The housing market is crunched, and Americans are feeling it

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: The housing market saw the fewest sales in nearly 30 years in 2024. Mortgage rates continue to be elevated from what we’ve seen in this generation. And we have a new president who has promised to lower prices on just about everything.

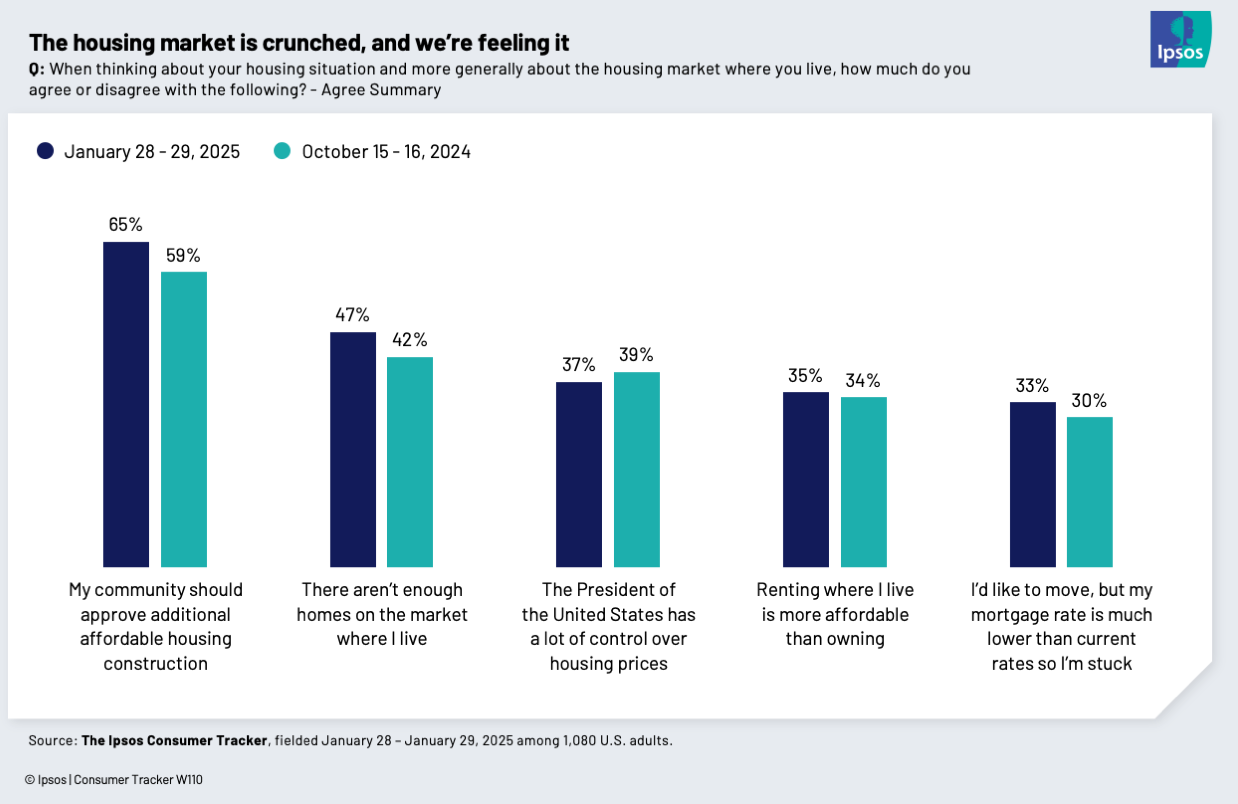

What we found: In the three months since we asked this question last, there’s a 5-point bump in people who think there aren’t enough homes on the market where they live. Likely related, there’s a 6-point bump in people who say their communities need to approve building more affordable housing. One in three say they’d like to move, but are stuck because they have a low mortgage now.

So there isn’t enough stock, and many people are trapped. Neither of those problems are likely to get solved any time soon, so it’s fair to expect that housing will continue to be a strain on people’s wallets in the near to mid-term.

But what about federal policy? We’ve had an election since the last time we asked this… and it’s interesting. Democrats are a bit more likely (35%, +5 points vs last wave) to think the president has a lot of control over this. And Republicans are similarly less likely (39%, -6 points) to think the president has a lot of control.

More insights from this wave of the Ipsos Consumer Tracker:

Americans still have a complicated relationship with AI

America’s love for Valentine’s Day is unbending

Most Americans plan to watch the Super Bowl, but many are more excited for the puppy bowl

We know climate change is a thing, but some of us think it’s a good thing?

The Ipsos Care-o-Meter: What does America know about vs. what does America care about