Blog: Measuring Financial Security and Vulnerability

A Brief Introduction to the Research

Earlier this year, Ipsos conducted research in 20 countries including Great Britain, on behalf of Genworth -173 with the aim of understanding the extent to which households are currently experiencing financial difficulties. The research also asked them how they feel their financial situation will change over the next 12 months.

Earlier this year, Ipsos conducted research in 20 countries including Great Britain, on behalf of Genworth -173 with the aim of understanding the extent to which households are currently experiencing financial difficulties. The research also asked them how they feel their financial situation will change over the next 12 months.

We interviewed a nationally representative sample of at least 1,000 adults online in each market – and in total we conducted 21,000 interviews globally. Fieldwork took place during January and February -173- and to put these timings into context, in Britain, at this point:

- The economy was improving

- Unemployment had started to fall

- The housing market had started to pick up (especially in London)

- Repossessions were declining

- But inflation continued to rise faster than wages, so household incomes remained under pressure -173- despite historically low interest rates

Financial Vulnerability

The first subject we covered in the research was financial vulnerability. We defined households as feeling vulnerable if they were either:

- experiencing financial difficulties some or all of the time and didn’t think that their situation will improve; or

- if they sometimes experienced financial difficulties, but felt that their financial situation was going to get worse in the next 12 months

Based on this definition, 22% of households in Britain were characterised as ‘financially vulnerable’. Despite the improving economic environment, this is a slight (although not statistically significant) increase on the 21% of households who felt vulnerable in 2012.

Of those defined as vulnerable, 12% felt that they were under pressure all ‘of the time’ or ‘more often than not’.

Looking at the bigger picture, the majority of households (51%) said that they have experienced financial difficulties ‘sometimes’ or more frequently than this. Those most likely to experience financial difficulties were respondents aged 35-173-54, who were also the most likely to feel that their financial situation would get worse in the next 12 months.

And we will come back to this age group a bit later on…

Comparing the level of financial vulnerability in Britain with other countries in Europe, wesaw that:

- Nordic countries (Norway, Denmark, Sweden, Finland) have the lowest levels of financial vulnerability

- But outside of this region, the UK actually has the lowest level of vulnerability in Europe. It is slightly better than France and Germany (both have 25% of financially vulnerable households) and much better than Portugal and Greece (where a half of households are vulnerable).

Financial Security

Looking at the other end of the comfort spectrum, the research also allows us to establish the proportion of households who are financially secure. We defined households as being financially secure if they hardly ever or never experienced financial difficulties and expected their financial situation to improve.

Using this definition, the research classified 9% of British households as financially secure. Again, comparing this to the rest of Europe:

- Nordic households (particularly Norway and Sweden) were again the most likely to feel financially secure

- Britain, meanwhile, was on a par with Germany (which has 10% of financially secure households), and ahead of France (which only has 6%)

- Portugal (with 2%) and Greece (0% of secure households) again had the lowest percentages in Europe

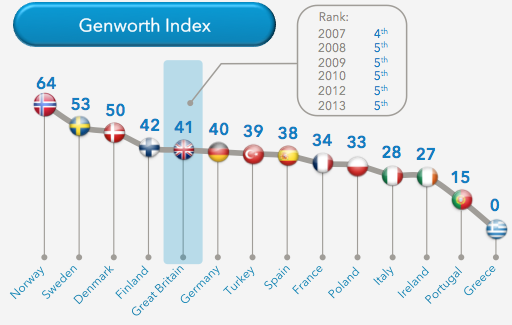

The Genworth Index

The main output from our research is the Genworth Index, which represents the degree to which households in each country feel financially vulnerable or comfortable. The Index uses the ratio of financially vulnerable households to financially secure ones, to quantify each country’s relative position.

The main output from our research is the Genworth Index, which represents the degree to which households in each country feel financially vulnerable or comfortable. The Index uses the ratio of financially vulnerable households to financially secure ones, to quantify each country’s relative position.

Great Britain’s index score of 41 places it in 5th place in Europe overall, behind only the four Nordic countries. This is the same rank position as in 2012 and its score puts it on a par with Germany (which has an index score of 40), but ahead of France (on 34) and all other European countries.

What Do These Findings Mean for British Households?

Ipsos’s regular Economic Optimism Index1 shows that the improving economic situation in Britain noted earlier has been recognised by the general public.

The proportion of adults who felt that the economic situation in Britain would improve in the next 12 months rose steadily throughout 2013 – and by early February 2014 (the same time as this research was conducted) a half (50%) felt that there would be an improvement in the economy over the next 12 months.

A month later, in March, the Economic Optimism Index (% improve -173- % decline) was running at a record level (+35). This is not surprising, given the wealth of positive economic data that were emerging at this time – including, and perhaps most notably, rapidly increasing house prices. This confidence in the economy, however, has not translated into an improvement in how households are feeling financially. Despite its relatively high ranking in the Genworth Index compared to the rest of Europe, the research shows that there are more than twice as many households in Britain that feel vulnerable compared to the number that feel secure.

This can be explained by three major factors:

- 41% of adults agreed with the statement that ‘household spending and other money issues are a constant source of stress in our household’ – which highlights the fact that household incomes remain under pressure

- 34% disagreed with the statement ‘my job is more secure than it was 12 months ago’, compared to only 21% who agreed – this shows that job insecurity is still lingering

- And the third factor is the strength of the housing market

72% of adults agreed that ‘house prices in my area are going to go up over the next 12 months’ – and although those in London/SE were most likely to be expecting a rise, more than two thirds of those outside of London/SE were also expecting an increase.

While house price rises will benefit many homeowners, they will put further financial pressure on those looking to move to a larger property, as well as those who want to get on to the housing ladder for the first time.

This was reflected in research conducted last year by Ipsos for Inside Housing2, in which more British adults felt that rising house prices would be a bad thing for them personally than thought it would be a good thing.

The negative impact of rising prices was also felt in this research, as:

- 81% of adults agreed with the statement ‘saving enough money for a house deposit is the main barrier to home ownership in the UK’. It is clearly felt that house prices are preventing people from getting on the housing ladder, as well as moving up it

- 56% agreed that ‘more houses need to be built in the UK’ – it is also recognised that one of the key drivers of price rises in the housing market is the lack of supply of housing stock

- 79% agreed that ‘many first time buyers need to borrow from their parents to put down a deposit on their first home’. This suggests the impact of higher house prices on first time buyers is also being felt by parents (many of whom could still be in the process of buying their own home / paying off a mortgage).

Despite this, the demand for housing remains as strong as ever. The British Social Attitudes Survey3 shows that 86% of adults, when given the choice between renting or buying, would choose to buy. Although these data are from 2010, this is an attitude that has not changed for a decade – so it is effectively hard-173-coded in the mentality of British people. The desire to own property today remains as strong as ever.

And, Finally, Coming Back to the 35-54 Year olds…

If you remember, the 35-173-54 year olds were the group who were most likely to feel that their financial situation would get worse in the next 12 months. Many of this group have mortgages, and with the likelihood of interest rate rises in the near future, they will be bracing themselves for increased mortgage payments which will further squeeze their disposable income. As we have just seen, they may also be anticipating the financial implications of having to support their children with a deposit for a property.

And if this wasn’t enough, many may also be concerned about the financial impact of the cost of education for their children and the cost of care for their parents as they get older – but that’s another story!

Key Take Outs from the Research

- Despite an improving economic situation, the proportion of financially vulnerable households in Britain remains high – there are more than twice as many financially vulnerable households, as secure ones

- More than half of households have experienced financial difficulties in the last 12 months -173- with day-173-to-173-day money worries and job insecurity commonplace

- House prices – and the knock on effect on the size of deposit required to fund a property purchase – are putting additional pressure on many consumers’ financial affairs

- But despite all of this, Britain continues to enjoy a higher Genworth Index score than most countries in Europe – which reflects the relatively high level of vulnerable households in the region overall

Technical notes: The research was conducted online using Ipsos’s Global Omnibus in 20 countries across Europe, Latin America and Asia between January and February 2014. Questions were asked of a representative sample of at least 1,000 adults in each country. In GB we interviewed 1,000 adults aged 15+ and results were weighted to be representative of the population.

- A nationally representative sample of 1,000 GB adults aged 18+ are interviewed by telephone each month

- A nationally representative sample of 1,970 GB adults aged 16+ were interviewed face-173-to-173-face in September 2013

- A nationally representative sample of 1,075 GB adults aged 18+ were interviewed face-173-to-173-face in October 2010