Support for student loan forgiveness varies across different amounts

Washington DC, May 10, 2023 -- Nearly half of Americans support forgiving up to $20,000 in federal student loan debt or $10,000 for non-Pell Grant recipients, with an income limit – which is the current proposal from the Biden administration under review by the Supreme Court – according to new research from USA Today and Ipsos. Support does decline at higher forgiveness amounts, and removing the income limit also weakens support. Support for various student loan forgiveness proposals is much higher among those with student loans; however, of all proposals tested in the survey, the only one favored by a majority of all Americans is implementing two years of tuition-free community college. Though support for the administration’s student loan forgiveness proposal is tepid, just a third of Americans support the Supreme Court actually overturning it.

Detailed Findings

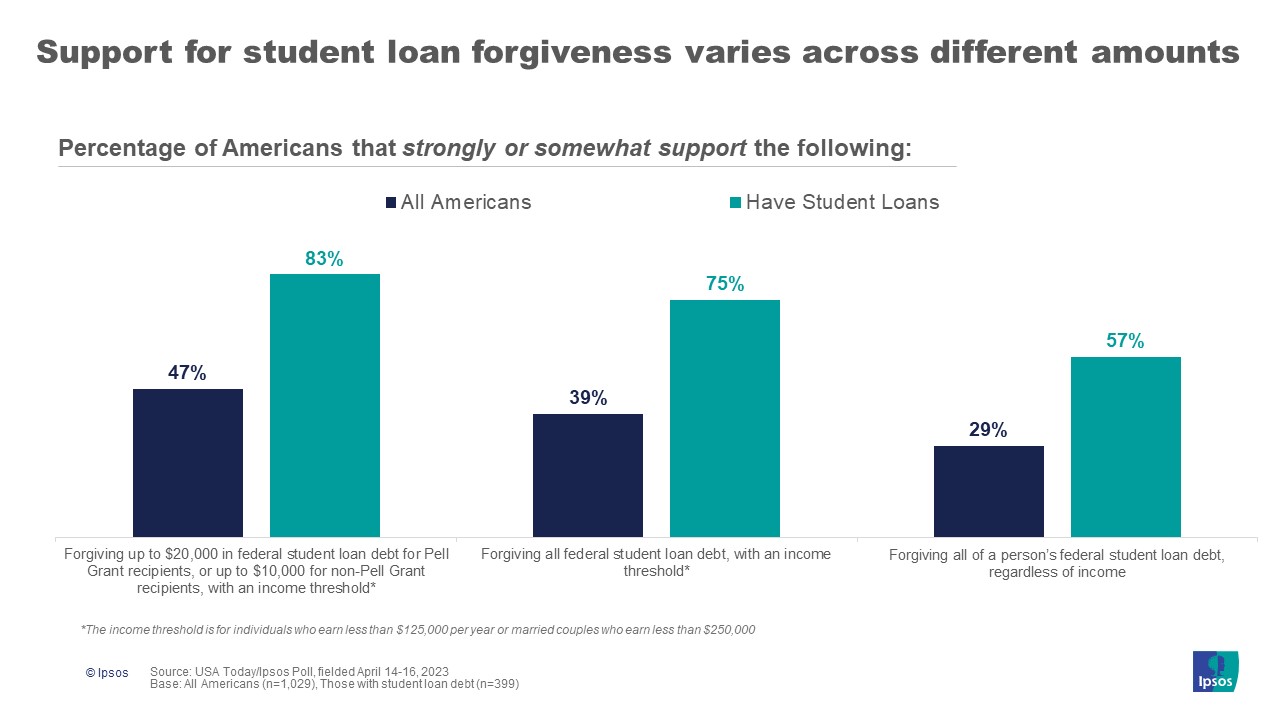

1. A plurality of Americans supports the current proposal from the Biden administration to forgive up to $20,000 in federal student loan debt. Support wanes for proposals of a larger amount. A majority of those with student loans support forgiveness across all amounts.

- Forty-seven percent of Americans support forgiving up to $20,000 in federal student loan debt for Pell Grant recipients, or up to $10,000 for non-Pell Grant recipients, for those that earn less than $125,000 per year or less than $250,000 for married couples.

- Around two in five (39%) support forgiving all student loan debt for people earning less than $125,000 per year or less than $250,000 for married couples.

- However, just three in ten Americans support forgiving all student loan debt, regardless of income (29%).

- A majority of those with student loans support each of these three proposals: forgiving up to $20,000 in federal loan debt or $10,000 in Pell grants for those that meet the income limit (83%), forgiving all federal student loan debt for those who meet the income limit (75%), and forgiving all student loan debt regardless of income (57%).

2. While support for forgiving student loan debt varies, a majority of Americans are in favor of making college more affordable for students and believe that’s where the priority should be.

- Seven in ten Americans agree that the government should prioritize making college more affordable for current and future students. Majorities across all demographics share this sentiment.

- This is one of the few things where a majority of Americans and current student loan holders agree. Fifty-two percent of student loan holders agree that making college more affordable should be the prioritized.

- In the same vein, nearly two in three (64%) Americans support the federal government providing two years of tuition-free community college for students. Eighty-four percent of those with student loans support this. This is the only proposal tested that nets a majority support among all American adults.

- A plurality of Americans (47%) and a majority of those with student loans (71%) support the federal government providing subsidies for students attending historically Black colleges and universities (HBCUs), tribal colleges, and other minority-serving universities, if they come from families that earn less than $125,000.

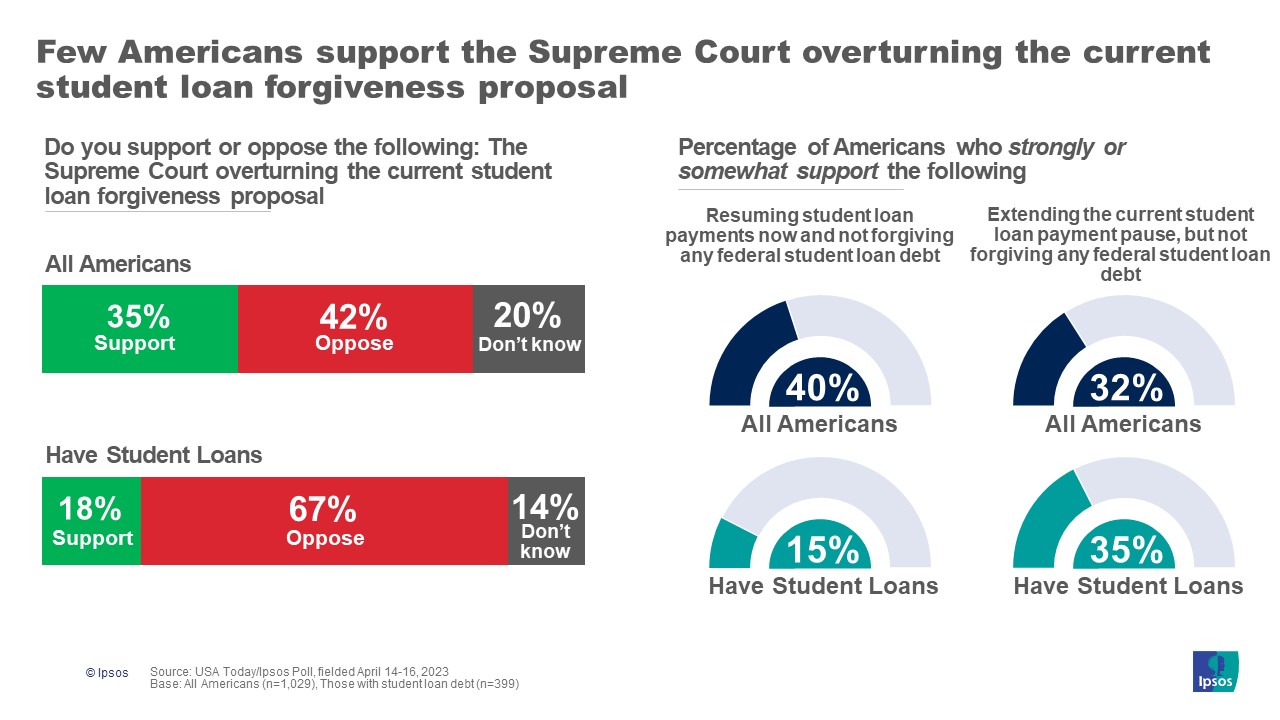

3. Though the current student loan forgiveness proposal in front of SCOTUS does not receive majority support from the public, few want the court to overturn it. Questions remain on what the best path forward is, as a minority of Americans support overturning the current student loan forgiveness proposal or extending the current pause without forgiving any debt.

- Just 35% of Americans and 18% of those with student loans support the Supreme Court overturning the current student loan forgiveness proposal.

- Among Americans, Baby Boomers (46%) are more likely than Gen Z (23%), Millennials (29%) and Gen X (34%) to show support. Additionally, White Americans (40%) and more likely than Black (19%) and Hispanic (28%) Americans to support the overturning of the current student loan forgiveness proposal.

- While support for overturning the proposal is low, so too are other potential solutions. A minority of Americans (32%) and those with student loans (35%) support extending the current student loan payment pause, but not forgiving any debt, both down significantly from June 2022 (42% and 47%, respectively).

- Likewise, just two in five Americans (40%) and 15% of those with student loans are in favor of resuming student loan payments now and not forgiving any federal student loan debt.

4. Many student loan holders report that the pause has had a positive impact on various aspects of their lives, from improved mental health to saving more money.

- Fifty-five percent of student loan holders report that the student loan payment pause has improved their mental health.

- Half of student loan holders say that they have been able to save money during the student loans pause that they otherwise wouldn’t have been able to.

- A slim majority of student loan holders (53%) believe the current pause has been an economic stimulus and helped boost the economy; however, just 29% of all Americans share this sentiment.

- In the same vein, nearly two in five student loan holders (38%) say they were able to afford a major purchase (such as a new home or new car) during the student loans pause that they otherwise wouldn’t have been able to.

About the Study

This USA Today/Ipsos poll was conducted April 14-16, 2023, by Ipsos using the probability-based KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,029 general population adults age 18 or older. The sample includes 399 people who have student loans.

The margin of sampling error is plus or minus 3.2 percentage points at the 95% confidence level, for results based on the entire sample of adults. The margin of sampling error takes into account the design effect, which was 1.09. For those with student loans, the margin of sampling error is plus or minus 5.2 percentage points at the 95% confidence level. This margin of sampling error takes into account the design effect, which was 1.12 for those with student loans. The margin of sampling error is higher and varies for results based on other sub-samples. In our reporting of the findings, percentage points are rounded off to the nearest whole number. As a result, percentages in a given table column may total slightly higher or lower than 100%. In questions that permit multiple responses, columns may total substantially more than 100%, depending on the number of different responses offered by each respondent.

The survey was conducted using KnowledgePanel, the largest and most well-established online probability-based panel that is representative of the adult US population. Our recruitment process employs a scientifically developed addressed-based sampling methodology using the latest Delivery Sequence File of the USPS – a database with full coverage of all delivery points in the US. Households invited to join the panel are randomly selected from all available households in the U.S. Persons in the sampled households are invited to join and participate in the panel. Those selected who do not already have internet access are provided a tablet and internet connection at no cost to the panel member. Those who join the panel and who are selected to participate in a survey are sent a unique password-protected log-in used to complete surveys online. As a result of our recruitment and sampling methodologies, samples from KnowledgePanel cover all households regardless of their phone or internet status and findings can be reported with a margin of sampling error and projected to the general population.

The study was conducted in English. The data were weighted to adjust for gender by age, race/ethnicity, education, Census region, metropolitan status, and household income. The demographic benchmarks came from the 2022 March Supplement of the Current Population Survey (CPS). The weighting categories were as follows:

- Gender (Male, Female) by Age (18–29, 30–44, 45–59 and 60+)

- Race/Hispanic Ethnicity (White Non-Hispanic, Black Non-Hispanic, Other, Non-Hispanic, Hispanic, 2+ Races, Non-Hispanic)

- Education (Less than High School, High School, Some College, Bachelor or higher)

- Census Region (Northeast, Midwest, South, West)

- Metropolitan status (Metro, non-Metro)

- Household Income (Under $25,000, $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, $100,000-$149,999, $150,000+)

The weighting categories for those with student loans were as follows:

- Gender (Male, Female) by Age (18-29, 30-44, 45+)

- Race/ethnicity (Black, Hispanic, all other)

- Education (Some college or less, Bachelor +)

- Census Region (Northeast, Midwest, South, West)

- Metropolitan status (Metro, non-Metro)

- Household Income (Under $50K, $50K-<$100K, $100K+)

The results of this poll are trended against the following previous polls:

June 3 – 5, 2022; All Respondents (N=1,022, MOE = +/- 3.3); Those with student loans (N=416, MOE = +/- 4.8)

For more information on this news release, please contact:

Mallory Newall

Vice President, US

Public Affairs

[email protected]

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com