Britain's economic pessimism rises to near record high: Ipsos survey reveals growing concerns ahead of Autumn Budget

The latest survey from Ipsos in the UK underscores the public's apprehension about the upcoming budget and demonstrates the extent of entrenched economic pessimism in Britain.

Economic Optimism Index

- Three quarters (74%) of Britons believe that economic conditions will worsen over the next 12 months, up 4ppts over the month. 15% think it will stay the same, and just 7% (-3) think it will improve.

- This provides a net Economic Optimism Index figure of -67, just one point above - and effectively the same as - the record low of -68 seen in April 2025 (Ipsos has been tracking this since 1978). The net figure of -67 is slightly worse than levels seen during some of the most challenging economic periods in recent history, including the January 1980 recession under Margaret Thatcher after the winter of discontent (-64), the global financial crisis of July 2008 under Gordon Brown (-64), and the cost-of-living crisis triggered by the COVID-19 pandemic and the invasion of Ukraine in June 2022 (-64).

Mood of the nation ahead of the budget

- 27% of Britons find their household income situation difficult, rising to 1 in 3 of those aged 35-54 (35%), and half (49%) of those on incomes below £20k. Half (50%) say they are coping, and another 23% living comfortably.

- When asked what the top priorities are for economic growth, almost three in five (58%) say keeping inflation low, followed by around half who say reducing taxes (49%) and helping UK businesses to grow (47%).

- Three in five say that they are more fearful than hopeful about how the Autumn Budget might impact their own financial situation (60%) and the British economy (59%). Just over half are fearful about the quality of public services (54%) and British businesses (52%). Views are more apprehensive about the Autumn Budget than they were ahead of the Spring Statement earlier this year (an increase of 10ppts saying they feel fearful for their own financial situation and the quality of public services).

- Other Ipsos research shows that the government is very unpopular, and public satisfaction with the Prime Minister and Chancellor has reached historic lows. But despite that, only around one in four (27%), say that if Labour replaced Starmer and Reeves that it would have a positive impact on the economy. Nearly half, 46%, think it would make no difference, while 17% think there would be a negative effect. Reform UK (42%) and Conservative (37%) 2024 voters are most likely to think replacing them would have a positive impact.

Attitudes towards potential tax rises and public spending

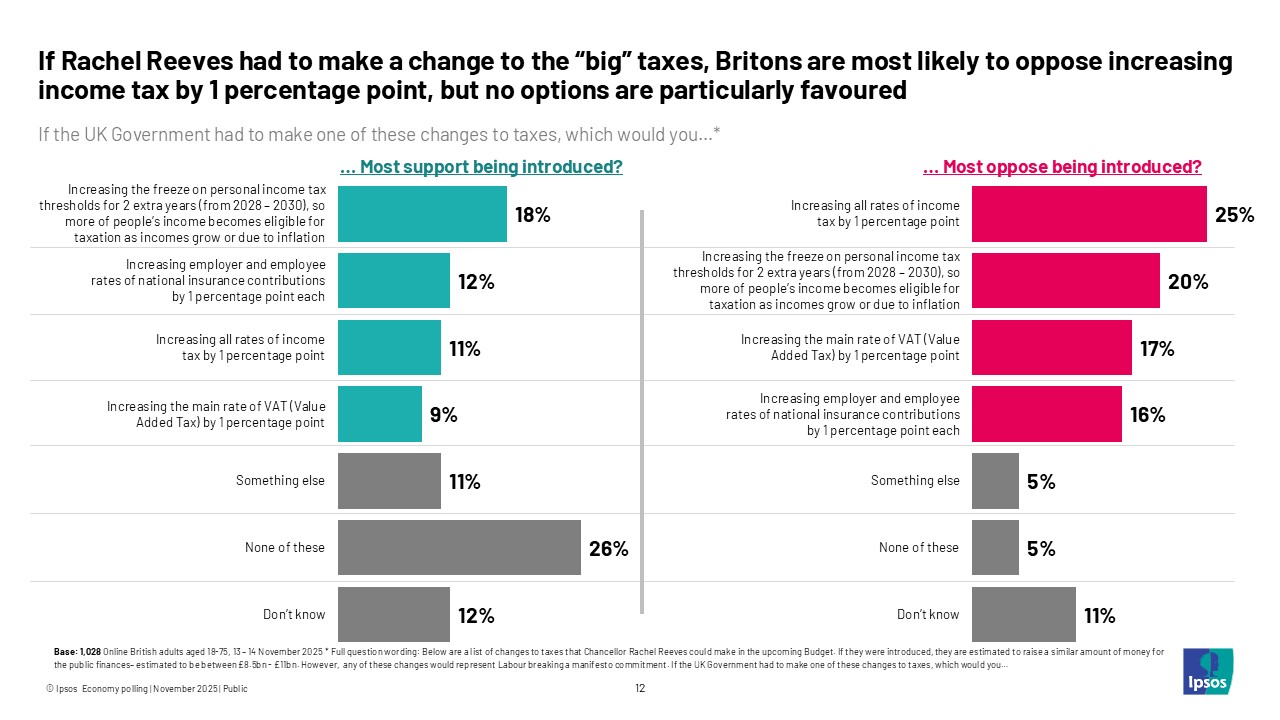

- If Rachel Reeves had to make a change to the “big” taxes – income tax, NICs, and VAT - Britons are most likely to oppose increase raising income tax by 1 percentage point, but no options are particularly favoured. Even the most supported, extending the freeze on personal tax thresholds, is only chosen by 18%, while as many say it is the option they most oppose, and even more would rather something else or none of the above.

- If the Chancellor has to raise taxes, more would prefer her to raise many different taxes that numerous specific groups pay (such as pensioners, GPs, motorists, high earners, people living in more valuable homes, landlords, lawyers and people who are self-employed), rather than raising a single tax that most people have to pay (such as income tax, NICs, or VAT), by a margin of 39% to 21%, though 31% say neither.

- When asked what areas should be prioritised to receive more/ less public spending in the future, there continues to be strong support for maintaining the NHS and healthcare funding (62%), while just over half (52%) think that expenditure on foreign aid and benefits should be reduced.

- On welfare spending, on the other hand, despite signals that Labour is considering removing the two-child benefit cap, the public are unconvinced it is necessary. Around 1 in 3, 35%, think parents should be able to claim benefits for more than two children, while 43% think the cap should be maintained as it is, and another 16% that it should be even lower than two. Since July last year, the proportion who think the cap should be kept at two children or even stricter has slightly increased. Labour 2024 voters are relatively split: 46% think the cap should be eased to more than two children, 49% think it should be kept at two or less.

Arguments for and against raising income tax

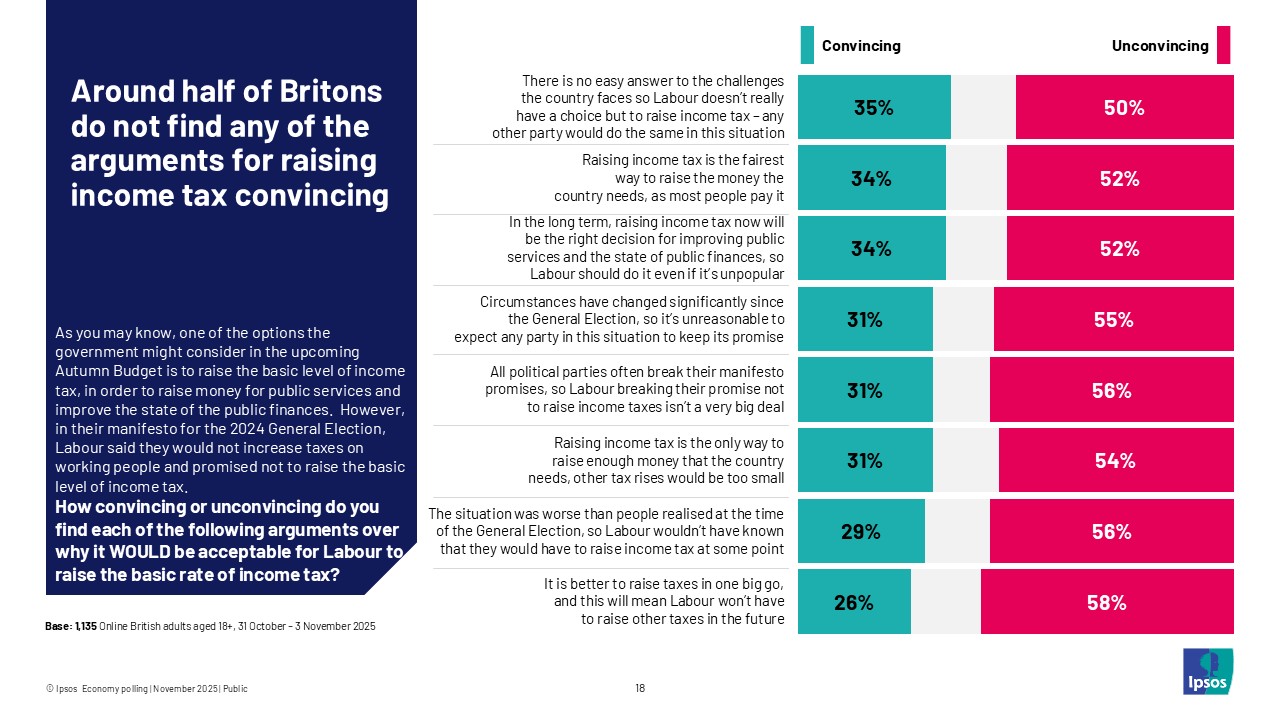

Although reports suggest the Chancellor has now decided that she will not be raising income tax rates at the budget, Ipsos polling shows that around half of Britons find none of the arguments supporting increased income tax convincing. In particular, few believe suggestions that it would be better to raise taxes in one go and this would mean Labour wouldn’t have to raise other taxes in the future (just 26%), or that the situation was worse than people realised at the time of the election (29%). The most convincing argument, for 35%, is that “there is no easy answer to the challenges the country faces, and Labour has no choice but to raise income tax – any other party would do the same in this situation”.

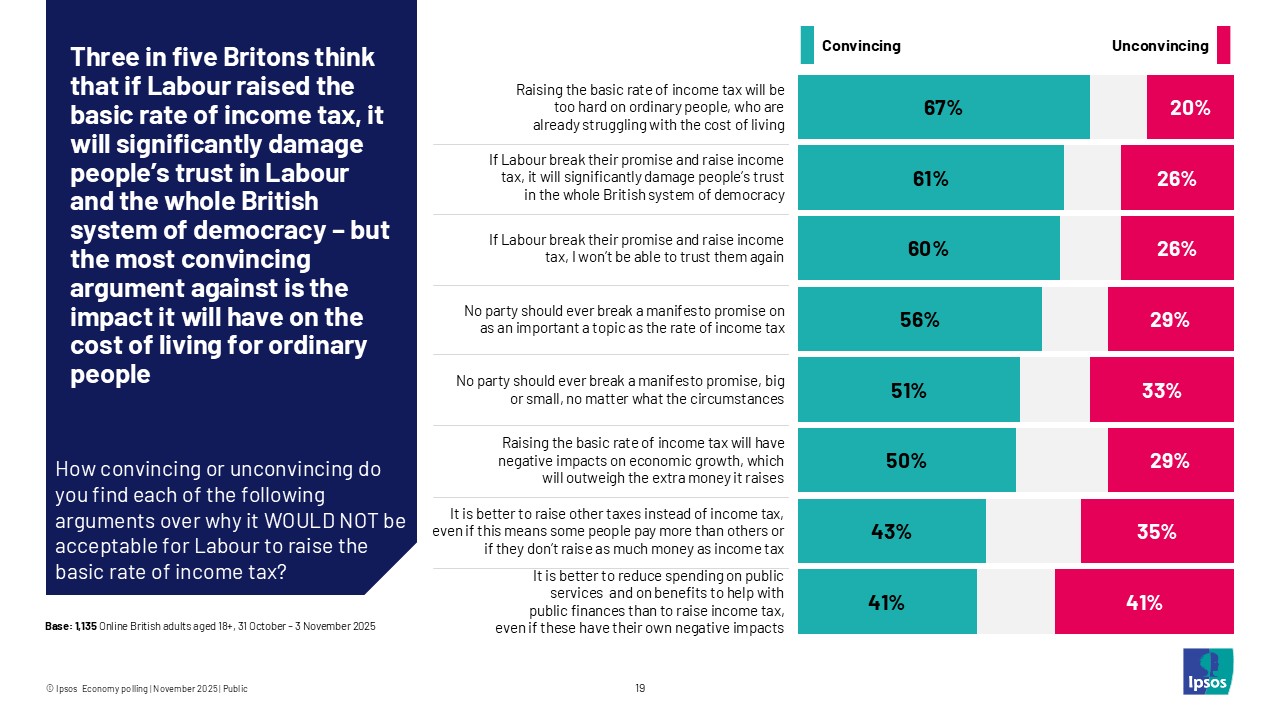

Furthermore, two-thirds (67%) are persuaded by the argument against raising income tax that such an increase would unduly burden ordinary citizens who are already struggling with the cost of living. In addition, three in five believe that breaking a campaign pledge to maintain current tax rates would erode trust in British democracy (61%) and the Labour Party specifically (60%). 56% believe that no party should deviate from manifesto promises regarding significant issues like income tax rates.

Commenting on the findings, Gideon Skinner, Senior Director of UK Politics at Ipsos, said:

Our latest data underscores the gravity of the widespread and deeply entrenched economic pessimism prevalent across Britain - a level of concern that is as bad today as some of the historically toughest periods in our nation’s past. Although it may be some small comfort for the Prime Minister and Chancellor that few think replacing them will lead to a boost for the economy, this probably reflects the depth of gloom and a “none of the above” public mood more than a great deal of confidence in them specifically.

Nor does the public show much appetite for the difficult decisions the Chancellor may take, particularly if it involves raising one of the big 3 taxes: income tax, NICs, or VAT. Few find arguments in favour of raising income tax very convincing, and instead people are concerned that breaking a manifesto promise would damage trust both in Labour specifically and in British democracy more generally – but it is the practical impact on ordinary people’s finances that is most worrying. A small minority are marginally more open to extending the freeze on tax thresholds, but still with little enthusiasm. But that still leaves the question facing the Chancellor – how to grow the economy, ease the cost of living and stabilise public finances, while still finding funds to invest in improving public services that the public also want to see?

Technical note:

- For the Ipsos Economic Optimism Index, Ipsos interviewed a representative sample of 1,008 adults aged 18+ across Great Britain. Polling was conducted by telephone between the 5th-12th November 2025.

- For the polling about arguments for and against raising income tax, Ipsos interviewed a representative sample of 1,135 adults aged 18+ across Great Britain. Polling was conducted online between the 31st of October-03rd November 2025.

- For all other questions, Ipsos interviewed a representative sample of 1,028 adults aged 18-75 across Great Britain. Polling was conducted online between the 13th-14th November 2025.

- Data are weighted to match the profile of the population. All polls are subject to a wide range of potential sources of error.