Ipsos Financial Wellbeing Tracker shows stark divides in concern about household finances

While seven in ten UK adults (71%) say they are either living comfortably (25%) or coping (46%) on their household’s income nowadays, around six in ten (59%) are worried about their household’s financial situation, according to the first wave of Ipsos UK’s new Financial Wellbeing Tracker. Furthermore, the proportion of those struggling to cope, who say they are finding it very difficult/difficult to cope on their income has increased 7 percentage points between February and September 2022 – up from 21% to 28%.

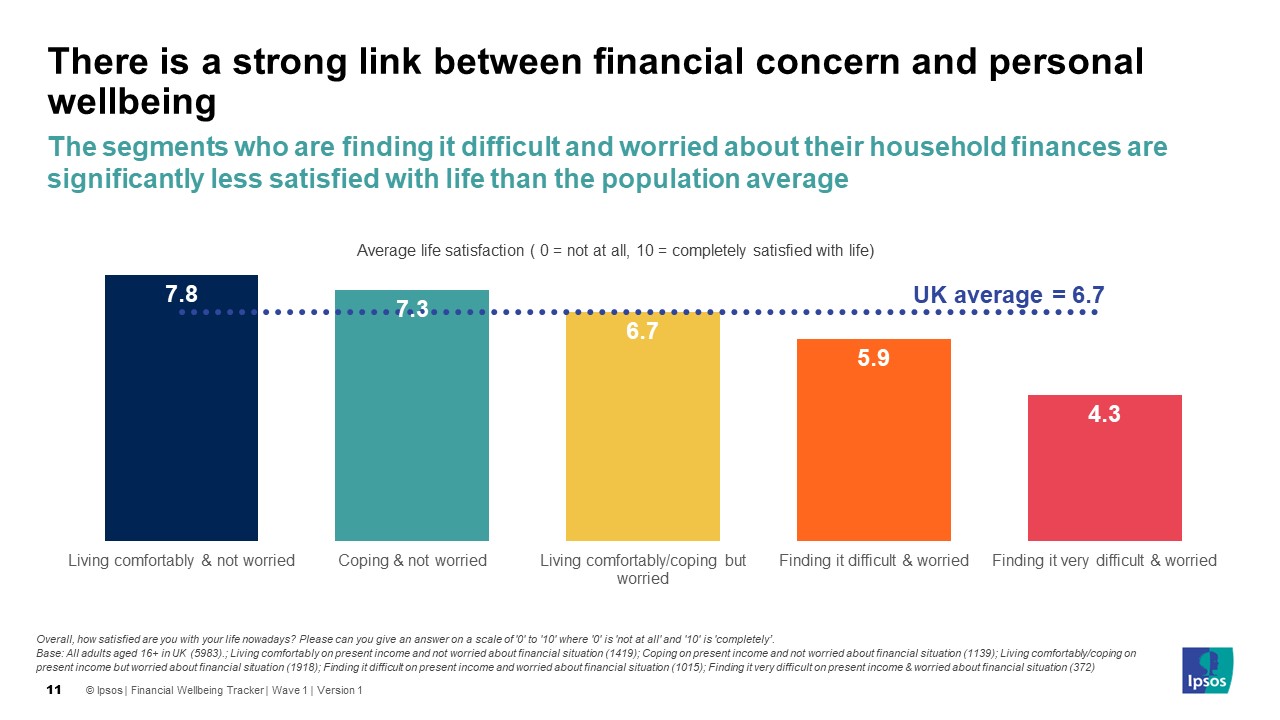

The research shows significant divides in concern about household finances across UK society, with this having clear links with life satisfaction.

Five perspectives on the current cost of living

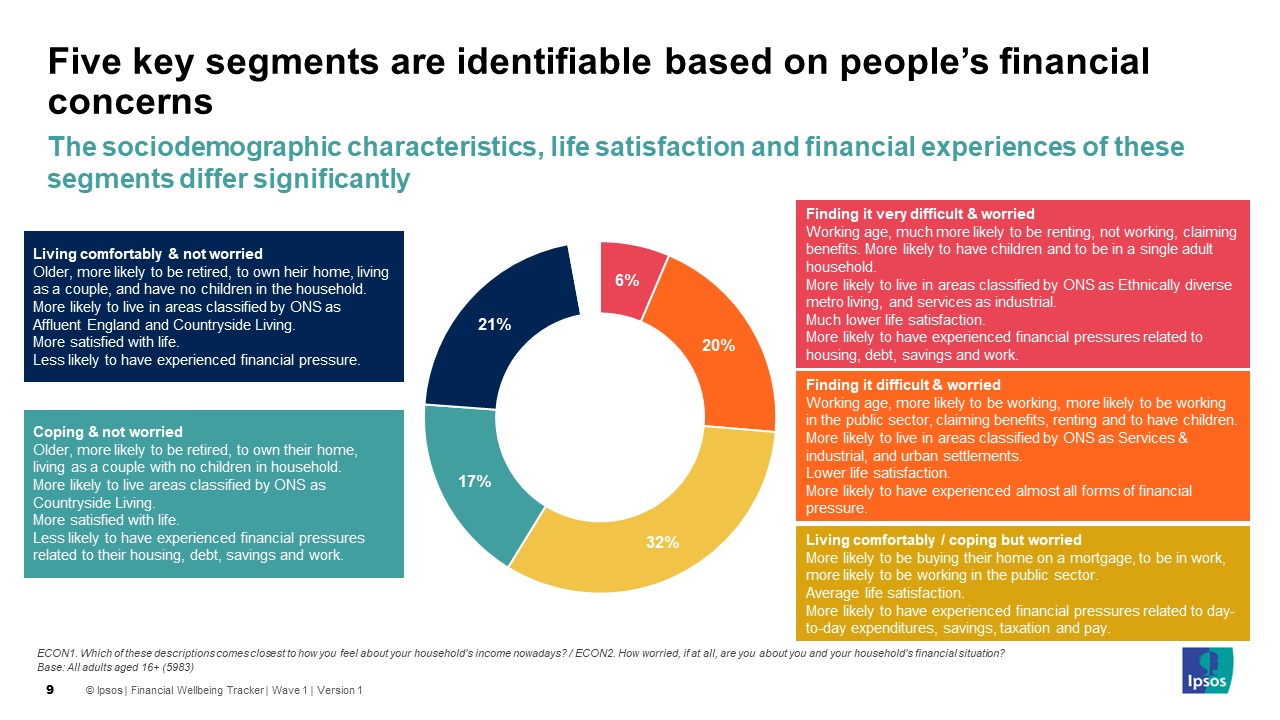

Overall, five segments of the UK population can be identified based on how they feel about their household’s income nowadays and how worried they are about their financial situation. And the sociodemographic characteristics, life satisfaction and financial experiences of these groups all differ significantly.

- One in five adults (21%) are living comfortably and not worried about their financial situation. This segment are older than average, more likely to be retired, to own their home outright, to be living as a couple and not have children in their household. They are more satisfied with life, and less likely to have experienced financial pressures in the last 12 months.

- One in six (17%) are coping and not worried about their financial situation. Similar to those in the comfortable group, this segment are slightly older than average, more likely to be retired, to own their home outright, to be living as a couple and not have children. They are slightly more satisfied with life and less likely to have experienced financial pressures related to their home, debt, savings and work in the last 12 months.

- Around a third (32%) are living comfortably or coping, but worried about their financial situation. This segment are likelier to be buying their home on a mortgage and to be working – particularly in the public sector. While their life satisfaction is in line with the overall average, they are more likely to have experienced financial pressures related to the cost of living, savings and taxation.

- A further one in five (20%) are finding it difficult and worried about their financial situation. This segment are relatively more likely to be of working age, to be in work (particularly in the public sector) or claiming benefits, to rent their home and to have children. They are less satisfied with life than the overall average and likelier to have experienced all forms of financial pressure.

- Finally, 6% are finding it very difficult and worried. Again, this segment are likelier to be working age but – compared to the previous group – are much more likely to be renting, out of work, claiming benefits and to be living in single adult households with children. Their life satisfaction is much lower than average. Meanwhile, in the last 12 months they are more likely to have experienced financial pressures related to their home, debt, savings and work.

There is a clear gradient of life satisfaction across these groups, with the most vulnerable less satisfied than those who are more comfortable.

Feeling the pinch

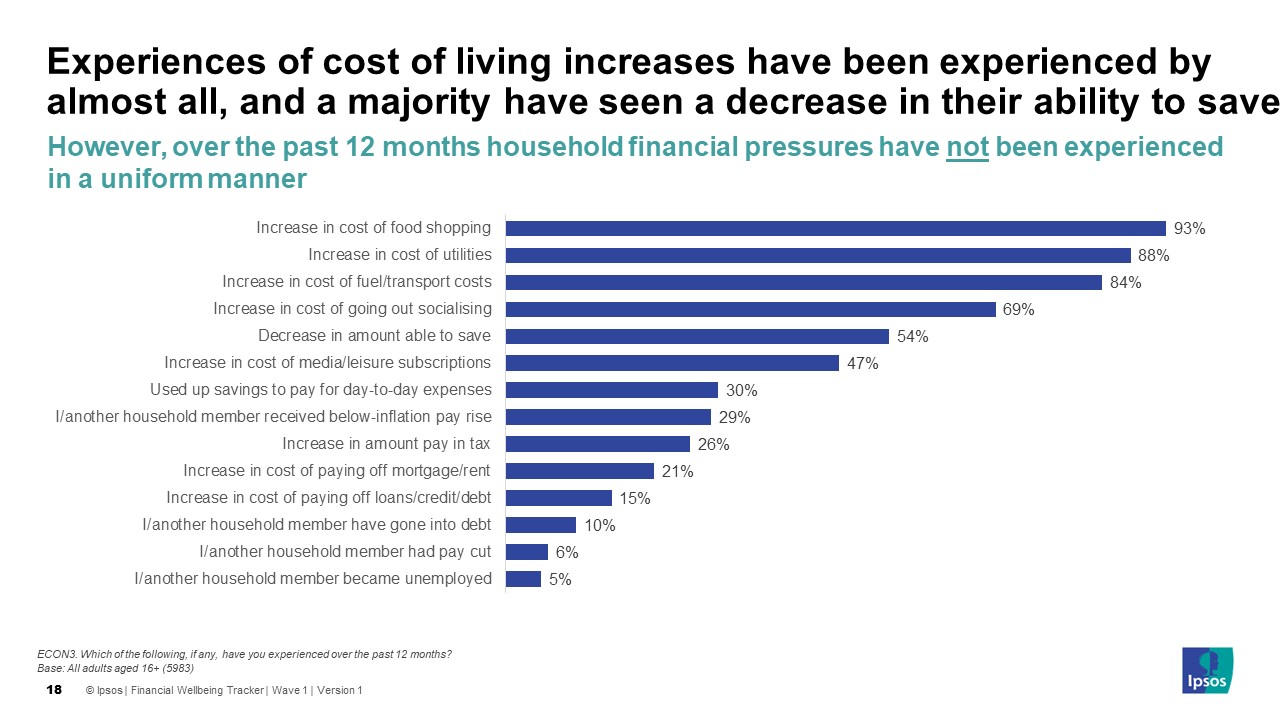

Few people seem to be immune to the change in cost of living, with 93% saying they have noticed an increase in the cost of food shopping, 88% noticing an increase in utilities and 84% an increase in fuel/transport costs. More financially vulnerable segments tend to be more likely to have experienced other impacts such as increases in housing costs, loan repayments, have gone into debt or had to use savings for day-to-day spending.

A third of people (34%) say that they would have to use savings if they faced an unexpected expense of £200, 27% that they would use their income and not need to cut back on essentials, whilst 19% would use their income but have to cut back and 1 in 9 people (11%) say they would use a form of credit. Again more comfortable groups are much more likely to say they would not need to cut back on essentials, while financially-struggling segments would be more likely to need to use credit or borrowing.

Economic expectations

When asked whether the UK economy, the economy of their local area and their household’s standard of living will improve over the next 12 months, a majority of people are of the view that each of these would get worse - with pessimism particularly strong for the UK economy (86%). When it comes to the economy of their local area, 75% feel it will get worse with one in five (20%) saying it will stay the same. Meanwhile, 59% expect their household’s standard of living to get worse (higher among the more vulnerable segments), with more than a third (36%) of the view this will stay the same.

Trinh Tu, Managing Director of Ipsos UK Public Affairs, said:

“Our new Financial Wellbeing tracker clearly shows the link between financial resilience and wellbeing, with the most vulnerable – accounting for 1 in 4 adults, mainly people on benefits – experiencing difficulties coping and reporting below average life satisfaction. Our analysis also shows the stark divide in our society between those able to cope and those who are exposed on multiple fronts. However, there is also a sizeable squeezed middle group who are just about coping but have widespread concerns for their future. And with public sector workers over-represented among this group, the current debate over public sector pay is set to get louder”.

Technical Note:

Ipsos interviewed online a representative UK sample of 5,983 adults aged 16+ from 22-28 September 2022. This data has been collected by the Ipsos UK KnowledgePanel, an online random probability panel which provides gold standard insights into the UK population, by providing bigger sample sizes via the most rigorous research methods. Data are weighted by age, gender, region, Index of Multiple Deprivation quintile, education, ethnicity and number of adults in the household in order to reflect the profile of the UK population. All polls are subject to a range of potential sources of error.