Four in five Americans believe sporting events are too expensive

Washington, DC, May 1, 2024 – A new Ipsos poll finds that four in five Americans, including 88% of the public that considers themselves to be sports fans, believe that sporting events are too expensive for the average person to attend. In the same vein, a majority also agrees that there are too many separate platforms needed to watch sports and support a law that would limit the amount of taxpayer funds that can be used for both new stadiums and stadium renovations. However, also under the umbrella of monetization in sports, most Americans continue to support college athletes making money off of their name, image, and likeness (NIL).

The poll also finds that Americans are split on whether athletes should remain neutral on social and political issues. However, one area where Americans do agree is that if an athlete does take a public stand on an issue, they should stick by that stand, even if it makes some people upset.

In addition to these topics, this poll also explores sports betting, drug testing, the Olympics, and children’s tackle football. Compared to our inaugural sports poll in 2023, the number of Americans who report betting on sports remains low, interest in women’s sports is on the rise, and the top sports played remain relatively unchanged.

Detailed Findings

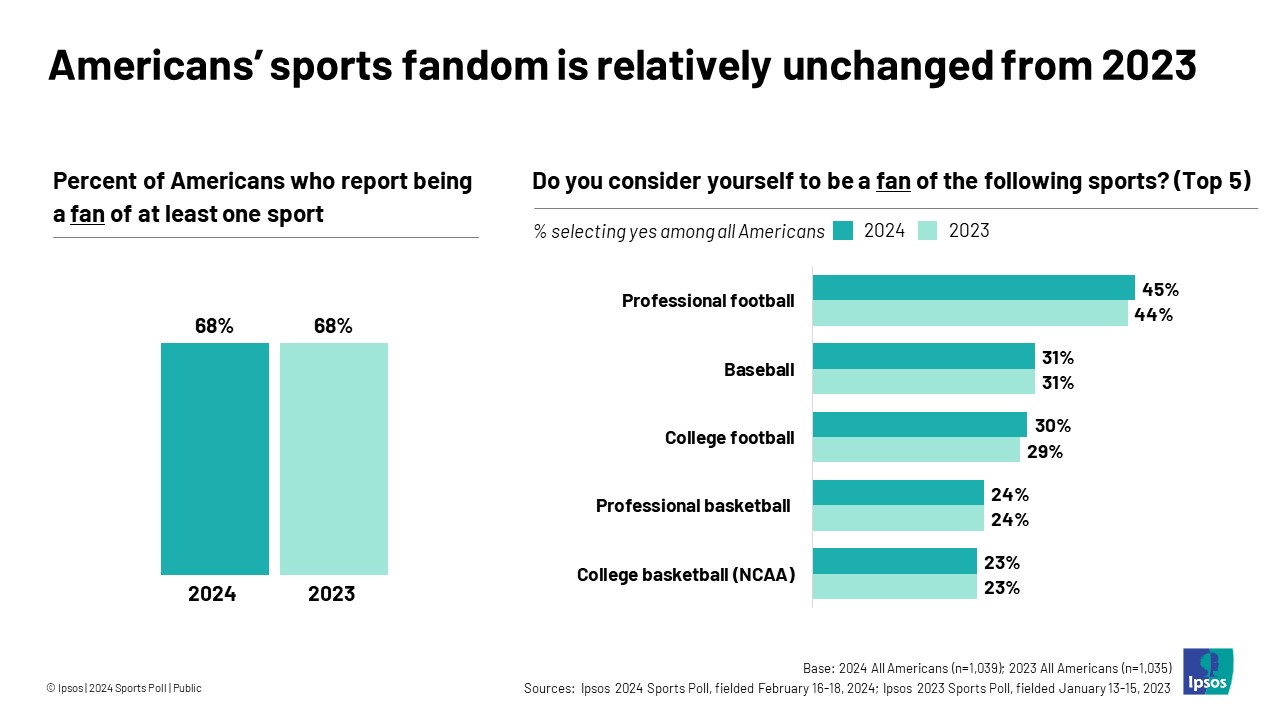

1. Most Americans are self-reported fans of at least one sport. About half of Americans report playing a sport at any time during 2023.

- Sixty-eight percent of Americans say they are fans of at least one sport, unchanged from 2023. A plurality of Americans say they are fans of professional football, followed by baseball, college football, professional basketball, and college basketball.

- Unchanged from 2022, about half (48%) of Americans say they played a sport in 2023. Swimming, cornhole, and bowling are the top three sports Americans report playing in 2023.

2. The NFL is the most popular sport watched by Americans in the past year.

- More than half (56%) of Americans say they have watched an entire NFL game in the past year. Among sports fans, this share jumps to 76%.

- The second tier of sports watched among Americans and sports fans, respectively. includes college football (36% and 49%), the MLB (33% and 46%), the NBA (28% and 39%), and college basketball (26% and 37%).

- Along these lines, around half of both Americans (49%) and sports fans (54%) say they want to see more coverage of women’s sports, both up seven percentage points from a year ago. Compared to just 43% of men, 55% of women agree they would like to see more coverage of women’s sports.

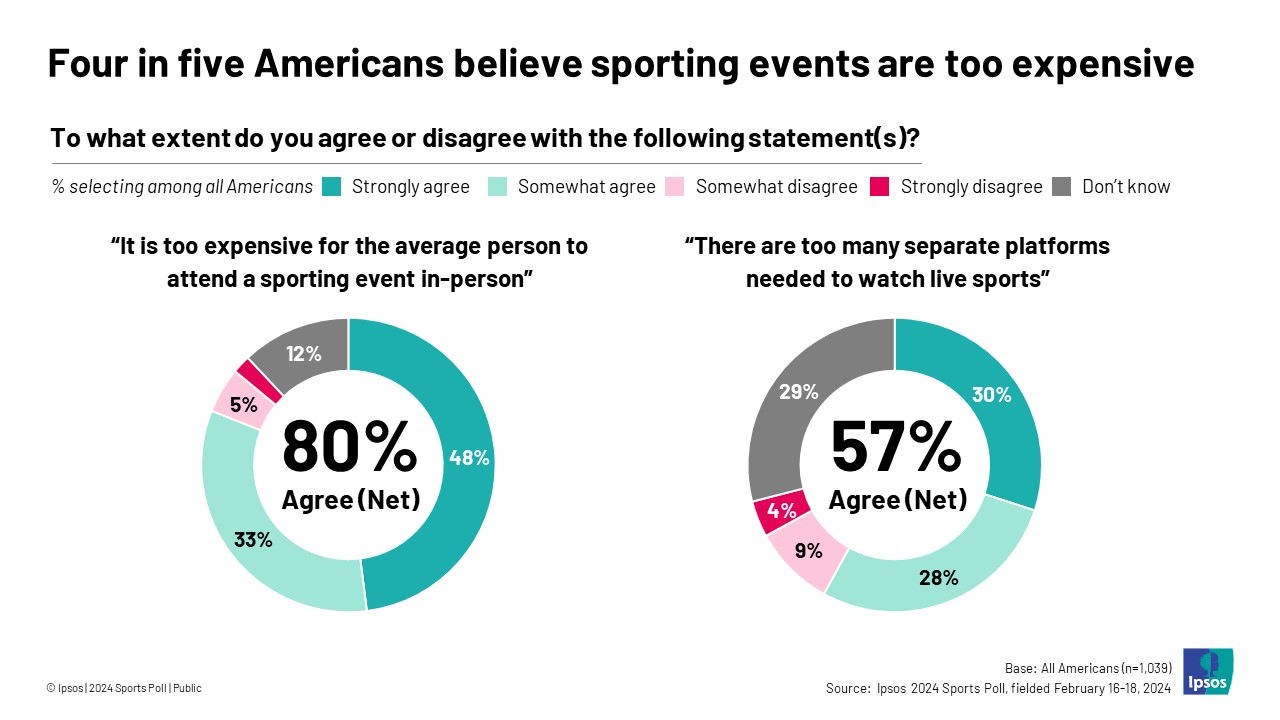

3. A majority of Americans believe that sporting events are too expensive for the average person to attend, and that too many platforms are needed to watch sports.

- Eighty percent of Americans and 88% of self-described sports fans believe that sporting events are too expensive for the average person to attend in-person. A majority across all demographics share this sentiment.

- Fifty-seven percent of Americans and 67% percent of sports fans also agree that there are too many separate platforms needed to watch sports.

- Along these lines, while few Americans are familiar with ESPN, Fox, and Warner Bros. announcing plans to launch a joint sports streaming platform (14%), a plurality say they support a sports streaming package that bundles multiple platforms (44%). A slim majority of fans support this idea (53%).

- Around half of Americans and sports fans alike say they are tired of seeing celebrities shown on screen during sports broadcasts (47% and 52%, respectively). A similar percentage say the same of broadcasts showing Taylor Swift (45% and 47%, respectively).

- Americans under age 35 (35%) are less likely than their older counterparts to feel tired of seeing celebrities shown on screen.

- While both Americans and fans have issues with the sports world, the length of seasons is not a major problem for the public. Just one in five (20%) agree that it is getting harder to keep interest in sports because seasons are too long.

4. As in 2023, the majority of Americans say they support allowing college athletes seeking name, image, and likeness (NIL) deals. Further, most Americans believe that allowing college athletes to earn money using their NIL has a positive impact on college athletics.

- Fifty-six percent of Americans say they support allowing college athletes to be paid money for sports-related business ventures using their NIL. A similar share, 54%, said the same in 2023.

- Similar to 2023 (57%), three in five (61%) Americans now say that allowing college athletes to make money off their NIL has a positive impact on college athletics by ensuring platers are fairly compensated. Just 35% say it is bad for college athletics because it gives certain schools a competitive advantage.

5. Two-thirds of Americans (67%) support a law in their state that limits the amount of taxpayer funds sports teams can use for new stadiums or stadium renovations.

- Nearly three in four sports fans (72%) also support this proposed law.

- Of note, there are no significant differences by partisanship.

- In the same vein, 42% of Americans support requiring newly built stadiums to include roofing. Those living in the South (46%) are more likely than those in the Midwest (36%) to share this sentiment.

6. Americans are split on if athletes should remain neutral on social and political issues. However, a majority says they should stick by their stance on an issue, even if it makes some fans angry.

- About one-third (36%) of Americans agree that athletes should remain neutral on social issues, compared to 45% that disagree. A similar percentage say the same of political issues (39% agree, 42% disagree).

- Americans ages 55+ are more likely to say athletes should be neutral on political (47%) and social (43%) issues than those ages 18-34 (29% each) and 35-54 (37% and 34%, respectively).

- Additionally, Republicans are significantly more likely than Democrats and independents to agree that athletes should remain neutral on these issues.

- While Americans are split about whether athletes should take public stances on issues, 61% agrees that if they do take a stand, they should stick by it even if it makes some fans angry. Democrats are more likely to agree than Republicans and independents.

7. Behaviors and sentiment around sports betting are stable compared to a year ago. However, a sizeable portion of Americans and fans say that it lessens their enjoyment of sports.

- Seven percent of Americans report placing an official bet on a live sporting event online, and just 3% say they placed a bet in person. Both numbers are in line with last year.

- Two in five Americans (41%) and 46% of sports fans believe that sports betting lessens the integrity of the game. Similar to last year, Americans ages 55+ are more likely than their younger counterparts to share this sentiment (53% vs. 32% under age 35 and 36% ages 35-54).

- Three in five Americans (61%) and fans (64%) agree that people should be able to gamble on sports and spend their money how they want.

- However, 43% of both Americans and fans also agree that the amount of advertisements for sports betting lessens their enjoyment of sports. Of note, white (47%) and Hispanic (38%) Americans are more likely than Black Americans (25%) to agree.

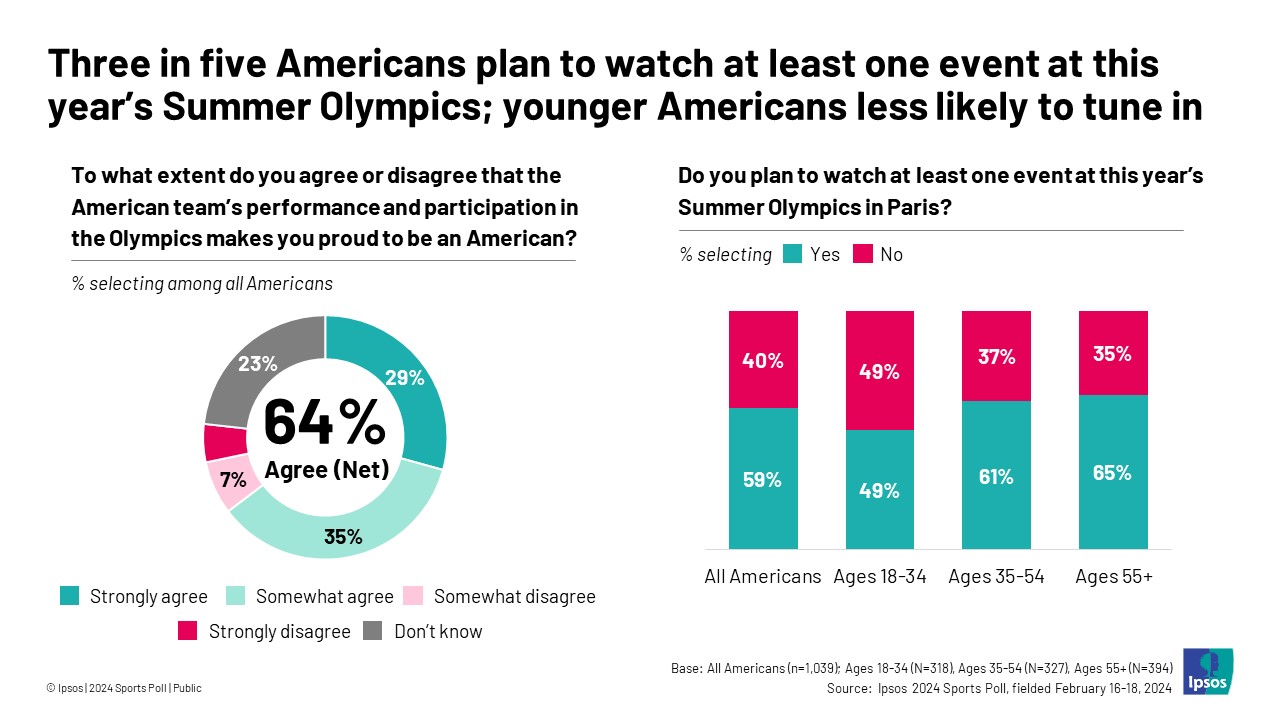

8. Younger Americans are less likely to watch the Olympics and take pride in the United States’ performance.

- Three in five Americans plan to watch at least one event at this year’s Summer Olympics in Paris, including 71% of sports fans.

- Gymnastics (44%) is the Olympic sport that Americans are most planning to watch, followed by swimming (35%) and track and field (31%).

- Notable differences exist by age. Americans ages 18-34 (49%) are more likely to say they do not plan to watch the Olympics than those ages 35-54 (37%) and 55+ (35%).

- Similarly, those ages 18-34 (49%) are less likely than those ages 35-54 (62%) and 55+ (78%) to agree that the U.S. team’s performance and participation in the Olympics makes them proud to be an American.

About the Study

This poll was conducted February 16-18, 2024, by Ipsos using the probability-based KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,039 general population adults age 18 or older. The sample includes 701 sports fans.

The margin of sampling error is plus or minus 3.2 percentage points for at the 95% confidence level, for results based on the entire sample of adults. The margin of sampling error takes into account the design effect, which was 1.09 for all respondents. For sports fans, the margin of sampling error is plus or minus 3.8 percentage points at the 95% confidence level, and the design effect was 1.08. The margin of sampling error is higher and varies for results based on other sub-samples. In our reporting of the findings, percentage points are rounded off to the nearest whole number. As a result, percentages in a given table column may total slightly higher or lower than 100%. In questions that permit multiple responses, columns may total substantially more than 100%, depending on the number of different responses offered by each respondent.

The survey was conducted using KnowledgePanel, the largest and most well-established online probability-based panel that is representative of the adult U.S. population. Our recruitment process employs a scientifically developed addressed-based sampling methodology using the latest Delivery Sequence File of the USPS – a database with full coverage of all delivery points in the U.S. Households invited to join the panel are randomly selected from all available households in the U.S. Persons in the sampled households are invited to join and participate in the panel. Those selected who do not already have internet access are provided a tablet and internet connection at no cost to the panel member. Those who join the panel and who are selected to participate in a survey are sent a unique password-protected log-in used to complete surveys online. As a result of our recruitment and sampling methodologies, samples from KnowledgePanel cover all households regardless of their phone or internet status and findings can be reported with a margin of sampling error and projected to the general population. KnowledgePanel members receive a per survey incentive, usually the equivalent of $1 (though for some it is $2) in points, that can be redeemed for cash or prizes. No prenotification email for this study was sent prior to field. Panelists receive a unique login to the survey and are only able to complete it one time. One reminder email was sent for this study.

The data for the total sample were weighted to adjust for gender by age, race/ethnicity, education, Census region, metropolitan status, and household income. The demographic benchmarks came from the 2023 March Supplement of the Current Population Survey (CPS). The weighting categories were as follows:

- Gender (Male, Female) by Age (18–29, 30–44, 45-59 and 60+)

- Race/Hispanic Ethnicity (White Non-Hispanic, Black Non-Hispanic, Other, Non-Hispanic, Hispanic, 2+ Races, Non-Hispanic)

- Education (Less than High School, High School, Some College, Bachelor or higher)

- Census Region (Northeast, Midwest, South, West)

- Metropolitan status (Metro, non-Metro)

- Household Income (Under $25,000, $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, $100,000-$149,999, $150,000+)

- Party ID (Democrat, Republican, Independent, Something else)

This topline is trended with data from a previous Ipsos poll fielded January 13-15, 2023 using the probability-based KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,035 general population adults age 18 or older. The margin of sampling error is plus or minus 3.2 percentage points for at the 95% confidence level, for results based on the entire sample of adults. The margin of sampling error takes into account the design effect, which was 1.12 for all respondents. More information about this poll can be found here.

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

Our tagline "Game Changers" sums up our ambition to help our 5,000 customers move confidently through a rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com