More Americans are cutting back on streaming and repairs

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: I know we sound like broken records here, but… there’s some uncertainty in the economy. On top of new tariffs being rolled out, and some being rolled back, we currently have a shut-down of the federal government. No biggie. So how are folks feeling? To find out, we dusted off a question we hadn’t asked fully since October 2023.

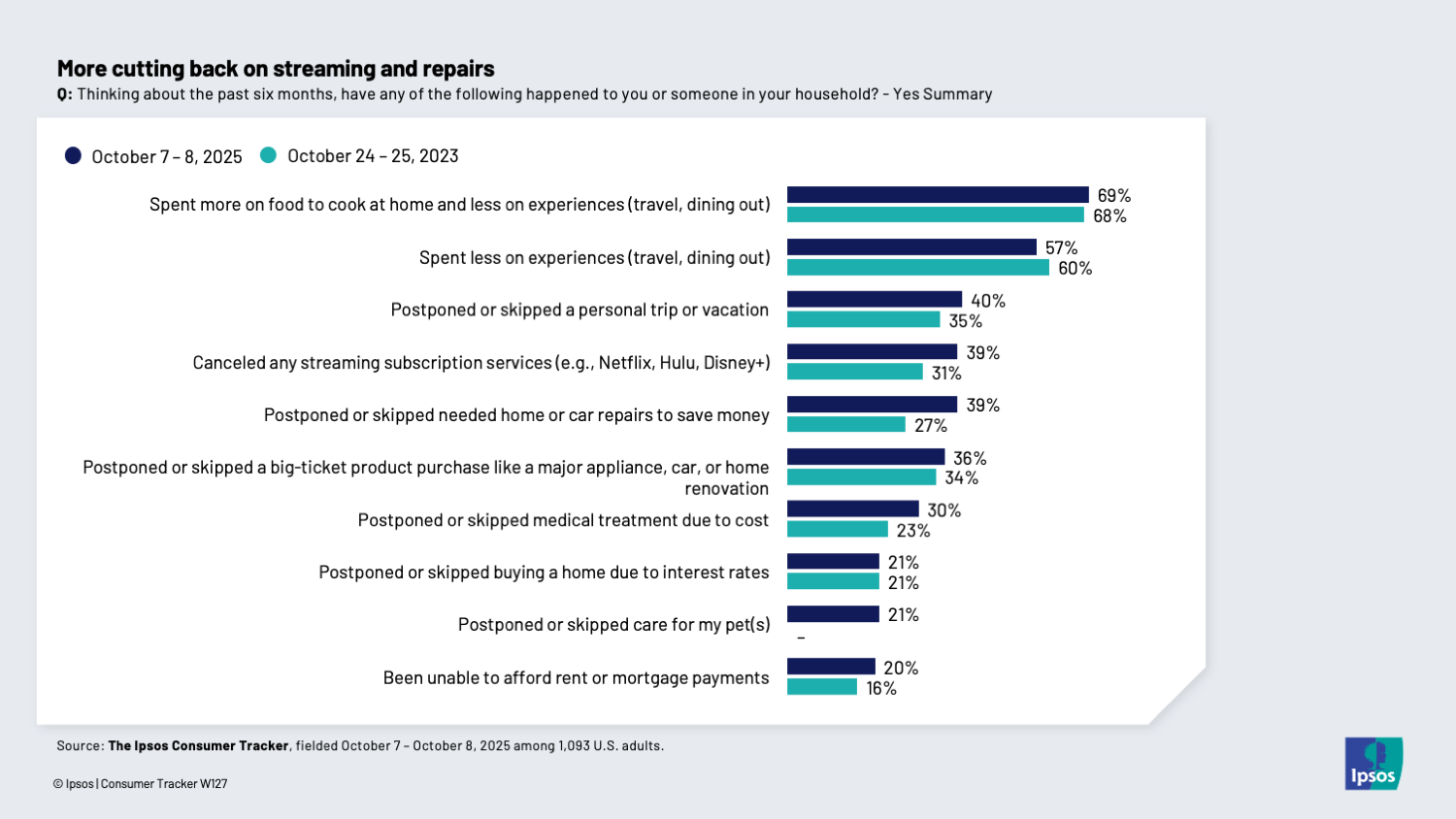

What we found: Just on its own this wave, we see a fair amount of consumers shifting behaviors. Seven in ten are spending more on food at home and less on dining out and travel. Four in ten have put off a vacation, or a big-ticket purchase like an appliance, car or home renovation.

But the growing areas of cutbacks are streaming services (39% have canceled one in the last six months, up from 31% two years ago) and home and car repairs (also 39%, up from 27%).

Three things strike me in this data. One, every income level reports a majority of folks changing at least one behavior – including 60% of the $100K+ households who are making meals in their kitchen more.

Second, lower-income and younger Americans are cutting back at above-average rates – often double or triple the 55+ set.

And third, everyone is cutting back differently. Many of these behavior changes have 20% or 30% of folks saying yes, they’re changing. If you think back to last wave, where we found that half of Americans are spending their entire paychecks, that makes sense. I’ll say it again: For most Americans, the economy is zero-sum. If one part of their budget goes up, something else is getting cut. I don’t think we pay enough attention to that reality as marketers or market researchers.

We write a lot about economic flux. But if anything is certain, it’s that a prolonged shutdown will lead to more uncertainty. Partially because it might impact decisions on rate cuts at the Federal Reserve. Partially because it impacts the availability of government statistics on the economy. As J.P. Morgan’s chief U.S. economist said, “we will be operating a little bit blind.” Partially because depending on the spending plan that does eventually get passed, it could lead to ballooning health care costs for millions of Americans.

The other problem is relates to a phenomenon Ipsos calls the “Perils of Perception” where people make bad decisions based on bad information. In this case, the peril is more acute. Consumer fears of inflation can actually cause inflation.

So until it all shakes out, Americans don’t know what’s going to happen and that could have serious impacts on how they spend and save.

More insights from this wave of the Ipsos Consumer Tracker:

Just one in four plan to spend more money on gifts this holiday season

We are feeling excited, grateful and stressed about the holidays

People trust authenticity and track record for product reviews

The Ipsos Vibe Check: Here's how Americans feel about the government this week

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?