U.S. consumer sentiment: The summer of 2020 ends just as it started

Visit our interactive portal, Ipsos Consolidated Economic Indicators (IpsosGlobalIndicators.com) for graphic comparisons and trended data pertaining to the Ipsos Global Consumer Confidence Index and sub-indices -- and all the questions on which they are based.

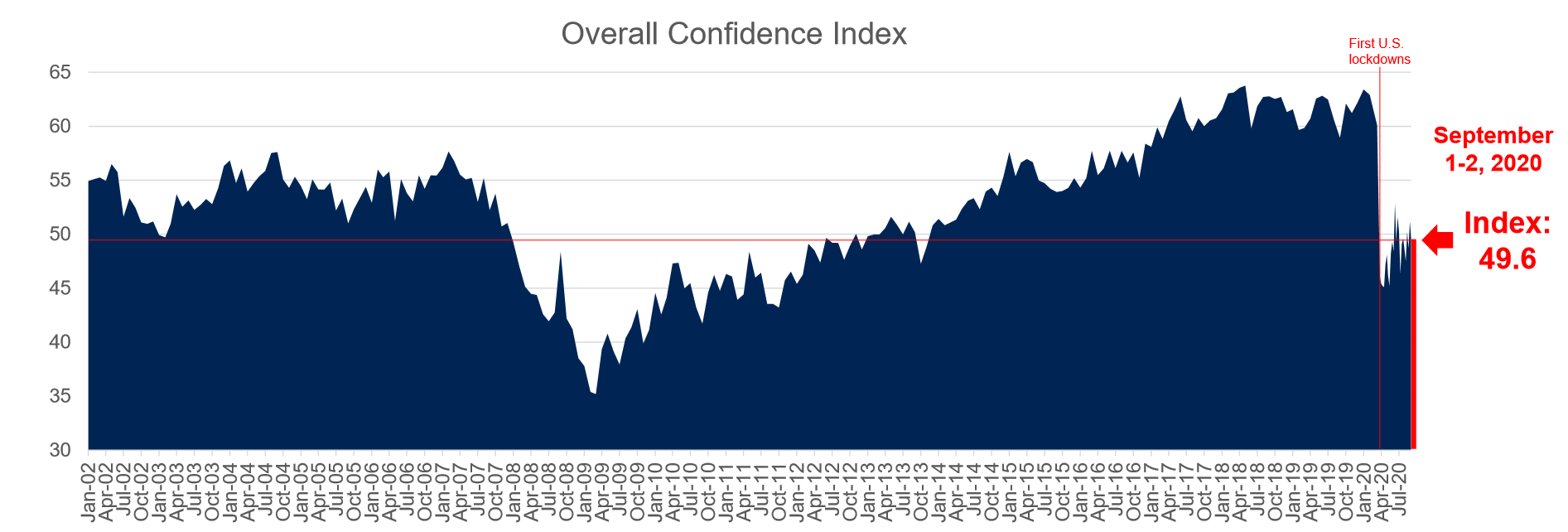

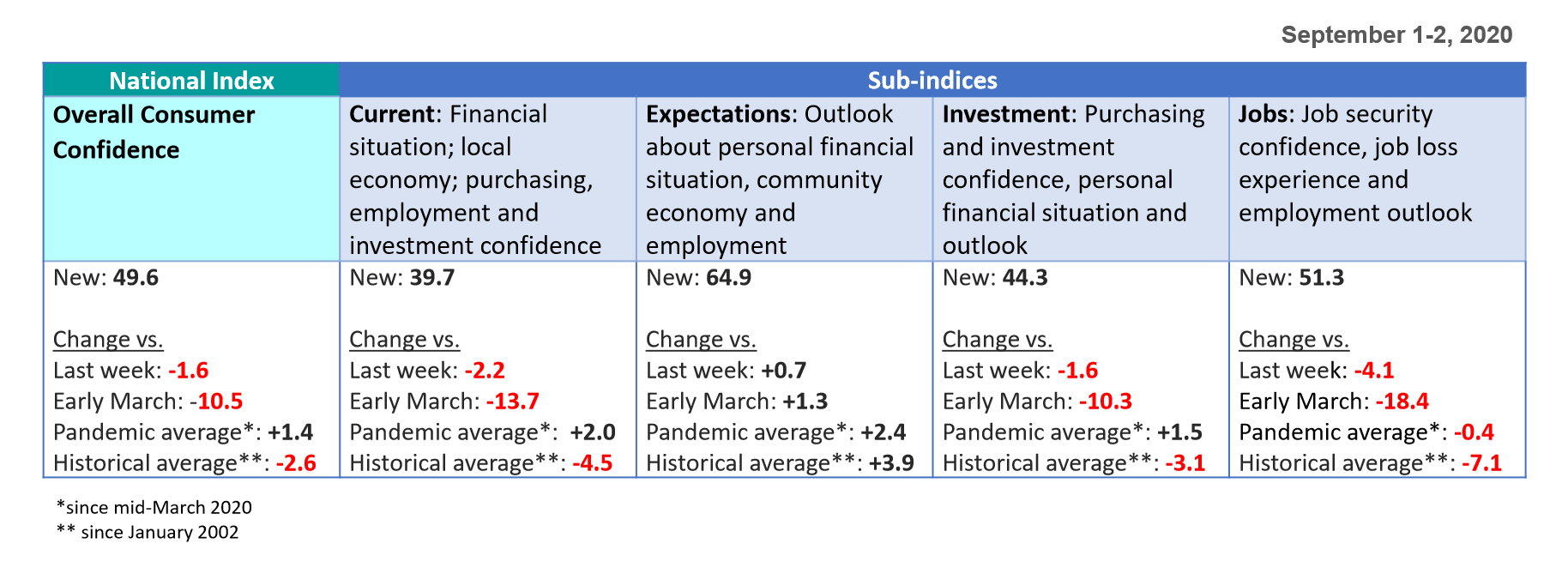

Washington, DC, September 3, 2020 — At 49.6, Ipsos’s consumer confidence index is down 1.6 points from last week after experiencing a notable uptick the previous week. Yet, despite week-to-week volatility, the index ahead of Labor Day weekend is nearly at the same exact level as it was on Memorial Day and is on par with its summer average of 49.5, indicative of remarkable stability over the past three months. Still, overall consumer sentiment remains well below its pre-pandemic heights.

Over the past week, the Jobs index incurred a drop of 4.1 points, erasing most of its gains from the previous week. Another 881,000 Americans for first time unemployment claims last week.

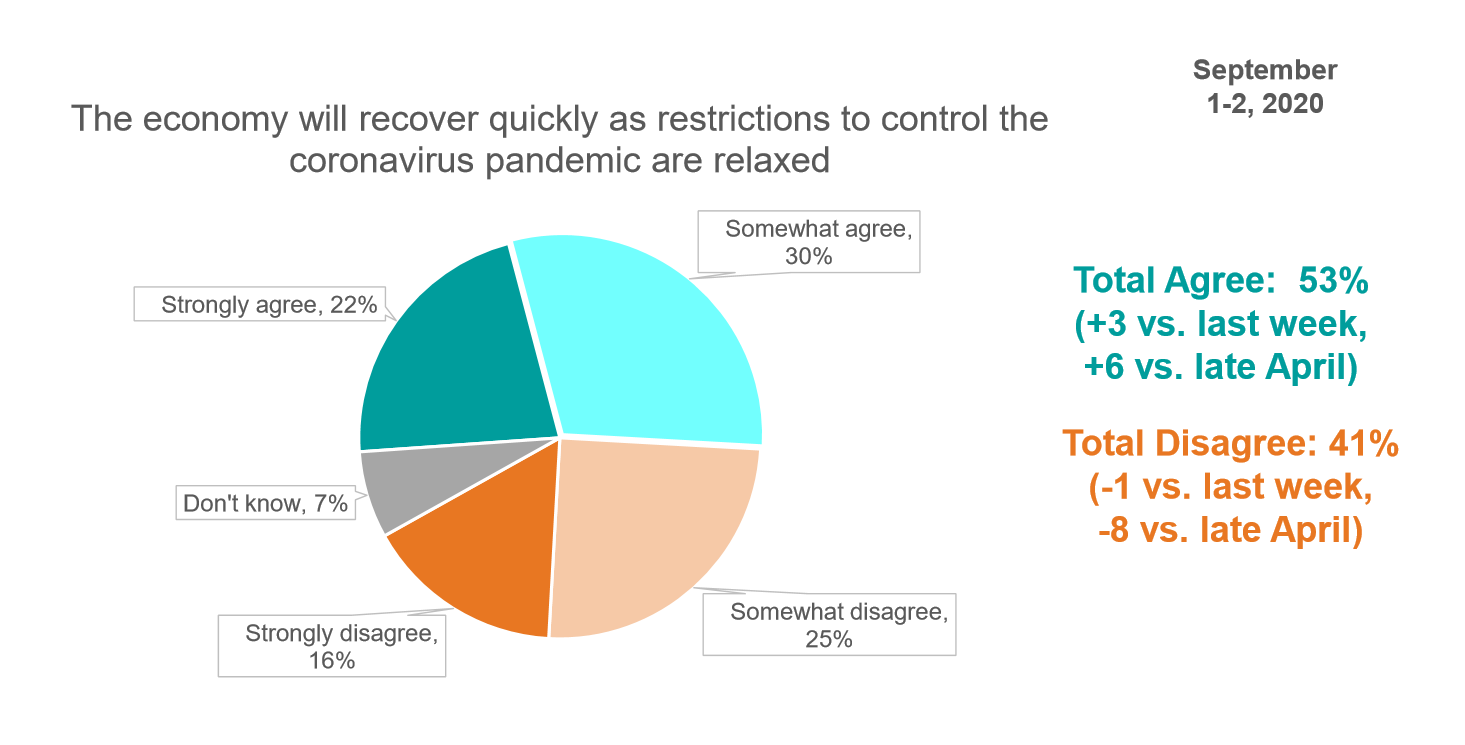

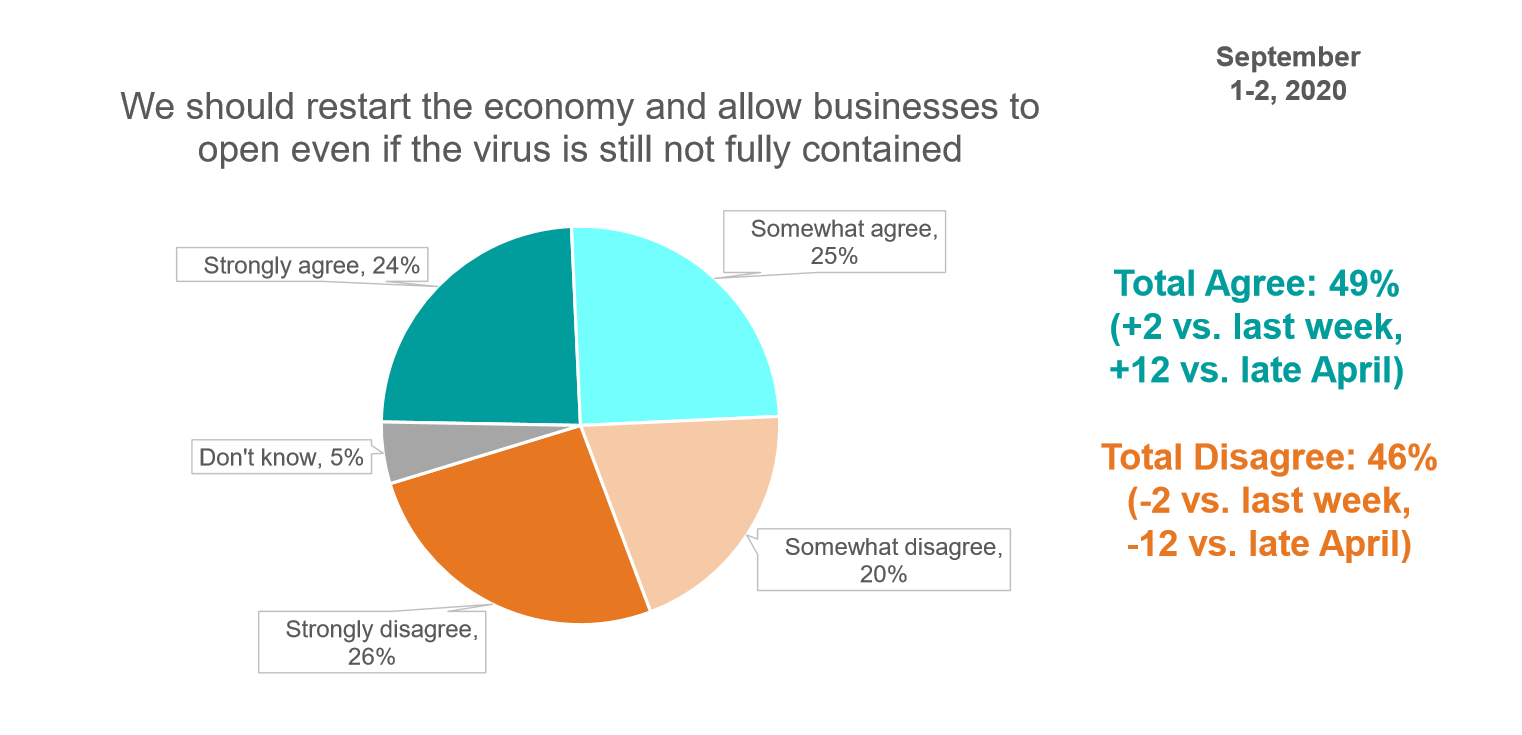

Americans remain divided on allowing businesses to open up again before the coronavirus is contained, but half believe that the economic recovery will be quick once restrictions are relaxed.

Nevertheless, looking ahead, Americans show signs of improving optimism. The Expectations index stands at a robust 64.9, slightly above where it was before the first lockdowns in March. A majority of Americans currently believes that the economy will recover quickly once limits on business due to the coronavirus are relaxed.

Detailed Findings

1. Scoring at 49.6, the latest overall Consumer Confidence index fell 1.6 points from last week.

- The Confidence index is currently 10.5 points lower than in early March (60.1), but 1.4 points above its average throughout the pandemic.

2. The Jobs sub-index fell by 4.1 points, reversing most of the 5.2-point gains of last week.

- This week, 47% of those surveyed say they, someone in their family, or someone else they know personally lost their job in the last six months as a result of economic conditions, up from 42% last week.

- In addition, 52% think that it is at least somewhat likely that this will be the case in the next six months (in line with 51% last week, and down from 60% in late March).

3. The Current and Investment indices also fell this week (by 2.2 and 1.6 points, respectively) reversing an upward trend seen the week prior. However, the Expectations index is up again this week (by 0.7 points) and now stands at a strong 64.9.

4. A majority of Americans (53%) believe that the economy will recover quickly once restrictions are relaxed, up from 50% last week. Just 41% disagree.

5. The nation remains divided on the restarting the economy even if the coronavirus is not yet fully contained: 49% agree that the economy should be allowed to reopen (up two percentage points from last week) while 46% disagree.

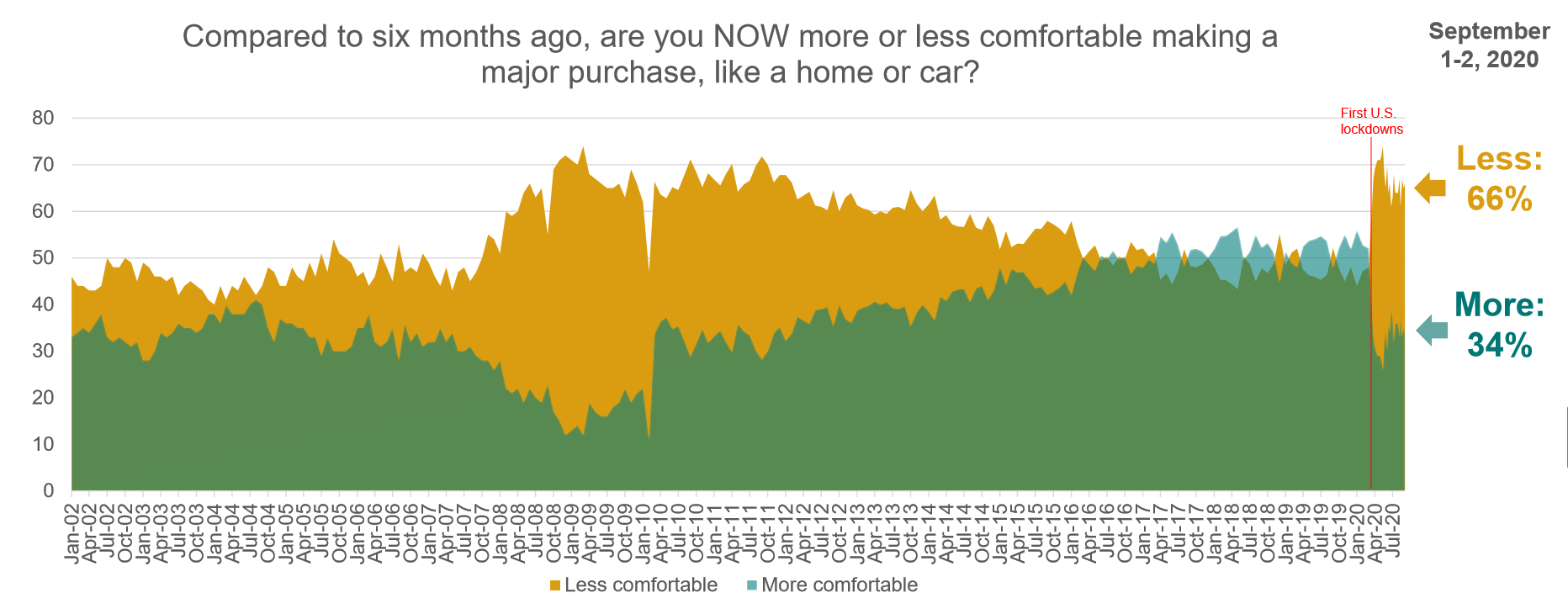

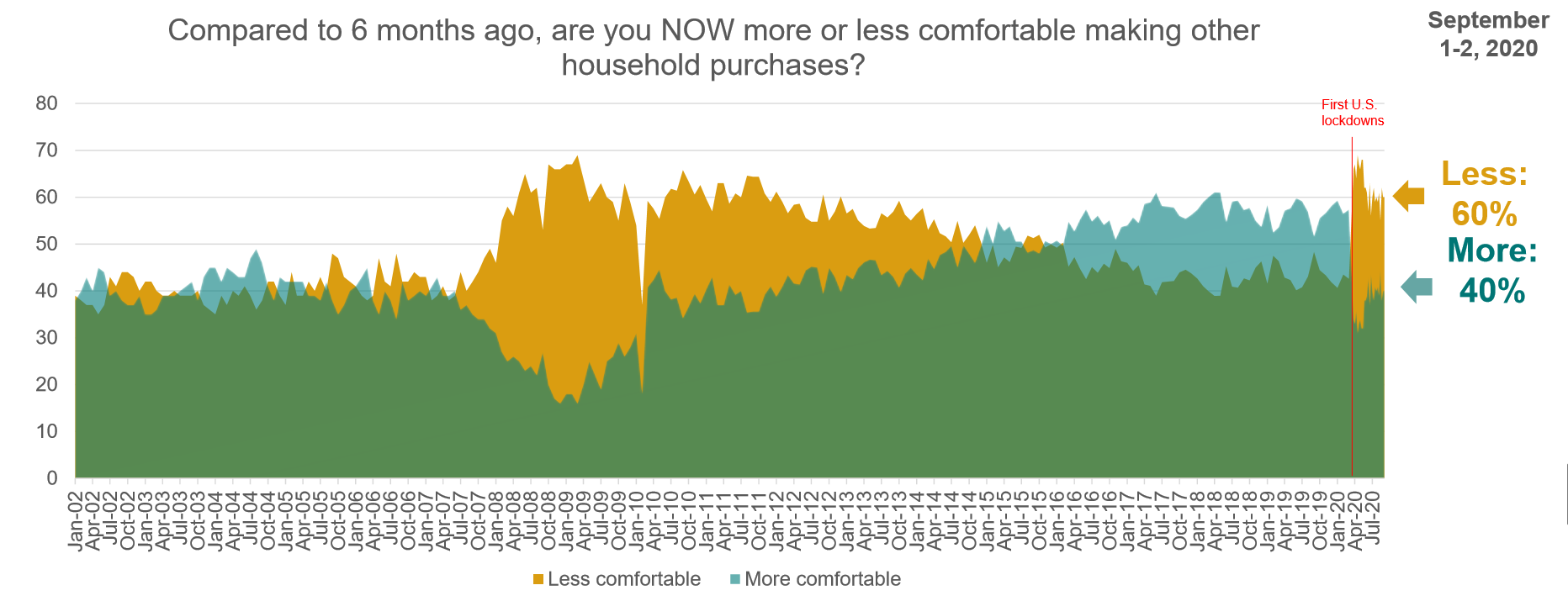

6. Most Americans remain uncomfortable with making major and other household purchases.

- Two thirds say that, compared to six months ago, they are less comfortable making a major purchase like a home or a car (66%, statistically unchanged from 65% last week).

-

Compared to six months ago, 60% say they are less comfortable making other household purchases, down from 62% last week.

Questions

The data used for the Consumer Confidence index and sub-indices is based on the following questions:

- Now, thinking about our economic situation, how would you describe the current economic situation in US? Is it… very good, somewhat good, somewhat bad or very bad?

- Rate the current state of the economy in your local area using a scale from 1 to 7, where 7 means a very strong economy today and 1 means a very weak economy.

- Looking ahead six months from now, do you expect the economy in your local area to be much stronger, somewhat stronger, about the same, somewhat weaker, or much weaker than it is now?

- Rate your current financial situation, using a scale from 1 to 7, where 7 means your personal financial situation is very strong today and 1 means it is very weak

- Looking ahead six months from now, do you expect your personal financial situation to be much stronger, somewhat stronger, about the same, somewhat weaker, or much weaker than it is now?

- Compared to 6 months ago, are you NOW more or less comfortable making a major purchase, like a home or car?

- Compared to 6 months ago, are you NOW more or less comfortable making other household purchases?

- Compared to 6 months ago, are you NOW more or less confident about job security for yourself, your family and other people you know personally?

- Compared to 6 months ago, are you NOW more or less confident of your ability to invest in the future, including your ability to save money for your retirement or your children’s education?

- Thinking of the last 6 months, have you, someone in your family or someone else you know personally lost their job as a result of economic conditions?

- Now look ahead at the next six months. How likely is it that you, someone in your family or someone else you know personally will lose their job in the next six months as a result of economic conditions?

Additional questions

Q. To what extent do you agree with the each of the following

- The economy will recover quickly once the restrictions to control the coronavirus pandemic are relaxed.

- We should restart the economy and allow businesses to open even if the virus is still not fully contained.

About the Study

These findings are based on data from an Ipsos survey conducted August 25-26, 2020 with a sample of 910 adults aged 18-74 from the continental U.S., Alaska and Hawaii who were interviewed online in English.

The sample was randomly drawn from Ipsos’ online panel, partner online panel sources, and “river” sampling and does not rely on a population frame in the traditional sense. Ipsos uses fixed sample targets, unique to each study, in drawing a sample. After a sample has been obtained from the Ipsos panel, Ipsos calibrates respondent characteristics to be representative of the U.S. Population using standard procedures such as raking-ratio adjustments. The source of these population targets is U.S. Census 2016 American Community Survey data. The sample drawn for this study reflects fixed sample targets on demographics. Post-hoc weights were made to the population characteristics on gender, age, race/ethnicity, region, and education.

Statistical margins of error are not applicable to online non-probability polls. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. Where figures do not sum to 100, this is due to the effects of rounding. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll has a credibility interval of plus or minus 3.6 percentage points for all respondents. Ipsos calculates a design effect (DEFF) for each study based on the variation of the weights, following the formula of Kish (1965). This study had a credibility interval adjusted for design effect of the following (n=910, DEFF=1.5, adjusted Confidence Interval=+/-5.2 percentage points).

Findings from previous time periods going back to March 2011 are based on data from Refinitiv /Ipsos’ Primary Consumer Sentiment Index (PCSI) collected in a monthly survey on Ipsos’ Global Advisor online survey platform with the same questions. For the PCSI survey, Ipsos interviews a total of 1,000+ U.S. adults aged 18-74. The Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of local economies, personal finance situations, savings and confidence to make large investments. The PCSI metrics reported each month consist of a “Primary Index” based on 10 questions available upon request and of several “sub-indices” each based on a subset of these 10 questions. Those sub-indices include a Current Index, an Expectations Index, an Investment Index and a Jobs Index.

Findings for January 2002- February 2011 are based on data from the RBC CASH Index, a monthly telephone survey of 1,000 U.S. adults aged 18 and older conducted by Ipsos with a margin of error of +/- 3.1 percentage points.

For more information on this news release, please contact:

Chris Jackson

Vice President, U.S., Public Affairs

Ipsos

+1 202 420 2025

[email protected]

Kate Silverstein

Media Relations Specialist, U.S., Public Affairs

Ipsos

+1 718 755-8829

[email protected]

For more information on COVID-19 please click here

About Ipsos

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com