Americans never forgot about inflation

Insights into the New America brought to you by Clifford Young and Bernard Mendez.

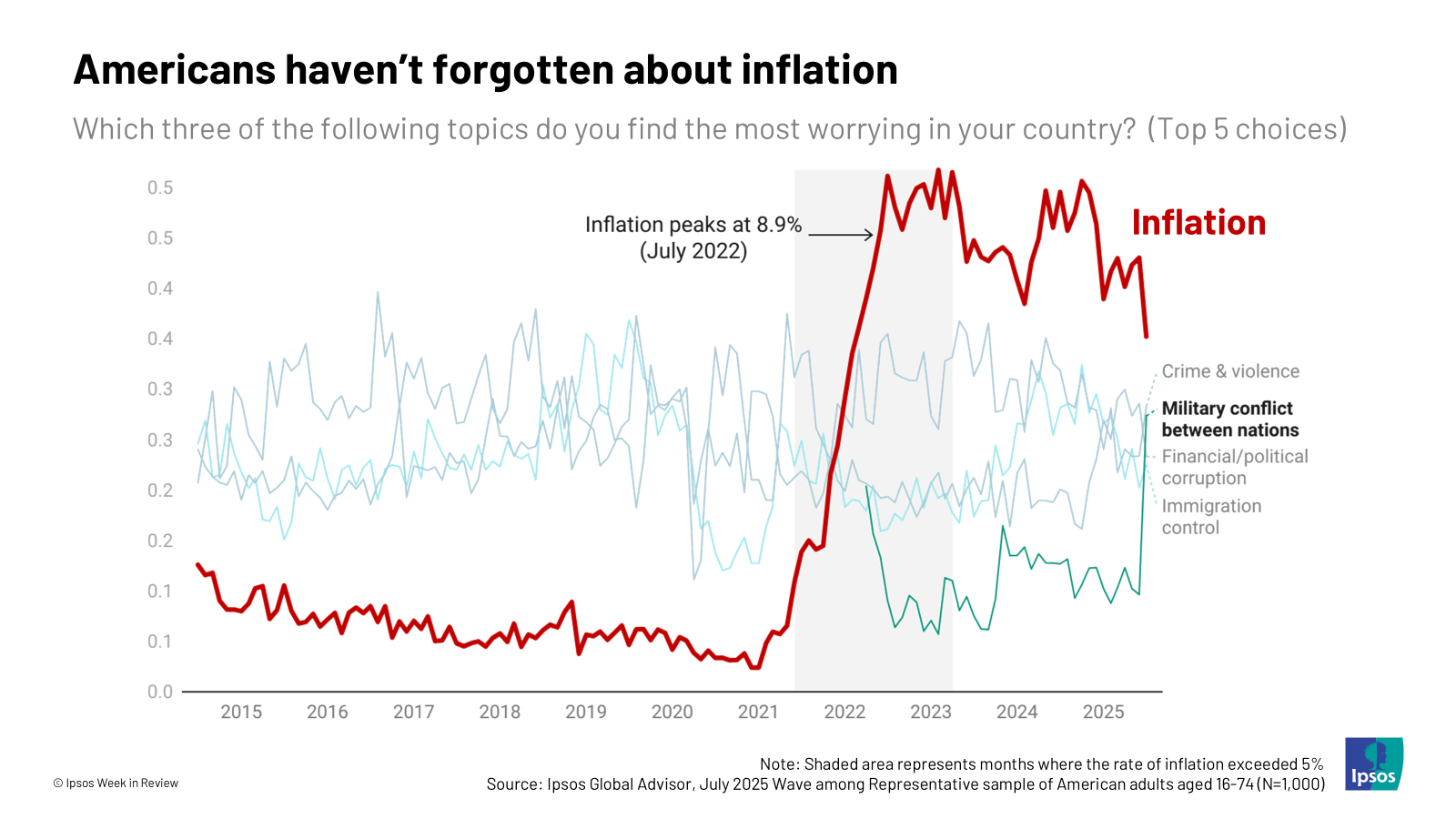

Inflation hit its peak in the summer of 2022. By the summer of 2023, it cooled to a rate less than half of its peak, and by the summer of 2024, the rate of inflation dipped under the three percent mark, a level it hasn’t passed since. Likewise, this summer featured relatively solid (though not stellar) levels of inflation.

New data suggests that might be about to change. A higher-than-expected Producer Price Index report has left economists worried that companies will soon be passing on tariff-related costs to consumers and that the inflationary effects of tariffs may be at our doorstep.

How big of a blip tariffs will end up being on prices remains to be seen. But for Americans, inflation is a familiar story, one that never really left their minds, even several summers after 2022’s historic wave of inflation hit its crest.

Below are five charts on where Americans stand on inflation.

- Inflation never left the building. Yes, the rate of inflation cooled. But it remains something many Americans worry about, even when inflation numbers have seemed positive. It should be noted that the most recent downtick in concern with inflation can at least partially be attributed to a temporary spike in concern over “military conflict.” Inflation is still on people's minds.

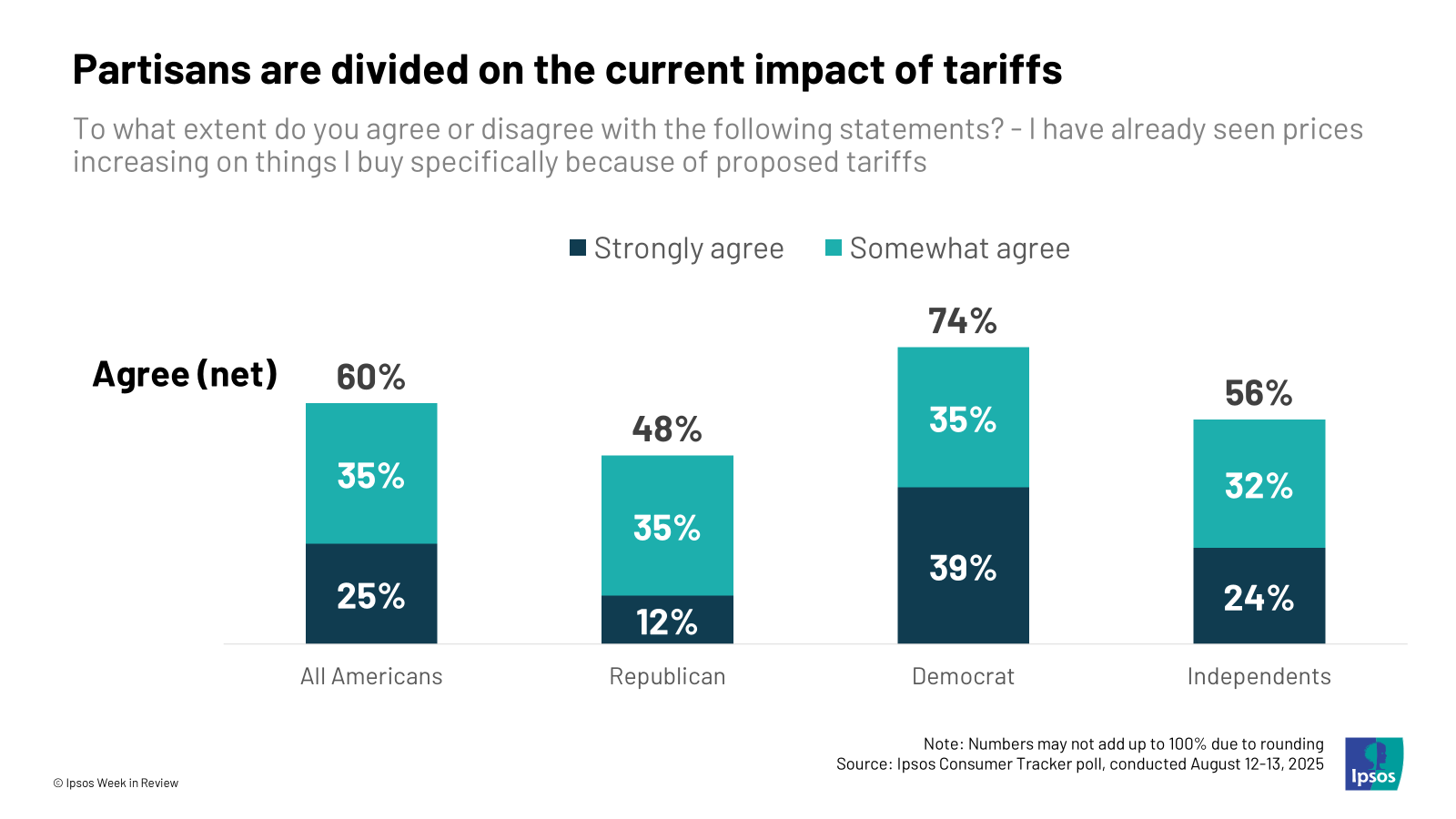

- Have tariffs already raised prices? Most say yes, but it depends on who you ask. In this case, Democrats are more likely than Republicans to say they have experienced price increases, but this effect has historically worked both ways. In 2024 under former President Joe Biden, Democrats were more likely than Republicans to report seeing costs go down. A sign of the times: partisanship affects how Americans report their material reality.

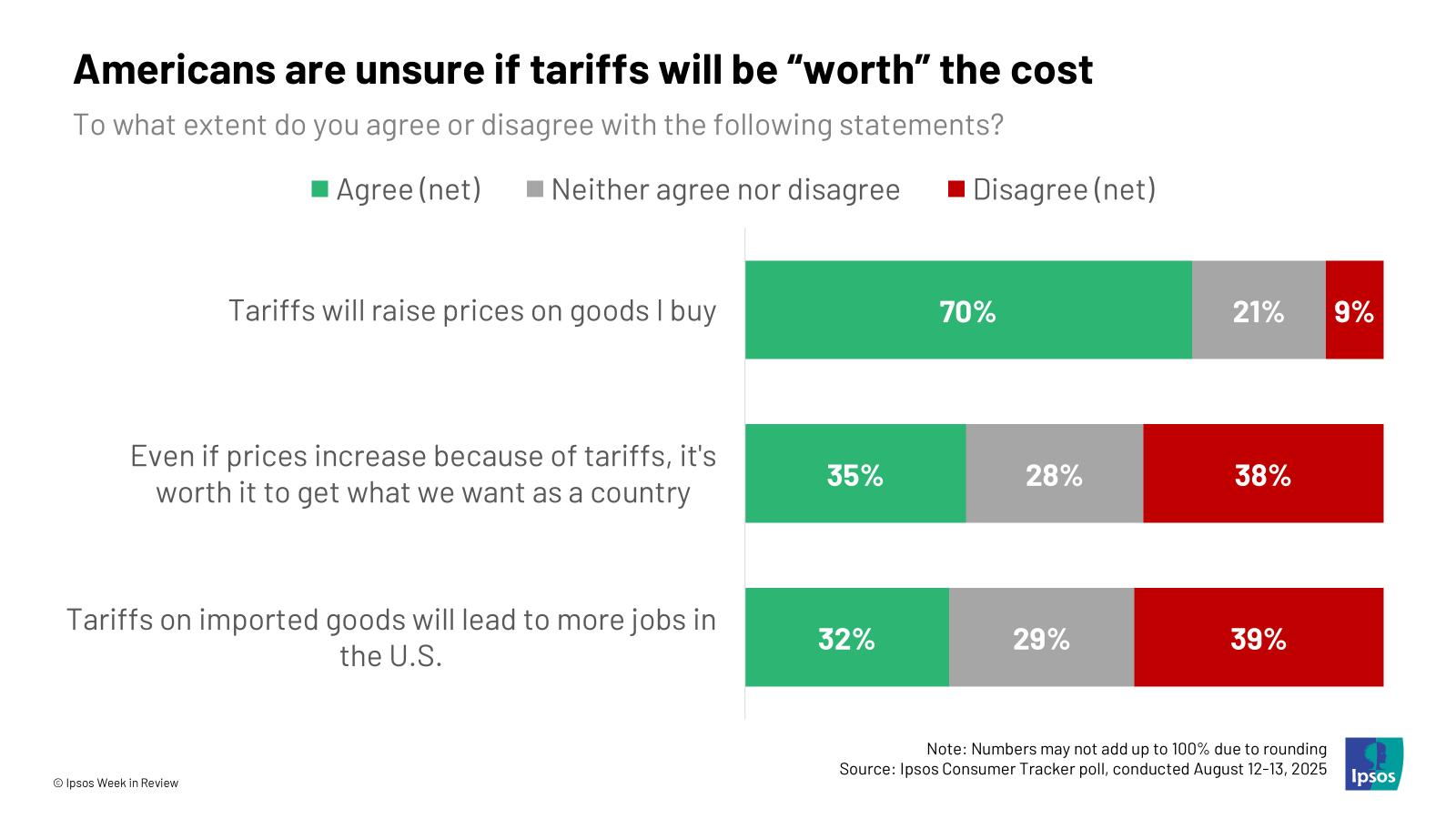

- Not a fight everyone signed up for. Americans are largely divided on if tariffs will lead to more American jobs and are unsure if tariffs will end up being “worth it,” but most are in agreement that tariffs will raise prices. It’s hard to rally the troops when not everybody believes in what they’re fighting for. For Trump, messaging discipline will be key.

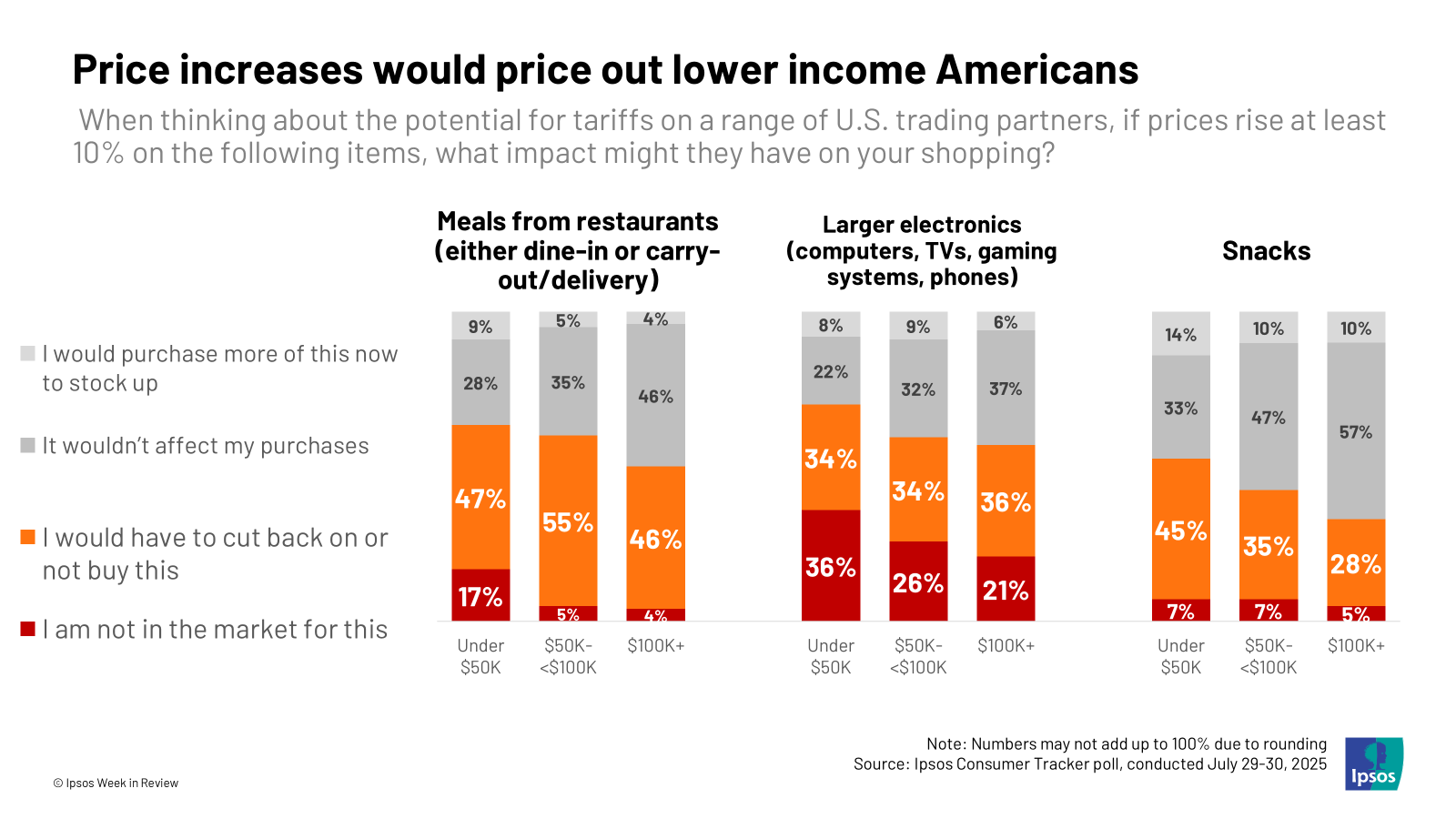

- Priced out. Americans with lower income levels are already more likely to feel priced out of things like large electronics and restaurants. Another wave of inflation would only exacerbate this. Inflation is a regressive tax and its impact is not equal on all Americans.

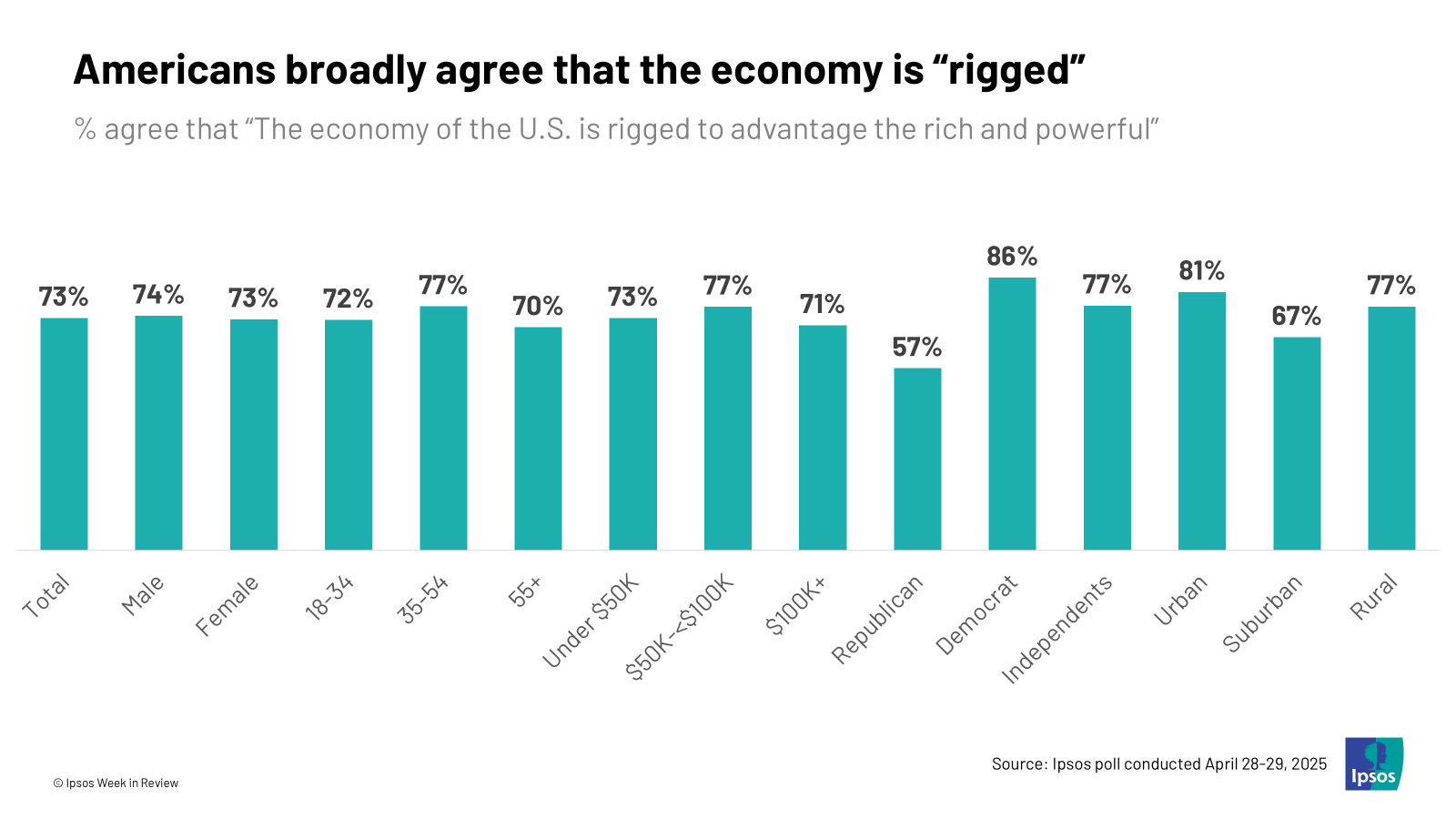

- A rigged game. In 2024, voters largely preferred Trump and the Republican Party’s approach to inflation over that of the Democrats. Now, America’s preferred candidate on inflation is in the White House, but most still feel inflation and the economy in general are headed on the wrong track. One underlying constant between now and then is that Americans continue to view the economy as “rigged.” The longer Americans feel that they aren’t reaping the rewards of the economic system they live under, the longer Americans will continue their search for someone or something to fix it.

The bottom line: This week’s inflation data is a good reminder that the economy doesn’t always shake out the way experts predict. Ultimately, we don’t know when (or if) tariff-induced inflation will end up materializing. We also don’t know how much of the costs of tariffs will be absorbed by companies versus consumers, or how consumers would react to another wave of price changes.

What we do know, however, is that the people that stand to lose the most from another wave of inflation are the ones that have the least.