Vacation Deficit Decreasing, But American Summer Vacationers Being More Cautious with Spending

A majority (51%, down 1 point from 2014) of Americans remain confident (36% very/16%) that they'll take a vacation in 2015, compared to just 36% (down 3 points) who are not confident (19% not at all/17% not very). One in ten (10%, up 2 points) has already taken a vacation, while 3% simply aren't sure.

In fact, six in ten (57%, up 1 point) say that taking an annual vacation is important (28% very/29% important) to them, while 43% (down 1 point) say that an annual getaway is not important (21% not at all/22% not very) to them.

The vacation deficit is measured by examining whether those people who say a vacation is important to them are actually confident that they'll take a vacation this year. In 2015, just shy of one in five (19%) Americans who say a vacation is important to them are not confident that they'll take a vacation, meaning that the vacation deficit is down by 2 points since last year and 5 points since 2013.

That vacation confidence has remained high is perhaps a function of the fact that many Americans appear due to take a vacation, since many haven't been in quite some time. A majority (56%) of Americans say they haven't been on vacation in over a year, up from 52% last year. Another 15% haven't been on vacation for seven to twelve months, 10% say it has been 4 to 6 months, and only 16% have been within the last three months (down 3 points). In short, more Americans this year have been waiting a longer period of time since their last vacation.

Summer Vacation Travel Holds Steady...

Summer vacation travel intentions are holding steady with last year, after having seen a significant rise from 2013, according to the poll. Nearly half (46%) of Americans say they're confident (31% very/15% somewhat) that they will take a summer vacation this year, while 31% are not confident (19% not at all/12% not very). One in ten (10%) says that while they won't take a summer vacation this year they intend to take an annual vacation at some other time this year, and 8% say they've already taken their annual vacation this year and won't travel this summer. One in twenty (5%) doesn't yet know their summer travel plans.

The proportion of Americans who say they typically take an annual vacation has been fluctuating since 2010, likely a function of the tenuous recovery from the Great Recession. In 2010, 49% of Americans said they usually vacation in the summer, the proportion of which rose to 55% in 2011, decreased to 50% in 2012 and 45% in 2013, shot back up to 51% in 2014, and now rests at 47% in 2015.

While roughly the same proportion of Americans this year as last year are confident that they'll take a summer vacation, the amount of money that they will spend on their vacation, on average, has decreased significantly. The average American who is at least somewhat confident to take a vacation this summer will spend $1621 on average, down sharply from the $1895 vacationers intended to spend in 2014. However, both 2013 and 2014 were significant increases from the $1565 vacationers intended to spend in 2012, and these 2015 levels are still ahead of 2012. Specifically, more vacationers this year are doing things cheaply by intending to spend less than $400 (19%) on their vacation, far more than said the same last year (13%).

While the aggregate spend for Americans is down on the whole, at the individual level more this year (13%) than last (11%) say they will spend more on their vacation, while fewer this year (13%) than last (16%) say they'll spend less. Three in ten (26%) will spend the same amount (up 1 point), while 44% said they didn't vacation last year and so they can't compare.

Sharing Economy Services More Popular, Trusted among Young Americans

The poll also gauged Americans familiarity and thoughts towards sharing economy services used for traveling:

- Four in ten (35%) are familiar (15% very/20% somewhat) with uber, while 64% are not (56% not at all/8% not very)

- Two in ten (19%) are familiar (7% very/12% somewhat) with Air BnB, while eight in ten (79%) are not (71% not at all/8% not very)

- Two in ten (15%) are familiar (6% very/9% somewhat) with Lyft, while eight in ten (84%) are not (77% not at all/7% not very)

- One in ten (10%) is familiar (4% very/7% somewhat) with HomeAway, while most (88%) are not (79% not at all/9% not very)

- One in ten (7%) is familiar (3% very/4% somewhat) with GetAround, while most (91%) are not (86% not at all/6% not very)

- Four percent (4%) are familiar (1% very/3% somewhat) with Feastly, while most (94%) are not (88% very/7% not very)

Despite relatively low awareness of many of these services among the general population, four in ten (44%) Americans find them to be trustworthy (6% very/38% somewhat), compared to 35% who think they're not trustworthy (24% not at all/10% not very). Two in ten (21%) don't know if they trust these services or not.

However, a majority (60%) of young adults aged 18 to 34 trust these services, as do those with a household income over $75,000 (58% trust). Other groups more trusting of sharing economy services include those who say an annual vacation is important to them (54% trust) and those who are confident that they'll take a summer vacation this year (50%).

Nearly two in ten (17%) Americans say they're likely (4% very/13% somewhat) to use a sharing economy service during their summer vacation this year, including nearly three in ten (28%) young adults under the age of 35 who are likely to use one, and 20% of those who are confident that they'll take a summer vacation this year.

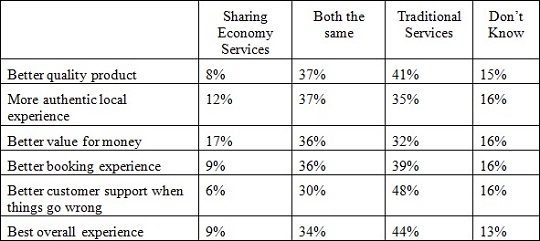

The poll also asked whether or not Americans thought that sharing economy services or traditional travel and booking services provided the better experience. The chart below shows the proportion of Americans who believe that either sharing economy services or traditional services has the edge, or whether they consider them both to provide the same level of experience.

These are some of the findings of an Ipsos poll conducted June 5th to 9th, 2015. For the survey, a nationally representative sample of 1,000 randomly-selected adults residing in the U.S. interviewed by telephone via Ipsos' U.S. Telephone Express omnibus. With a sample of this size, the results are considered accurate within 1773.1 percentage points, 19 times out of 20, of what they would have been had the entire population of adults in the U.S. been polled. The margin of error will be larger within regions and for other sub-groupings of the survey population. These data were weighted to ensure the sample's regional and age/gender composition reflects that of the actual U.S. population according to data from the U.S. Census Bureau.

For more information on this news release, please contact:

Sean Simpson Vice President Ipsos Public Affairs (416) 572-4474 [email protected]

About Ipsos in Canada

Ipsos is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos' marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. Ipsos ranks third in the global research industry.

With offices in 87 countries, Ipsos delivers insightful expertise across five research specializations: brand, advertising and media, customer loyalty, marketing, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,669.5 ($2,218.4 million) in 2014.

Visit www.ipsos.com to learn more about Ipsos' offerings and capabilities.