ESG across borders: South Africa

South Africa is a country with large natural bounty, a history of wildlife, and also one of great inequality – the history of apartheid pervades into everything that South Africans do.

South Africa is a country with large natural bounty, a history of wildlife, and also one of great inequality – the history of apartheid pervades into everything that South Africans do.

Today, there are mixed trends around sustainability. The Caucasian, non-African relationship with nature was historically characterised by wildlife, hunting and conquest but the local African culture is one of co-existence. South Africa has a strong history of indigenous habits around sustainable farming, but this increasingly conflicts with strands of extractivism.

The Nguni Bantu concept of ‘Ubuntu’ which encapsulates collectivism, community and taking care of each other shapes much of South Africans’ attitudes towards ESG and strengthens the importance placed on the S pillar. Perhaps one unintended consequence of this philosophy is ‘black tax’, a South African term describing the money that Black workers, who have taken their place in the corporate world, give to parents, siblings or other family members out of a sense of obligation or familial responsibility.

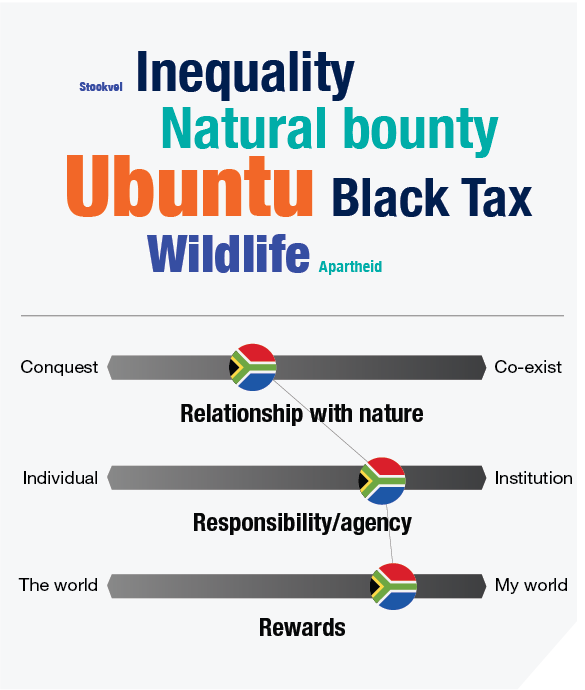

Plotting South Africa on the three ESG cultural dimensions, the country’s relationship with nature is closer to conquest than co-existence, a pattern we can trace to colonialism. This is somewhat balanced out by sustainable indigenous habits surrounding nature and farming. In terms of responsibility, there is a very clear reliance on the government and the business sector for guidance, with individuals unwilling to take the lead. And when it comes to rewards, priority is given to short-term benefits, with a reluctance to sacrifice immediate gains for an intangible, unforeseeable future.

Plotting South Africa on the three ESG cultural dimensions, the country’s relationship with nature is closer to conquest than co-existence, a pattern we can trace to colonialism. This is somewhat balanced out by sustainable indigenous habits surrounding nature and farming. In terms of responsibility, there is a very clear reliance on the government and the business sector for guidance, with individuals unwilling to take the lead. And when it comes to rewards, priority is given to short-term benefits, with a reluctance to sacrifice immediate gains for an intangible, unforeseeable future.

Of 29 countries, South Africa is one of most concerned about financial and political corruption[4] – this is reflected in discourse happening in the country. There is also high concern around poverty and social inequality and about unemployment, which is little surprise given that South Africa has one of the world’s high rates of unemployment, especially among young people.[15]

South Africans are currently experiencing crippling water shortages, as well as frequent power outages – but this lived experience contrasts the country’s abundance of resources and natural bounty. As a result, most South Africans believe they are being cheated on their natural right and that it is corruption, poor governance and poor policies that are leading to these shortages. Concern about resources is less about their finiteness and more about the lack of transparency or accountability in their management. The expectation of government is therefore very high and in some ways absolves the individual of responsibility. Unsurprisingly, South Africa has one of the lowest levels of confidence in their government’s plans to tackle ESG issues. There is awareness among South Africans today of the need to be more critical and to hold businesses to account. We now see examples of younger consumers boycotting brands that are seen to transgress ESG best practices, whether this is around use of plastic or not being transparent or ethical about how materials are sourced.

South Africans are currently experiencing crippling water shortages, as well as frequent power outages – but this lived experience contrasts the country’s abundance of resources and natural bounty.

Unlike in many other markets, when it comes to how South Africans feel about ESG and nature, we find emotions of optimism, calmness, and a need to reset the balance and co-exist. South Africans therefore respond well to brands that create access for them to do their bit towards this goal, for instance, by offering a depot for depositing recyclable waste. This makes it easy for consumers to participate in sustainable practices and they value the brand taking on the responsibility.

Unlike in many other markets, when it comes to how South Africans feel about ESG and nature, we find emotions of optimism, calmness, and a need to reset the balance and co-exist. South Africans therefore respond well to brands that create access for them to do their bit towards this goal, for instance, by offering a depot for depositing recyclable waste. This makes it easy for consumers to participate in sustainable practices and they value the brand taking on the responsibility.

We see increasing adoption of ESG norms across larger industry too. While some of this comes from international demands for compliance, much of it has also evolved naturally from South Africa’s own history of socially responsible investing (SRI) during apartheid. We see growing trends of linking CEO pay to ESG performance and sustainability bonds or financing i.e. only supporting investments in companies that have good or best practices around ESG.

Unlike in many other markets, when it comes to how South Africans feel about ESG and nature, we find emotions of optimism, calmness, and a need to reset the balance and co-exist.

Another major trend is an increased focus on ethical sourcing, source traceability, as well as support for local businesses and small enterprises. The S and E pillars have both become highly important, with strong expectations surrounding the G. The biggest priorities for the country surround ending poverty, having access to water and nutritious food and of course, employment.

Notes

[15] International Monetary Fund. 2023. “World Economic Outlook Database: April 2023”

Table of contents

- ESG across borders: the cultural context

- "Sustainability": All on the same page?

- Equality Kaleidoscope

- The climate of climate change opinion

- Applying cultural transferability analysis to ESG

- ESG across borders: United States of America

- ESG across borders: India

- ESG across borders: Brazil

- ESG across borders: South Africa

- ESG across borders: China

| Previous | Next |

![[Webinar] Real evidence from real experiences: Patient Centric Evidence](/sites/default/files/styles/list_item_image/public/ct/event/2026-03/ipsos-webinar-real-evidence-real-experiences.webp?itok=i_Bx2O-9)