Decision Makers or Decision Breakers?

KEY Findings:

- According to the Greenbook 2022 GRIT report, 48% of buyers made at least one poor business decision in the past six months due to sample quality or availability.

- When companies look to do B2B research, they face a higher hurdle than typical B2C research in gathering an accurate audience to answer their questions and provide feedback.

- If B2B audience sample costs are too low, it’s a sign that you are not getting decision-makers.

- If you know the specific things to ask for when running B2B research, you can avoid fraud contaminating your results…and your decisions.

There’s a moment when a research presentation is delivered to a key stakeholder and their eyes light up at the findings of the study. Executives celebrate the powerful research and insights that help them see things in a new light and accelerate growth. Uncovering insights from the target customer delights folks across departments and makes decision-making more data driven. Researchers can be heroes.

But far too often, this a-ha moment is a mirage — because the data is not correct. It’s coming from fraudulent survey takers who got through the study without proper vetting by the audience supplier. The fraudsters’ phony answers deliver the wrong insights, sending the company in the wrong direction. The scary part is that unless researchers are proactively assessing the quality of the audience sample powering the study, erroneous results may go unnoticed, and poor outcomes will appear to come out of the blue.

High quality B2B audience supply: your secret weapon for growth

When companies invest valuable time and resources to conduct market research with professionals, they are seeking answers that enable them to take critical actions to accelerate growth. When the answers to those questions come from fraudulent respondents, companies make bad business decisions and waste money on two fronts. The research budget is wasted, and worse still, bad decisions powered by bad insights can cost millions. Unfortunately, this is not an uncommon scenario. According to the Greenbook 2022 GRIT report, 48% of buyers made at least one poor business decision in the past six months due to sample quality or availability.

Mike Vannelli, Creative Director at Envy Creative, felt the impact of poor sample quality in a recent B2B research project for one of his clients:

“We surveyed IT Directors via a panel provider, but post-analysis realized many didn’t actually hold that senior title. It was garbage, irrelevant data. Significant time and budget were wasted acting on flawed data and incorrect audience assumptions. Vetting is crucial. In my experience, around 30% of purported B2B research audiences don’t match their stated profiles. Screening helps mitigate this. Proper participant recruitment and qualification checks are essential for quality B2B insights.”

Why it’s getting harder to do B2B research

Have you ever met a CEO who wanted to fill out a 15-minute survey for $5? No? That’s good, because they don’t exist.

Senior business decision-makers value their time and their knowledge. If they are going to share either of these, they expect value in return which often comes in the form of payment that is at, or above, their hourly rate. In some cases, business decision-makers may share their expertise because they enjoy publicity or helping others, but this secondary benefit often still requires moderate financial compensation.

When companies look to do B2B research, they face a higher hurdle than typical B2C research in gathering an accurate audience to answer their questions and provide feedback. Given the value they place on their expertise, B2B audiences expect higher compensation from research companies. Another challenge for B2B research is that there are simply fewer people who can supply insights on niche topics. Only so many people can discuss the industrial steel purchasing process at an elevated level, while millions of people can weigh in on popular soft drink flavors.

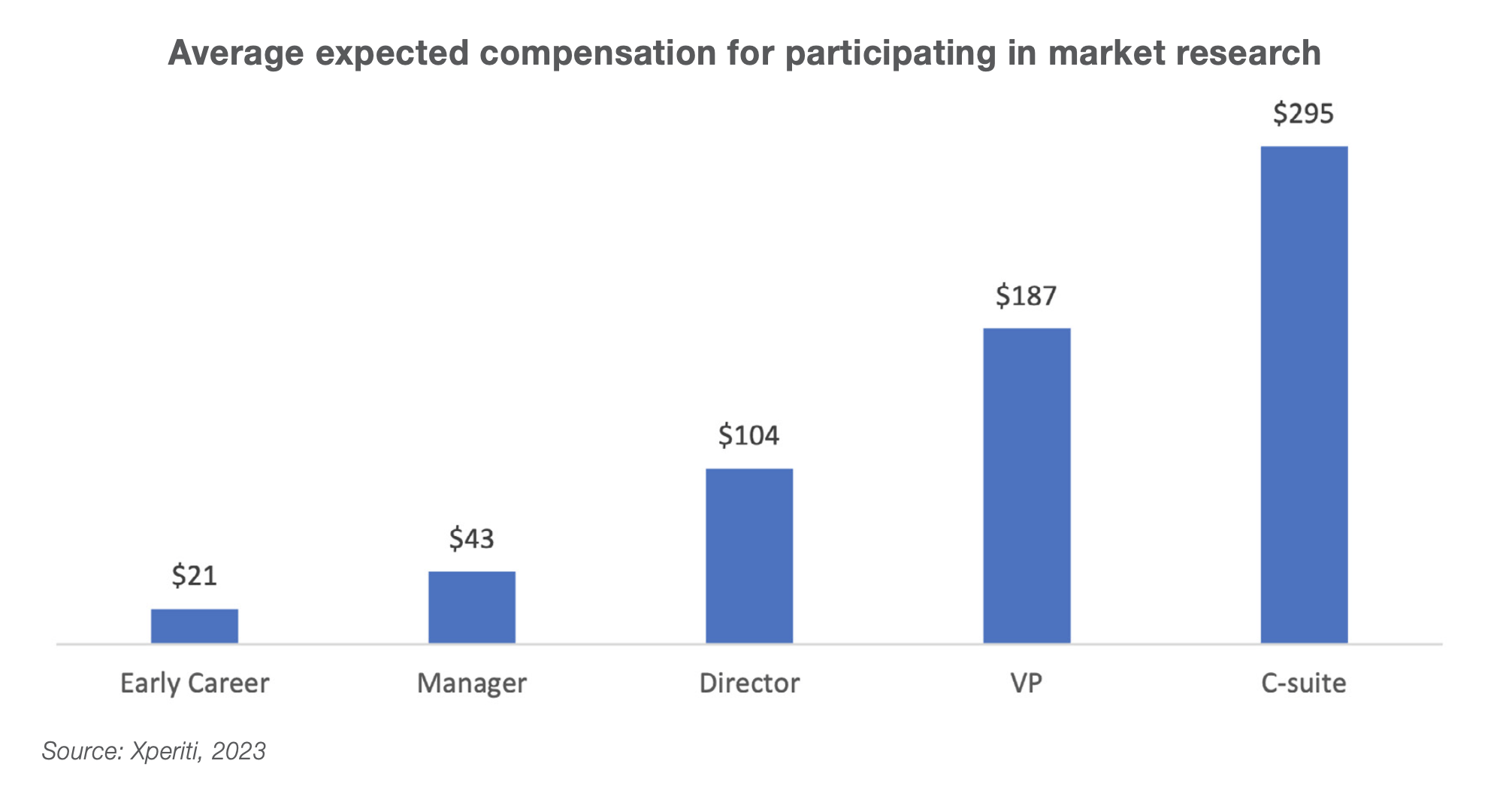

If B2B audience sample costs are too low, it’s a sign that you are not getting decision-makers. Xperiti, a B2B expert network owned by Ipsos, has been assessing the compensation different professionals expect for taking part in a research project across hundreds of studies. They proved that the more senior the professional, the higher the expected compensation on average between quantitative surveys and qualitative interviews:

Source: Xperiti, 2023

Source: Xperiti, 2023

After thousands of discussions with experts, Xperiti has also seen a participant’s industry can factor into their expected compensation. For example, look at the range in the expected average compensation from experts in three different industries:

- Retail $ 43

- Utilities $169

- Chemical engineering $422

If you are expecting chemical engineers to provide their opinions, be prepared to compensate them based on their advanced schooling, high salaries, and niche expertise.

How the fraudsters do it

Because research projects that look to understand professionals tend to pay out considerable amounts to get responses, they are highly attractive to people who want to get easy money by committing research fraud. This fraud can come in many forms, but the most common are:

- Seniority Exaggeration – People commit seniority exaggeration because they want to get compensated as if they were a more senior leader to get a higher financial incentive for taking part in research. Some seniority exaggeration is intentional, such as when a junior software developer claims to be the decision-maker for a large new cloud security platform, even though they are not part of selecting the system. Other seniority exaggeration can happen when people think they are more influential than they are, like when a mechanic says they are a decision-maker for which motor oil to stock in the garage because they always use a certain brand. While seniority exaggeration may or may not be intentional, it presents a problem for businesses. Often people who exaggerate are not part of the true decision-making process and don’t know the other factors, such as corporate strategies and budget policies, which might actually impact a corporate business decision.

- Identity Falsification – One of the most aggressive forms of B2B research fraud, identity falsification, is when someone deliberately supplies incorrect information about who they are. In some cases, this may take the form of creating a false persona, including even a false LinkedIn profile or other social proof, to take part in research studies targeting highly valuable business audiences. In other cases, identity falsification can occur when a bad actor steals the identity of a real person and misrepresents themselves as that person to participate in financially lucrative research. In both cases, the fraudster ends up costing a company and causing considerable damage, because they cannot answer the questions that the business is trying to understand with any true expertise.

- Non-human responses – A damaging new type of B2B response fraud is when opinions are not given by a human at all but randomly made up by a computer. This is caused by technologically savvy fraudsters creating bots that fill out high value B2B surveys en masse. When this happens, a company trying to do research gets zero value, and may in fact be driven in the wrong direction by random survey answers which are provided by bots. Thankfully, bots are less of a concern in qualitative interview or focus group research, where the research is conducted by talking live to real people.

- Incomplete responses – In some cases, the right person ends up on the other side of a survey, but they are not holding up their end of the bargain and providing valuable responses in exchange for a reward. They may speed through the survey, randomly clicking buttons and writing non-sense or minimal responses in open text field questions.

Your options for B2B audience sample

To find high-quality audiences comprised of relevant professionals who will supply real answers, you need to understand the different options for sourcing B2B sample.

- Consumer panels – Consumer panels consist of people who actively sign up to participate in research projects. They reach the general population and pay out small amounts to their members, sometimes as little as one dollar to take a research survey. Consumer panels are designed for general population audiences and are paid appropriately based on their level of knowledge, product usage, and opinions. When B2B research costs seem too good to be true, often the vendor is using consumer sample to provide responses. Vendors try to use this cheaper sample for B2B projects by asking consumer panelists a screening question such as, “are you an enterprise software decision maker?” Since panel members know taking more surveys means more rewards, they have an incentive to say “yes, I am an enterprise software decision maker,” even when that is not true. This fake B2B audience can significantly steer your research in the wrong direction. But there is one case where using consumer panels on a B2B project does make sense: when seeking people in less specialized professions such as truck drivers and retail associates. Sole proprietor business owners can also be found on consumer panels accurately.

- B2B panels – B2B panels are made up of business professionals who sign up to earn income taking surveys and sitting for interviews in exchange for reasonable compensation. Often B2B panels pay members a reward similar to their hourly rate. For example, a B2B panelist might be willing to take a 15-minute survey for $50 because they typically bill their services at $200 per hour. Because the rewards on B2B panels are much higher than on consumer panels, there is a greater incentive for fraudsters to create fake profiles on B2B panels to take surveys. They can even set up shop in another part of the world and create fake social media profiles to masquerade as a desirable business professional. To ensure that B2B panel respondents are who they say they are, multiple layers of validation should be used, including an assessment of how the panel recruits members and the application of third-party validation technology.

- Expert networks – Expert networks actively recruit unique individuals for a specific research project by reaching out directly to people they have identified that match your target audience. They can also be built on networks of professionals who are part of communities for industry thought leadership, networking, job placement, and career advice. Referrals are also a large part of how expert networks recruit. From there, the experts will be further vetted through extensive screener questions, profile reviews and in some cases pre-research interviews. Only if they pass a review process can they take part in your research. Expert networks are often the only way to reach senior decision-makers who do not typically join online panels. They are commonly used for qualitative in-depth interviews, although they can be used for quantitative surveys as well. The costs of finding, vetting, and compensating a true professional are high, so while expert networks are the most accurate way to get sample for a B2B research project, they are also the most expensive.

In addition to the three primary sources of B2B audience sample, custom communities may also be used. These are groups of professionals who join a research project on an ongoing basis over a period of months or years and provide quick responses to all sort of different types of questions from the brand who commissioned the community. Because these communities are purpose built for a specific brand, professionals who join these communities often feel a connection to the brand and want to help them succeed with helpful feedback on an ongoing basis. They can be built for short-term projects, such as a new product launch, or as a long-term asset that brands can use to gauge the sentiment of their audience over time. In most cases professionals who join the community participate in multiple research projects during their time in the group which can include surveys, interviews, product testing and even video diaries. Research companies who build brand specific communities must be especially adept at sourcing high quality community members and keeping them engaged over long periods of time.

Zulfar Azimi, Head of Marketing at CanXida, a medial supplements company, explains how she is focusing on maintaining research quality.

“Unfortunately, bad research audience samples can be quite common in the research market. It’s crucial to work with trusted research partners and implement strict screening processes to minimize the chances of encountering such difficulties. It’s an ongoing effort to continually refine our research methodologies and collaborate with reputable firms to obtain reliable data. Remember, it’s all about understanding our audience and delivering products that genuinely meet their needs.”

What to look for in quality B2B research

If the price for B2B sample sounds too good to be true, it probably is. One of the easiest ways to assess the quality of the audience who will be participating in your research is the cost. If you think about your audience and how much they earn, ask yourself: would they realistically take a survey or sit for an interview for this amount? Does the sample cost cover the costs for a research company to properly find and vet your target audience, or is it too low for them to do quality control?

As you assess the quality of audience sample suppliers, be careful not to fall for ineffective certifications. Some audience providers claim their sample is vetted, validated or verified (there are no standard definitions) or that they have been approved by an external organization. In many cases these are superficial assessments or self-reported data, such as checking that an email doesn’t bounce or asking the panelist about themselves, and not a deep quality check intended to root out fraud. There are also certifications for data quality that look at GDPR compliance or privacy practices, which may be useful for other purposes but are irrelevant to preventing fraud.

To get high-quality B2B research sample you should ask about assessments that validate multiple points in the audience selection process through four main steps:

- Source Assessment - Inquire about how the audience is sourced. Ask why a respondent would want to participate in a research study with them, as well as the exact steps they take to ensure the respondent is exactly who they say they are.

- Defensive Programming - Program your survey defensively to prevent fraud. This can include basic defenses, such as screening out people who give gibberish answers or who take the survey exceptionally quickly, but it should go deeper. There are advanced technical tricks to eliminate bots such as honeypots that should be part of high-quality B2B research studies.

- Respondent Verification - Assess the respondent themselves. You should determine the accuracy of what the respondent has told you about themselves, such as whether their email is actually coming from the company they claim to work for, or that they really have the large social following they tout.

- Response Verification - With good response verification, you can also look for fraud from exaggeration and incomplete respondents. Check that the people taking your survey have the budget authority that they claim to have against known databases for their role and industry. Confirm business ownership with third-party databases. Eliminate weak answers that don’t indicate the survey taker was paying attention to the question, even if they were the correct target for the survey through manual or AI review.

If you don’t have the capabilities in-house to execute techniques such as these to prevent B2B market research fraud, be sure your research partner does, or add-on a verification partner, such as VEPP.

This is how Ipsos delivers B2B research that companies can use to make confident decisions. As Michel Guidi, Chief Operating Officer Ipsos explains:

“Because of the higher incentives, B2B research is a target for fraudulent respondents and organizations. When conducting B2B research, respondent certification is critical... Is this person really the B2B profile they claim to be? This is why we at Ipsos have developed VEPP, our proprietary platform that can verify respondents in real time, and why we rigorously assess the performance of our certified audience partners and have the highest standard of B2B quality assurance in the industry. We take this very seriously because we have heard too many stories from clients who have bought cheaper B2B samples and ended up with datasets that are sometimes 90% fraud... When you work with Ipsos, you can be sure you are getting accurate data.”