On its fifth anniversary, Halifax survey finds dip in house price sentiment

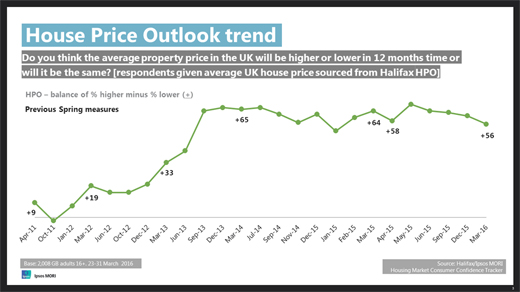

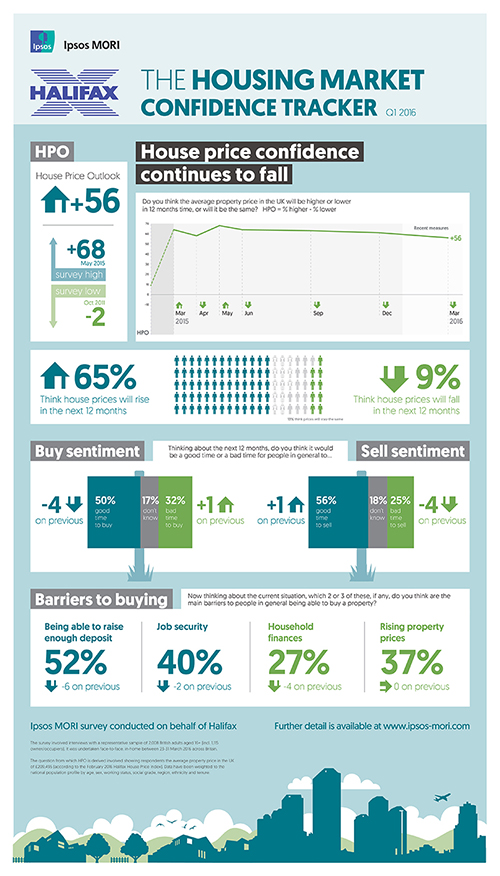

Expectations of future house prices have fallen over the past quarter and are down to their lowest point since January 2015, according to the latest quarterly Halifax Market Confidence Tracker (HMCT).

This continues a trend of modest decline following a high point in May 2015. Still, 65% expect the average UK house price to rise in the next 12 months (down 2 points since December 2015) with 9% anticipating a fall (up 3 points). At the same time, there has been a rise in the proportion saying they ‘don’t know’; now at 13%, the highest since March 2012.

Buying sentiment has also declined slightly with half (50%) saying the next 12 months will be a good time to buy a property, the lowest since September 2014 (when it was at 49%). Meanwhile, 59% think the next 12 months will be a good time to sell, little changed from December 2015.

The survey was the 25th undertaken by Ipsos for Halifax since its inception in April 2011. Over that time the House Price Outlook has been positive on all but one occasion. And while buying sentiment has changed comparatively little, selling sentiment has improved as expectations have risen about house price rises. Since April 2011, the average UK house price has risen from £160,785 (April 2011) to £214,811 (March 2016) according to Halifax.

Five year comparison

| April 2011 | March 2016 | Difference | |

|---|---|---|---|

| % prices higher | 32 | 65 | +33 |

| % prices lower | 23 | 9 | -14 |

| % prices same | 26 | 13 | -13 |

| ± HPO (House Price Outlook) | +9 | +56 | +47 |

| % good time to buy | 49 | 50 | +1 |

| % bad time to buy | 31 | 32 | +1 |

| % good time to sell | 18 | 56 | +38 |

| % bad time to sell | 61 | 25 | -36 |

Downloads

Technical note

Ipsos interviewed 2,008 British adults aged 16+ face-to-face, between 23-31 March 2016. Data have been weighted to the known population profile.