How reputation and trust affect purchase decisions and marketing efficiency

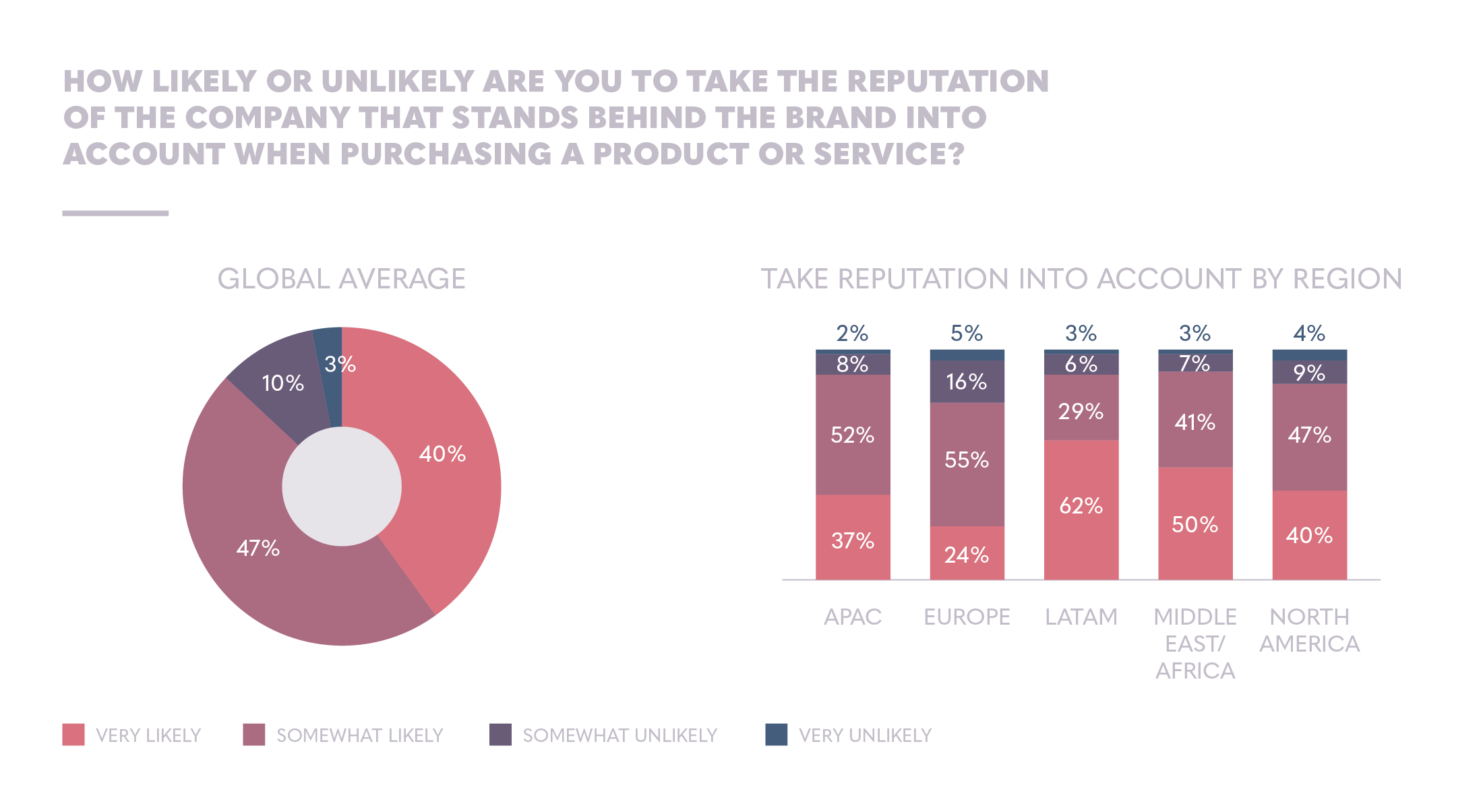

Reputation is a key consideration in purchase decisions.

The vast majority (87%) of consumers around the world say that they take the reputation of the company into account when purchasing a product or service.

There are regional differences in intensity. Consumers in Latin America and the Middle East/Africa are the most likely to say they are “very likely” to take reputation into account.

Consumers in Europe feel less strongly about taking reputation into account (just 24% “very likely”), but still a vast majority (79%) say they take reputation into account to some extent.

How reputation and trust affect marketing efficiency

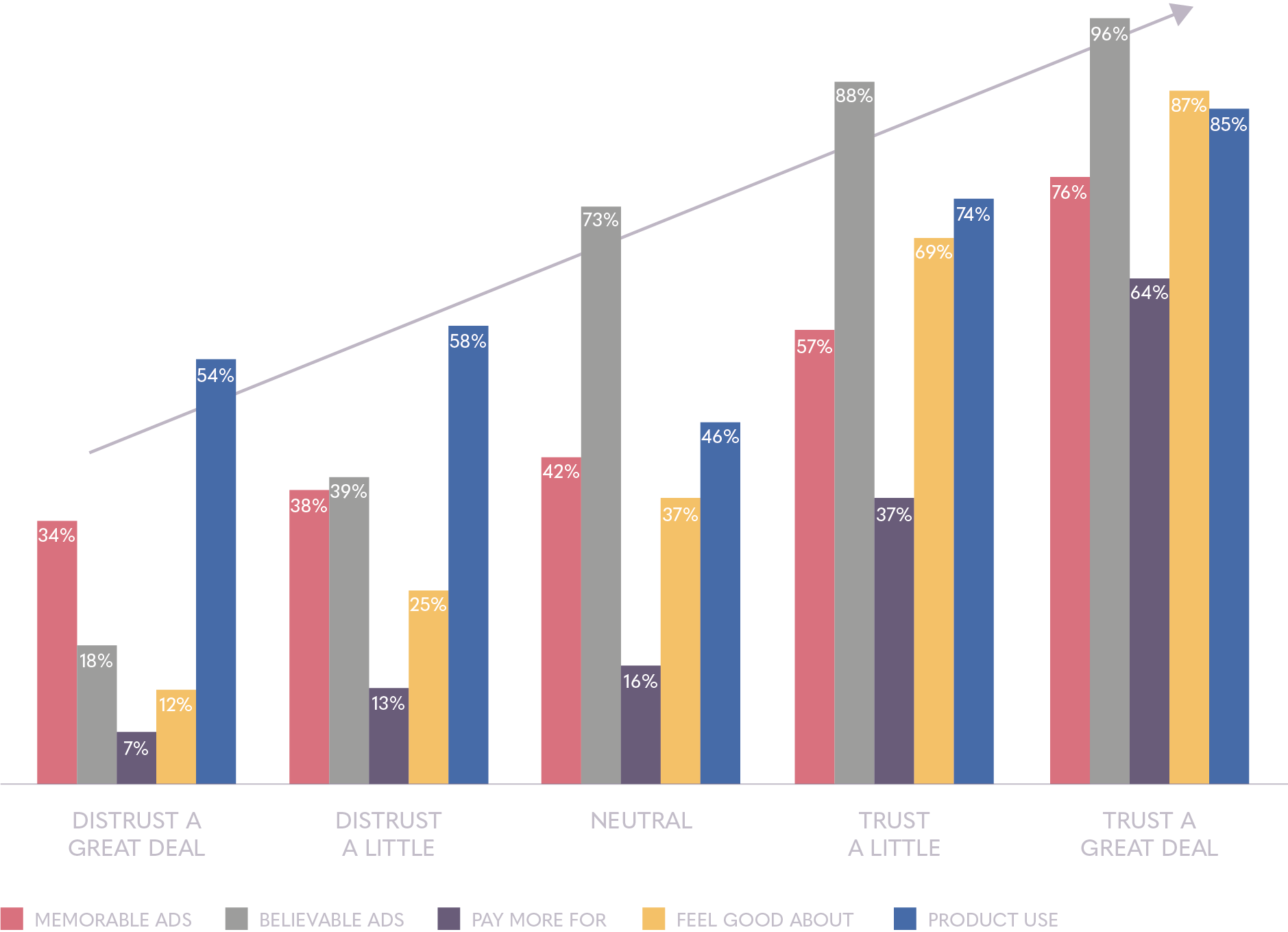

Building a good reputation generates greater marketing efficiency for companies. When you trust someone, you are more likely to believe what you hear and act on what you’re told. Companies that are trusted gain marketing efficiencies in two ways:

- consumers are more likely to see and believe advertising from companies that they trust AND

- consumers are more likely to act on this advertising by purchasing goods and services while being willing to spend a premium.

Around the world, trust has an enormous impact on advertising and product use. In advertising, ad believability is impacted much more than ad memorability – so even though people who distrust a company remember the ad, they are much less likely to believe it. The most significant impact on believability comes when people move into active distrust – only 39% believe advertising for companies that they “distrust a little”. This drops to just 18% for companies who are “distrusted a great deal.” People who are “neutral” toward a company on trust, are still likely to believe the ads they see (73%).

Product/service use overall is less impacted by trust. In fact, people who are neutral are the least likely to have ever used a company’s products or services – reflecting the role that experience plays in driving corporate trust.

Two metrics that are dramatically impacted by trust are feeling good about using a product/service, and being willing to pay a premium for it. Feeling good about using a product/service has a linear relationship with trust – as trust increases, so does the percentage of buyers’ who report feeling good about it. Being willing to pay a premium, however, has the most impact on the most trusted side of the scale, and falls dramatically among those who have a “neutral” or lower trust rating.

Advertising believability suffers most from active distrust, while willingness to pay a premium benefits the most from active trust. People who are neutral toward a company are willing to believe the ads, but they are unwilling to pay a premium. This suggests that companies that avoid distrust will be able to maintain their marketing efficiency, while those that actively build trust are more likely to reap the profits of premium pricing.

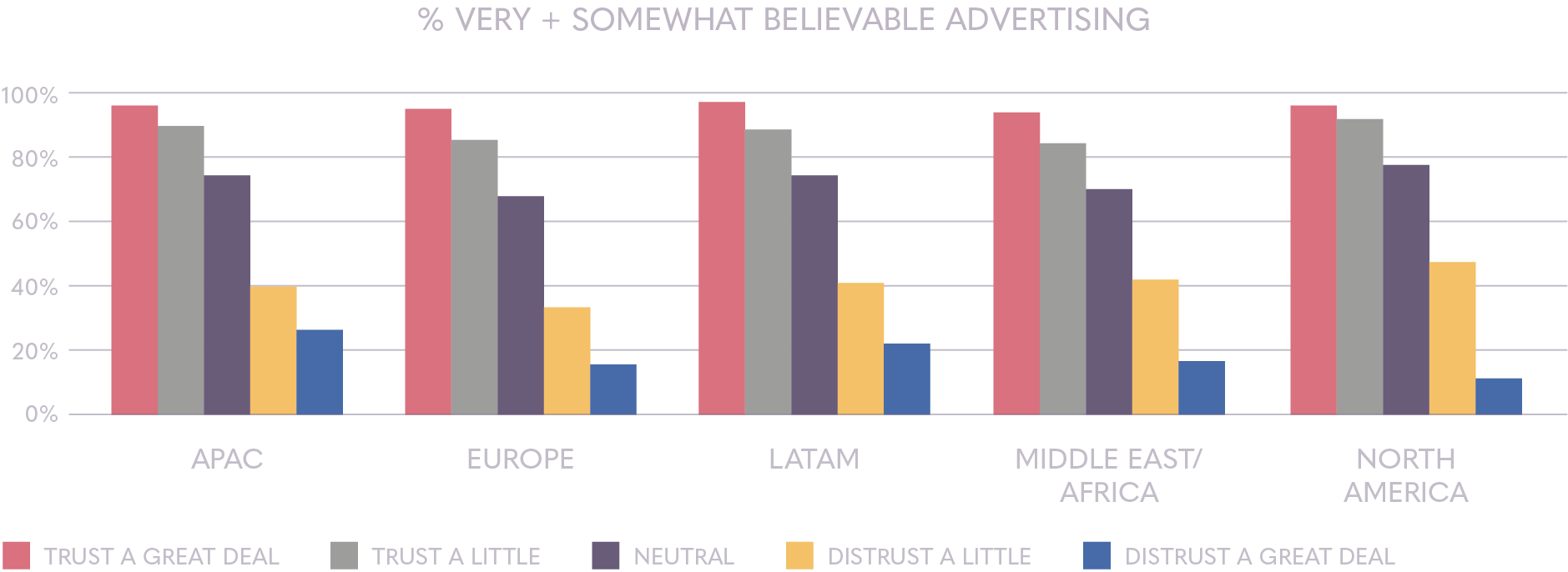

The impact of trust on belief in advertising

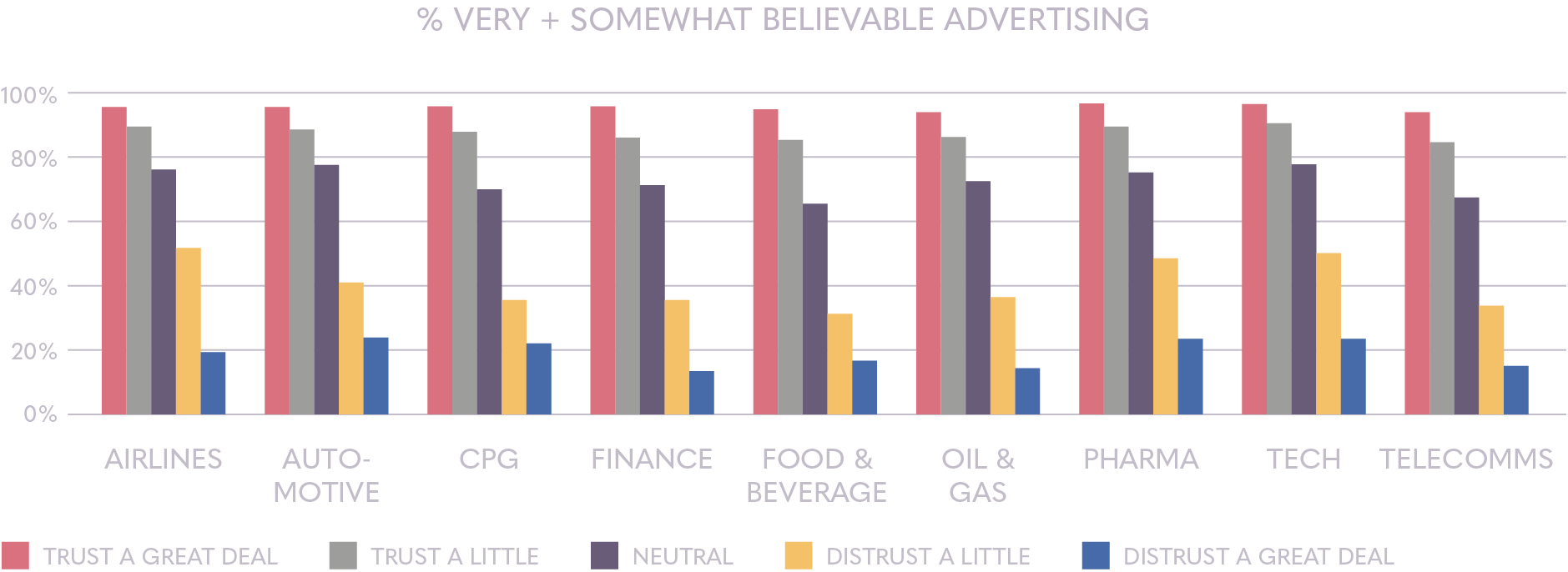

The impact of trust on advertising believability spans all regions and industries

Across regions, the steepest decline in advertising believability occurs when people move from “neutral” to “distrust a little.” The decline is greatest in APAC and Europe, but exists in every region.

Among the industry averages, the same inflection point is apparent and holds across industries. Automotive, pharma, and technology advertising are a bit more resilient in the face of distrust.

Maintaining trust, and avoiding active distrust, is important across all companies, everywhere in the world.

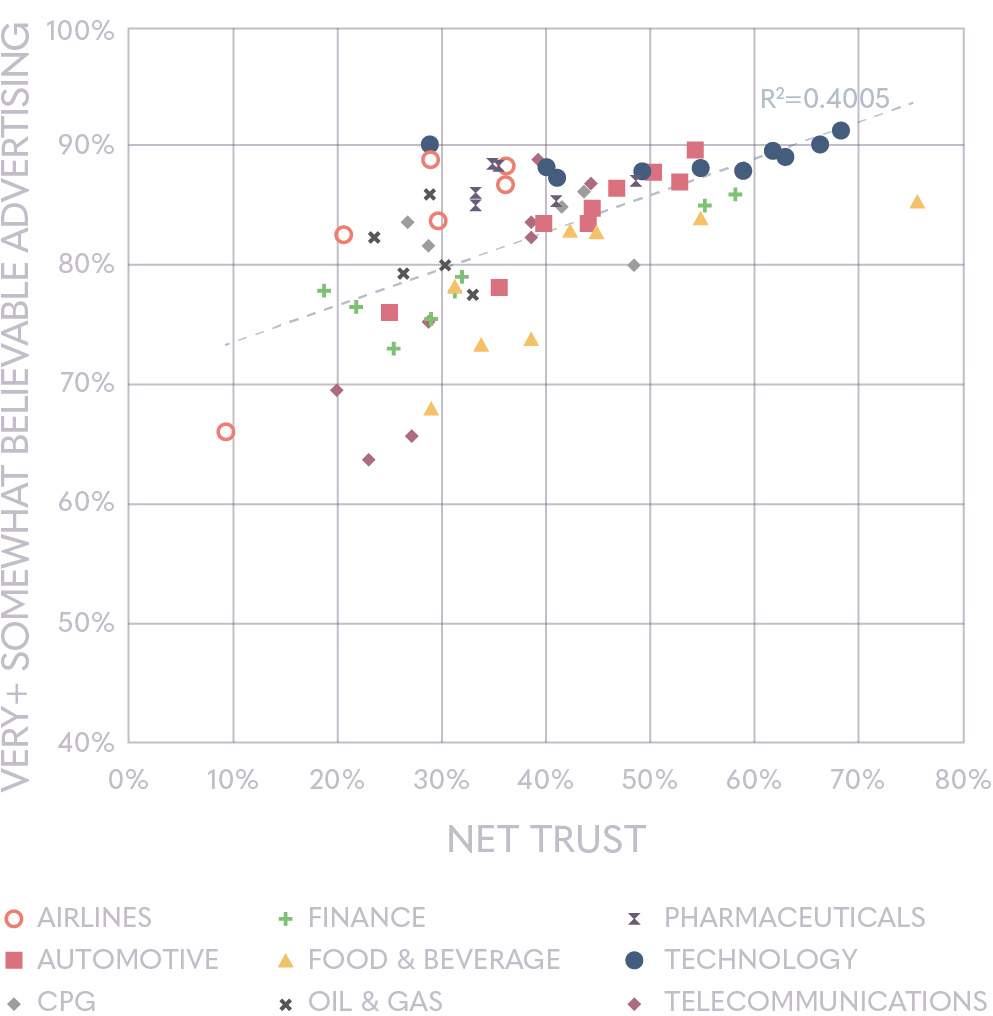

Ad believability and trust at the company level

Companies need to understand trust at the individual level.

The impact of trust on advertising believability is not as apparent at the aggregate level as it is at the individual level.

Companies with low aggregate levels of trust still have relatively high advertising believability. However, the level of believability becomes much more variable as trust decreases - all of the companies with high net trust have very high advertising believability while those with lower net trust show much greater ranges of believability.

The fact that this effect is somewhat hidden at the aggregate level means that companies need to understand trust at the individual level and be able to target those who distrust the company.

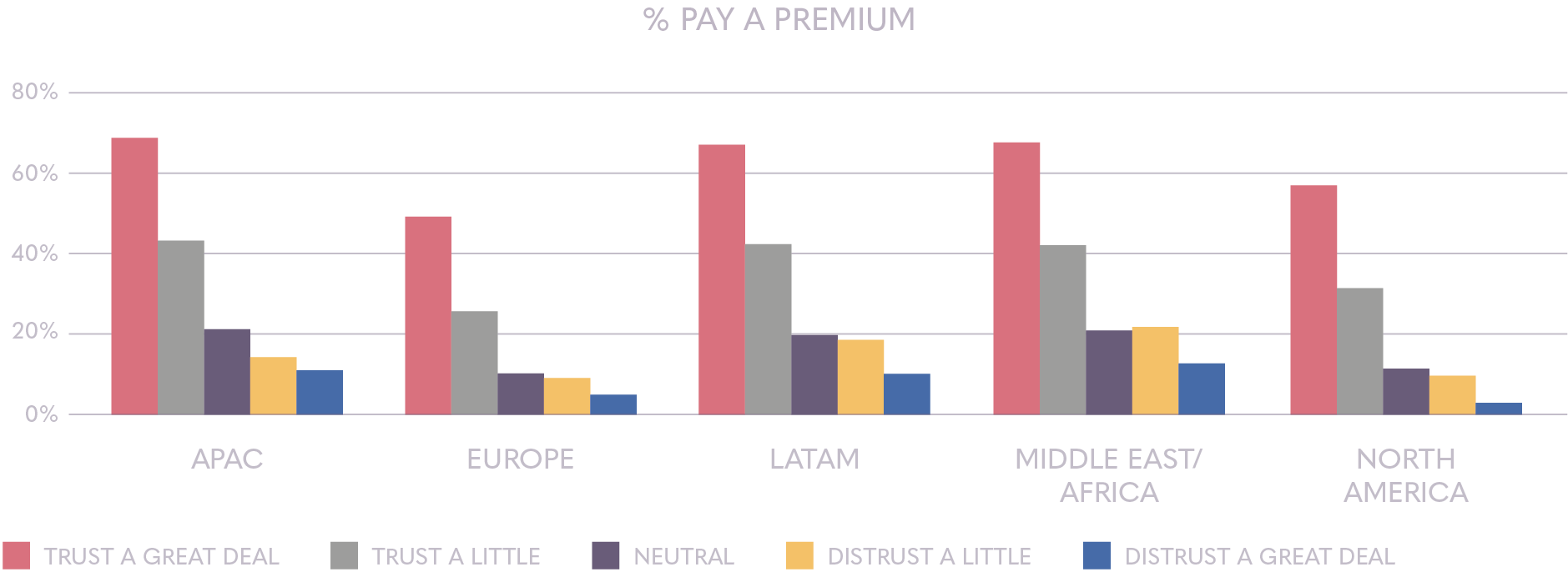

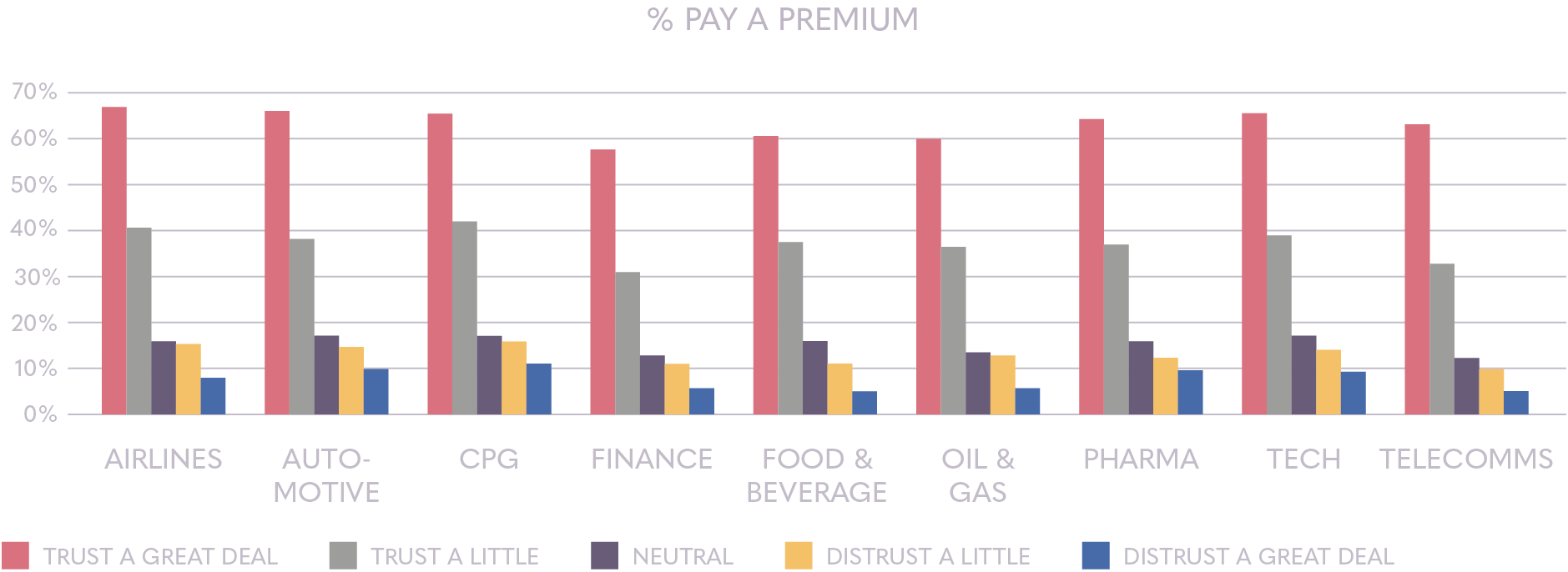

Would you spend more for a product made by a company you trust?

There is a direct relationship between trust and willingness to pay a premium. Companies with high trust can generally command a premium whereas those with low trust need to offer a discount. The impact of trust on willingness to pay remains consistent across regions and industries.

Across industries and regions, the greatest decline in willingness to pay a premium happens between people who trust a company “a little” and those who are “neutral.” The ability to charge a premium depends on actively building trust, rather than just avoiding distrust.

The willingness to pay a premium is lowest in Europe, but we see the same impact of trust on willingness to pay a premium.

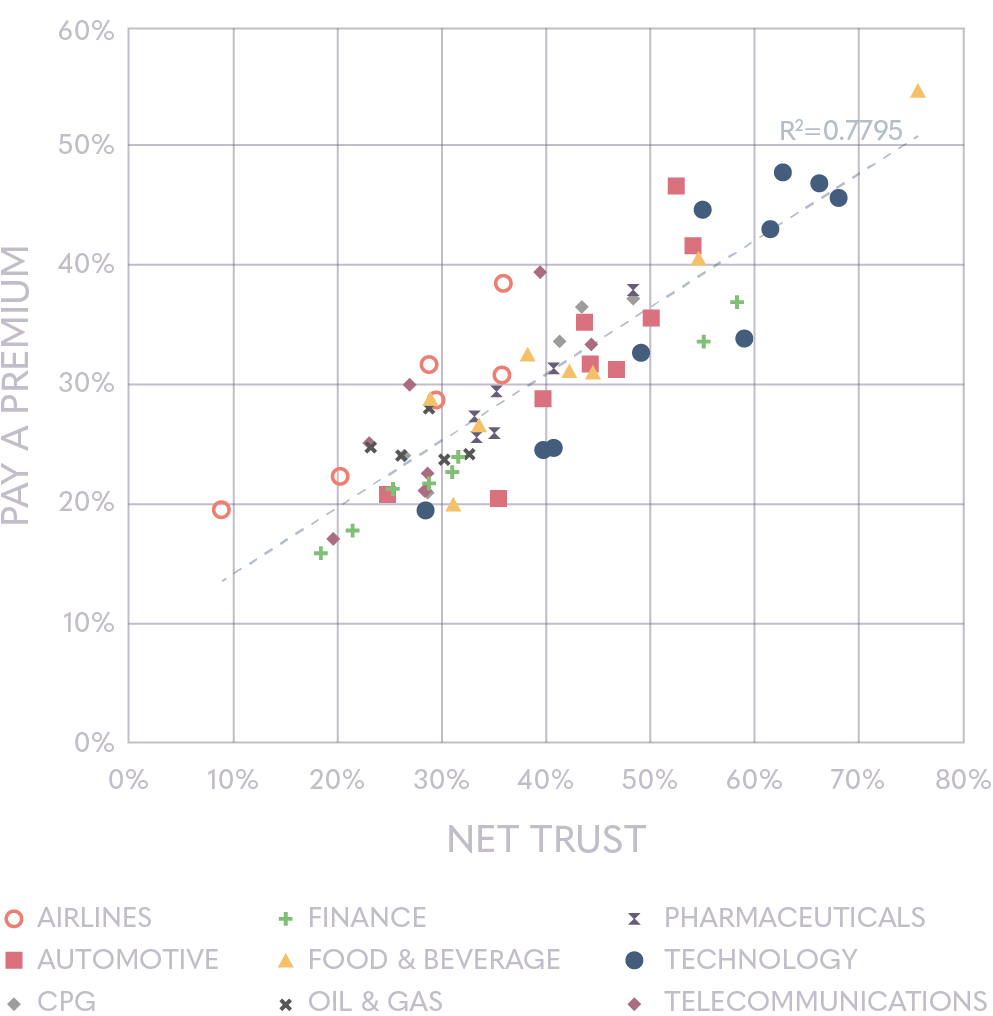

Trust explains 78% of the variance in willingness to pay a premium.

The impact of trust on willingness to pay a premium is more apparent at the aggregate level.

At the aggregate level, trust explains 78% of the variance in willingness to pay a premium. This effect will be magnified when examining individual country results (rather than the global average), and when analyzing at the individual company level.

![[WEBINAR] Ipsos@Cannes 2025 - The Empathy Re-Connection](/sites/default/files/styles/list_item_image/public/ct/event/2025-09/Cannes_1.jpg?itok=1BV8OhRD)