Why is cryptocurrency still confusing?

Brad Garlinghouse, the CEO of Ripple, was quoted as saying, “If the cryptocurrency market overall or a digital asset is solving a problem, it’s going to drive some value.” Indeed, market data would suggest that this rings true (to some extent). Market capitalization figures exceed 1.2 trillion USD, with 300 million users worldwide either expertly using or just dabbling in the cryptocurrency world.

However, recent studies conducted by Ipsos show that Americans, for example, have been slow to embrace crypto more widely, with 85% saying they are not likely to purchase a cryptocurrency such as bitcoin in the next year. While this does vary across age groups, with younger cohorts such as Gen Z, Millennials, Gen X more likely to buy, the numbers on average are low (below 10%). When we look at those over the age of 50, it drops to just 1%.

Despite the increasing search and social volumes evident through meta-analysis over the last five years, there are barriers to crypto uptake. One such roadblock may be fear around its legitimacy, especially in a trepidatious world. Ipsos’ recent What Worries the World study showed that political and financial corruption ranked 5th among top global concerns, with 24% of people citing it as a worrying factor in their country right now. While cryptocurrency is likely not be the sole cause of this, it does outline the macro environment in which crypto is operating.

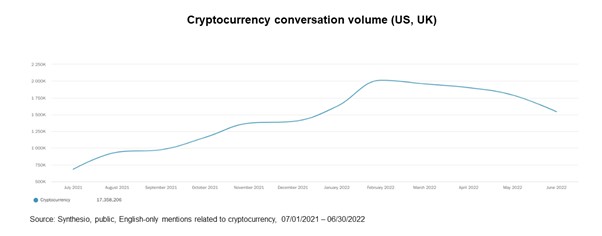

To dig deeper into consumers’ perspectives on cryptocurrency, we used Synthesio’s AI-enabled consumer intelligence platform to analyze social conversations in the US and UK. Over the last six months, crypto mentions have grown by 68% compared to the preview period. While growth has eased in recent months, the rise over time is evident.

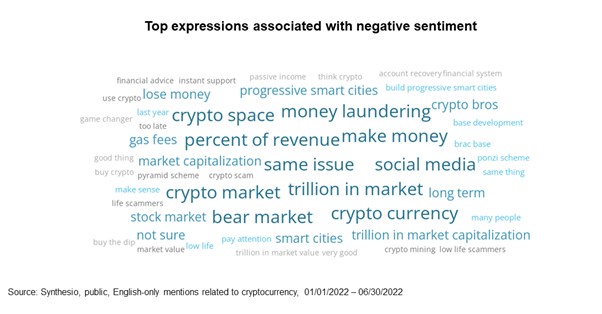

But what are people really saying? Using text analytics, we can dive deeper into the most prolific topics in the online crypto conversation and uncover stories that provide insight into the major barriers to adoption like credibility, familiarity, and usage.

Concern over bona fides is apparent in the top phrases detected by Synthesio AI, with the consistent references to “scammers,” “pyramid scheme,” “crypto scam”, “low life scammers,” “ponzi scheme” and “money laundering” - all topics of discussion that highlight consumers’ views on the cryptocurrency market.

- “Struggling so hard to figure out how to avoid crypto scams. Just not sure. Think, think, think” Twitter

- “How about the crypto scam problem? What is the fix for people losing all their crypto to hackers?” Twitter

While we can see a call for increased regulation in online conversations, there’s also a sense that we have a long way to go to protect those at risk from scammers, fraud, and volatility of the market.

A lack of familiarity is also evident with the recurring use of “not sure” as consumers call out their confusion about understanding market activities. When there are shifts in the market, consumers are unsure what to make of them. This applies to both the new players and to those who have some expertise already.

- “It does not include #crypto, this doesn't make me a hater, just not something I understand and I don’t invest in what I don’t understand”

- “Not sure how I feel. Especially one of my largest #NFTProject is on #Solana. Is this due to volume or mechanics?”

In more recent times, the “bear market” is underpinning the experience of investors, with some losing money and unable to recover, and others confident in the cycle and their ability to ride out the volatility.

- “Always thought that Cryptos are just another tech speculation & when the tech bubble popped Bitcoin et al would join the rest in a bear market, early days, but so far, my theory’s looking good Got Gold? 👇” Twitter

- “Don’t give up on crypto currency’s, they always bounce back. I’ve made a fortune on HEX even though the price has dropped in this bear market” Twitter

The crypto market may seem confusing, but data from the social space would suggest that while it’s complex, it is intriguing for many. Internet users are curious and eager to find their way through the maze of digital currency. For brands, social intelligence can help unlock some of the mysteries behind consumer barriers, needs, and market dynamics.

Want to learn more about using social intelligence to track industry trends, brands, and competitors in the digital currency space? Request a demo with one of our experts.