Ipsos Encyclopedia - Usage & Attitude Surveys (U&A)

Usage & Attitude studies (U&A) are useful in providing clients with a foundational understanding of the markets in which they operate. The client often starts with a quite broad need to “understand a market”. This need often stems from a business process, that clients a few years go through to identify strategic growth opportunities. The client needs to understand where to invest their money and resources: what products or brands, for what targets? More pragmatically, this often drills down to wanting to understand who uses what, how often, how much, when, where, why and/or why not. These are the typically W’s collected in a U&A. In summary, a U&A is about what people do and what people feel regarding a category.

Depending on the specific business objectives each of these elements is explored in various levels of detail.

Some sort of sizing is often required as it helps the client to prioritize the opportunities.

Though client’s briefs often focus on the specific research needs, the real business questions behind such studies, are about (to name a few …):

- Where are the biggest opportunities? Which opportunities should I prioritize?

- Are there any unserved or underserved opportunities? How can I benefit from these opportunities?

- Who am I competing with, when and where? What is my performance? • Where can I win? Where do I need to defend my market?

- Where is the market heading? How has the market changed?

- What targets (people, occasions, …) should I focus on?

Note that, U&A is sometimes also referred to as a Usage and Habits study, or any other combination of these words with other words like, routines, needs, etc.

Ipsos Point of View

As U&As often have such a broad purpose, U&A research can be plagued by briefs that we often refer to as kitchen sink briefs that result in a lack of actionability. Many U&A's suffer from one or more of the following issues:

- No precise definition of business objectives, i.e. no clear idea of how results of the U&A will be used once results are available. As U&A’s are to be conducted once every several years to lay the foundation in the company, they often need to serve many stakeholders in the company. Hence the briefs contain information needs for each of these stakeholders. Gradually many nice to have requirements are added, which dilutes the real objective of such projects. In the end, the briefs focus on the research objectives and needs and far less on the business objectives.

- As a result, U&A's can become 'mega surveys', that measure anything that could be useful at some point, that take a long time to complete and require a lot of resources both on the client and supplier side.

- Data quality is often a problem as the surveys take a long time to administer increasing respondent fatigue and reducing willingness to participate. Hence the data are not always representative of all consumers. Or the collected information is influenced by the attempt to

- And they often rely on stated usage and/or memory: it is hard for respondents to recall what they did in the past week, 4 weeks of months.

The solution therefore lies in modularizing the U&A, measuring the behaviour and needs in the moment and increase the engagement. Plus, it is worth exploring using non-survey data sources that can collect behaviour much better.

In view of the above, Ipsos has developed a new, more insightful, approach for conducting U&A's which addresses the above issues. Key features of the new approach are:

Business Need And Insight Focused

As in any foundational study, it is essential to start with a client onboarding phase where we aim to understand client’s context, their ambitions, their challenges, their needs, their activation plans, etc. This step should also include a kick off workshop aimed at building hypothesis that will be tested, validated and reshaped, throughout the journey. Ipsos has developed the Client First initiative to always start from the business context, for every project. It helps us and the client to focus on the business need in terms of growth the client wants to accomplish, the changes they want to make in their strategy, the challenges they want to overcome, etc. In the end, this will also help us, to understand why the client needs the U&A, how this project needs to inform and help them in their strategy. More practically: it will help us be specific in our reporting writing. It prevents us from making lengthy reports. It helps us to be to the point.

It Uses A Modular & Flexible Approach Which Allows For Incremental Decision Making

Ideally, we don't start from a big, one shot survey that takes months to complete, analyse, report and deliver. Rather, we use a modular and interactive approach. As such, insights come in incrementally and faster than with the traditional mega survey approach.

The Process: A Journey

A U&A is a journey. We should never consider a U&A a research project on its own. In this deconstructed, iterative flow, we should have regular working sessions with the client to debrief, reshape the hypothesis and needs. Such a collaboration will ensure incremental insights and it will allow for follow up deep dives where needed. The key element in here is the in-between discussion with the client to reflect if the defined next step is still the right one to gather the relevant information for the client to define next steps. The whole process is, as mentioned above, hypothesis driven and should be able to deliver higher actionability

Increased Validity Of (Core) Survey Results By Using Mobile Friendly - Device Agnostic Surveys

- Each step has a clear focus to address a specific well defined business need.

- But also within each step, very specific information needs can be defined that will help address the business challenges. If a question from the brief does not clearly connect to the main business challenge, it could be skipped: it is a nice to have. This will help us create focus and a shorter questionnaire. Every question should have a very specific purpose.

- Hence, the survey length can be limited to a maximum of 15 mins, so we avoid the issues with long questionnaires described above with many nice to have questions. We should only ask questions that are key to the business objective.

- We survey respondents on the device they want, allowing both for interviews on a mobile and PC. As a result, we can now fully reach certain target audiences which are difficult to survey on PC only (e.g. young adults, mothers with babies, and ethnic groups).

- Mobile phones allow us to gather information 'in the moment' and use pictures and videos to enrich the insights

Data Agnostic

- We take advantage of structured as well as unstructured data (both open ends coming from the survey as well as social intelligence)

- The deconstructed U&A should always apply approaches with best fit for the respective hypotheses (e.g. using pop-up communities, diaries, panels, …)

- The goal is to use any other type of data that can bring the right insights (social listening, ethnography, market data, etc.)

Use Of A Clear Analytical Framework And Targeted (Advanced) Analytics

Traditional U&A's are often only descriptive in nature. The reason for this is: there is a lack of purpose for many of the questions asked. This lack of clear objectives, as mentioned before, often lead to a “kitchen-sink” approach. And, as many questions lack a purpose, we resort to reporting each question separately without a structure. In our point of view, each question asked, should connect with a specific business or research question, that connects in turn with a clear business objective.

Only when we have a clear purpose for each question, we can follow a clear path for analysis. Where needed advanced analytics can unlock the best insights from the data.

Enhanced U&A

Ipsos’s unique plug-in modules bring deeper and more nuanced insights to U&A’s.

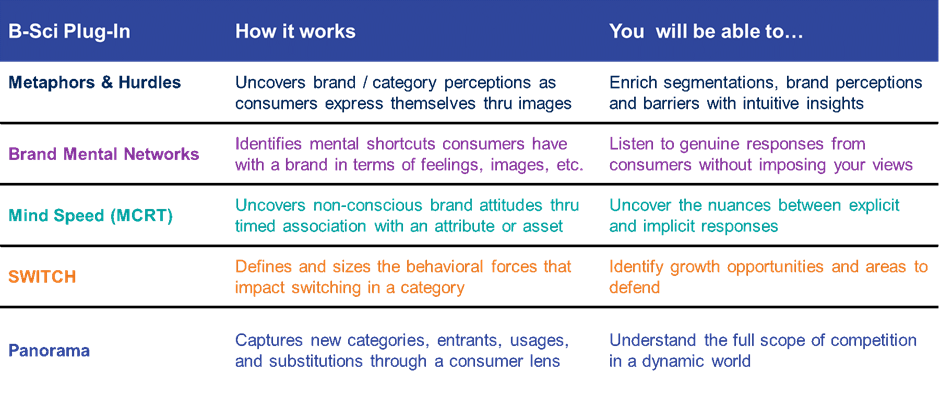

- B-Sci Plug-Ins

Infuse behavioural science techniques into your U&A to uncover insights about what consumers really think about your brand and category

- Insight Plug-Ins

Insert micro-surveys into your U&A to learn how consumers are responding to today's challenges (inflation, sustainability, evolving needs)

![[Webinar] Global Voices of Experience 2026 - Ipsos](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/global-voices-of-experience-carousel.webp?itok=BEAGdhsC)