Who is stepping up in the 'retirement revolution'?

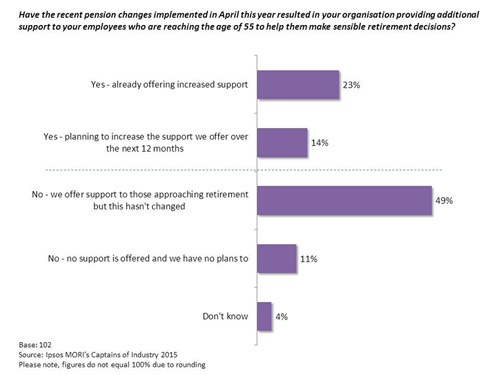

More than a third of the UK’s largest businesses have started or plan to offer additional support to those reaching the age of 55 as a direct result of the new pension freedoms, according to findings of the latest Ipsos Captains of Industry1 survey. This is in addition to around half who say they are already providing support for their employees approaching retirement.

More than a third of the UK’s largest businesses have started or plan to offer additional support to those reaching the age of 55 as a direct result of the new pension freedoms, according to findings of the latest Ipsos Captains of Industry1 survey. This is in addition to around half who say they are already providing support for their employees approaching retirement.

(Click or Tap to Enlarge)

(Click or Tap to Enlarge)

This should be welcome news to those concerned that many consumers approaching retirement, since the new freedoms were introduced in April 2015, are drawing down and spending the cash from their pension funds.

Retirement is not a one off event but a journey that can span many years and demand many stages of review and decision making, particularly considering that life expectancy is continuing to rise. These decisions are not simple to make and affect everyone. Pensions are now a ‘mass-market’ product and even the most disengaged working consumer will have one through auto-enrolment. In the words of Baroness Ros Altmann, Minister of State for Pensions, we are in a ‘retirement revolution’2.

Auto-enrolment is forcing employers to provide pension provision for their staff, while the new pension freedoms mean that individuals have more choices to consider before and throughout retirement. In this new retirement landscape, the pensions and long-term savings industry, employers and the Government, all have a role to play.

This is particularly the case as we know individuals themselves are still not doing enough. A report recently published by Skipton Building Society3, based on Ipsos research, states that only 26% of those pre-retires aged 18-34 surveyed say they are actively preparing for retirement. This rises to just 34% of people aged 35-54. This level of engagement will not change overnight. The recent changes introduced by the Government will need to be accompanied with the relevant support from both the retirement industry and employers more generally in order to ‘nudge’ people in a more active direction.

Employers

Employers have an important role in engaging their workforce in retirement planning and promoting access to support and guidance. This should be provided throughout their employment, but with the new pension freedoms, provision actually at retirement is paramount and employers are well positioned to deliver this.

We have already noted that a majority of Britain’s leading businesses are already offering, or plan to offer, additional support to employees approaching retirement. While half say this has been the case since before the new pensions freedoms, a third say the recent changes have directly affected their decision to provide additional support for those reaching 55.

Among those who have already or plan to increase the support offered, it is encouraging that 38% say this involves access to, and in some case direct encouragement to take independent financial advice. However, one in ten (11%) of these major UK employers offer no support and have no plans to do so. While this is worrying in itself – given the number of people employed by larger businesses – it is even more concerning as it is likely to be higher among UK employers as a whole.

The Industry

Since the Retail Distribution Review (RDR) came into effect in January 2013, investment / pension advisers have had to move from receiving commission to fee-based remuneration, so access to tailored advice is no longer affordable for many consumers. In addition, advisers have been forced to consider whether it is financially viable for them to service low value clients - typically those with under £50k, the size of the vast majority of pension funds. That’s not forgetting that there are many people who would not consider or know how to access good quality financial advice. So what is being done to help consumers make good retirement decisions?

Along with the new pensions freedoms introduced in April 2015, the Government launched Pension Wise to provide those people at retirement (from age 55) with free and impartial guidance. While this is far from the tailored advice that would be provided by financial advisers, it is designed to help people understand their options so they are better informed to make decisions themselves.

Customer satisfaction with Pension Wise appears, so far, to be high4, but not enough people know about it. The industry could be doing more to promote this service and encouraging people to use it. It is possible for product providers to promote the service over and above their own helpdesks. This means that consumers would be able to fully evaluate their choices (which may include leaving their pension where it is) and not simply led to believe that taking a product with their existing provider is the best option for them. If providers are promoting a totally independent service, there may be potential for a competitive differentiation here too. Would consumers trust these providers more?

Some have argued that this service is mainly needed at retirement age. But surely it would help if everyone had access to, and was encouraged to use, a free service to help them understand how to manage their retirement planning effectively from an earlier point?

What is clear is that the industry, including providers, should be working together with employers to support consumers throughout their ‘retirement journey’. This support needs to focus on empowering them at the point of auto-enrolment to take responsibility for their retirement saving, as well as encouragement to access impartial guidance via Pension Wise, at the very minimum, when they approach retirement . This will help consumers to become informed and aware individuals, so they continue to make good decisions throughout retirement.

Notes 1 Ipsos conducted 102 interviews with respondents (Chairmen, CEOs, MDs/COOs, Financial Directors and other executive board members) from the top 500 companies by turnover and top 100 by capital employed in the UK. Interviews were carried out face-to- face (and five were carried out by telephone) between 7th September and 9th December 2015. 2 Ros Altmann, in an article for the Daily Telegraph, December 2015 3 The Skipton Building Society Retirement Index, November 2015 http://www.skipton.co.uk/retirement-index 4 Ros Altmann, speaking at the Marketforce Retirement Solutions Forum, November 2015