The Rise of the Conscious Shopper

KEY TAKEAWAYS:

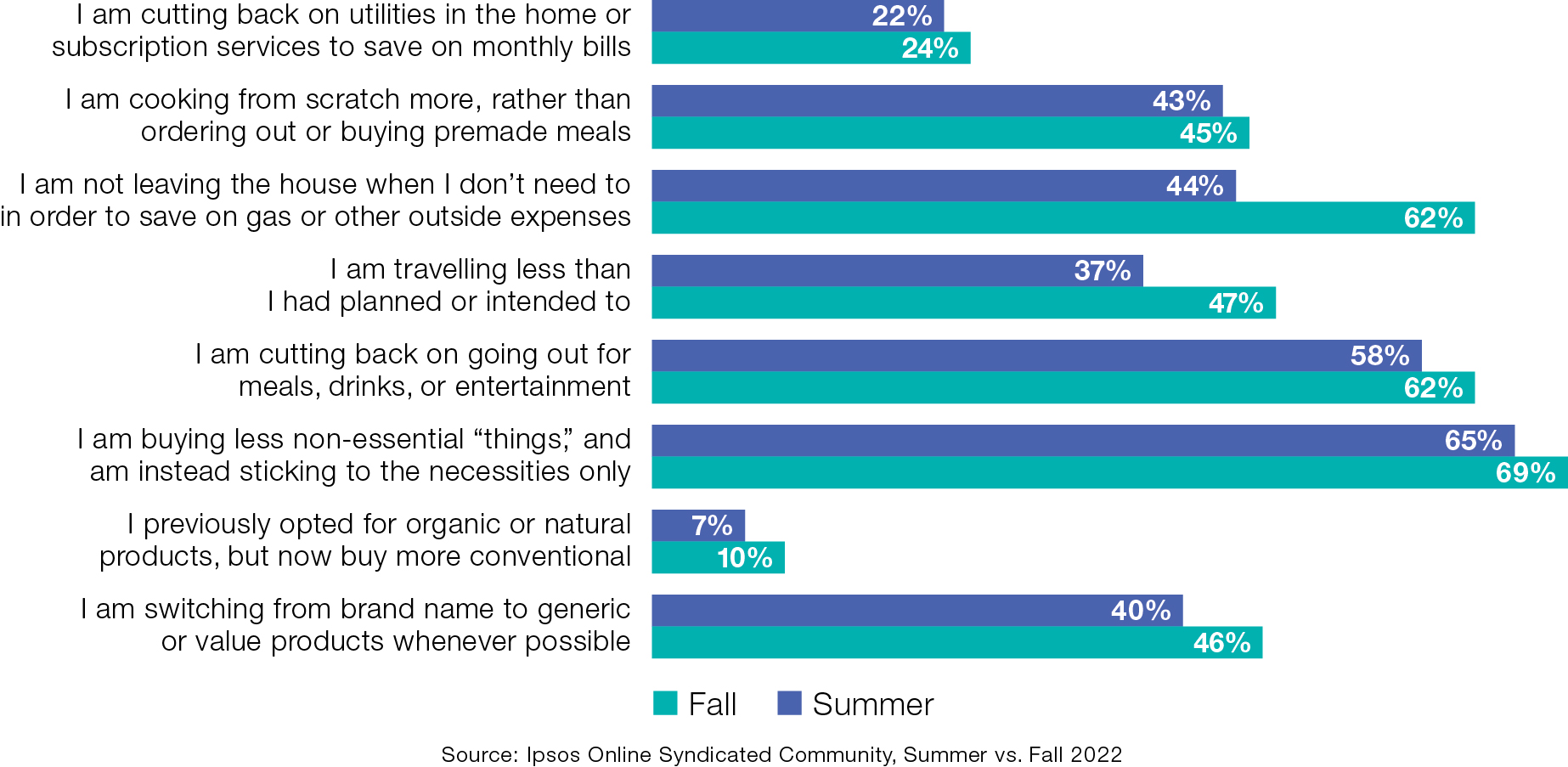

- Aside from cutting back on travel, which saw a 10% decrease in likelihood, most cost-saving habits consumers have adopted in recent years are likely to persist in the new year.

- With half personally accepting that we are currently in a recession, consumers are prioritizing making purchases with cash and are focused on managing credit card balances and savings levels.

- This belief, along with rising costs, has brought forth a sense of responsibility among consumers to be more conscious when shopping—with many adopting a “need vs. want” mentality and 65% continuing with the intention to buy less non-essential items.

Despite a lack of official confirmation from the government or media, 50% of Ipsos online community members feel we are currently living in a recession.

After continuously making sacrifices due to the COVID-19 pandemic and rising inflation, many believe these patterns will persist as they look ahead in 2023. In a recent Ipsos online community study, consumers say they are taking more of a long-term view towards their finances and spending habits. This includes reducing spending on discretionary purchases, prioritizing paying with cash over credit, striving to increase savings, and paying down credit card balances, all in preparation for a recession.

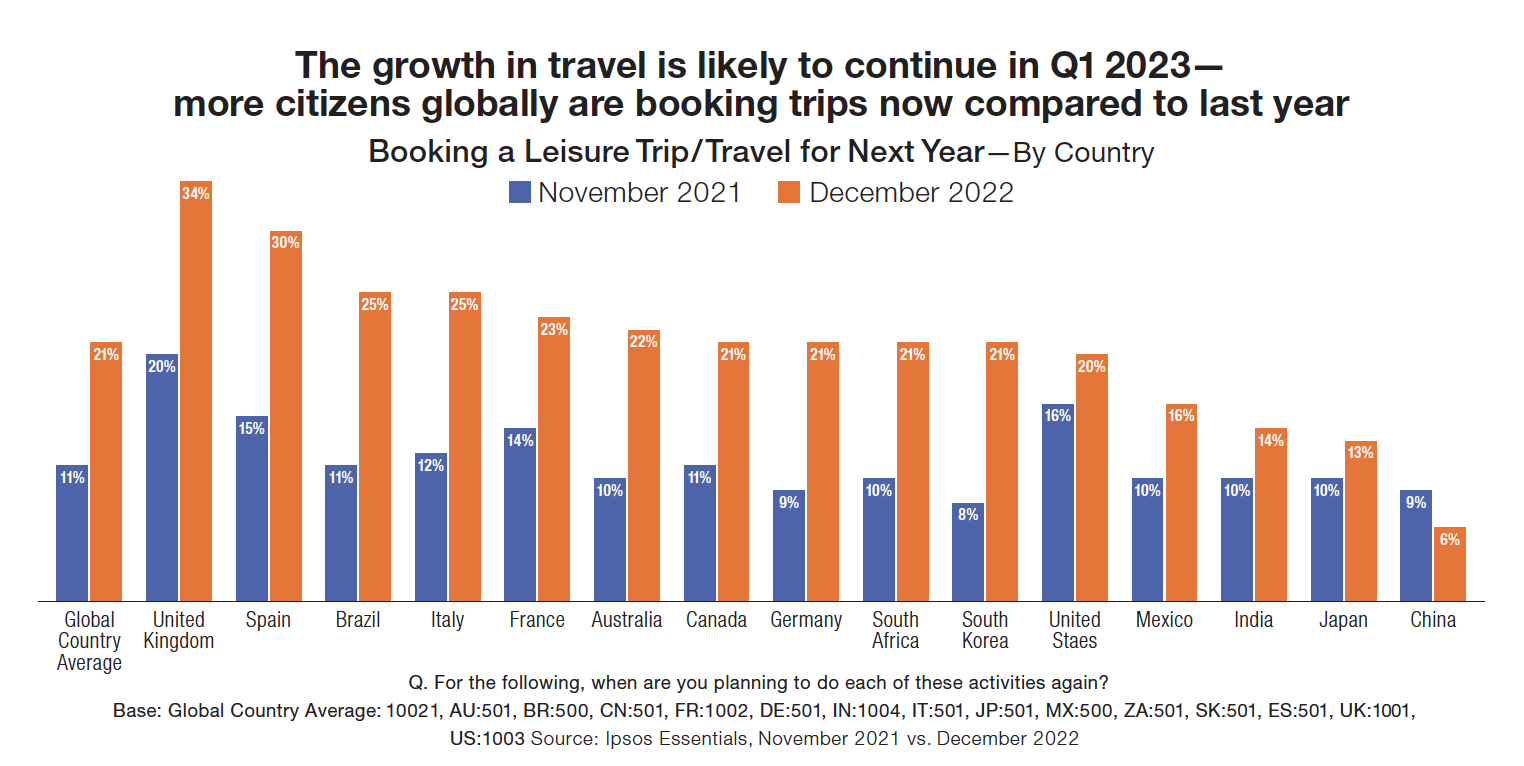

These conditions point to the continuation of many cost-mitigating behaviors from 2022, aside from a couple key exceptions—travel and experiences. Additionally, with consumers taking a more long-term view, we’re also seeing signs they are willing to invest in products and services that support their future goals—this includes seeking products that are higher-quality, longer lasting, and those that benefit their physical or mental health.

The triple threat of COVID, inflation, and prospects of a recession have caused financial disruption for many and have resulted in a decline in consumer confidence levels and signs of settling in for the long haul. Spending on travel and experiences are notable exceptions.

Alongside declining consumer confidence levels in the U.S., Ipsos online community members believe most of their cost-saving behaviors from the summer will continue, aside from cutting back on travel. Specifically, compared to the summer of 2022, they feel they are less likely to hold back on taking trips outside the home or making travel plans. After living through years of lockdowns and restrictions, they say travel isn’t something they are willing to give up in 2023.

This stems from a belief that staying vigilant in protecting their financial status in 2023 will ultimately pay off in memories and stress relief achieved by prioritizing these experiences.

“I plan to continue spending more on these categories (experiences and travel) in the next year, because I think the memories are worth it more than physical goods. My goal is to travel to three new places in the coming year.”

—Ipsos Online Community Member

“I have started saving more for experiences instead of things. I think that I will really start saving more for the future to reach my financial goals.”

—Ipsos Online Community Member

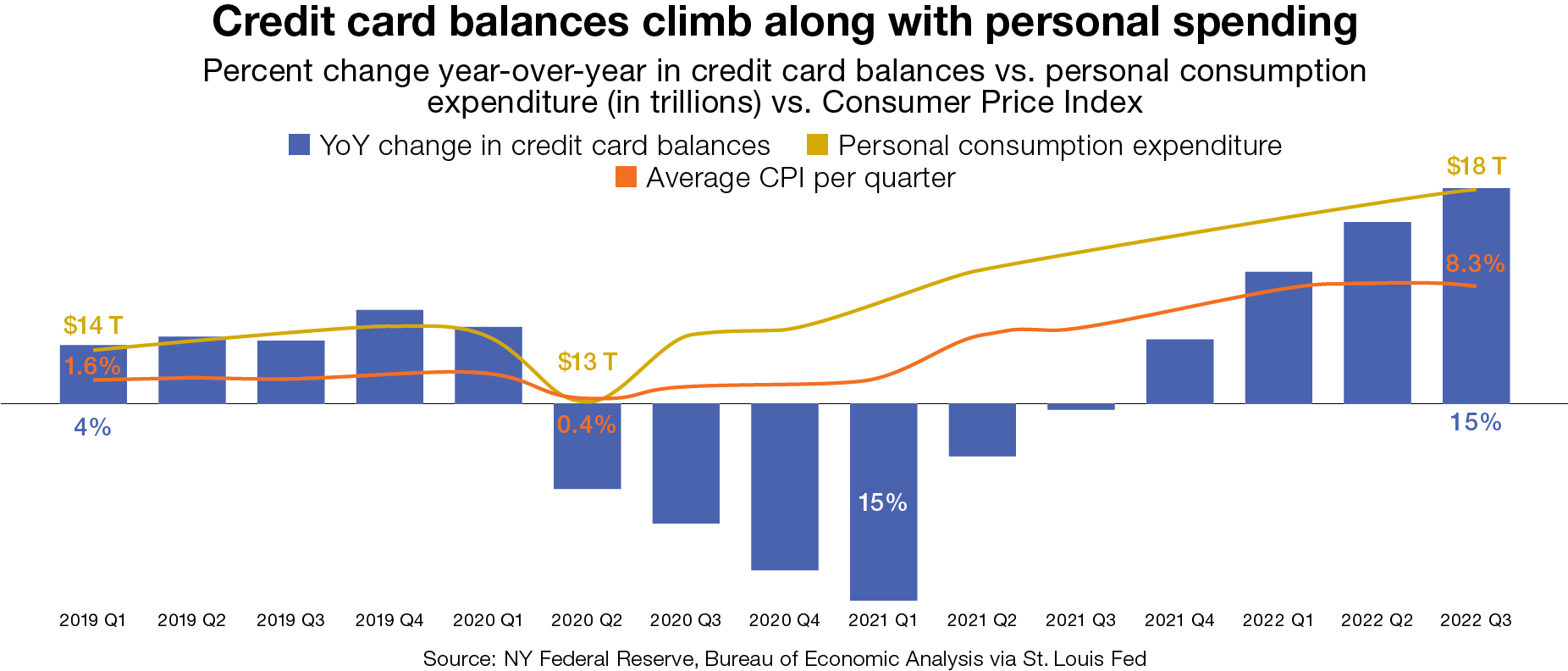

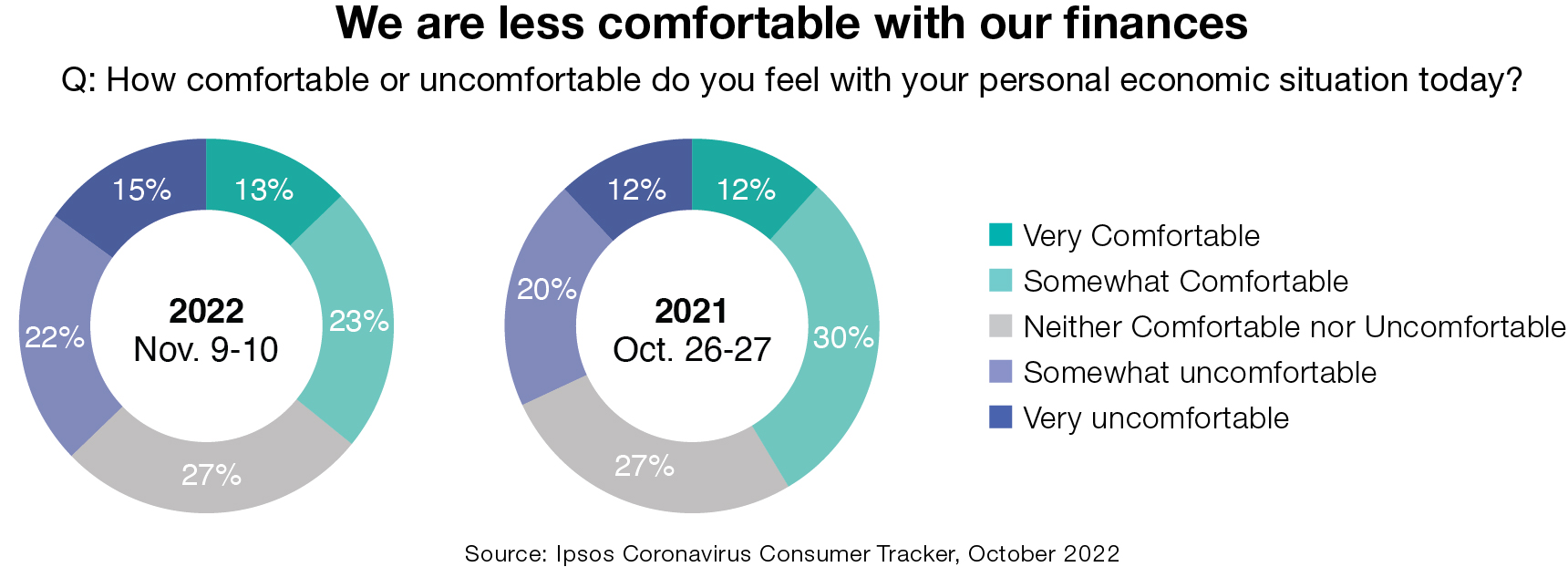

Comfort levels for their personal economic situation have declined for many. Meanwhile, personal spending and credit card balances were up at the end of 2022, causing people to think more stringently about how and what they plan to buy in 2023.

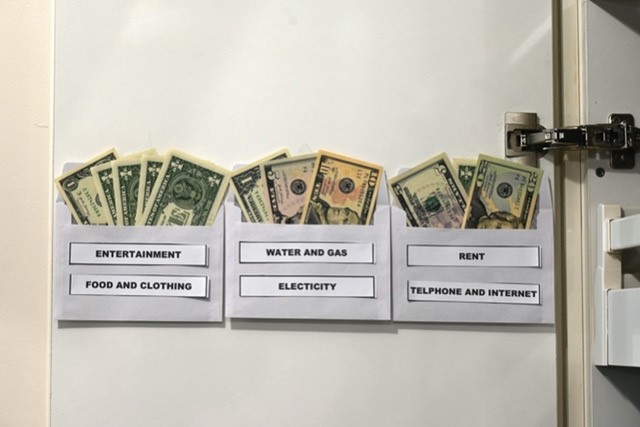

In preparation for a recession, Ipsos online community members say they will prioritize making purchases with cash, when possible, along with being more mindful of paying down credit balances and increasing their savings. For some, this means waiting until they have cash to make purchases or adopting habits like cash-stuffing, recently made popular on TikTok, which is placing money budgeted for different spending categories in envelopes.

“Already am thinking about money differently and will be for a while. Even when he does get a new job, we want to replace what we’ve used out of savings and pay down the credit cards we have needed to use.”

—Ipsos Online Community Member

“My feeling about and relationship to money has definitely changed. I am much more careful in buying. I’ve moved from paying for most things via credit card to only making a purchase when I have the cash to pay for it.”

—Ipsos Online Community Member

While 44% say their non-essential spending has remained the same, 35% state a decrease in such purchases. Items deemed “non-essential” are at a higher risk for impact as consumers say they are much more conscious while shopping, leading with a “need vs. want” mentality.

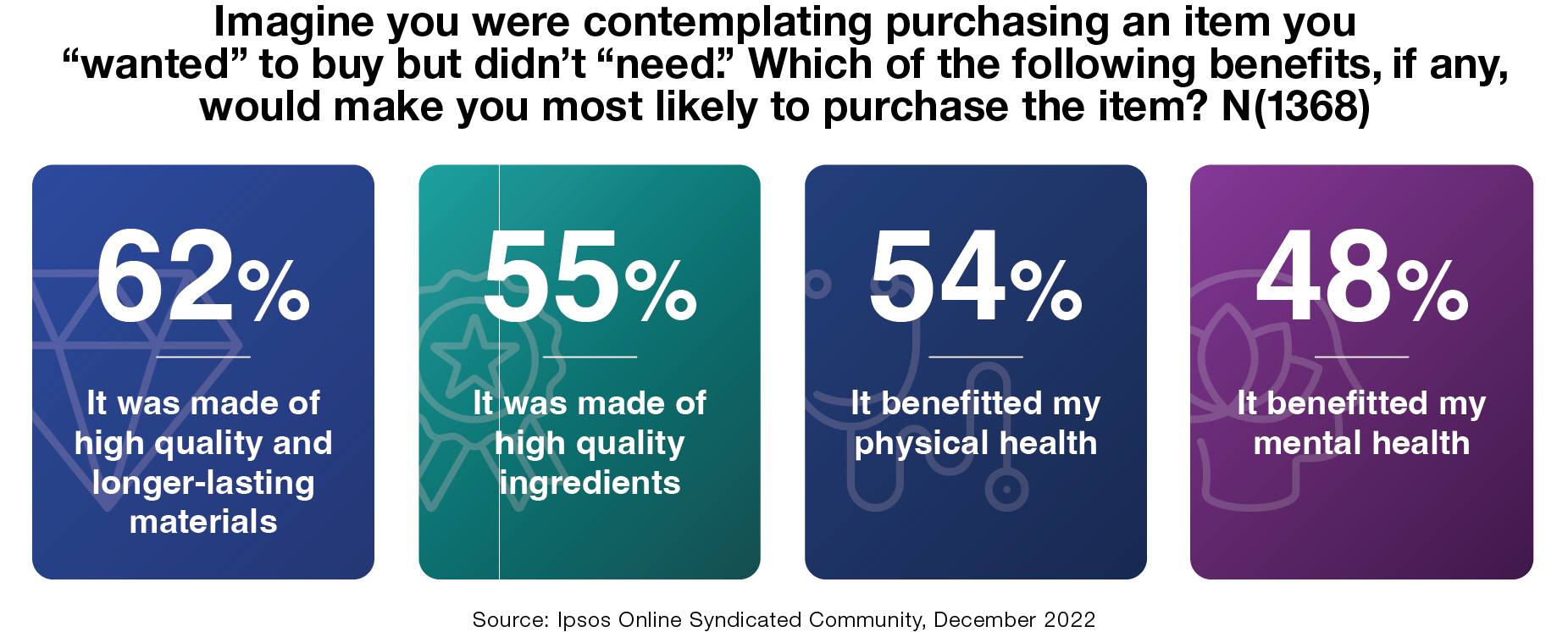

This mindset shift has led to less impulse buys and more attention on the benefits their purchase provides. Consumers are especially mindful of the long-term benefits an item could provide, which can quickly shift a purchase from a “want” to a “need.” Indeed, only 7% stated they couldn’t be convinced to make a purchase even if it offered a long-term benefit.

Some frequently mentioned examples of long-term benefits include items that are made with high-quality materials that last longer, and those that benefit their health, both physical and mental. Feeling good about a purchase long-term versus something that only provides temporary satisfaction is more top of mind these days, according to our community members.

“I find that I’m a more cautious shopper now. I’m shopping when I need to, not because I want to. And asking myself “do you really need this?” I have always loved to shop for clothes and shoes, but I have so many items that I’ve worn only once or twice and some not at all (due to working remotely and social distancing during the pandemic) that now when I see sales and items I want, I’m not being so impulsive!”

—Ipsos Online Community Member

“I have become more conscious and mindful of my purchases, especially unnecessary ones. Yes, I will continue to consider my purchases and think about my long-term goals rather than short-term pleasures and weigh the options.”

—Ipsos Online Community Member

WHAT’S NEXT:

- Market towards longer-term views and less on instant gratification. Specifically highlight benefits tied to quality materials, longevity, and aiding in their physical and mental health.

- Knowing travel and experiences are priorities, communicate similar benefits such as lasting memories, intangible happiness, and stress relief.

- Keep a close eye on unemployment rates and consumer debt as these could greatly impact evolving spending habits in 2023.

- Join us for our live webinar exploring this topic further on February 7

“In these times of inflation and during the pandemic, we’ve had more time to think about our finances and we’ve observed an increase in our savings and less on our “wants” and “needs.” While I’ve always been debt-free, I did have the habit of making impulse purchases and that’s certainly behind me. I’m focusing more on the future.”

—Ipsos Online Community Member