Affluent Americans more likely to have increased their net worth this year

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: As we are firmly in Q3, the markets are having a good year but there are mixed signals all over the economy, we thought we’d check in on how people are doing at kind of a personal macro level.

What we found: We asked two questions about personal finance, one about debt/savings and one about net worth. Since we’re asking about money, let’s look at this by income.

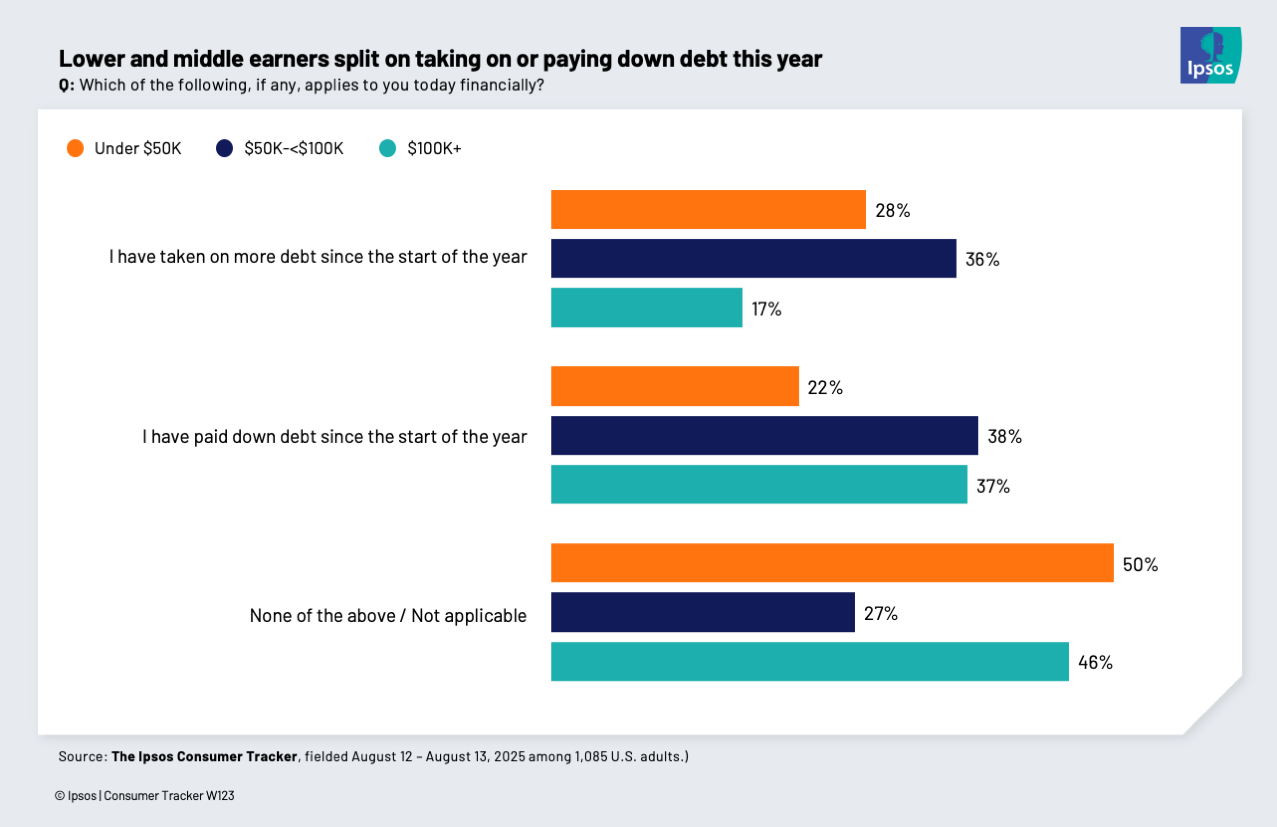

In terms of debt and credit, a plurality of both households making under $50,000 and those making over $100,000 have neither taken on more debt, nor paid down debt since the start of the year. The upper-income households are twice as likely to have paid down debt (39%) as taken on more debt (17%).

But those in the middle are more likely to have had a change, and are evenly split – 36% say they have taken on more debt and 38% say they have paid down debt.

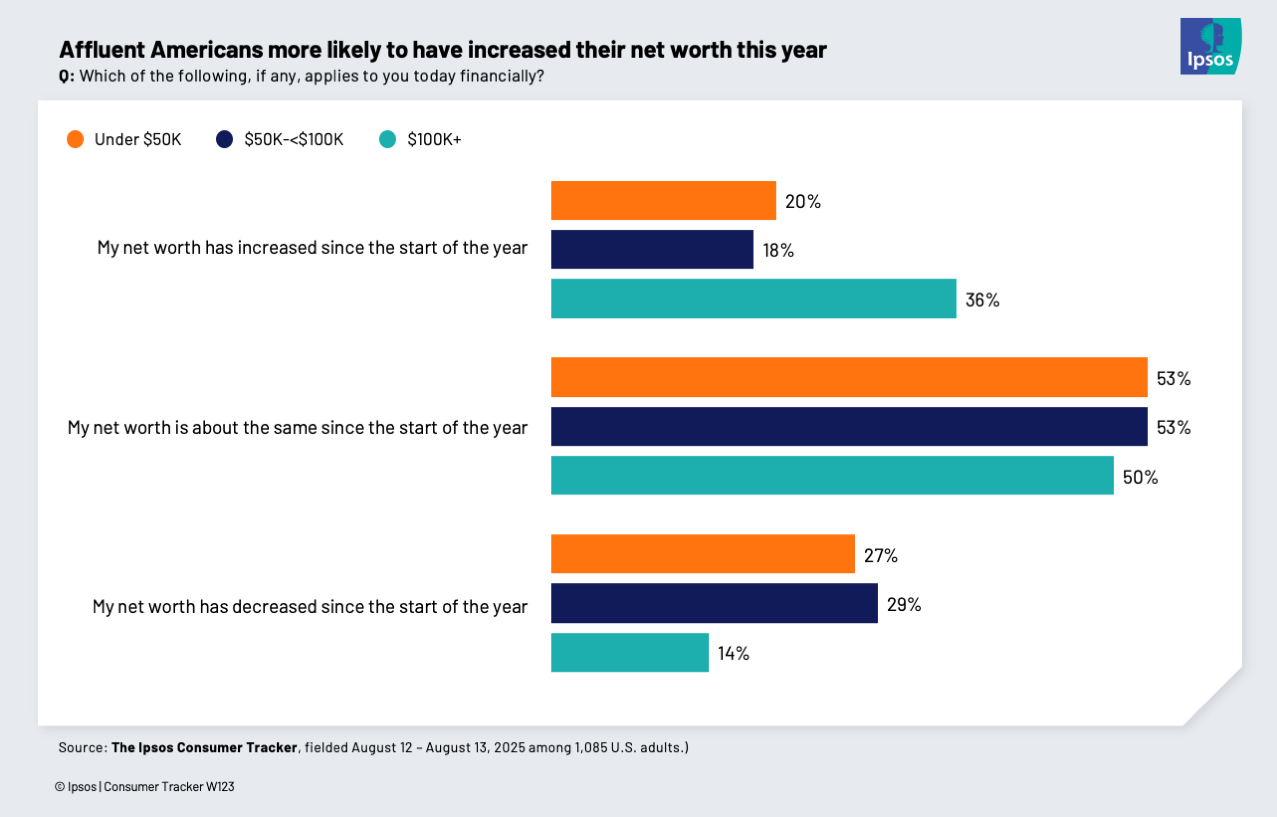

In terms of net worth, about half of each bracket say their net worth is unchanged over the course of the year, again despite a pretty strong showing (so far) in the markets. Upper-income households were about twice as likely as other brackets to say their net worth had increased and also twice as likely to say their finances had increased as to say their finances had decreased.

More insights from this wave of the Ipsos Consumer Tracker:

Most Americans aren't seeing positive news about the economy

Are electronics the new luxury?

The Ipsos Vibe Check: Here's how Americans feel about the government this week