The Role of YouTube Connected TV in Offline Action & Behavior Change

KEY FINDINGS:

Ads on YouTube CTV are relatable, and drive recall, consideration, and action.

- After seeing an ad on YouTube CTV, viewers are 7% more likely to find similar YouTube content relatable.

- Viewers are 5% more likely to recall the advertised topic unaided, and 7% more likely to recall the advertised message unaided, on YouTube CTV compared to linear TV.

- After seeing an ad on YouTube CTV, viewers are 18% more likely to strongly agree that content they’ve seen on YouTube inspires them to learn more.

- After watching ads on YouTube CTV, viewers are likely to take 8% more actions related to the ads.

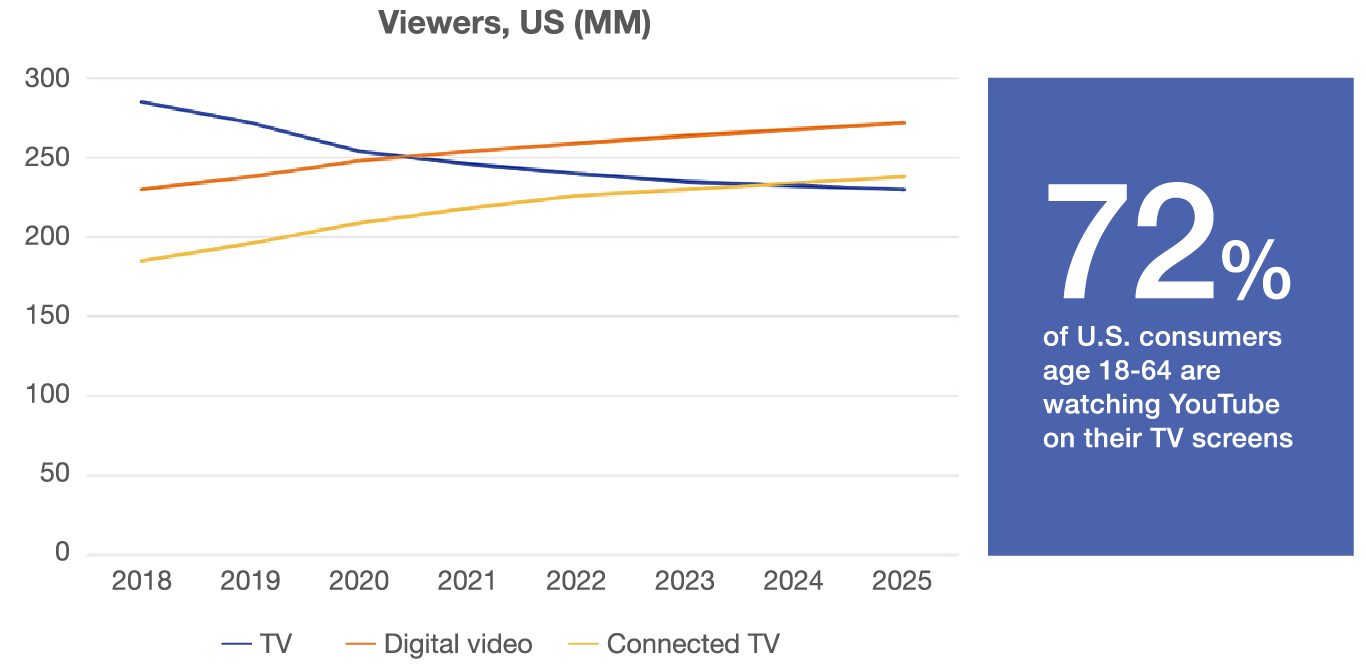

Cord-cutting is on the rise and Americans are moving away from linear TV. In its place, we see the rise of online video, and specifically the rise of connected TV viewing.1 Connected TV (CTV) is any TV set that is connected to the internet, allowing users to stream videos.

In a study conducted by Ipsos for Google in June-September 2022, Ipsos found that YouTube is a leader in the CTV landscape. 72% of U.S. consumers age 18-64 are watching YouTube on their TV screens.2 Of those who watch YouTube on their CTV, 72% agree that YouTube is TV to them as consumers are redefining TV. 3 Part of YouTube’s increasing CTV viewer base may be attributed to the diversity of its offering. 80% of those who watch YouTube on their CTV agree that YouTube has the widest array of content on their TV.4

YouTube commissioned research with Ipsos to understand if ads on YouTube CTV vs. linear TV impact viewers differently, specifically in driving offline actions and behavior changes.

Methodology Overview

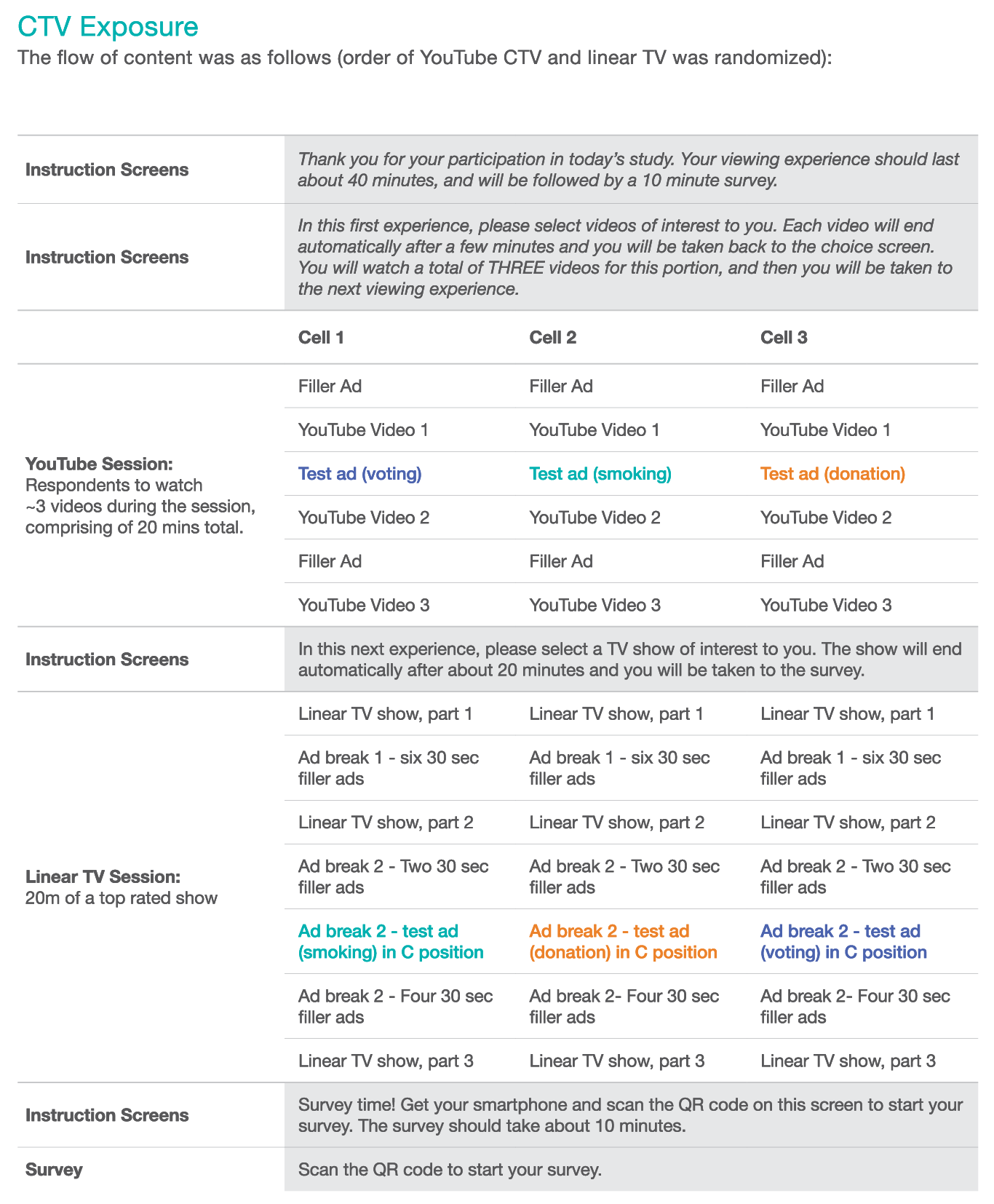

Respondents throughout the U.S. were invited to participate in the study using enabled Connected TVs (CTVs that have the app downloaded which provides the simulated viewing experience). On these enabled CTVs, they were provided on-screen instructions and a customized viewing experience based on respondents’ video preferences. They were then directed to their smartphones for a post-exposure survey.

This study was conducted using the free YouTube app on a CTV device; it did not include the YouTube TV paid subscription service.

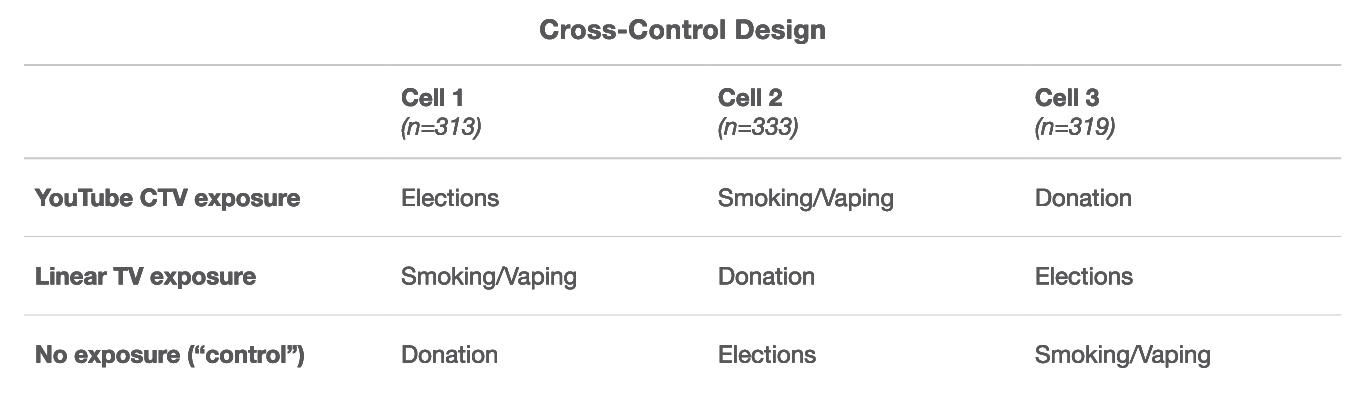

The research focused on testing three different ads: each respondent was exposed to one ad on YouTube CTV and a different ad on linear TV. They were not exposed at all to the third ad. The three ads tested contained call-to-actions related to three industries that have historically proven hard to encourage action among consumers: voting, making a health change, or donating to an organization. In the survey, we asked each respondent about all three topics. Then, we analyzed the data by platform for each topic, based on respondent ad exposure. This allowed us to understand the impact of an ad on YouTube CTV, the impact of an ad on linear TV and how this differs from those unexposed to an ad.

On YouTube CTV, respondents had a choice of 20 top-trending videos that appeared on the YouTube CTV homepage that they could browse through and choose to watch. Upon selecting a video, a 30-second unskippable ad would play (filler ad or the test ad). Each video would play for five minutes and then the respondent would be taken to the homepage to watch another ad and video. The test ad appeared during the second out of three videos.

On linear TV, respondents had a choice of 10 top-rated TV shows that appeared on a mock linear TV homepage that they could browse through and choose to watch. Upon selecting a TV show, the show would play with two ad breaks. The first ad break was all filler ads. In the second ad break, the test ad was shown in the third position out of seven 30 second ads. The set up best mimics a real ad experience for respondents when watching TV. It ensures comparison to the YouTube CTV test, with tested ads placed in the middle of both ad experiences.

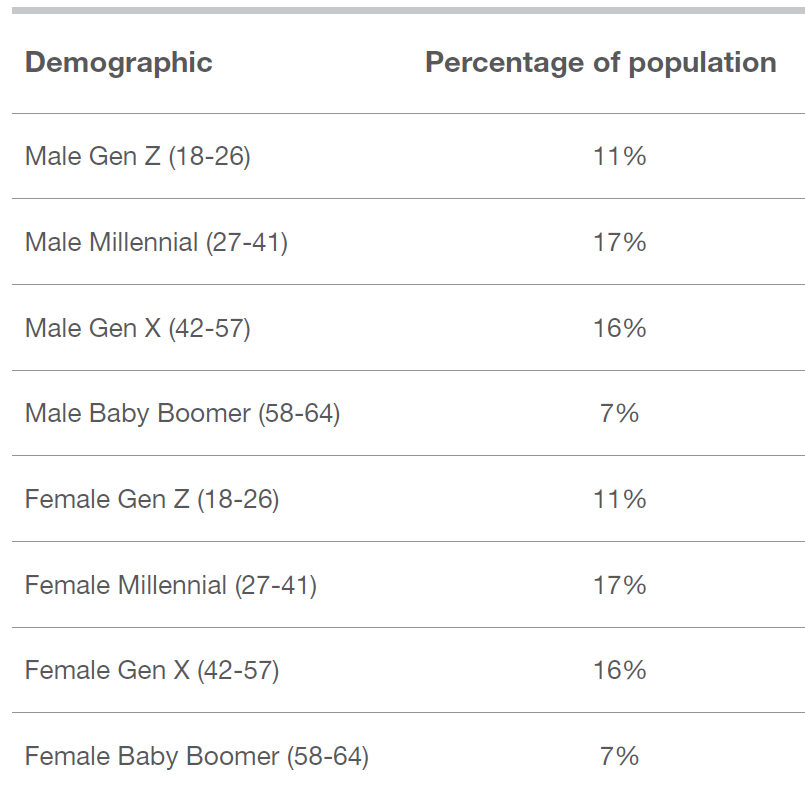

All respondents were 18- to 64-year-old U.S. residents who were viewers of both YouTube and linear TV. The total sample size was 965. The research was conducted in April-May 2023.

In terms of data presentation, all comparisons shown are the relative lift. For example, if YouTube CTV is 55% and linear TV is 50%, the relative lift would be 10%.

Findings

YouTube CTV ads are impactful in driving offline action and behavior change. Ads on YouTube CTV are relatable, and drive recall, consideration, and action. Compared to ads on linear TV, ads on YouTube CTV are more impactful in increasing recall and action.

Ads on YouTube CTV are Relatable

The personalized nature of YouTube CTV ads engages viewers. After seeing an ad on YouTube CTV, viewers are 7% more likely to find similar YouTube content relatable. The relatability of YouTube CTV ads drives impact down the entire marketing funnel.

“Ads on YouTube, I feel like I can relate to it in a way, like it was made for me to watch. Cable TV kind of has random commercials, but YouTube may have something that I was just recently talking about or products specifically for women or different things that I am interested in.” - Gen Z

Ads on YouTube CTV Increase Recall

Ad messages on YouTube CTV resonate with viewers, more so than the same advertising on linear TV. Viewers are 5% more likely to recall the advertised topic unaided, and 7% more likely to recall the advertised message unaided, on YouTube CTV compared to linear TV.

Viewers consider YouTube ads content to be memorable. Viewers are 13% more likely to find content on YouTube related to the ads they’ve watched memorable, after seeing an ad on YouTube CTV.

Ads on YouTube CTV Drive Consideration

YouTube’s status as a research and discovery engine motivates viewers to dive deeper into the advertised topics.

After seeing an ad on YouTube CTV, viewers are 18% more likely to strongly agree that content they’ve seen on YouTube inspires them to learn more. Whether it’s on Google, searching for more information or watching additional videos on the topic, viewers choose to learn more after seeing an ad.

“I feel like the content I see on YouTube is more vast, and I can dig deeper and get different viewpoints than broadcast/cable TV. I feel like there is way more information on YouTube than on broadcast/cable TV.” -Baby Boomer

Ads on YouTube CTV Inspire Action

After watching ads on YouTube CTV, viewers are likely to take 8% more actions related to the ads. This includes actions like talking to friends or family about the advertised topic, searching online or watching YouTube videos to learn more, and following the call-to-action with voting, making a health change, or making a donation to the advertised organization.

Specifically, viewers are 7% more likely to talk with a professional or friends and family, encouraging them to take action related to the message they saw, or about taking action themselves, after seeing an ad on YouTube CTV, compared to linear TV.

Not only are viewers taking action, they’re taking more actions (for example, if they were only going to search online before watching the ad, they are now going to search online and talk to friends) after seeing an ad on YouTube CTV. Viewers can go deep with YouTube, seeking out more information on the platform, and sharing information they see with others.

“There have been tons of times where I saw an ad [on YouTube] and I have taken out my phone and search/shop whatever [ad] I just watched and that is usually how I would research.” -Gen Z

Conclusion

Ads on YouTube CTV are relatable, and successfully drive recall, consideration, and action.

We hypothesize that YouTube CTV’s ad experience rather than a linear TV ad experience may contribute to increased engagement, and ultimately provide more impact down the marketing funnel.

The personalized nature of YouTube, and the engagement with the content by seeking out what’s most relevant to each individual, may help to make the ads on YouTube CTV more resonant than the same ads on linear TV.

As cord-cutting continues to increase, consumers are redefining TV, and advertisers must adapt in turn. Americans’ definition of TV has changed, and they see YouTube as TV. Ads on YouTube CTV meet consumers where they are and successfully change consumer attitudes and behavior.

Interested in learning more about the methodology of testing ads on CTVs? For more information, please contact Par Ljungstrom.

Appendix

Sources

1 - eMarketer

2 - Google/Ipsos, Video Research Study, US, 2022 n=2249

3 - Google/Ipsos, Video Research Study, US, 2022 n=1626

4 - Google/Ipsos, Video Research Study, US, 2022 n=1626

Sample Design

Respondents were placed in one of three cells:

CTV Exposure

The flow of content was as follows (order of YouTube CTV and linear TV was randomized):

Weighting

Data is weighted to be representative of 18-64 year-old US YouTube viewers in terms of age & gender:

Data is also weighted so the share of those who smoke/vape is equal across all cells, the share of those who are a registered voter vs. non-voter is equal across all cells, and so the share of those who donate regularly vs. do not donate is equal across all cells.

Author Info:

Par Ljungstrom

Senior Vice President, Media & Entertainment Platforms

[email protected]

Grace Maltby

Director, Media & Entertainment Platforms

[email protected]

Josie Speltz

Senior Account Manager, Media & Entertainment Platforms

[email protected]

About Ipsos

At Ipsos we are passionately curious about people, markets, brands, and society. We deliver information and analysis that makes our complex world easier and faster to navigate and inspires our clients to make smarter decisions. With a strong presence in 90 countries, Ipsos employs more than 18,000 people and conducts research programs in more than 100 countries. Founded in France in 1975, Ipsos is controlled and managed by research professionals.

![[WEBINAR] The Super Bowl’s Best Ads of 2025](/sites/default/files/styles/list_item_image/public/ct/event/2025-01/linkedin_1.png?itok=LXfnrrAL)