Business Banking Service Quality: Northern Ireland Results

Date Published: August 2025

These results are from an independent survey carried out between July and June 2025 by BVA BDRC (now part of Ipsos) as part of a regulatory requirement, and we have published this information at the request of the providers and the Competition and Markets Authority so you can compare the quality of service from business current account providers. In providing this information, we are not giving you any advice or making any recommendation to you.

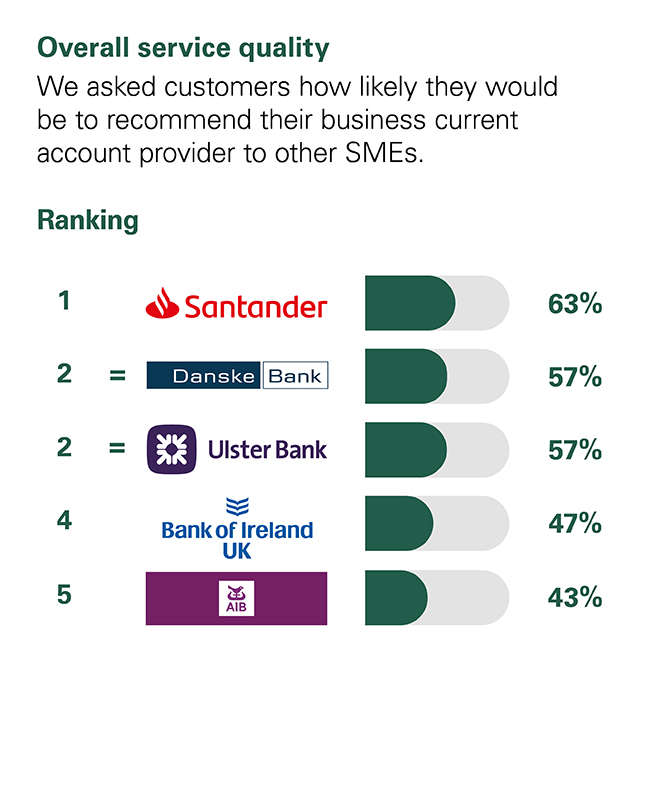

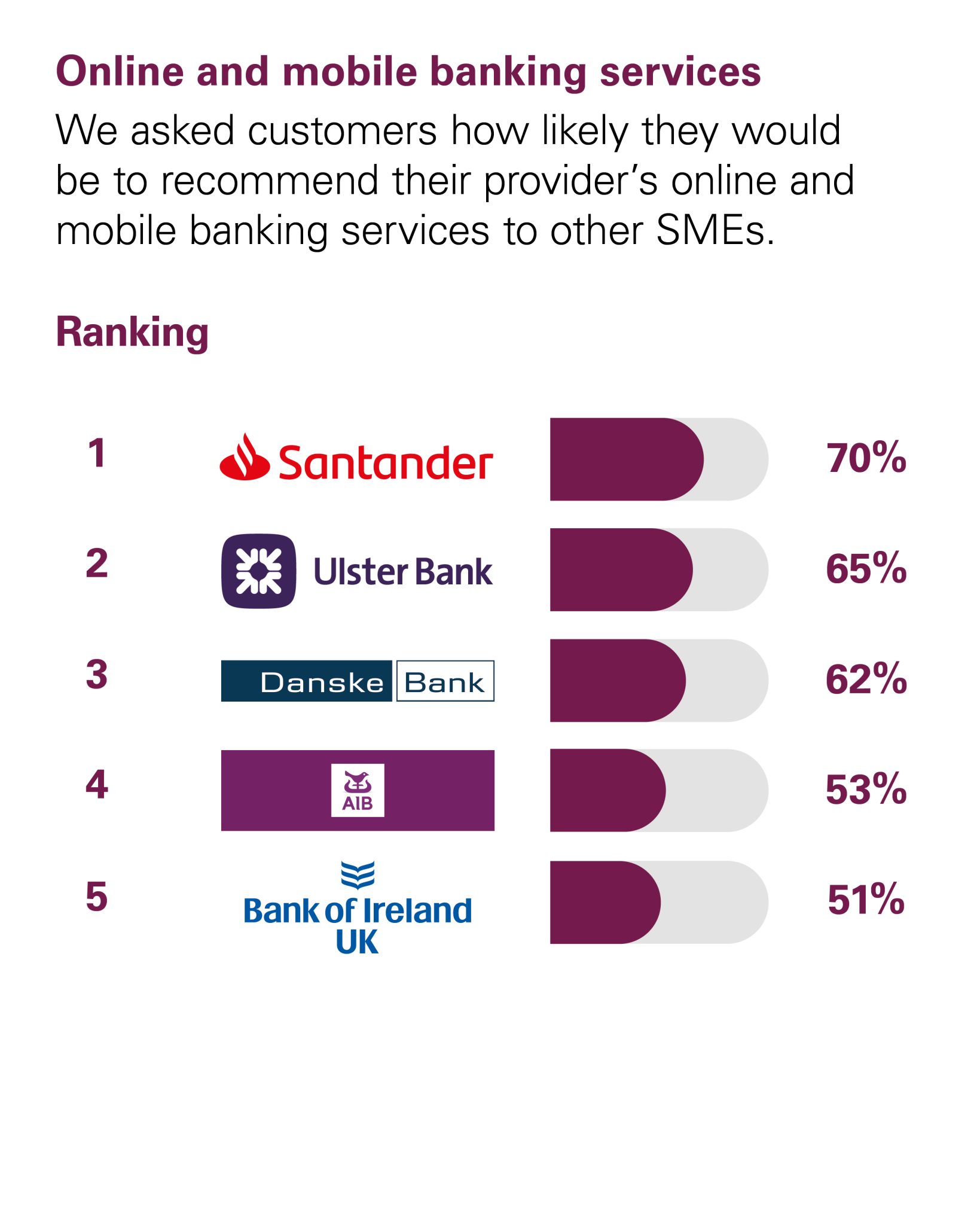

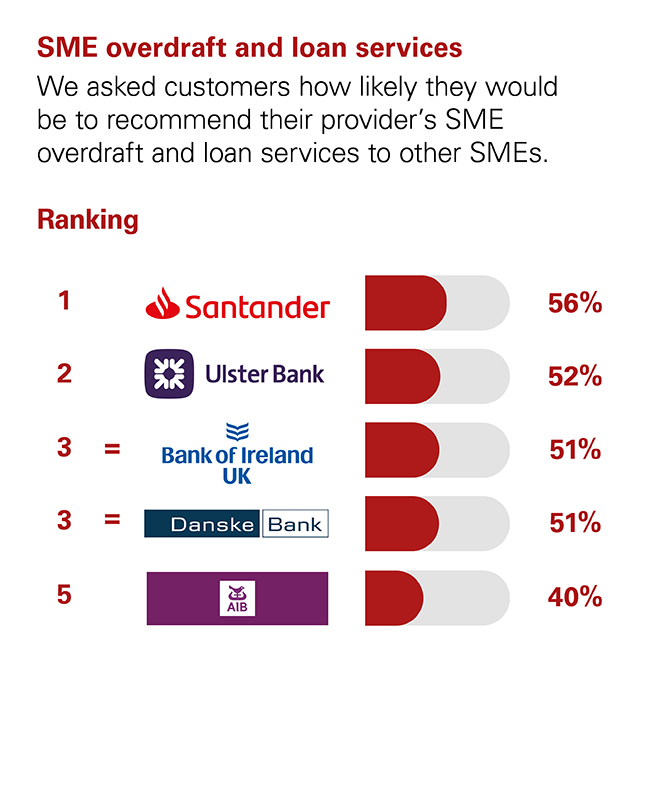

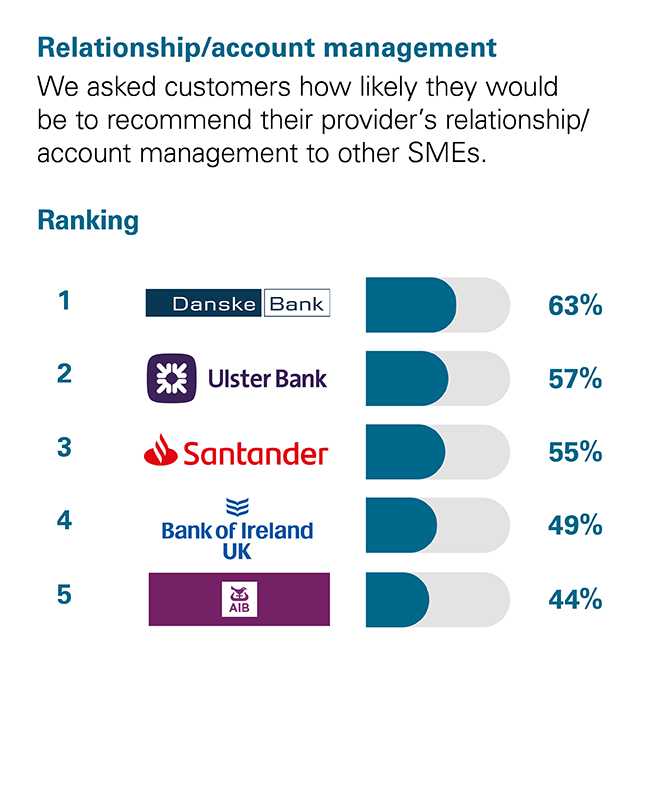

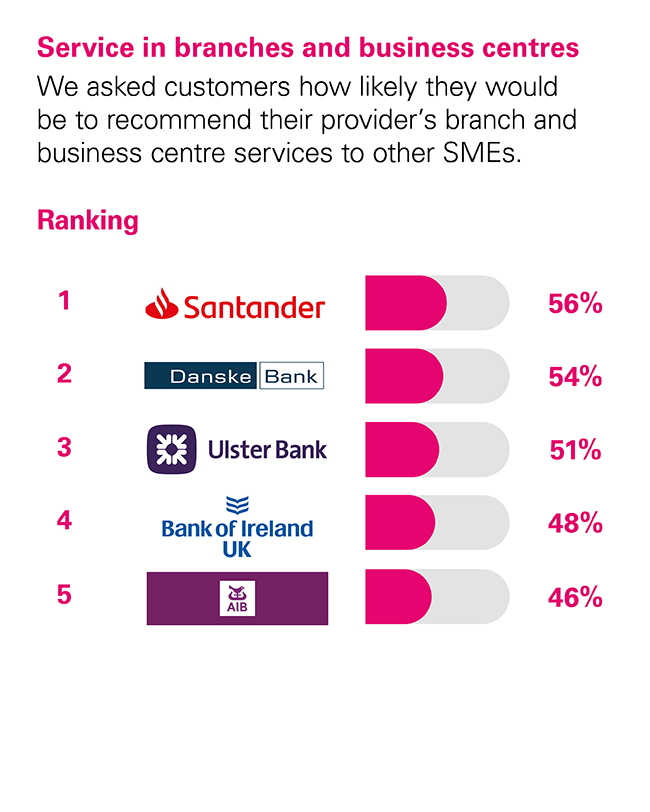

SME customers with business current accounts were asked how likely they would be to recommend their provider, their provider’s online and mobile banking services, services in branches and business centres, SME overdraft and loan services and relationship/account management services to other SMEs. The results show the proportion of customers of each provider, among those who took part in the survey, who said they were ‘extremely likely’ or ‘very likely’ to recommend each service.

To go straight to a particular set of results, click the links below.

- Overall service quality

- Online and mobile banking services

- SME overdraft and loan services

- Relationship/account management

- Service in branches and business centres

Alternatively, you can download the full results as a PDF here.

If you’d like to learn more about the methodology used, you can download a detailed guide here.

Overall service quality

Online and mobile banking services

SME overdraft and loan services

Relationship/account management

Service in branches and business centres

Participating providers: AIB, Bank of Ireland UK, Danske Bank, Santander, Ulster Bank.

Approximately 600 customers a year are surveyed across Northern Ireland and the Republic of Ireland for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

2,984 people were surveyed in total.

Results are updated every six months, in August and February.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

If you’d like to learn more about the methodology used, you can download a detailed guide here.