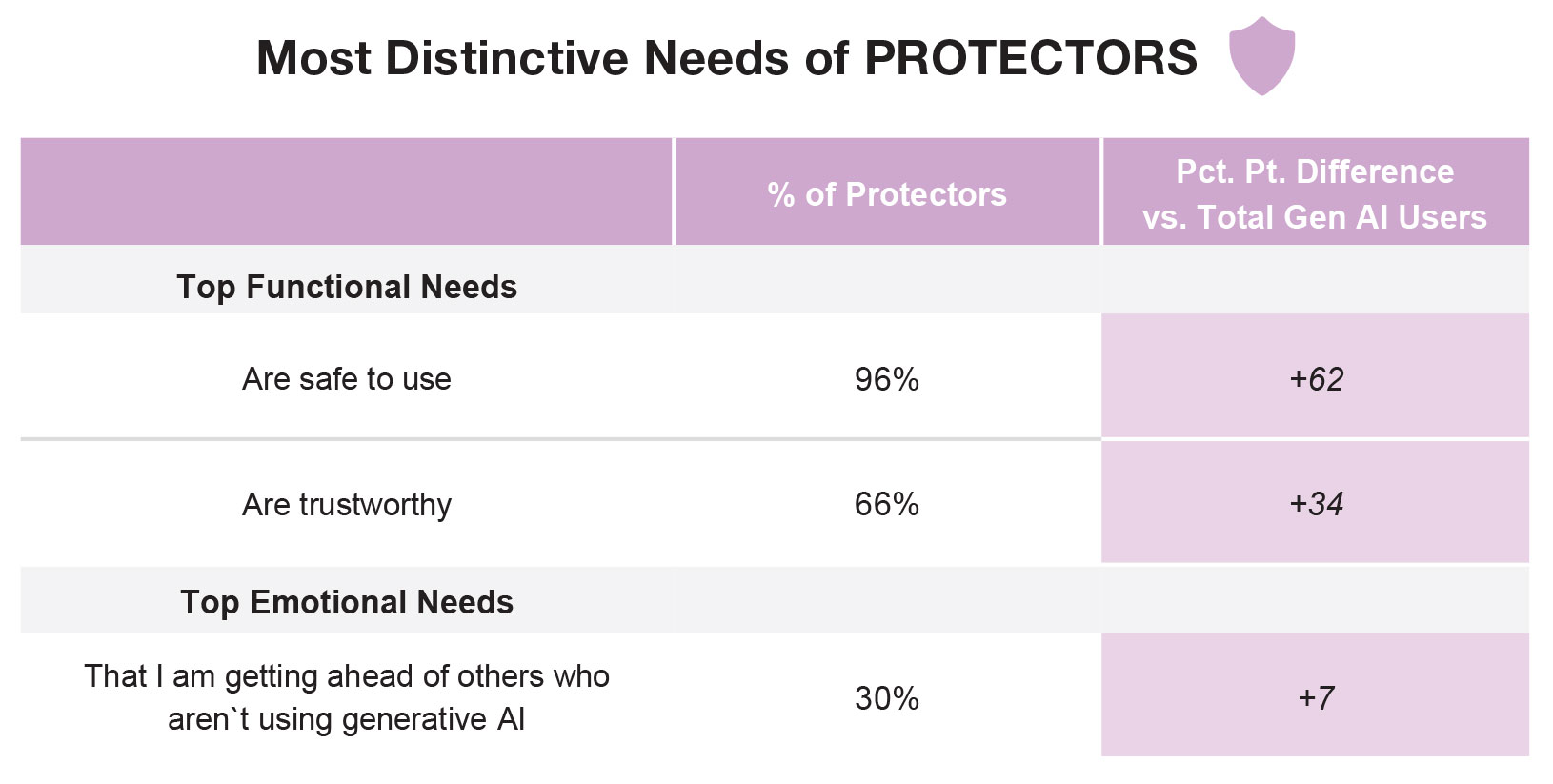

Protectors

Against a backdrop of anxiety and animosity towards the fast-paced growth of generative AI, Protectors go against the grain by welcoming its growth and potential to help users achieve their goals while remaining keenly tuned into product safety. This group gains a sense of empowerment when using AI tools, but requires the tools be trustworthy and safe to use. Data privacy is of utmost importance. This group is likely to skew older and are likely to be a mix of new parents or empty nesters.

Because this segment prioritizes data privacy, companies developing AI solutions should seek opportunities to create models that can run locally and fit on user devices and limiting interaction with server-run AI products will provide the reassurances needed that user data and inputs are kept private.

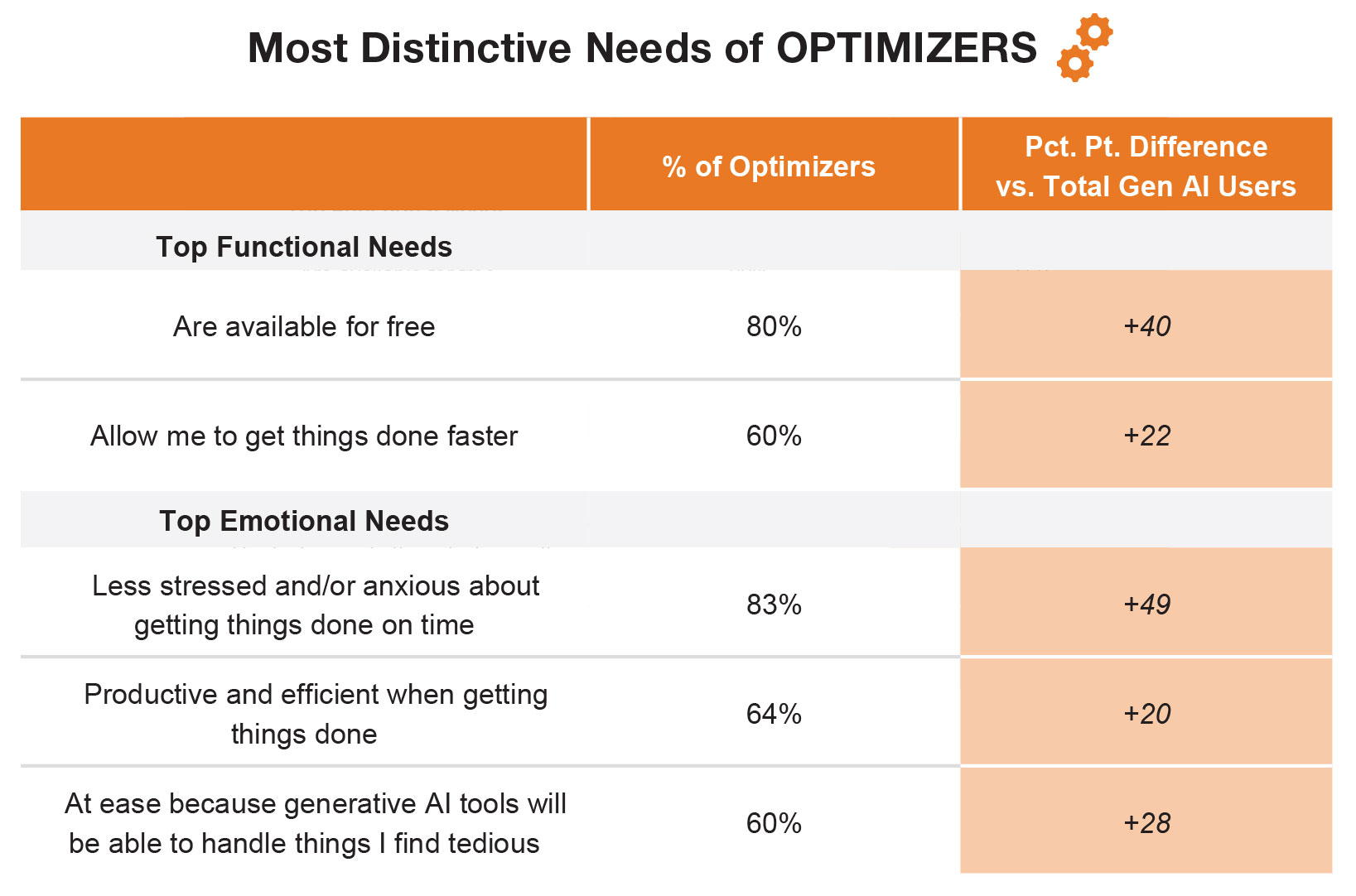

Optimizers

Optimizers view generative AI as a “tool” to help them be productive when doing everyday tasks. They are a “busy” group who look for ways to better handle tedious tasks that they may not have time for. Helping this group manage these tasks frees up more time for using AI tools to brainstorm and handle more important tasks. Overall, they are looking for something that can lessen their anxiety and put their mind at ease when thinking about their workload.

When addressing this segment, product teams should look for ways their AI models can save users time by automating repetitive tasks. Marketing teams looking to position AI efficiency tools should lean into messaging around how the products can lessen the load on workers and make their lives easier.

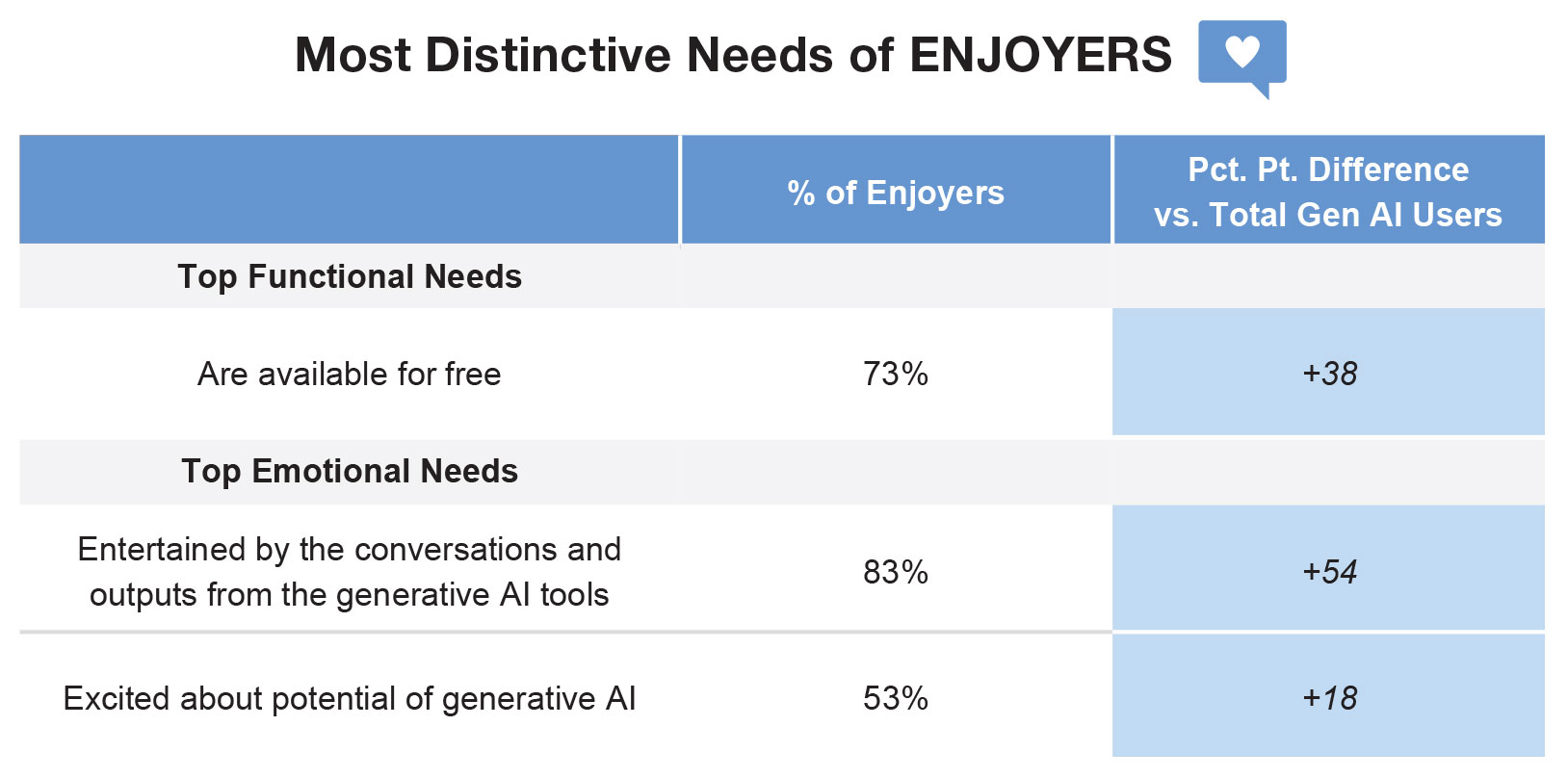

Enjoyers

Enjoyers are always looking for new ways to stay entertained, and for this group, generative AI gets the job done by providing an enjoyable experience. AI tools provide a platform for this segment to experiment with their inputs to see what they can get, whether it be through having interesting conversations or creating visual art. These outputs keep this group excited about the potential of generative AI and create a pathway for them to become active users of the product.

AI product teams should be aware of the Enjoyer segment, which prefers to “keep it light” when they engage with generative AI tasks. Ensuring tools are fun and enjoyable to use will satisfy these entertainment-seekers.

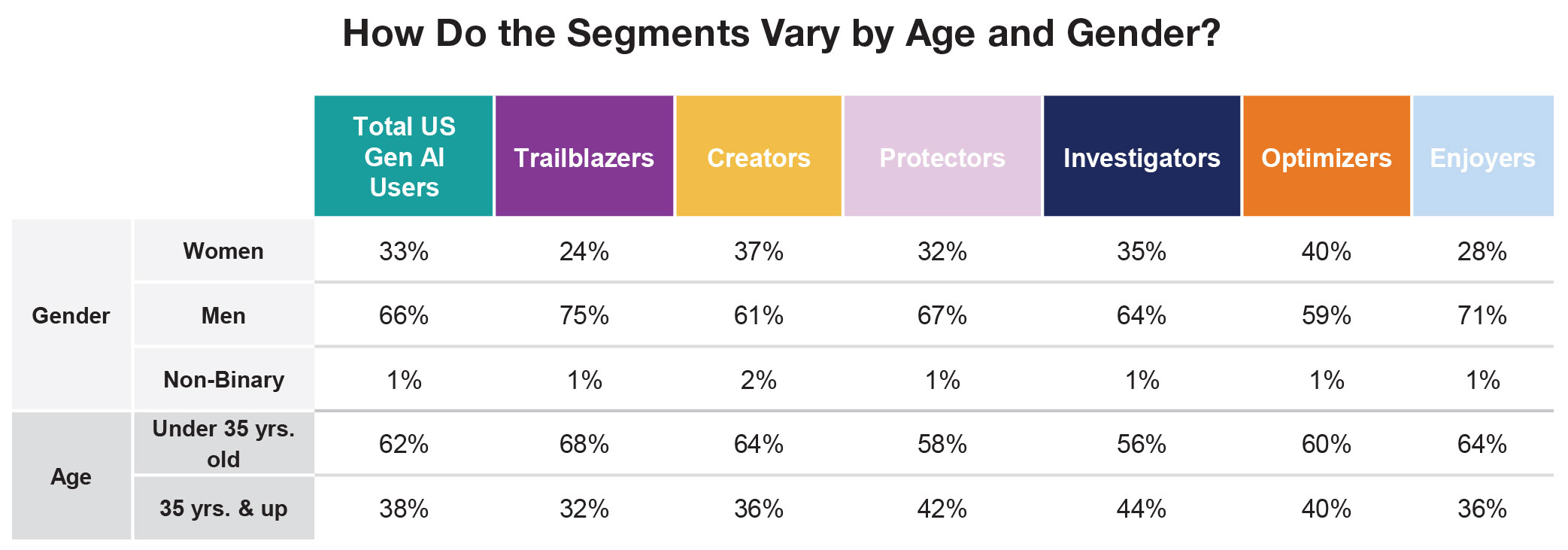

While generative AI users are more likely to be younger men, women and older Americans are also engaging with the technology. In fact, across segments, between 24 and 40% are women and 32% to 44% are aged 35 years old and up. These segments are not demographically monolithic: the needs that define them apply across gender and age groups.

What’s Next : Leveraging the Framework for Product-Market Fit

Segmentations help provide nuance from broad market noise by creating distinguishable groups so organizations can activate the right audiences with targeted marketing and intentional product design. Below are a few ways in which tech leaders can utilize the segmentation to achieve business objectives:

Interested in learning more about these segments? A detailed report with a typing tool is available for purchase. For more information, please contact Kim Berndt or Kayvon Spire.

¹ Source: Ipsos. Conducted April 20-24, 2023. Base size U.S. Adults 18+ (n=1,008)

² Source: Ipsos. Conducted May 11-19, 2023. Base: US Generative AI users between the ages of 18-65 (n=1000)