Be-Italy! Exploring the dynamics of Italy’s international reputation

Ipsos in Italy has completed a research study looking at the attractiveness of the country abroad. It comprised an online survey of the general public in 19 countries (N=500 per country, including 200 in higher socioeconomic grades. In addition, 40 interviews were conducted with international business leaders and a social listening exercise was carried out in three languages: English, French and Spanish.

Here are the main highlights:

Italy benefits from a rather good image abroad

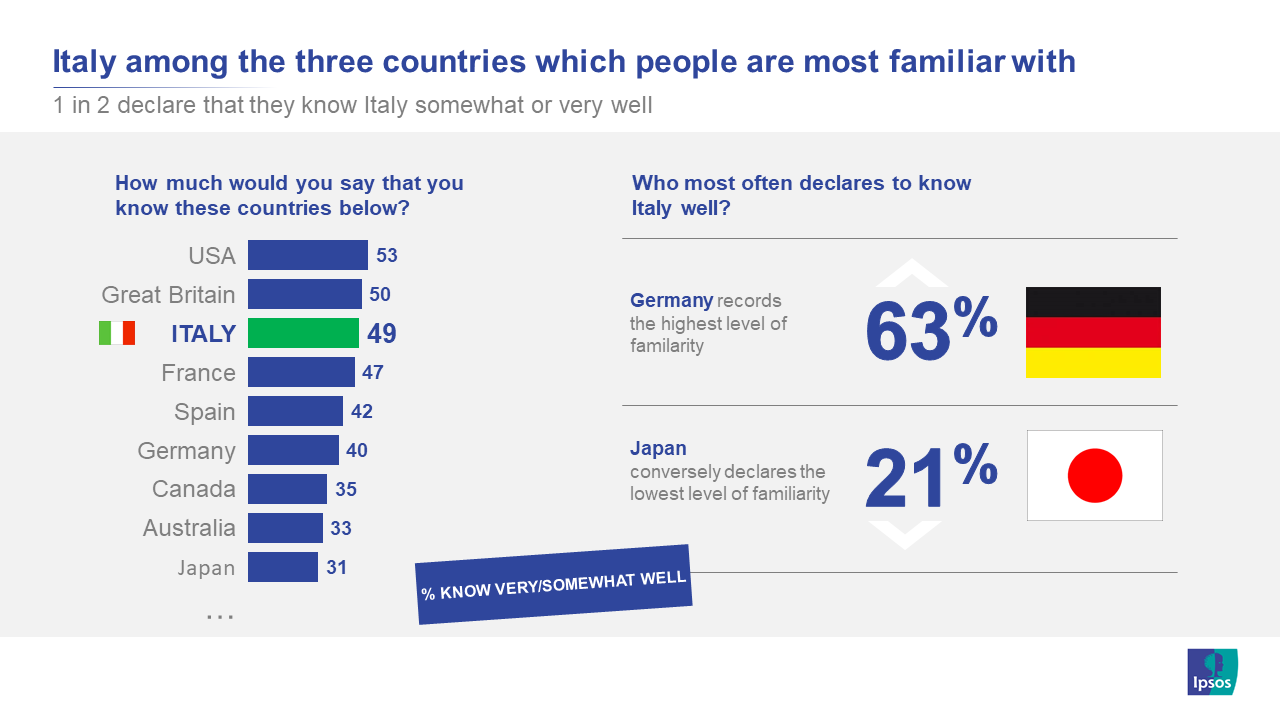

- 49% of respondents say they know Italy well or somewhat well, ranking it a close n°3 behind US (53%) and UK (50%).

- 44% use the Internet and social media to get information on Italy, its culture and ‘Made In Italy’.

- TV also plays a significant role (37%), particularly through popular culture (e.g. TV series like Gomorra, Suburra…), and thus forges a peculiar representation of Italy in people’s minds.

- Themes most often discussed or mentioned online include tourism (19%), Culture (19%), and Food & Wine (16%), with ‘Made in Italy’ amounting to only 8% of this volume, down 11 pts. from 2016.

- Food & Wine essentially generate positive sentiment (positive balance of 21%), only politics (-4%) and economy (-11%) generate negative sentiment balances.

- Italy is ranked n°1 by higher social grades for Quality of Life, Positive Attitude, and Creativity, second to Canada for Tolerance, Peace Keeping and Aid, and 4th to Canada for Sustainable Development.

- It ranks only n°6 for Economic Growth (US and Germany both n°1), 5th for Political Stability (Canada n°1), 8th for Efficiency (Germany n°1), and 6% for Innovation and R&D (US n°1).

- Design & Fashion (51%), AlcBev (50%), Tourism (48%), Food Processing (45%), and Arts and Culture (44%) are the industries most often mentioned as those where Italy produces high-quality goods and services. Furniture (20%) surprisingly closes the list…

- 62% “completely agree” that Italy has got an exceptional range of food and beverages to offer.

- Advanced Technology is the sector which superficially appears to be least developed in Italy. People also perceive Red Tape as a major obstacle to agile innovation on the part of businesses.

- The difficulty to innovate for Italian businesses is first and foremost due to the complexity of the system. The ‘physiological’ sluggishness of public administration is a brake on private initiative. Political instability implies that political decision mostly rests with the European Union and not with Italian politicians. The current system seems to favour the status quo to the detriment of change. Speed, support and stability are thus what is needed from the institutional framework. There is also a lack of dialogue between business, research and academy.

- There is an emerging consensus that Sustainability should be an important evaluation criterion of business performance (42% globally, 52% for higher social grades and 58% in Italy).

- While ‘Sustainable Products’ in general are first and foremost associated with environment-friendliness (47%), this feature is associated with Italian products by only 5% of all respondents. Quality (44%) and Taste (35%) are more saliently associated with Italian products than they are with ‘Sustainable Products’ in general (with respectively 34% and 15%).

The Perceived Value of ‘Made In Italy’

- The meaning given by respondents to ‘made in Italy’ is first “manufactured and assembled in Italy” (44%), then “raw materials are extracted from Italy” (37%) and only marginally “the product is sold by an Italian company” (11%) or “the product is packed in Italy” (5%). LABEL and BRAND are the main cues of authentic Italian-ness.

- “Made In Italy” is associated with Passion, Creativity and Attention to Details. “Italians are a passionate people. So when they translate their passion into something concrete, they do it really to perfection.”

- Passion and Tradition are often associated to each other AND both to Italy. Passions means dedication, love and pride. “Made In Italy” means creativity, research and attention to details. It is communicated through brands across sectors.

- But it remains important to convey the distinctive assets of “Made In Italy”:

- 1. LINK TO TERRITORY: very important to make food products and beyond immediately recognizable.

- 2. BRAND NAME: they are often the main vehicle of Italian-ness. But beware of confusion when a brand name “sounds Italian” though it isn’t…

- 3. QUALITY AND SOURCING: it is difficult to appraise, and consumers thus rely mostly on brands to help them with their choice.

- 4. LABELS: brands can be particularly successful when they “tell a story” about themselves and their know-how.

Italian Food Service perceived quality is high

- Italy’s leadership in culinary arts is undisputed: 49% associate it with Italy, vs. 22% to France and 16% to Japan.

- Italian Food Service is both the most often experimented with and delivering the most satisfactory overall experience.

- Pasta, Pizza, Wine, and Cheese are the most often mentioned Italian foods online.

Italy is a rather attractive destination for tourists

- If they were offered a travel to a destination of their choice, 40% (up 3 pts. from 2016) would choose Italy, 26% Australia, 25% Japan, and 21% United States. Among those who have already visited Italy more than 3 times in the past, 44% are still willing to return.

- The tourist experience gets a positive ratings overall, particularly for the beauty of landscapes (63% very positive), restaurants (61%), museums (60%). The least satisfactory experience was with public transportation (only 23% very positive).

- 27% of the overall samples and 43% among higher social grades express likeliness to travel to Italy in the next 5 years.

- Those who have been living in Italy for some time testify to a unique experience: they’ve been often surprised by Italy, particularly the ones who came from countries with a comparatively weaker historic heritage. They experienced a “wow effect” which is not always properly leveraged by the tourist industry to promote the exceptionalism of Italy vs. other destinations. It is thus important to promote:

- Traveling on side roads: visit small towns, discover by yourselves places unheard of before, as those can be a major source of enjoyment for a particular kind of tourist. Yet this implies facilitating this discovery by improving transportation and services locally.

- ‘Environmental’ tourism related to nature and sustainability.

- The landscape and climate diversity: something which is often overlooked by tourists coming from distant countries like the USA "most Americans see Italy as a country which is always sunny, a small country, where one doesn’t expect to find such a diversity. We have a very ‘monolithic’ image of Italy. This turns out to be belied by the diversity of its seashores or by its Alpine landscape.”

To conclude: what is expected of Italy in a near future?

Italy must leverage the positive image which it currently enjoys, making the most of its assets when it comes to sustainability and innovation.

It’s therefore worth using centralized and cross-sector communications to ensure that Italy’s image abroad evolves and goes beyond the stereotypes which have been lingering over time.