Visit our interactive portal, Ipsos Consolidated Economic Indicators (IpsosGlobalIndicators.com) for graphic comparisons and trended data pertaining to the Global Consumer Confidence Index and sub-indices -- and all the questions on which they are based.

At 49.5, September 2019’s Global Consumer Confidence Index is down 0.7 points over the past month, 0.2 points over the past three months, and 1.1 points compared to September 2018. Compared to the past 36 months’ average across all 24 countries surveyed, this September’s Global Consumer Confidence Index is down 0.6 points.

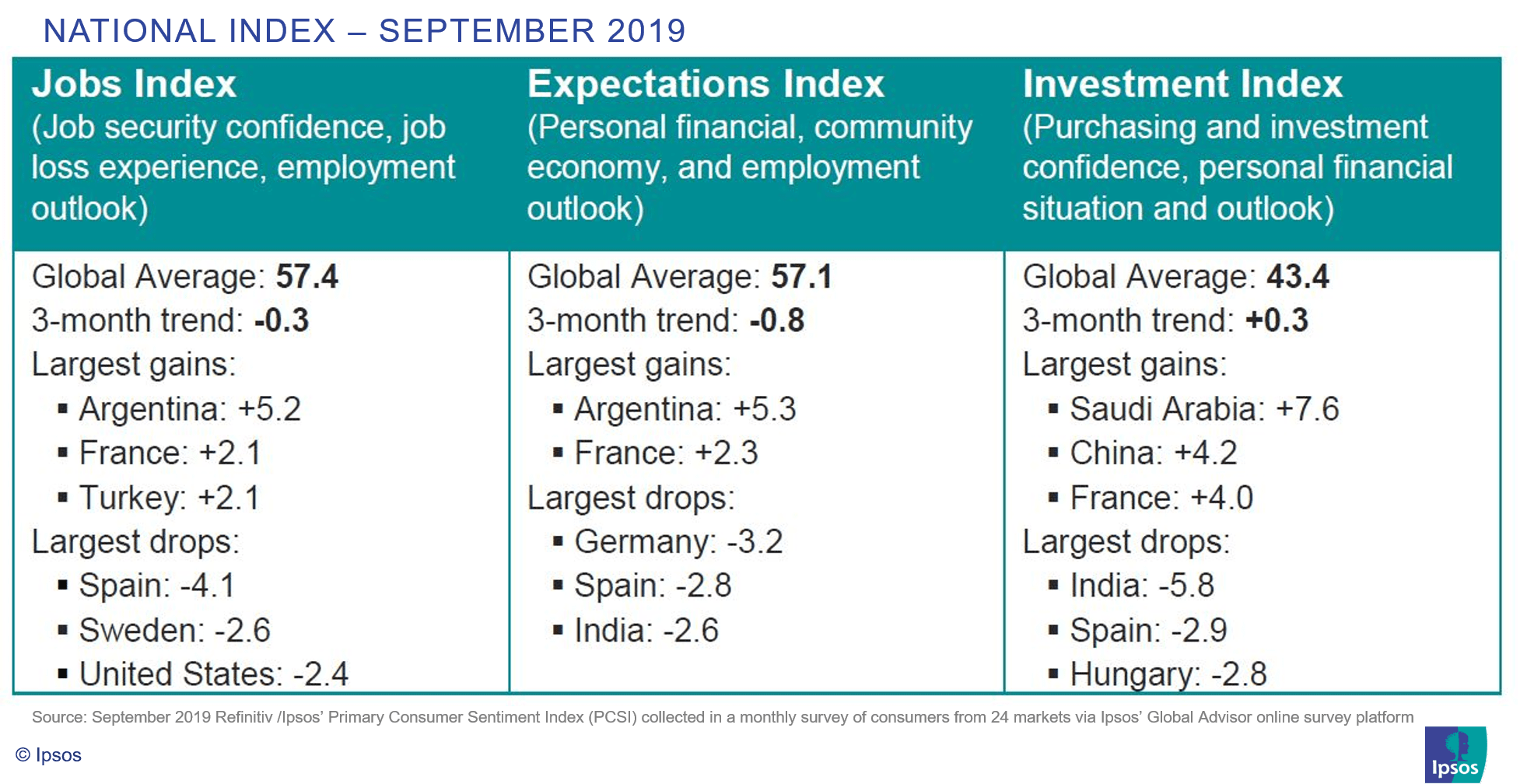

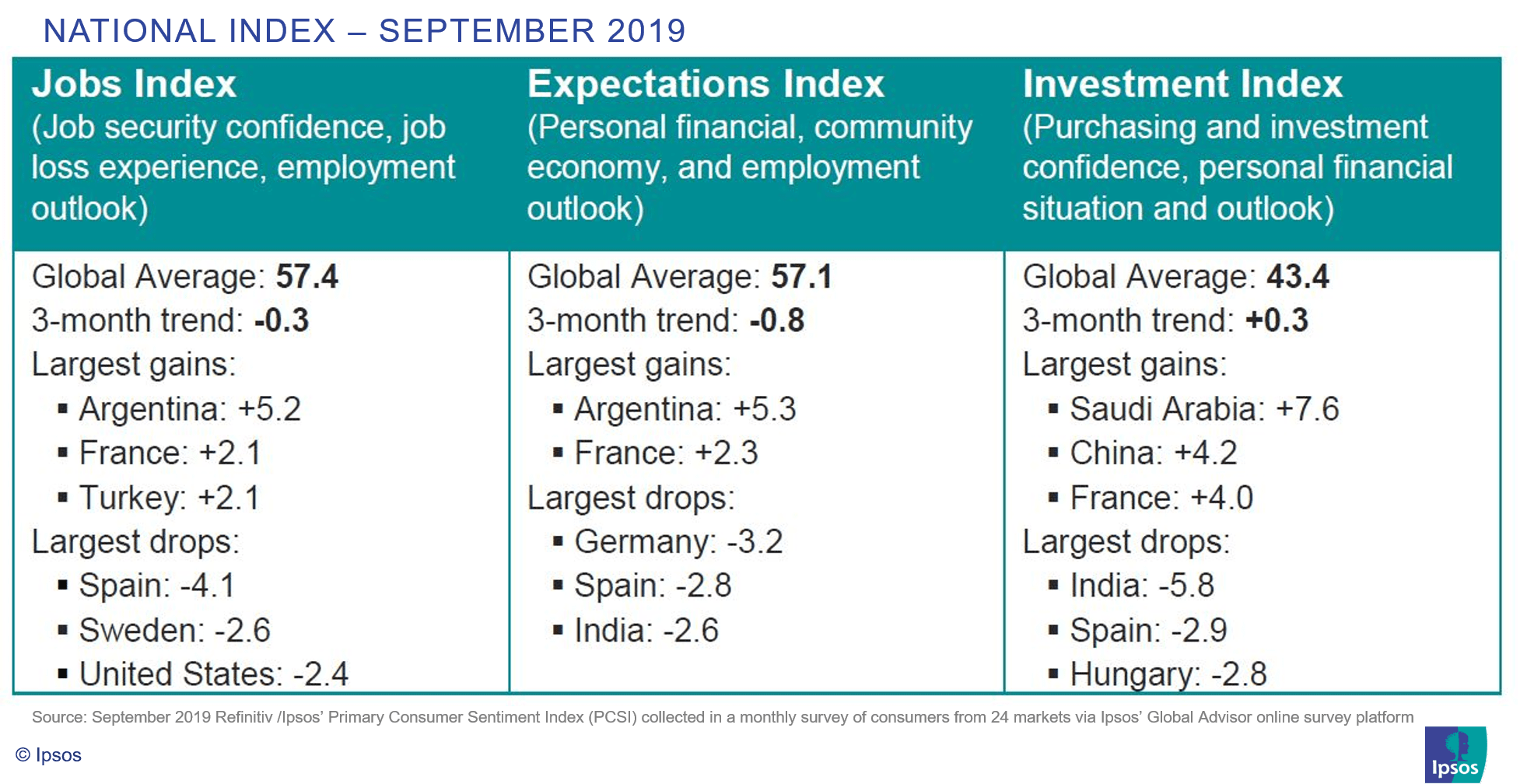

Six of the 24 countries show significant three-month declines in their National Index: India (-3.7), Spain (-3.3), Germany (-2.2), the United States (-2.1), Sweden (-1.7), Italy (-1.7), and Mexico (-1.5). At the same time, five markets show significant three-month gains: Argentina (+4.8), Saudi Arabia (+3.0), France (+2.9), Turkey (+1.7), and mainland China (1.6).

Compared to the past three years’ average, the current level of consumer confidence as reflected by this September’s National Index, is notably higher in Brazil (+5.8), Saudi Arabia (+5.7), France (+2.1) and Belgium (+1.5). However, it is notably lower in Argentina (-4.4), Japan (-3.6), South Korea (-3.3), Sweden (-2.5), Germany (-2.4), South Africa (-2.4), India (-2.3), and the U.S. (-1.5).

The Consumer Confidence Index, also called the “National Index,” reflects consumer attitudes on the current and future state of their local economy, their personal finance situations, their savings and their confidence to make large investments.

These findings are based on data from Refinitiv /Ipsos’ Primary Consumer Sentiment Index (PCSI) collected in a monthly survey of consumers from 24 markets via Ipsos’ Global Advisor online survey platform. For this survey, Ipsos interviews a total of 17,500+ adults aged 18-74 in the United States of America, Canada, Israel, Turkey, South Africa; and age 16-74 in all other markets each month. The monthly sample consists of 1,000+ individuals in each of Australia, Brazil, Canada, China (mainland), France, Germany, Italy, Japan, Spain, Great Britain and the USA, and 500+ individuals in each of Argentina, Belgium, Hungary, India, Israel, Mexico, Poland, Russia, Saudi Arabia, South Africa, South Korea, Sweden and Turkey.

Data collected each month are weighted so that each country’s sample composition best reflects the demographic profile of the adult population according to the country’s most recent census data. Data collected each month are also weighted to give each country an equal weight in the total “global” sample. Online surveys can be taken as representative of the general working age population in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, Poland, South Korea, Spain, Sweden, and the United States. Online samples in Brazil, China*, India, Israel, Mexico, Russia, Saudi Arabia, South Africa and Turkey are more urban, more educated and/or more affluent than the general population and the results should be viewed as reflecting the views of a more “connected” population.

Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error. The precision of the Refinitiv/Ipsos online surveys is measured using a Bayesian Credibility Interval. Here, the poll has a credibility interval of +/- 2.0 points for countries where the 3-month sample is 3,000+ and +/- 2.9 points for countries where the 3-month sample is 1,500+.