Why empowering intermediaries can help financial services companies in a challenging economy

KEY TAKEAWAYS:

- “Ease of doing business” is critically important and has a cascading effect upon actual business results—addressing it helped insurance agents increase premiums written by an average of 25%, according to an Ipsos survey

- Intermediaries expect products that fit client needs—they want to quickly find the products that align with what their client is looking for and close the sale

- Digital tools need to be easy to access with superior navigation, enabling intermediaries to quickly complete the sales process

- Customer support ensures success: Intermediaries tend to do business with companies that provide greater resources and with whom they have better, easier service experiences

Intermediaries are representing your brand. Here’s how you can help them succeed.

Many financial services businesses deploy external intermediaries in one form or another. These B2B (business to business) relationships can be between the financial institution and external salespeople, advisors, agents, brokers, wholesalers, etc. These are often independent third parties who serve as the intermediary between the customer and your firm. In many cases, these businesses are selling to other businesses, rather than the end consumer.

Unfortunately, it’s often easy to overlook people who don’t work directly for your firm because you may not “see” or have regular contact with them. However, as an extension of your firm, they represent your brand, products, and services. More importantly, their success has a significant impact on the success of your firm during challenging economic times.

Inflation adversely affects businesses, just as much as it does ordinary consumers. With the cost of doing business on the rise, are you doing everything you can to help your sales intermediaries succeed? In this article, we’ll reveal four core tenets of a successful firm-intermediary B2B relationship.

More than anything, make it easy for them to do business with your firm. Independent intermediaries typically have many firms to choose from and you want to be their first choice. Make the sales process easy and you’ll enjoy a larger share of their business. You make this happen by:

- Providing superior products that are distinct from the competitors’

- Building exceptional DIY tools that empower rather than impede

- Delivering a support network that can quickly address any obstacles to the sales process

Doing this will allow them to get your product to their customers with minimal hassle and reassures them that they made the right choice in working with your firm.

‘Ease of doing business’ is critically important and has a cascading effect upon actual business results

Intermediaries have a myriad of providers to choose from with a wide range of products, solutions and support networks. The needs of an independent intermediary may change over the course of their career. Do you know what those needs are, and which ones have the most impact on the companies they choose to recommend to their customers?

Perhaps surprisingly, many firms are relatively detached from their intermediaries and engage in what could best be described as a “transactional” relationship. However, Ipsos has done several B2B research studies among intermediaries to explore, identify and quantify what drives their satisfaction with, and selection of, the providers they engage with.

What one factor will make them choose you as their provider partner? The answer: make it easy to do business with you.

Just like harried consumers, time is currency to intermediaries. Time spent navigating a process online or having to call for support eats into their next money-making opportunity. In a recent Ipsos study among insurance agents, perceived “ease of doing business” was the single most important driver of their likelihood to recommend that firm to their peers (NPS). This was also found to be true among financial advisors, where Ease of Doing Business was the single largest contributor to positive NPS results, surpassing firm reputation and investment products.

Based on a 2021 Ipsos survey of over 900 agents and brokers, addressing ease of doing business as a “pain point” among insurance agents had the potential to lift NPS scores by 49% and to increase premiums written by an average of 25%.

Next to NPS, this is the most critical metric to track among your sales intermediaries.

Intermediaries expect products that fit client needs

Intermediaries don’t have time to sift through a multitude of offerings. They want to quickly find the products that align with what their client is looking for and close the sale. Product breadth, depth and value are key differentiators. From the continuum of product choices, intermediaries build preferences around companies that consistently deliver reliable products.

Ultimately, the B2B provider must demonstrate the ability and expertise to readily bring intermediaries relevant products that fit a wide variety of needs. This, in turn, greatly contributes to the intermediaries’ perceived Ease of Doing Business with a firm: Our 2021 survey among agents and brokers found that delivery of expert products had an impact score of 50% on this KPI.

Tools and solutions make a difference

Intermediaries need leads, sales training and solutions support from digital and traditional marketing channels. Once they have the prospect in the door, they must quickly identify the right solution for their soon-to-be client, and it’s their interaction with your company that will make that happen.

Intermediaries have told us that digital tools need to be easy to access with superior navigation, enabling them to quickly complete the sales process. Providing applications and interfaces that serve up the information they need and expedite the sales process will positively impact personal productivity. Our 2022 survey of over 1,000 financial advisors found that the impact of technology, tools and solutions upon ease of doing business is nearly as high as having relevant products (46% vs. 50%, respectively). It accounts for a 100-point gap in net promoter score between promoters and detractors among financial advisors.

Customer support ensures success

Simply put, support matters. Just providing intermediaries and agents with products and DIY toolkits is not sufficient to earn their loyalty and their business. Ipsos has conducted driver analytics that demonstrate the types of support agents seek and its influence upon the B2B relationship. Firms cannot afford to have large gaps in performance vs. agent expectations if they want to maintain a steady flow of business.

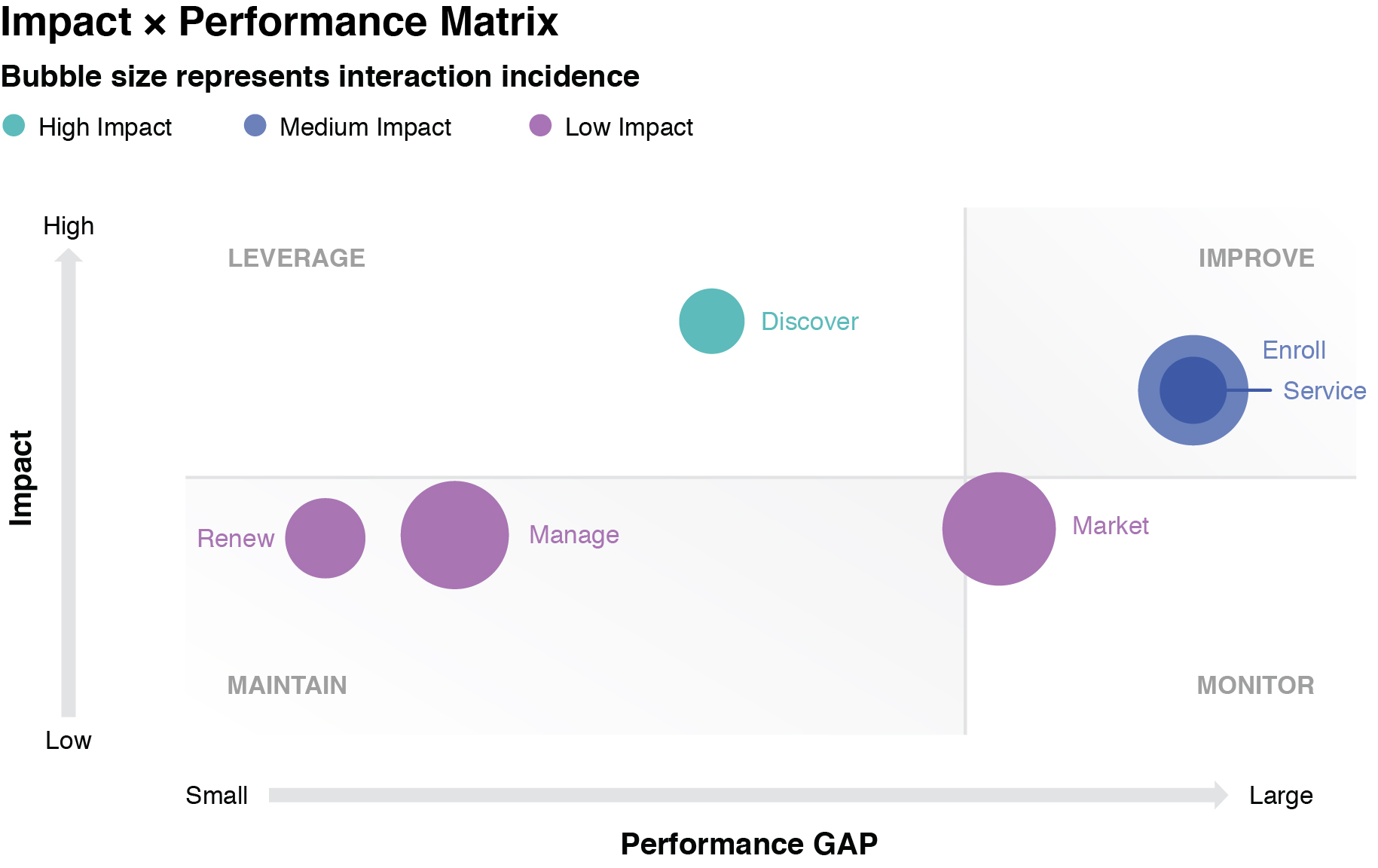

In another 2020 study among agents, Ipsos discovered that they placed high importance upon customer enrollment and service, but these two functional areas had huge delivery gaps vs. expectations. Ipsos’ Impact × Performance Matrix quickly calls out and prioritizes those areas where firms need to improve their performance amongst intermediaries.

Intermediaries tend to do business with companies that provide greater resources and with whom they have better, easier service experiences. Next to pricing, providing real-time access to service and support with minimal to no wait time is critically important to intermediary satisfaction and advocacy for your firm.

In our 2022 study among financial advisors, advocates (a.k.a. promoters) were much more likely to allocate a larger share of business to their preferred firm—on average, 80% more than detractors. The preferred firm delivers ready access to business consultants, product specialists and other experts. Additionally, our 2021 study among insurance agents discovered that providing superior customer support clearly delineated the market leaders—60% of their customers rate them a 9 or 10 on a 10-point scale.

Businesses can only improve their relationships with intermediaries if they know where to focus their efforts and resources. Money will be left on the table, or worse yet, wasted if your firm does not know what is truly needed to increase share among its independent intermediaries. Given the inflation in the cost of doing business, firms cannot afford wasting time, money or resources.

Although Ipsos has proven that “Ease of Doing Business” is a critical driver of share among agents, each firm must determine the business components that define this perception. And those components are often unique to a given firm or category. Ipsos helps firms gather, analyze and act upon this information.

Ipsos has devised proprietary methods to help businesses understand what it takes to maintain a successful B2B relationship with its intermediaries. “Business to business” sales are not the same as selling to the end consumer, as intermediaries have different needs and expectations. Ipsos will partner with your firm to precisely identify the specific actions needed for better relationships with your agents that will earn you a larger share of their business. We’ve given clients clear and actionable insight that enables them to establish a roadmap to growth. We’d welcome the opportunity to talk to you about how we can help.

![[WEBINAR] Global Voices of Experience 2026](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-global-voices-experience.jpg?itok=NN6W-9Ft)

![[WEBINAR] Increasing Efficiencies in Service Delivery in the Public Sector](/sites/default/files/styles/list_item_image/public/ct/event/2025-01/feature_4.png?itok=0fa4kfCx)