Adding AI to ads, search and social media drastically lowers Americans’ trust

Here’s what we know today from the Ipsos Consumer Tracker:

- We hit a new milestone. Since May 2020, we’ve been asking people to rate how much COVID is impacting their lives on a five-point scale, with 1 being “not a problem at all.” The mean has still refused to drop below 2.1. In the beginning, about 10% rated it a 1. In June 2021, that started to stay in the 20% range. We crested 30% in July 2022. And now, in wave 69 of the consumer tracker, we have crested 40% of Americans saying that COVID restrictions don’t pose a problem. When will we hit a majority?

- We hit another new milestone. For the first time in the history of the IPAC, Ipsos’ measure of how consumers are dealing with the pandemic, 70% of Americans are improving. We’ve come close to that a couple of times, back in summer of 2021 and again last December, but we have never hit the full 70/30 split (the other bucket is coping, our category for those on the bottom side of the spectrum).

- On inflation: When asked about expense changes in the past three months, about one in three feel that gas and grocery expenses are rising, but few are increasing the amount of money they spend on optional and discretionary goods, eating out, getting food delivered, etc. (See more below findings on inflation below.)

Read on for data about: AI, The Super Bowl, inflation, trust and more

We’re having trust issues

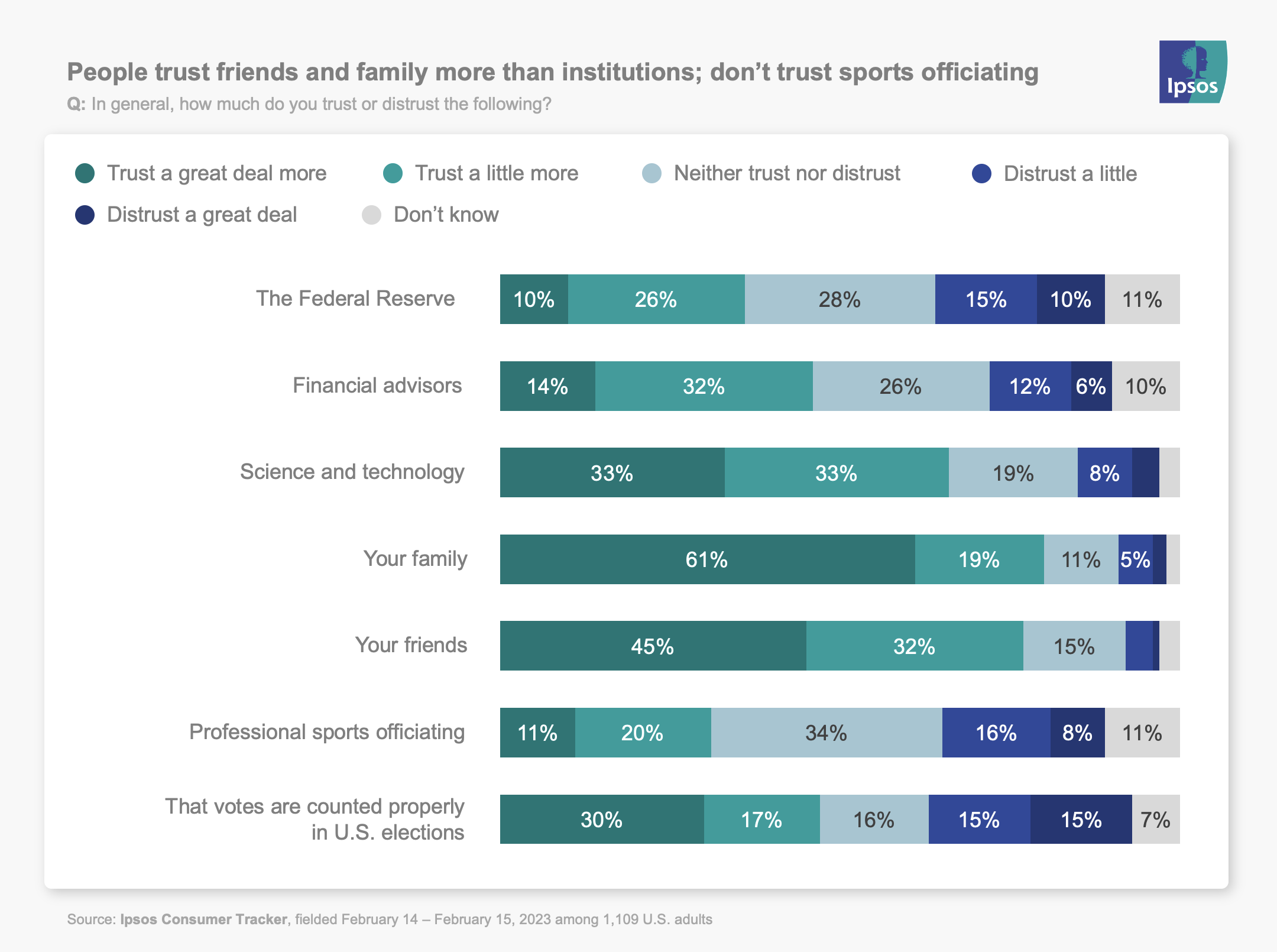

Why we asked: In full transparency, this question was spurred by a colleague who said that her town was in an uproar about a bad NFL call that had them questioning if the sport was rigged. And this was BEFORE that call. With all the money floating around in gambling, we were curious if that’s impacting trust. But also, with all the discussion of rigged elections, and rigged this, and rigged that, we were also curious if it was spilling over into other things.

What we found: We asked about a smattering of things. Some were about institutions and systems. Some were more personal. And yes, we asked about sports officiating. Overall, most people trust friends (77%), family (80%) and science (66%). Fewer trust financial advisors (46% trust) and elections being fairly counted (47%). We don’t really trust the Federal Reserve. And we REALLY don’t trust referees and umpires (31% trust).

And I know you’re wondering, because I was, what the party splits were like. Here’s where it gets interesting. Trust is basically even across party lines – except for the election question, financial institutions and science. For instance, 47% of Democrats trust the Federal Reserve but only 26% of Republicans do. Trust in election results is even more pronounced – 70% of Democrats say they trust elections, compared to only 27% of Republicans.

We’re having trust issues, part II

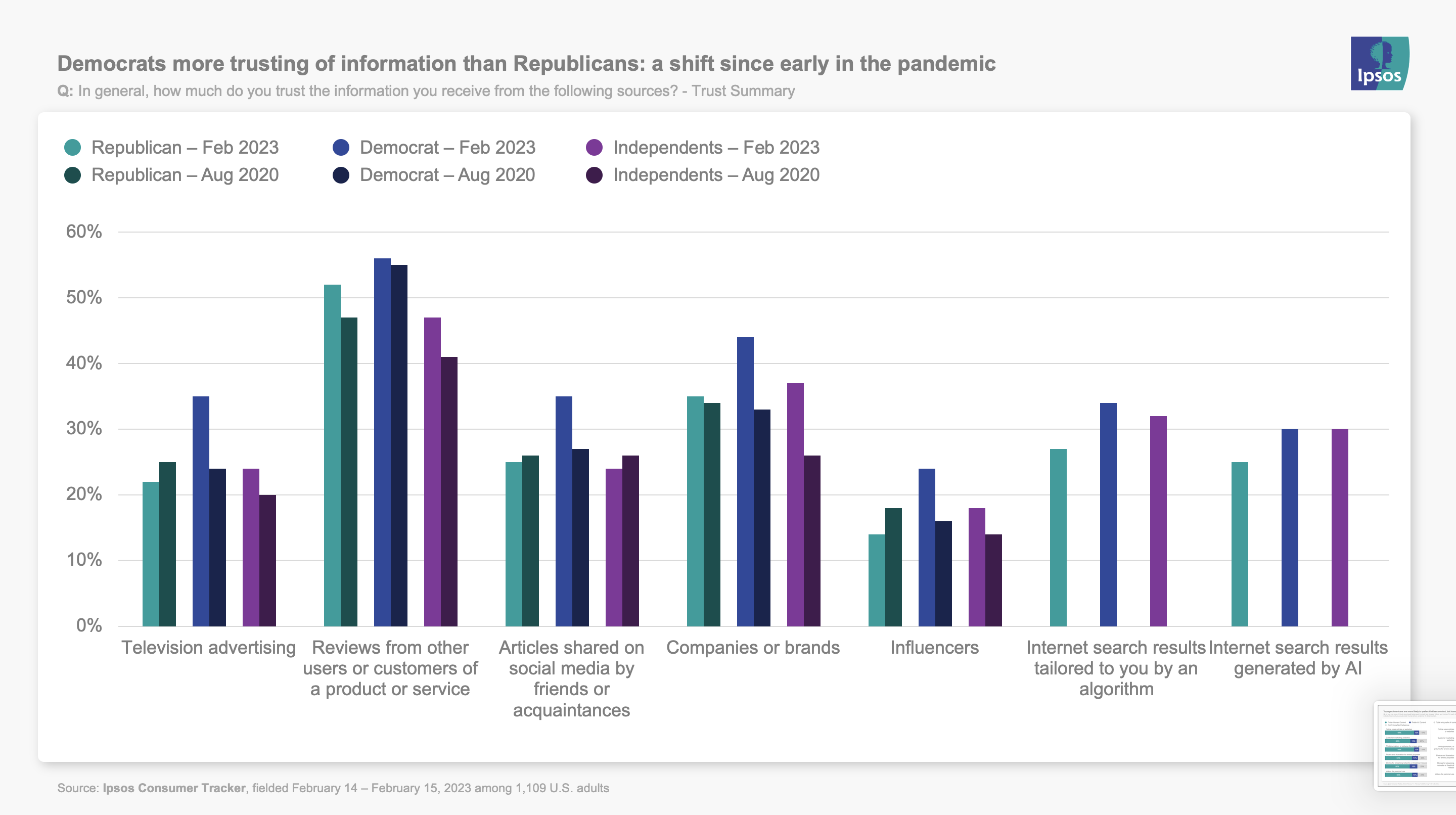

Why we asked: OK, so what about sources of information? What sources do we trust, especially when it comes to brands and products? Are there party splits here, too?

What we found: We are much less trusting of information sources than institutions in the previous question. Reviews from other users are the only thing in our battery that most people trusted. And barely that. Few trust information they get from brands or companies (39%), television advertising (29%), articles shared on social media (29%) or internet search results —whether generated by an AI (27%) or a traditional algorithm (32%). Party-wise, Democrats seem mildly more trusting of most sources of information except those higher-ranking customer reviews which both parties seem to trust equally. What’s especially interesting is that we asked this question as far back as wave 10 of this tracker, and Democrats have become more trusting while Republicans have stayed about the same. All of which leads the question for another wave: If we don’t trust any of these sources, where on earth are we getting information we DO trust? Stay tuned.

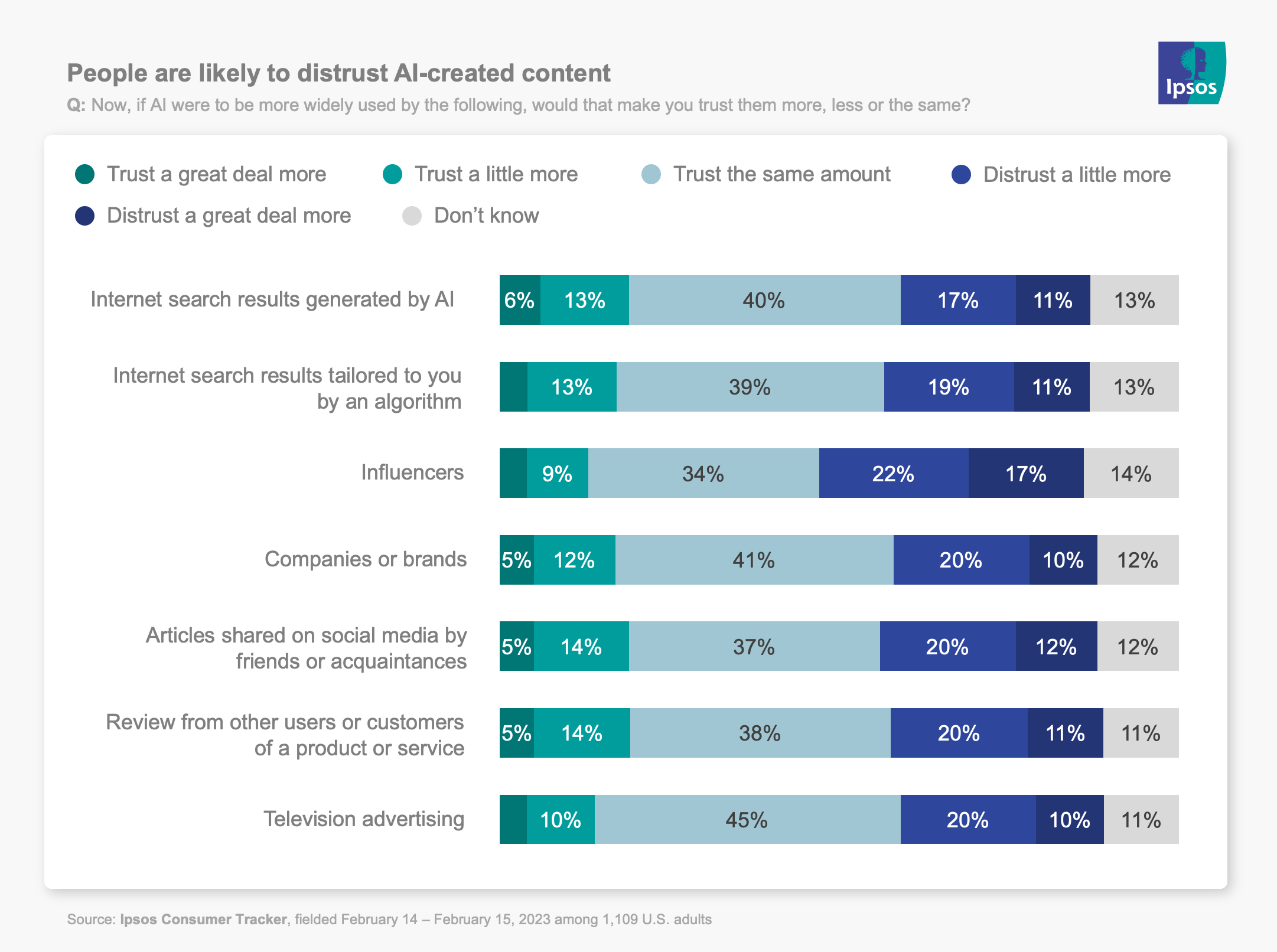

Would AI make us trust more?

Why we asked: We’ve now seen commercials and animations and text and videos and Ipsos surveys generated by AI. Will that help with trust?

What we found: We asked about trusting the same sources as above, but “if AI were used more widely by the following…” and yeah, no. Distrust outranked trust across the board. Often by two to one. Especially for influencers. Which might be a good thing to watch out for if that’s your bag. If your audiences catches on that you’re using AI to create your content, they are three times as likely to say they would lose trust rather than gain. All that said, a plurality in almost all cases would trust the same amount.

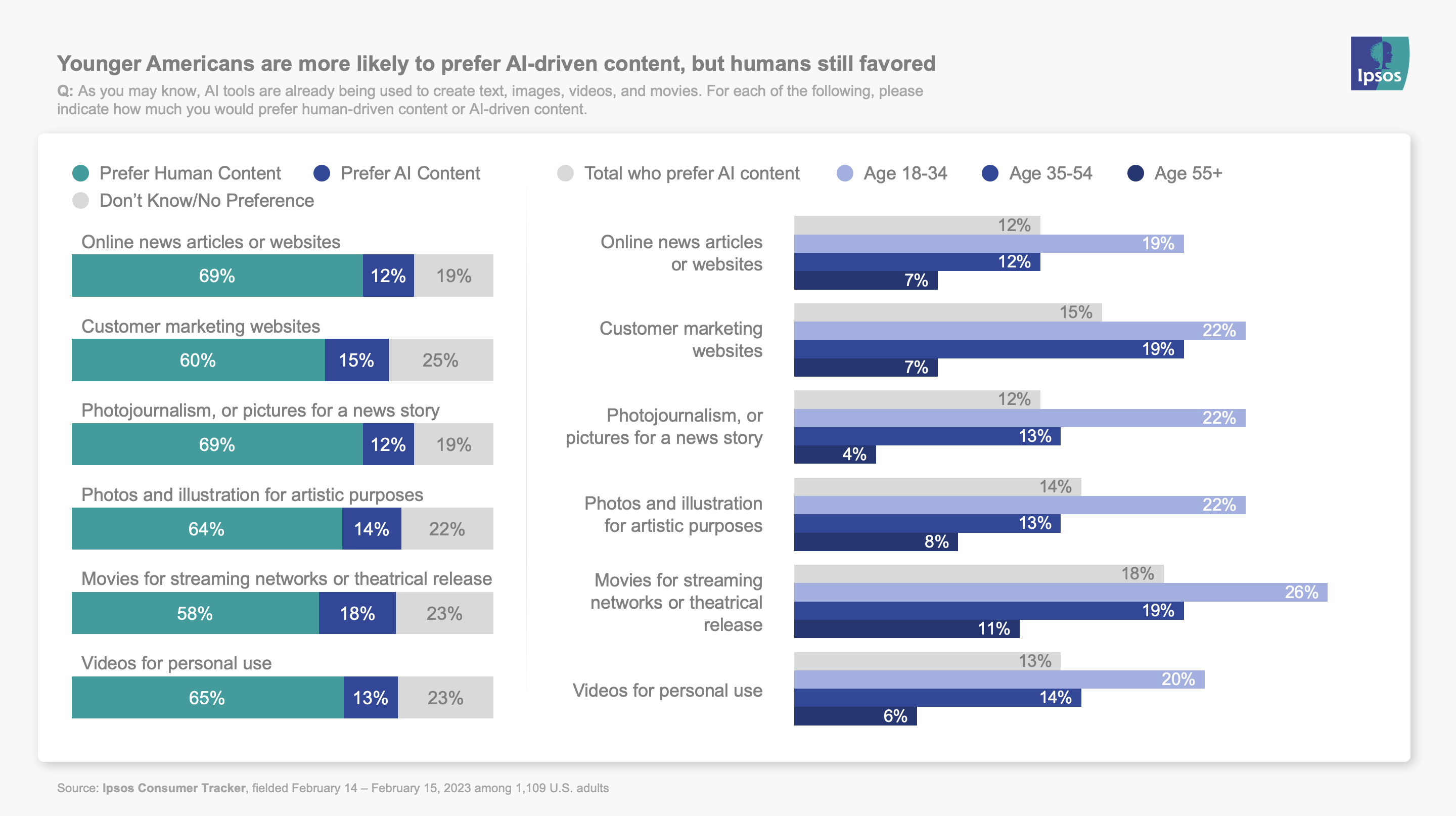

Would we rather have AI or humans making content?

Why we asked: Again, generative AI is already making all kinds of content, from images to stories on Buzzfeed. Would we rather have humans make it?

What we found: Yup. Sure would. High levels of people would rather see humans making everything from news stories to marketing web sites. Very few – but not zero – would prefer AI content. Those that do are much more likely to be younger. Which brings us to a point we will keep making: All of these AI numbers are going to change. One way or another. So we’ll come back to them and check in.

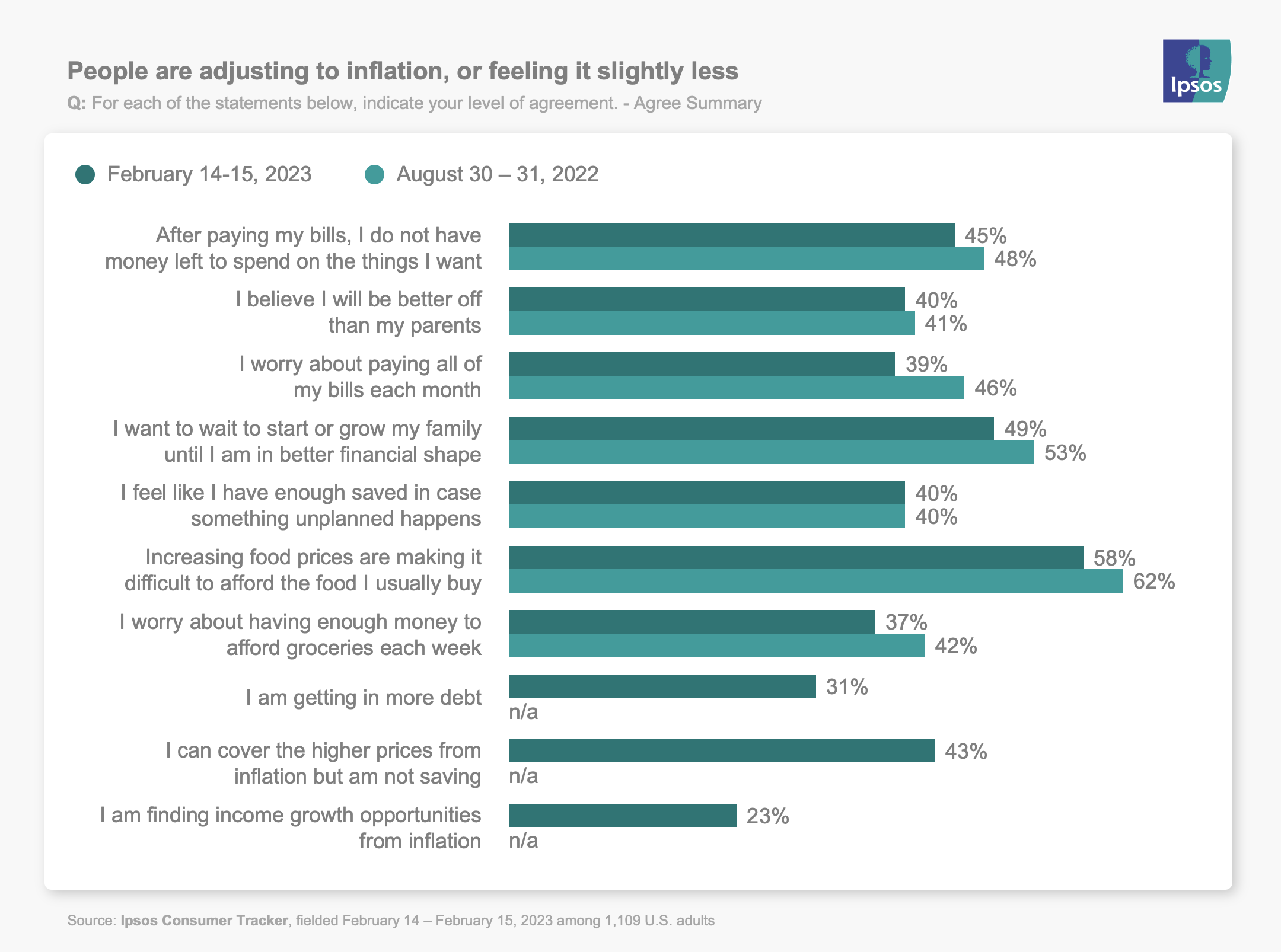

We’re still feeling inflation, but less than we were recently

Why we asked: Inflation is waning a bit and signs seem to be pointing to the U.S. dodging a full-on recession. Maybe? Are consumers feeling better?

What we found: A sizeable number of Americans do not have money left over after paying bills (45%), worry about paying bills each month (39%), and most (58%) still find it difficult to afford groceries due to increasing food prices. Almost half of Americans 18 to 39 said they want to wait to start or grow their family until they are in better financial shape. A minority of all American adults (23%) report finding income growth opportunities from inflation, such as adjusting their portfolios to invest differently or saving more.

Here's the positive news: These numbers are generally better than when we last asked this in August 2022, though not as good as when we asked two years ago, in February 2021.

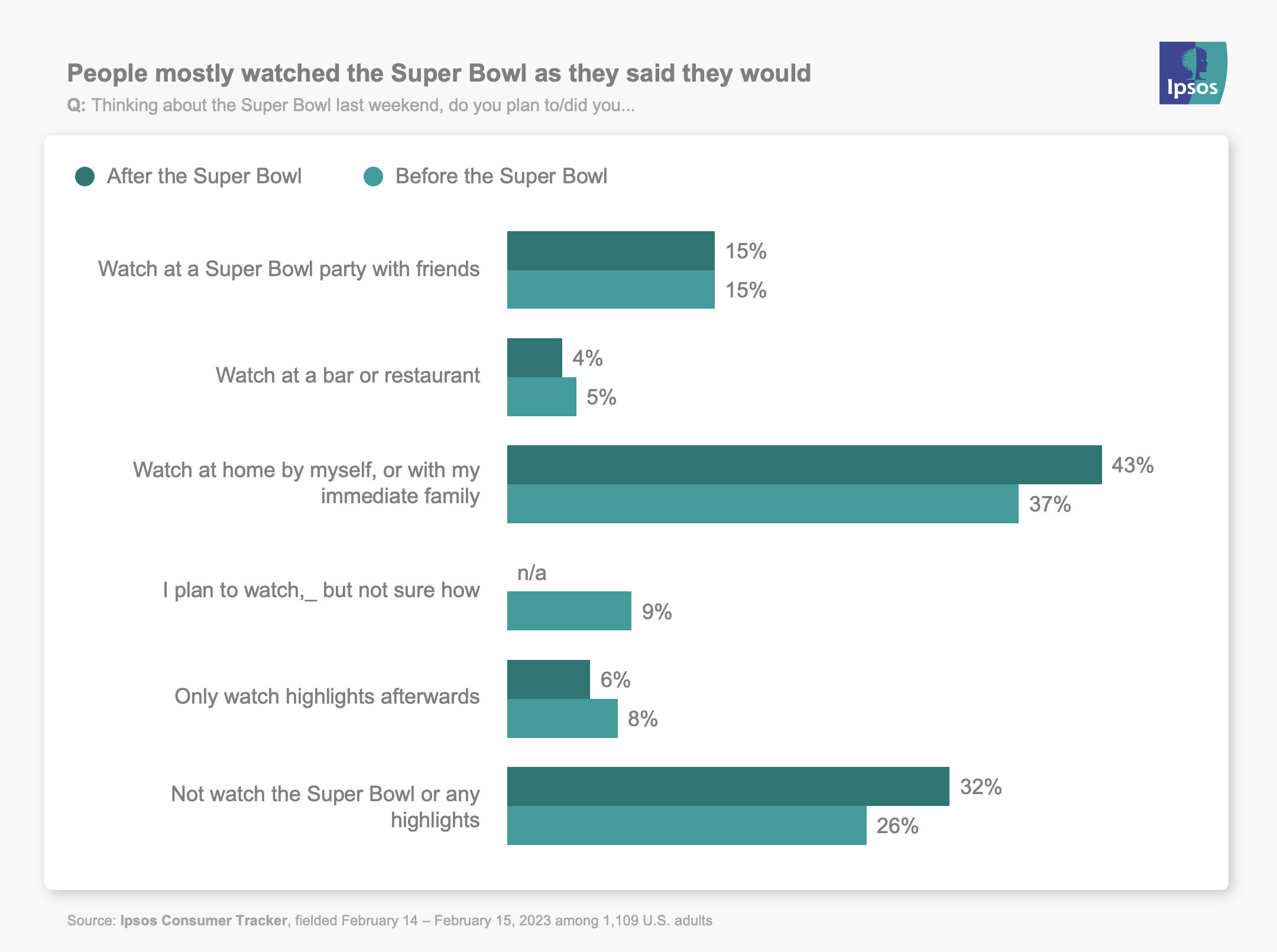

The Super Bowl happened. Did we do what we said we would?

Why we asked: We asked people before the Super Bowl if and how they would watch. Then we asked if and how they actually did.

What we found: People mostly say they did what they said they would. Now, we didn’t ask the exact same group of people, making the study longitudinal, but the numbers line up pretty well. Basically, the group that didn’t have a plan to watch split pretty evenly between watching themselves and not watching. Which sounds a lot like the research we’ve seen on "get out the vote” efforts: Get people to make a plan and they’re more likely to stick to it.

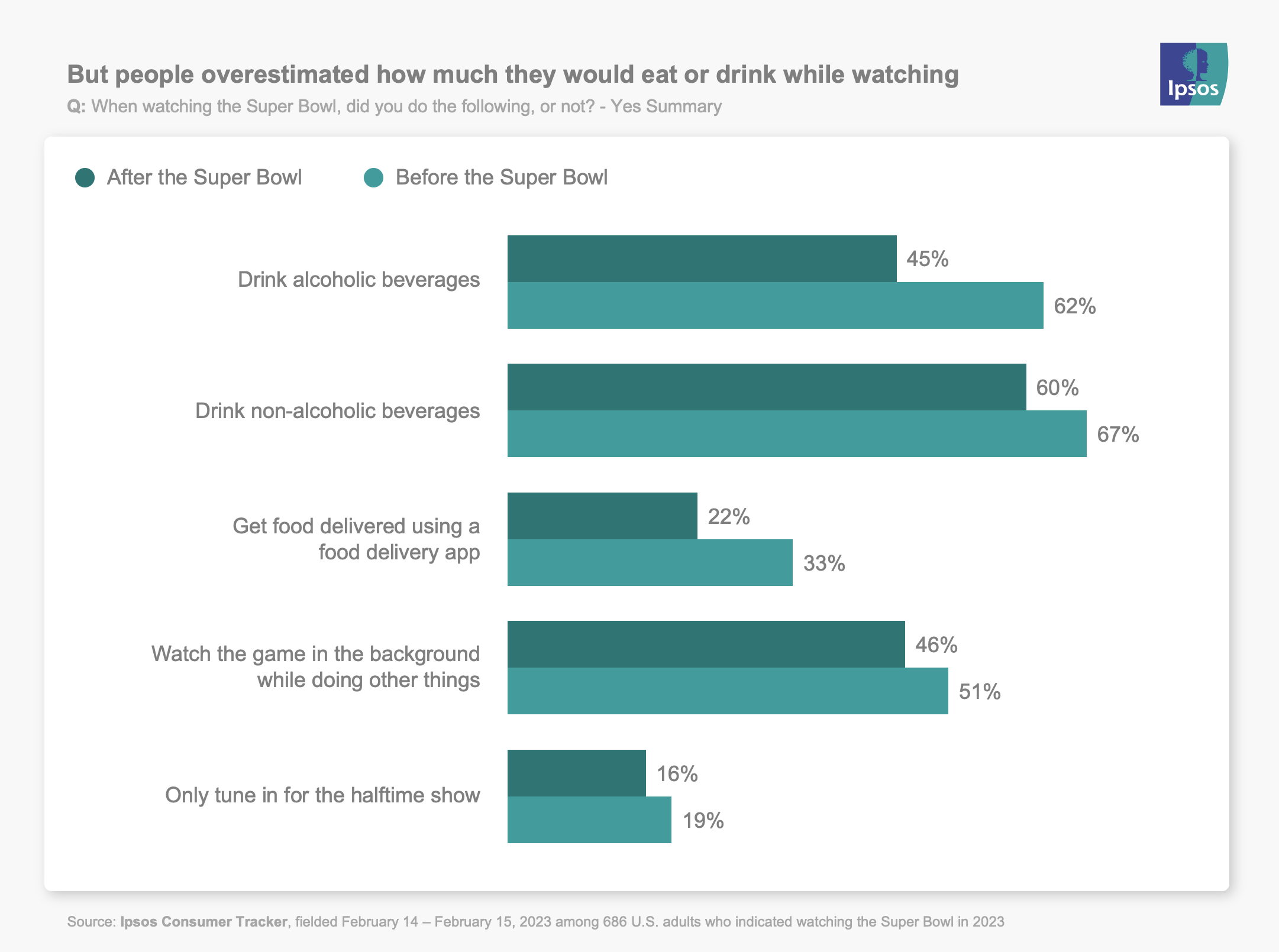

The Super Bowl happened. Did we do what we said we would?

Why we asked: We also asked what people would do when they watched. Did these do those things?

What we found: Interestingly, here we see a bit of a say-do gap. People said they would eat and drink at much higher rates than they report doing (again, not longitudinal but these are the same people who answered the previous question the same in regards to viewing patterns.) Those who were pretty noncommittal in the first place (would watch in the background or only the halftime show) were the most consistent about not really being “tuned in” in the post-mortem.

Signals

Here’s what we’re reading this week that has us thinking about the future.

- Hermes wins an IP suit vs MetaBirkin. (via Reuters)

- “Deinfluencers” are a (confounding) thing (via Insider)

- Netflix made an anime with AI and fans are not happy (via Vice)

- Logan Lane and the smartphone liberation movement. (via NYT)

For complete toplines for all waves, please see the full data and methodology.