Santa’s newest little helper? AI’s role in Christmas gifting

The marketing world has been abuzz this year with discussion on changes in the search ecosystem. Many are watching out for AI summaries, chatbots and assistants will change everyday purchase decisions.

Our latest research shows AI is playing a growing role in Christmas gifting, especially among younger shoppers.

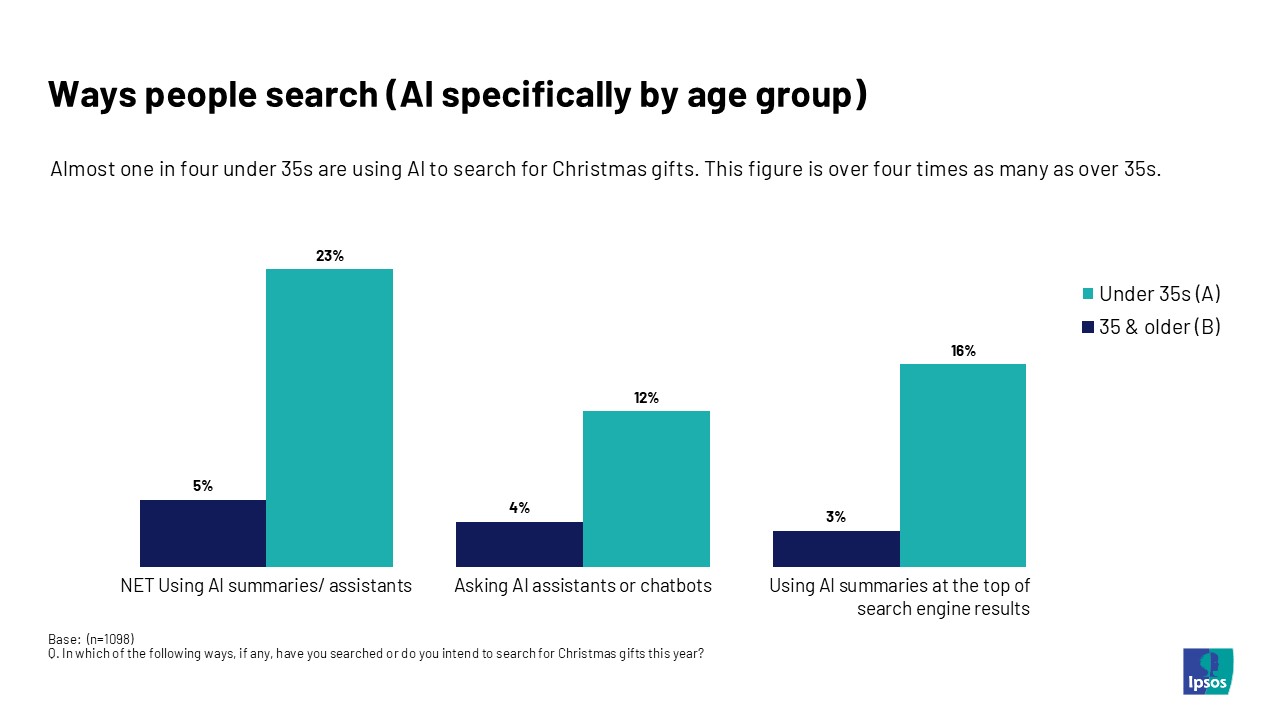

- Nearly one in four under-35s are using AI to search for Christmas gifts. This figure is over four times as many as over 35s, suggesting younger shoppers are making more use of AI tools in their gifting journeys.

- What’s more, those who have adopted it are finding it useful. Almost all of those who have searched for gifts with AI, put it in their top three most useful ways to search.

Shoppers who are using AI for gifting are finding real benefits. As familiarity with AI tools increases, so does the perceived value they offer. Shoppers who leverage AI-driven summaries, assistants, and chatbots find these tools to be informative, time-saving, and straightforward.

Brands, in turn are seeing commercial value.

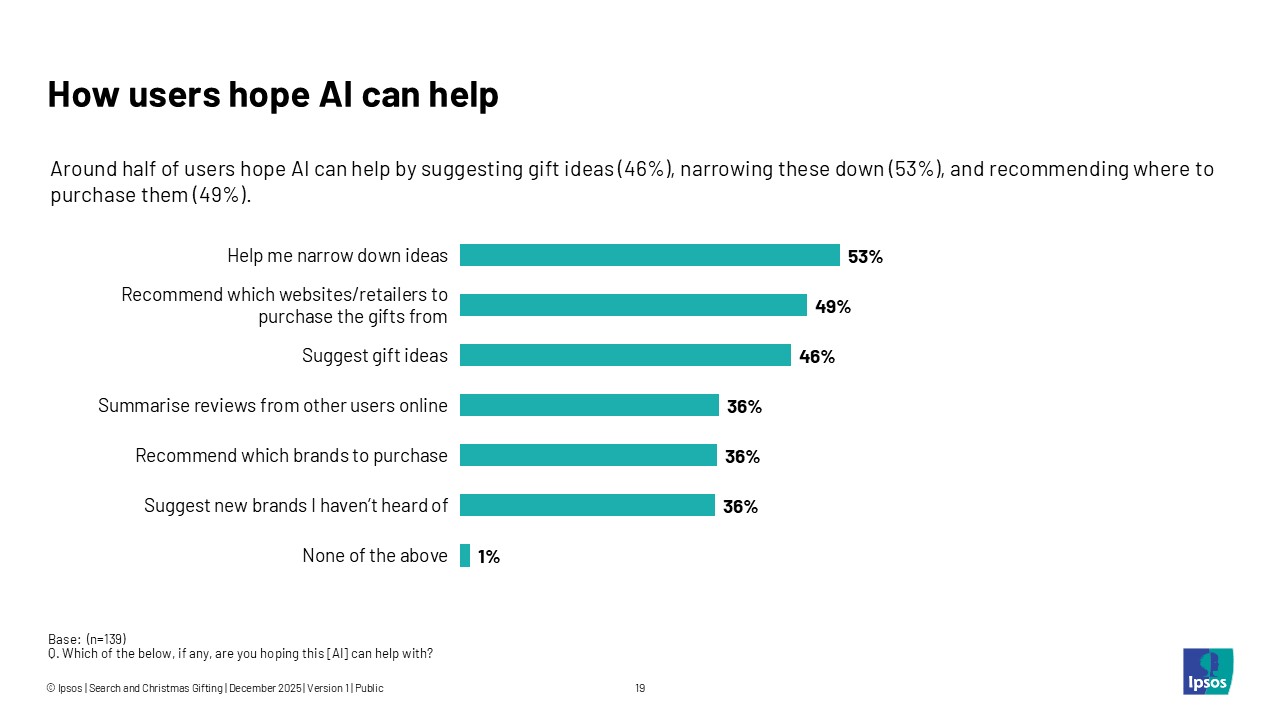

- Around half of AI users are hoping that AI will give them recommendations on where to purchase gifts, alongside suggesting ideas and helping them narrow them down.

- Among those who use it, AI is also becoming relied on and implicitly trusted, with good news for recommended brands. Almost 8 in 10 feel they can rely on recommendations of brands and retailer websites in AI summaries (78%).

There are some caveats, however. Trust in the accuracy of results is slightly higher for AI summaries embedded in search engines (80%) than chatbots & assistants (69%), perhaps due to the long-term halo effect of trusted search engines.

There is also still some way to go before AI embeds itself fully as an established helper for the wider population. ‘Traditional’ channels still remain dominant, especially for older shoppers.

- Over 35s have a clear preference for both physical and online retail. Nearly half of 35 and overs put going to physical shops/retailers (50%) and looking at retailer websites apps (45%) in their top three most useful ways to search.

- Even for under 35s, traditional retail is still important. Over 1 in 3 put these options in their top three (36% and 35% respectively).

- Younger shoppers are also increasingly turning to social media, with one in four (27%) shoppers under 35 putting social media in their top three options for searching out ideas for Christmas gifting.

Understanding new purchase journeys

This is clearly just the start of shifts in the way that shoppers are discovering and searching for gifts. The everyday usage of AI is continuing to rise. According to Ipsos iris, our passive online measurement solution, 21 million people in the UK used LLM AI platforms in September 2025 - up 78% from the same time last year. While 15-24s are still the biggest users of ChatGPT, reach has at least doubled among all older age groups over the last year.

Interesting, older shoppers who have less familiarity with AI options are not seeing their value in the same way (with only 4% of 35 and overs putting AI their top 3 most useful options for gifting compared to 20% of under 35s). This may change in 2026, though. We expect the market to continue to shift, and consumers behaviours with it.

It is also worth noting that while the number of people using AI to help make purchase decisions may be growing, this is still part of a broader purchase journey. AI summaries and LLMs aren’t operating in a vacuum so it’s important to understand where they sit and the role they play alongside ‘traditional’ channels.

For example, data from Ipsos iris shows that just 8% of visits to the ChatGPT website are followed by a visit to a retail site. In fact, the biggest share of people go on to search engines, showing how LLM AIs are often one stop on a longer journey. So it’s not necessarily the case that people are shifting from search engines to AI - there is interplay between them (and other touchpoints).

These complexities present both threats and opportunities. How, when and why people are making the most of new search options is shifting constantly. Brands need solid insight to keep up – from passive monitoring of complex journeys (like Ipsos iris), tools to dig into Generative Engine Optimisation such as Synthesio GEO, to in depth understanding from more traditional methodologies like ethnography.

To find out more about how Ipsos can help with strategies for the evolving search landscape contact Tim Bond below.

Commenting on the findings, Tim Bond at Ipsos in the UK said:

Our latest data underscores a seismic shift in the shopping landscape, as AI has fast become a trusted companion in the hunt for the perfect holiday gift. With 23% of Brits under 35 using AI for gift inspiration, compared to just 5% of older consumers - the generational digital divide is unmistakable. The fact that 78% of AI users say that they trust the recommendations they make also highlights its burgeoning role as a reliable ally in the consumer decision-making process.

However, this evolution is undeniably just the start of a larger trend. As AI usage continues to grow, marketers will need to get ahead of the curve by paying attention to the nuances in how these digital tools are impacting the path to purchase across categories. With everyday use continuing to rise, 2026 may well herald the year AI becomes an intrinsic part of customers' everyday shopping journey.

Technical note:

- Source: Ipsos interviewed a nationally representative quota sample of 1,098 adults aged 18-75 in Great Britain using its online i:omnibus between 28th November - 1st December 2025. The sample achieved is representative of the population with interlocking quotas on age within gender, and quotas on region and working status. Data has been weighted to the known offline population proportions for interlocking cells of gender within age, working status, and region, age within region, as well as social grade and education.

- *A nationally representative 15+ passively collected panel, Ipsos iris measures over 7,000 website and 1,500 apps daily to create a synthetic data set of 2m devices, providing detailed demographic, geographic, and attitudinal audiences. For more information visit https://iris.ipsos.com

- All polls are subject to a wide range of potential sources of error.