Ukraine and Russia's brands one year later

New York, February 23, 2023 – A year ago, on February 24th, Russia’s invasion of Ukraine had the world on edge. Recent Anholt-Ipsos Nation Brands Index (NBI) results find that Russia has taken a reputational hit, dropping from 27th to 58th place in 2022, while Ukraine results are relatively stable, moving up one rank to 47th.

Other Ipsos polling shows the fear of military conflicts between nations is not one of the top concerns for citizens globally (8%) and is down six percentage points since it was first measured in April last year1 after the invasion occurred. Rather, cost of living or inflation (40%) is the biggest concern and has been since April 20221. While concerns of conflict have softened, a year into Russia's invasion of Ukraine, we see nations who are geographically closer to the war are more likely to be concerned, such as Poland (26%) and Germany (20%)1.

Despite lower levels of fear, the world's eyes are still on Ukraine as nearly two-thirds (64%) of adults across 28 countries report closely following news about it, down only two percentage points since March/April of 20222.

What does having the world's attention mean for these two nations?

For Ukraine, it means public support, as a large majority of citizens in every surveyed nation agree that their country must support other sovereign countries when attacked (70%). Still, this support does not translate to military involvement, as 71% agree that their country should avoid getting involved militarily in the conflict in Ukraine2. However, many also believe that their country should take in Ukrainian refugees, though the percentage is down from last year (66%, down 7 points since March-April 2022). 2And even though inflation is the number one worry across the world, more than half agree that paying more for fuel and gas because of sanctions against Russia is worthwhile to defend another sovereign country (53%)2.

War Changes How People View Ukraine as a Country

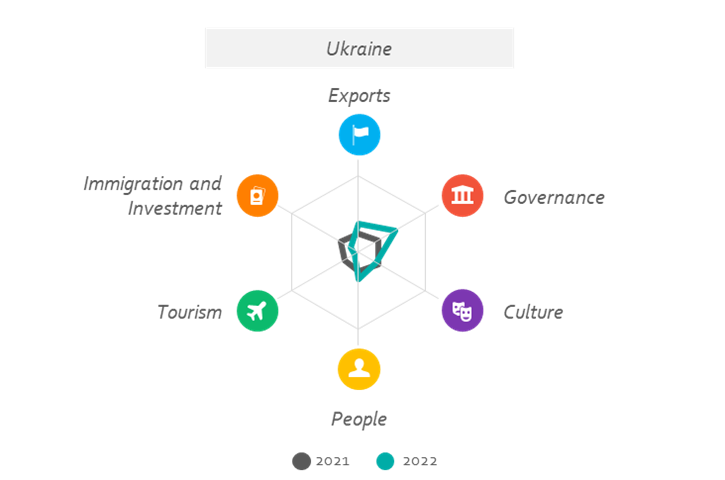

At the topline level, opinions on Ukraine appear to hold stable between 2021 and 2022—but that masks bigger differences below the surface. War has changed the material reality on the ground for Ukrainians and the way people around the world perceive the country. Between 2021 and 2022 perceptions of Ukraine on the NBI increased on the Governance, Exports, and People dimensions, but perceptions have decreased on the Immigration and Investment, Tourism, and Culture dimensions. Given the overarching ramifications of a nation in war, the indices that Ukraine has seen decrease are a nod to Ukrainians experience with war – another nation challenging the Ukrainian culture and identity, countries are accepting Ukrainian refugees rather than immigrating and visiting the nation, and investments are no longer business related but humanitarian.

Considering the current status of a war-torn country, and the uncertainties that existed a year ago, the average impact of these changes across the six dimensions that make up the Anholt-Ipsos Nation Brands Index (NBI) hexagon result in Ukraine rising one rank overall.

Respondents are hesitant about the quality of life and investing in Ukrainian businesses and are not as willing to visit, work, or live in Ukraine. Its tourism is described as “risky” and “stressful” and its Immigration and Investment as “declining”. And even though its Governance scores have increased, it is still seen as “unstable” and “dangerous”. However, not all aspects of the war have been damaging to Ukraine’s brand. With the increased level of support, respondents are more willing to buy Ukrainian products, resulting in Ukraine’s performance on the Exports Index jumping from 46th in 2021 to 34th. Perceptions surrounding the desire to have a close friend and employability of Ukrainian people have also become more positive.

After a Steady Reputation, Russia Falls

After a consistent run in the top-30 rankings for the past five years, Russia falls near the bottom of the list – now in 58th place, following its invasion of Ukraine.

Russia’s brand was hard hit in 2022 by low perceptions across the board, but particularly on Immigration and Investment, Tourism, and Exports. Respondents do not feel good about investing in Russian businesses or buying Russian products, and its governance scores deflated across all attributes. After invading Ukraine, over half of respondents see Russia’s government as “dangerous”, and its Immigration and Investment as “isolated” and “declining”.

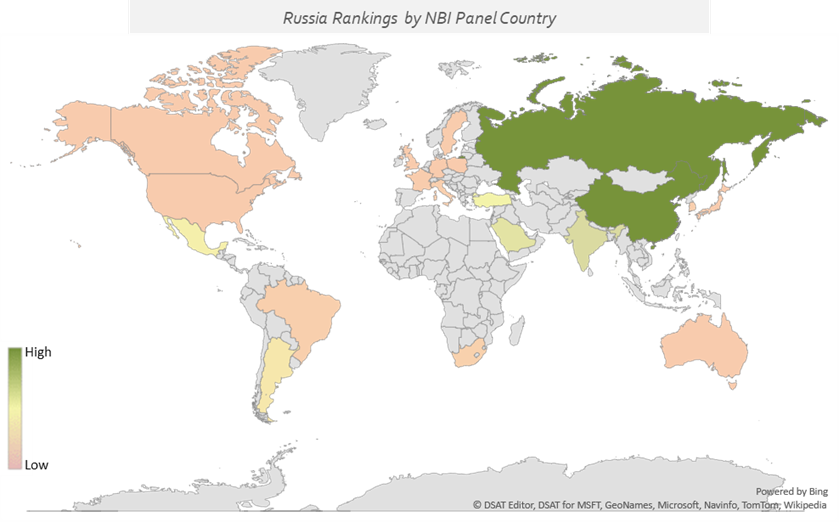

While at a global level Russia’s brand is seen in a more negative light, this is not the case for all markets. Markets like China, India, and Saudi Arabia rank Russia quite high – China being the most positive and giving Russia a second-place ranking. China ranks Russia within the top-10 on all dimensions and gives them specifically high marks on Governance, People, Tourism, and Culture (all ranked within the top-3).

According to Simon Anholt, “Since the invasion of Ukraine, nearly 15% of Russia’s reputational equity has vaporized, and this is already affecting the country’s ability to trade, as well as the prestige of its culture and institutions.

Such a collapse in the country’s brand equity operates as a potent “virtual sanction” alongside the economic sanctions already levied on Russia: economic sanctions hit the country’s business relationships, but the deletion of brand value hits its mass-market appeal and erodes the perceived value of everything the country makes and does for many people around the world.

A key question is how long this effect will last. The last time a major power earned itself truly global pariah status was during the Second World War: then, the aggressors, Germany and Japan, found that their ability to trade and prosper in the international community was severely curtailed for at least twenty years. Today, Germany and Japan sit in first and second place in the NBI’s global ranking, but it has taken them seventy years to reach these remarkable heights – and pockets of mistrust and resentment towards both countries still persist in parts of the NBI data.”

“In attacking another state, Russia’s international prospects are in question for at least a generation to come,” added Simon Anholt.

News Impact on Russia and Ukraine’s Reputation

The most notable change year-over-year has been Ukraine’s heightened levels of familiarity. Three in four global respondents (76%) know at least a little about Ukraine, up 17 percentage points from 2021 and 23 percentage points from 5 years ago. The 2022 Anholt-Ipsos Nation Brands Index captured awareness of news for each of the measured nations and, unsurprisingly given the war, Russia and Ukraine topped the list of countries with the highest levels of news awareness. Both Russia and Ukraine’s favorability levels have fallen in 2022 overall. Their news impact – the levels of favorability towards the nations after a respondent has seen, read, or heard news about the nation – are also low compared to other countries in NBI. Despite both nations having high levels of news awareness, Russia yields a net negative impact (-55%), while Ukraine’s net favorability is fairly neutral (-1%), with global citizens being more than twice as likely to report favorable impact of news about Ukraine than news about Russia.

Research Roundup

Russia’s invasion of Ukraine has had an extreme impact on Russia’s brand. Ukraine hasn’t experienced overall significant movement on the overall NBI rankings, but experienced movement within the individual dimensions. Ukraine’s NBI 2022 results demonstrate that global support is not enough to move the reputational needle and that news awareness does not always translate to more positive opinions. There are still relative weaknesses at a nation brand level for Ukraine to address as Ukraine focuses on physical rebuilding following the end of the war, as well as reputational opportunities to strengthen global perceptions.

For more information on this news release, please contact:

|

Jason McGrath Executive Vice President, US Corporate Reputation |

Mark Blutstein Senior Account Manager, US Corporate Reputation |

Moriya Bobev Account Manager, US Corporate Reputation |

About the Studies

The Anholt-Ipsos Nation Brands Index (NBI) collects over 60,000 interviews online in 20 panel countries with adults aged 18 or over each year. Data are weighted to reflect key demographic characteristics including age and gender. Fieldwork was conducted from July through August.

The nations measured in 2022 are as follows, listed by region:

- North America: Canada, the United States

- Western Europe: Austria, Belgium, Finland, France, Germany, Greece, Iceland, Ireland, Italy, the Netherlands, Northern Ireland, Norway, Scotland, Spain, Sweden, Switzerland, the United Kingdom, Wales

- Central/Eastern Europe: Czech Republic, Hungary, Latvia, Poland, Russia, Slovakia, Turkey, Ukraine, Serbia

- Asia-Pacific: Australia, China, India, Indonesia, Japan, New Zealand, Singapore, South Korea, Taiwan, Thailand, Vietnam

- Latin America and the Caribbean: Argentina, Brazil, Chile, Colombia, Dominican Republic, Ecuador, Mexico, Panama, Peru

- Middle East/Africa: Botswana, Egypt, Israel, Kenya, Morocco, Palestine, Qatar, Saudi Arabia, South Africa, Tanzania, United Arab Emirates

1 Ipsos Global Advisor 20,570 online interviews were conducted between 22 December 2022 and 6 January 2023 among adults aged 18-74 in Canada, Israel, Malaysia, South Africa, Turkey and the United States, 20-74 in Indonesia and Thailand, and 16-74 in all 21 other countries.

2 The survey was conducted among 19,003 adults under the age of 75 between November 25 to December 9, 2022, on Ipsos’s Global Advisor online survey platform.

About Ipsos

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com

About Simon Anholt

Simon Anholt designed and launched the Nation Brands Index in 2005. Since 1998, he has advised the presidents, prime ministers and governments of 63 countries, helping them to engage more imaginatively and effectively with the international community. He is recognized as the world’s leading authority on national image. Professor Anholt also publishes the Good Country Index, a survey that ranks countries on their contribution to humanity and the planet, and is Founder-Editor Emeritus of the Journal of Place Branding and Public Diplomacy. He was previously Vice-Chair of the UK Foreign Office Public Diplomacy Board. Anholt’s TED talk launching the Good Country Index has received 12 million views, and is the all-time most viewed TED talk on ‘governance’. He has written six books about countries, cultures and globalization and is an honorary Professor of Political Science at the University of East Anglia. His latest book, The Good Country Equation, was published in August 2020.