U.S. consumer sentiment stagnant or falling

Washington, DC, December 4, 2020 — With no stimulus plan in sight and an ongoing surge in new coronavirus cases, consumer sentiment is static or falling across all indices. Overall consumer confidence indexes at 48.8 in this week’s Ipsos-Forbes Advisor U.S. Consumer Confidence Tracker, a decline of 0.7 points from two weeks prior.

None of the indices show any major change compared to two weeks ago and remain notably lower than before the election. All are down between 0.1 and 1.2 points than they were before Thanksgiving and around 3 to 5 points lower than they were in the last week of October.

The partisan optimism gap is opening up again as Republican and Democrat sentiment diverges. All gains in optimism among Democrats following Joe Biden’s victory have vanished over the past two weeks; meanwhile, the rapid decline in Republican sentiment following the election has slowed.

- Republicans now index at 52.1 in Consumer Confidence, up 1.5 points from two weeks ago, but still down 12 points from the week before the election.

- Democrats index at 45.6, down 3.4 points from two weeks ago and down 0.2 point from just before the election.

Read the full story from Forbes Advisor here.

Learn more about the Ipsos Global Consumer Confidence Index and sub-indices via the interactive portal, Ipsos Consolidated Economic Indicators (IpsosGlobalIndicators.com) including graphic comparisons, trended data and all the questions on which they are based.

Detailed Findings

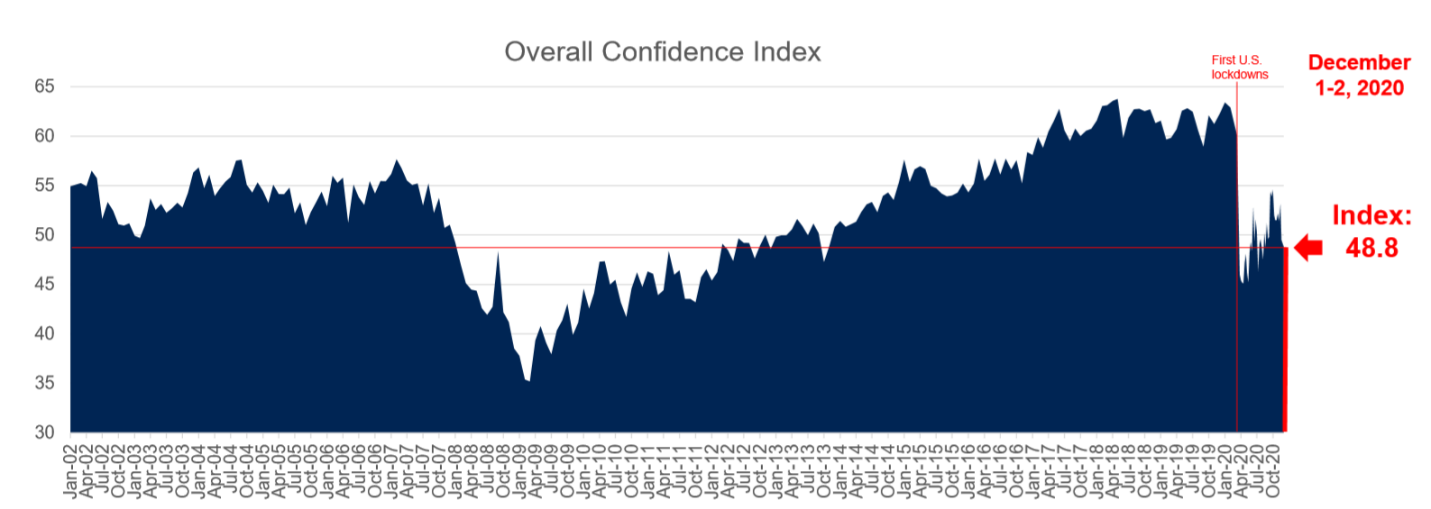

1. Scoring at 48.8, the latest overall Consumer Confidence fell 0.7 points from two weeks ago.

- The Confidence index is currently 0.7 points below the pandemic average and 11.3 points lower than where it stood in early March (60.1).

2. Both the Expectations and Investment sub-indices have fallen below their pandemic averages at 60.3 and 43.3 respectively.

- At 39.7, the Current sub-index is statistically on par with the pandemic average.

3. There is no improvement in jobs confidence, which fell 0.1 points from two weeks ago. Concern about future job losses remains at its highest point in three months as 712,000 Americans filed first-time unemployment claims last week.

- The proportion of Americans reporting they, a family member, or a personal acquaintance lost their job in the past six months due to economic conditions is, at 42%, unchanged from two weeks ago.

- In addition, 52% say it’s likely they, a family member or a personal acquaintance will lose their job in the next six months due to economic conditions, down 1 point from 2 weeks ago but up 6 points from just before the presidential election.

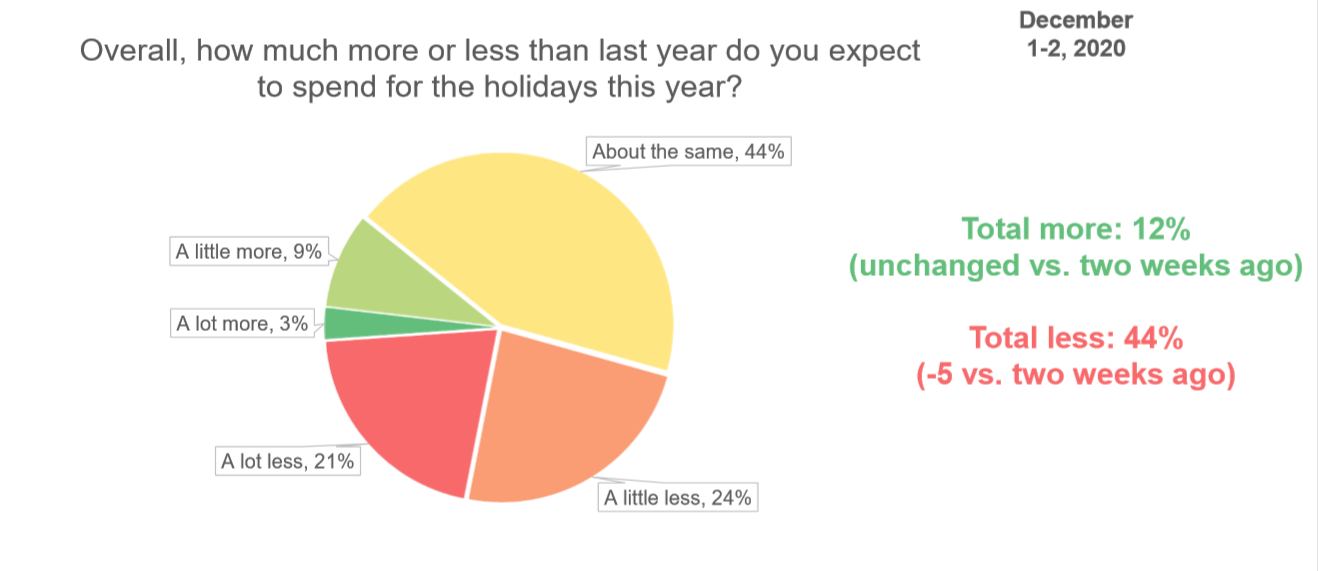

4. Holiday spending may be more constrained this year as a majority of Americans (88%) say they plan to spend less or the same as last year during this holiday season. There is a marginal improvement compared to two weeks ago, with the number of Americans who plan to spend less down 5 points.

5. Half of Americans (50%) still foresee a quick economic recovery once pandemic restrictions are lifted on businesses, down 3 points from two weeks ago. Those who disagree rose 2 points from two weeks ago, at 42%.

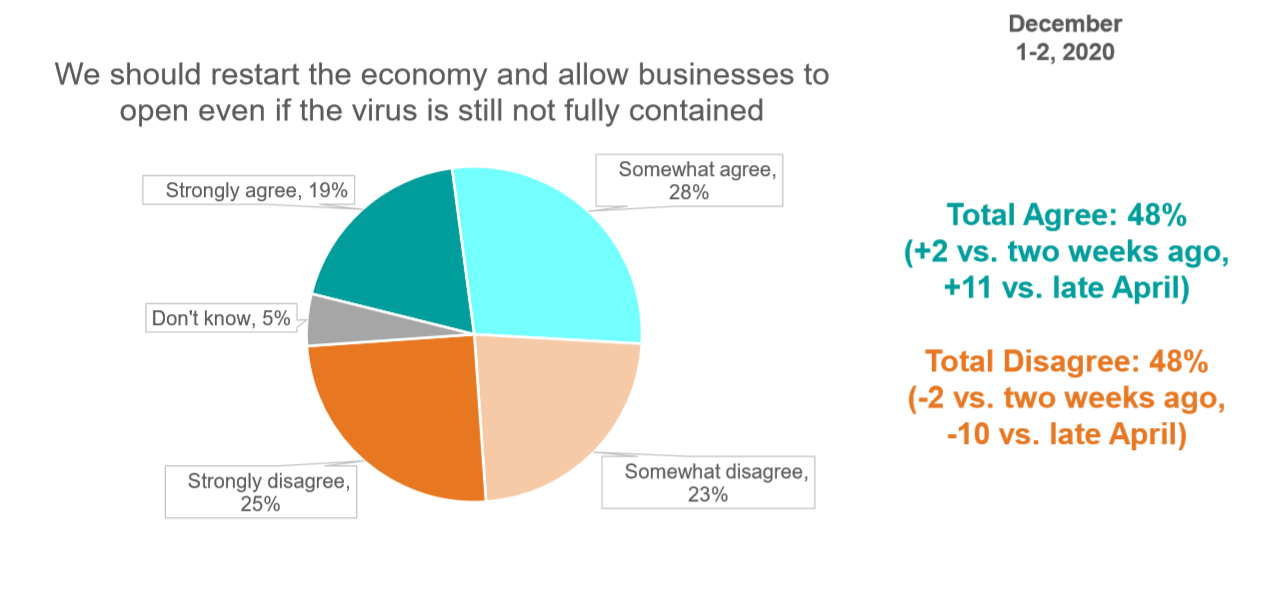

6. The nation is evenly divided on restarting the economy if the coronavirus is not fully contained yet (48% agree that businesses should be allowed to open up again, 48% disagree).

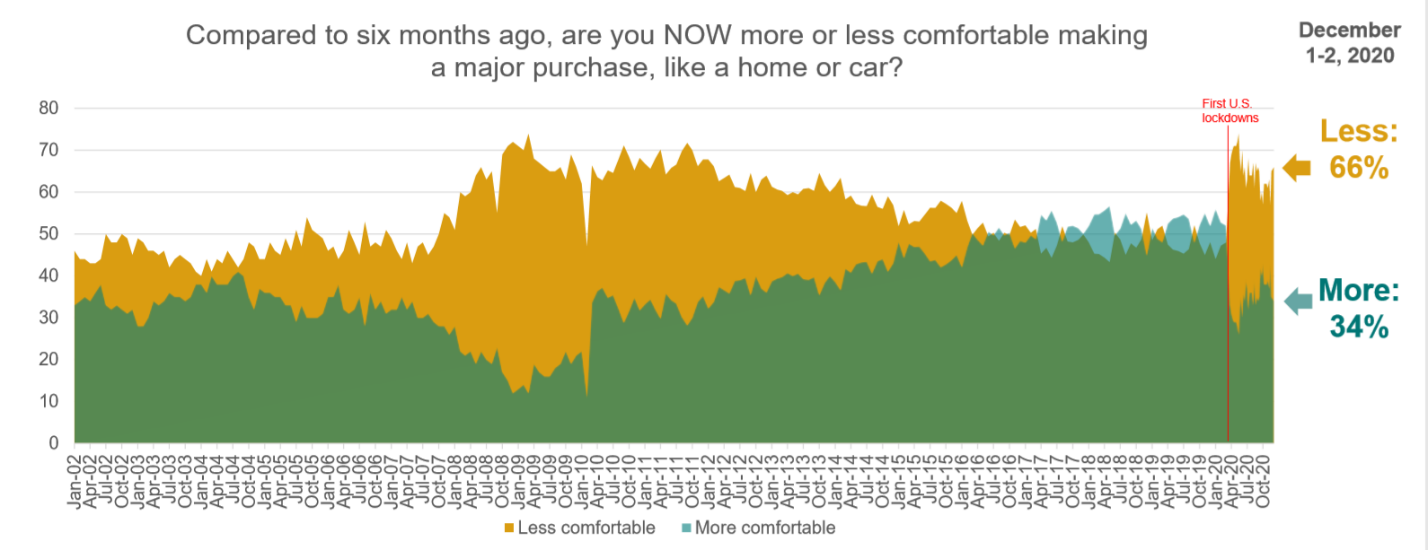

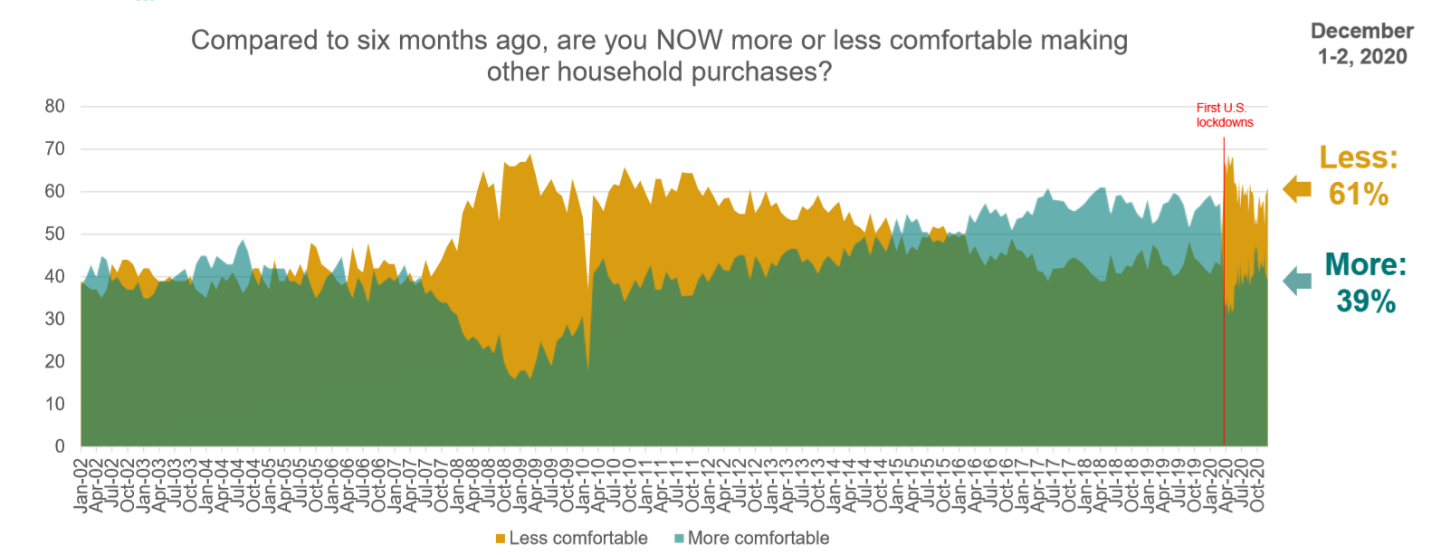

7. Purchasing confidence is at its lowest point in three months.

- Compared to six months ago, just 34% say they are more comfortable making a major purchase like a home or a car, down 1 one point from two weeks ago.

-

Compared to six months ago, 39% say they are more comfortable making other household purchases, down 2 points from two weeks prior.

Questions

The data used for the Consumer Confidence index and sub-indices is based on the following questions:

- Now, thinking about our economic situation, how would you describe the current economic situation in US? Is it… very good, somewhat good, somewhat bad or very bad?

- Rate the current state of the economy in your local area using a scale from 1 to 7, where 7 means a very strong economy today and 1 means a very weak economy.

- Looking ahead six months from now, do you expect the economy in your local area to be much stronger, somewhat stronger, about the same, somewhat weaker, or much weaker than it is now?

- Rate your current financial situation, using a scale from 1 to 7, where 7 means your personal financial situation is very strong today and 1 means it is very weak

- Looking ahead six months from now, do you expect your personal financial situation to be much stronger, somewhat stronger, about the same, somewhat weaker, or much weaker than it is now?

- Compared to 6 months ago, are you NOW more or less comfortable making a major purchase, like a home or car?

- Compared to 6 months ago, are you NOW more or less comfortable making other household purchases?

- Compared to 6 months ago, are you NOW more or less confident about job security for yourself, your family and other people you know personally?

- Compared to 6 months ago, are you NOW more or less confident of your ability to invest in the future, including your ability to save money for your retirement or your children’s education?

- Thinking of the last 6 months, have you, someone in your family or someone else you know personally lost their job as a result of economic conditions?

- Now look ahead at the next six months. How likely is it that you, someone in your family or someone else you know personally will lose their job in the next six months as a result of economic conditions?

Additional questions

Q. To what extent do you agree with the each of the following

- The economy will recover quickly once the restrictions to control the coronavirus pandemic are relaxed.

- We should restart the economy and allow businesses to open even if the virus is still not fully contained.

Q. Overall, how much more or less than last year do you expect to spend for the holidays this year?

About the Study

These findings are based on data from an Ipsos survey conducted on December 1-2, 2020 with a sample of 966 adults aged 18-74 from the continental U.S., Alaska and Hawaii who were interviewed online in English.

The sample was randomly drawn from Ipsos’ online panel, partner online panel sources, and “river” sampling and does not rely on a population frame in the traditional sense. Ipsos uses fixed sample targets, unique to each study, in drawing a sample. After a sample has been obtained from the Ipsos panel, Ipsos calibrates respondent characteristics to be representative of the U.S. Population using standard procedures such as raking-ratio adjustments. The source of these population targets is U.S. Census 2016 American Community Survey data. The sample drawn for this study reflects fixed sample targets on demographics. Post-hoc weights were made to the population characteristics on gender, age, race/ethnicity, region, and education.

Statistical margins of error are not applicable to online non-probability polls. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. Where figures do not sum to 100, this is due to the effects of rounding. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll has a credibility interval of plus or minus 3.6 percentage points for all respondents. Ipsos calculates a design effect (DEFF) for each study based on the variation of the weights, following the formula of Kish (1965). This study had a credibility interval adjusted for design effect of the following (n=966, DEFF=1.5, adjusted Confidence Interval=+/-5.1 percentage points).

Findings from previous time periods going back to March 2011 are based on data from Refinitiv /Ipsos’ Primary Consumer Sentiment Index (PCSI) collected in a monthly survey on Ipsos’ Global Advisor online survey platform with the same questions. For the PCSI survey, Ipsos interviews a total of 1,000+ U.S. adults aged 18-74. The Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of local economies, personal finance situations, savings and confidence to make large investments. The PCSI metrics reported each month consist of a “Primary Index” based on 10 questions available upon request and of several “sub-indices” each based on a subset of these 10 questions. Those sub-indices include a Current Index, an Expectations Index, an Investment Index and a Jobs Index.

Findings for January 2002- February 2011 are based on data from the RBC CASH Index, a monthly telephone survey of 1,000 U.S. adults aged 18 and older conducted by Ipsos with a margin of error of +/- 3.1 percentage points.

For more information on this news release, please contact:

Chris Jackson

Senior Vice President, U.S., Public Affairs

Ipsos

+1 202 420 2025

[email protected]

Kate Silverstein

Media Relations Specialist, U.S., Public Affairs

Ipsos

+1 718 755-8829

[email protected]

For more information on COVID-19 please click here

About Ipsos

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com