Russia TrendVision Review of State Statistics and Consumer Trends

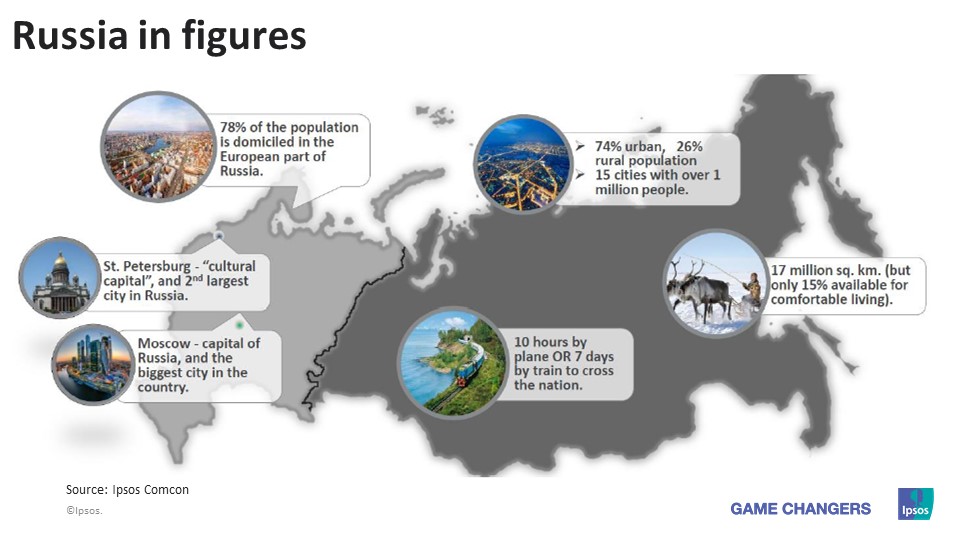

General facts

Russia is mainly urban state with nearly even distribution of population between big and small cities.

Russia is mainly urban state with nearly even distribution of population between big and small cities.

Is Russia a land of bears? Not only!

Russia is the country with the biggest territory in the world It spans across all northern Asia and Eastern Europe covering nearly all natural areas – steppes, forests, taiga, tundra and arctic deserts – and climate zones. Russian fauna consists of up to 130 kinds of animals and represents 10% of world variety of animals.

Income

Financial status and income changes.

The crisis has made people feel they are poorer than before, but still the majority (83%) of the population in 100k+ cities can afford to buy foodstuffs and clothes.

Income by strata

Cultural capital of Russia St. Petersburg is pretty close to other 1mln+ cities by income rates.

Income vs. Subsistence minimum

While most Muscovites’ and 1 mln + citizen’s disposable incomes exceed the country’s average, the majority of those living in small cities have below-average incomes.

Consumer confidence

Consumers’ incomes have doubled since 2008, but in 2015 growth is slowed down. Stagnated consumers’ confidence index for 2010-2014 followed by a sharp drop in 2015.

Savings on food

Consumers’ saving behavior has stable high level during 2015 regardless of the crisis importance. The shape of savings trend does not repeat crisis peaks and slopes.

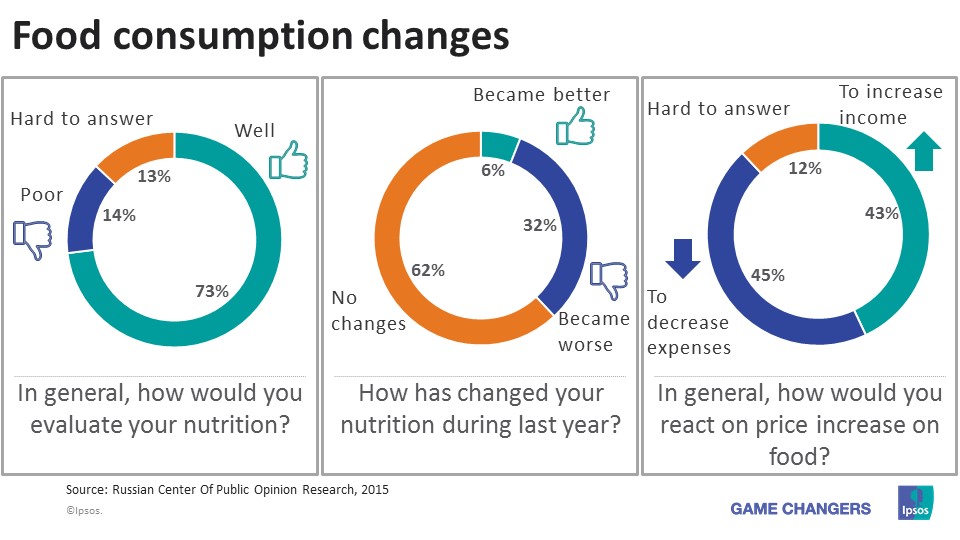

Food consumption changes

Most of people declared that their nutrition is good and they didn’t change their nutrition despite of crisis. Population equally tends to increase income and decrease expenses in crisis.

Consumption trends

Conscious consumption

Consumer used to adjust their purchasing behavior to the current economic situation and continue to save money on all main categories in 2015. While quality of the product is still the most important claimed purchasing factor, price importance is raising visibly too.

- Saving trend for all categories continued in 2015.

- Price importance is growing as crisis is progressing.

Going online!

Internet penetration is continuously growing. Consumers’ trust to the Internet information shows tendency to increase. Small Russian cities citizens and older age groups contribute to total Internet penetration growth a lot. Though current crisis situation influenced online purchasing behavior - consumers became more conscious about online purchasing too, spends on some categories purchased via online decreased.

- Internet penetration is growing while other media channels have negative trend.

- Number of daily Internet users doubled since 2010. Search engines and social networks are the most popular activities.

- Internet penetration is raising among all subgroups.

- Due to raise of exchange rates and price growth number of those, who buy online stopped its increase.

Smartphonisation

Smartphones made visible bound forward in 2015. About half of Russian people own at least one smartphone, while other gadgets penetration hasn’t increased.

- Smartphone penetration has been growing since 2012. Android is the most popular mobile OS.

- Almost every Russian has mobile phone. Landline phone penetration continues decreasing.

Healthy living?

Healthy lifestyle popularity has been staying on the high level for several years. But again crisis makes allowance to purchasing behavior - intention to pay for ecologically safe products decreased in 2015. Alcohol consumption experienced some changes too – people switched from expensive alcohol categories to cheaper beer category. However, the ‘healthy’ trend in smoking rates stays stable (not raising).

- Healthy food - Healthy trend is stable for the past 3 years, though number of consumers who prepared to pay more for ecologically safe products decreased.

- Healthy lifestyle - No visible change in ‘Going for sport’ trend can be seen.

- Smoking - Number of smokers is stable in 2014 Vs. 2015, though the trend is decreasing.

Alcohol consumption - Number of beer consumers increased in 2015 because of switching from more expensive alco categories.

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)

![[Webinar] KEYS: THE MIDDLE CLASS: In Crisis?](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/middle-class-family-dinner-food-carousel.webp?itok=iD1QyX8n)

![[Webinar] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/list_item_image/public/2025-09/image/minisite/keys0925.png?itok=3oAiYcxm)