Affluent Africans Working On a Sustainable Growth Plan for Africa

Key findings of the 4th bi-annual release of the Ipsos Affluent Survey Africa 2016.

- Social responsibility and being environmentally friendly are top-priorities for Africa’s most wealthy, as they work towards a long term sustainable strategy

- African Millennials are breaking economic barriers and joining the Affluent elite

- Media and personal/wearable technology are vital to the African Affluent

The Ipsos Affluent Survey Africa maps the behaviour and media consumption of the individuals within the Top 15% in terms of income across seven African countries.

Affluent Africans committed to adopting a green pathway for a sustainable Africa

Earlier this year United Nation’s Economic Commission for Africa released its Economic Report on Africa 20161, which stated the big opportunity for Africa, as a latecomer to industrialization, is adopting the green pathway towards sustainable and inclusive development. It will create jobs while safeguarding the productivity of natural resource assets. For the African Affluent, investing for the long-term is of great importance. Their progressive vision is confirmed by the involvement in their community: nearly 9 out of 10 African Affluent think it is important to contribute to the community they live in, while amongst the European Affluent it is 64%.

Social responsibility is the future

In line with the investment in their own and their communities’ potential, the Affluent African endorses a responsible, durable way of empowering Africa’s economy. Seven out of ten take a company’s commitment to corporate and social responsibility into consideration when purchasing products.

Not only is a company’s commitment important to them but they actively engage in pro-eco initiatives. 15% of Affluent Africans were involved in an environmental/conservative group, while amongst European Affluents this is only 5%.

On the lookout for Millennials

The Millennials* are the young entrepreneurs of the continent. As income generally grows as a career progresses for a Millennial to be among the Top 15% of income earners is unusual, it is therefore significant that 40% of all African Affluent are Millennial, by comparison only 17% of Europe’s Affluent are Millennial. Millennials are an important group for marketers. Affluent Millennial key facts:

- Tend to take the lead in decision making (8 out of 10).

- Are confident about the future of their standard of living (84%).

- 1 out of 3 already owns a gold/platinum credit card with which they go shopping for well-known brands (79%).

- Two out of three Affluent Millennials bought luxury products of one kind or another in the past year.

- Nearly two out of ten made 6 or more air trips in the past 12 months and an equal amount stayed in upmarket 4 or 5 star hotels or upscale resorts.

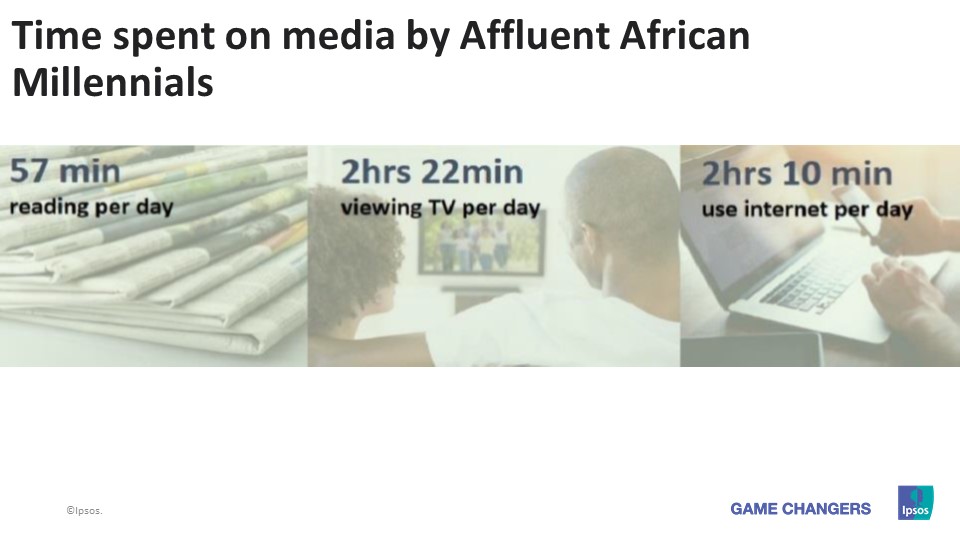

- To keep up with their upscale lifestyle, gaining knowledge and becoming better informed is a priority to the Millennials (82%). This is also confirmed by their media behaviour.

*definition Millennials: age 21-34

Non-Millennials (35-74), time spent reading: 61 minutes, time spent watching TV: 2 hours and 10 minutes, time spent using internet: 1 hour and 59 minutes.

Non-Millennials (35-74), time spent reading: 61 minutes, time spent watching TV: 2 hours and 10 minutes, time spent using internet: 1 hour and 59 minutes.

African Affluent consume digital for breakfast, lunch and dinner

The Affluent Africa Survey 2016 proves once more that the usage of mobile technology in Africa is vital for everyday life. While 52% of the Affluent Europeans are so called ‘3 screen users’, an impressive 66% of the African Affluent own all three of the main mobile devices: a smartphone, a tablet and a PC/Laptop. Over a half of the upscale population considers themselves as early adopters, by saying they are ‘always one of the first to have technologically innovative products’. One out of eight African Affluent owns a wearable device, like a smartwatch or smart glasses vs. a modest 5% of Affluents in Europe. They are not passive users of new tech with 37% of the Affluent Africans having bought products and services via their phone in the past year, which is over double the number for Europe (15.5%).

International Media Results

It will come as no surprise that digital takes a fair share of the media consumption for Affluent Africans. Affluent Africans have high consumption levels of international media, 45% of Affluent Africans consume international media digitally every week, 40% read an international title in print and nearly 9 out of 10 watch international TV on a weekly basis.

| Affluent 7 countries - % Reach | All |

|---|---|

| International Print – AIR | |

| All Int’l print Dailies Weeklies/Fortnightlies/Tri-weeklies Monthlies News/Business Inflights |

40.1 8.4 17.8 17.5 29.5 20.5 |

| International TV – weekly reach | |

| All Int’l TV News/Business TV General / Entertainment TV |

86.4 74.5 70.7 |

| International Digital – weekly reach | |

| All digital Website Mobile Apps |

44.9 34.6 32.3 17.4 |

| Total International Media Brand – reach | |

| (AIR + weekly reach) | 90,07 |