Cliff’s Take: To Ease Up or Not to Ease Up?

I now find myself in the seventh week of self-isolation. My hair is much longer; eyebrows crazier; and how I miss my porter beer from my favorite DC bar. Many of you I assume feel the same. Indeed, 92% of Americans, according to our own polling, are like me and social distancing.

The huge debate right now is whether we should open things up sooner or later. Trump and his administration have been all over the map on this key issue. Some states like Georgia, South Carolina, Tennessee, Texas and Florida have already begun to ease up restrictions contrary to federal guidelines. Others are holding to the administration’s own rules—only easing up after two weeks of reported COVID-19 decline.

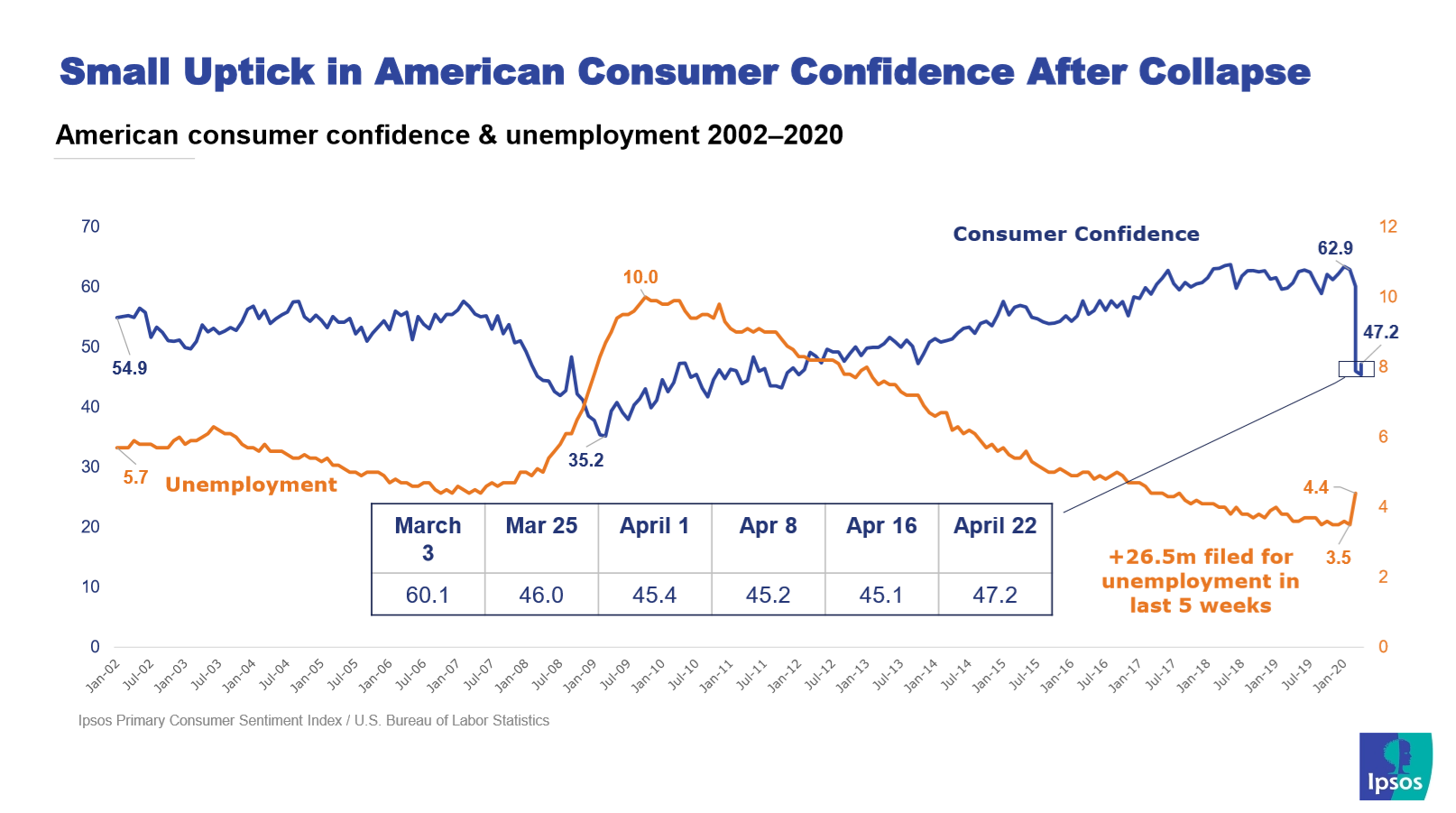

- Consumer confidence holding in the mid-40’s BUT storm clouds on the horizon. After a precipitous decline in consumer confidence five weeks ago, it has been holding steady. I still believe that our indicator is not fully capturing the economic angst out there. Indeed, we have more than 26.5 million unemployment claims and still have not reached the nadir of our time series at 35 points during the darkest period of the Great Recession. And approximately 40% of Americans believe that the economy will rebound quickly after easing up. Are we in for a big let down when the uptick is slower than expected? Let’s see.

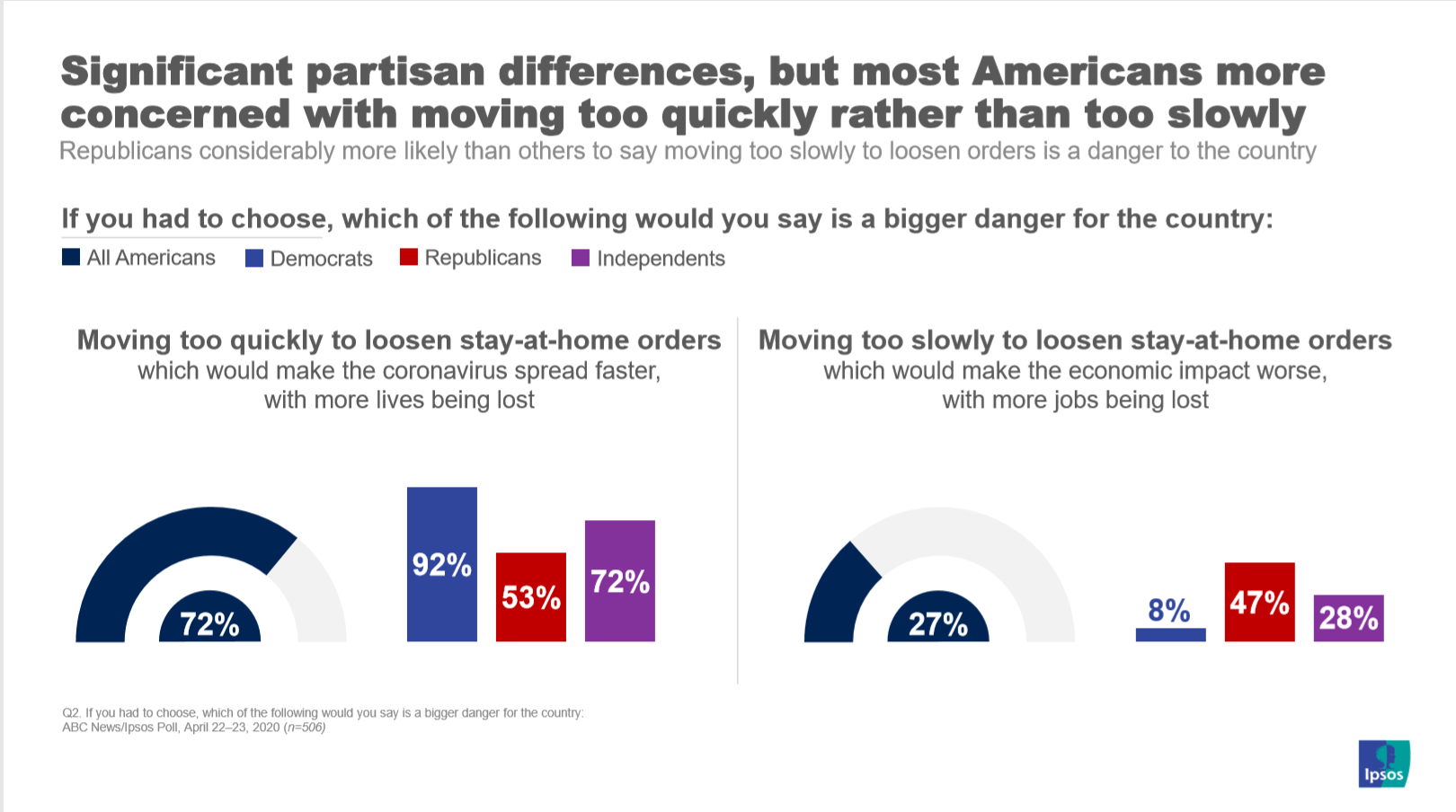

- To ease up or not to ease up? In our recent ABC-Ipsos poll, a strong majority of Americans (72%) believe that we are moving too quickly in easing “stay at home” orders. That said, there is still a very stark partisan divide here: Democrats 92% versus Republicans 53%. Interestingly, maybe there is some "method to the madness" of Republican governors in opening up things right now?

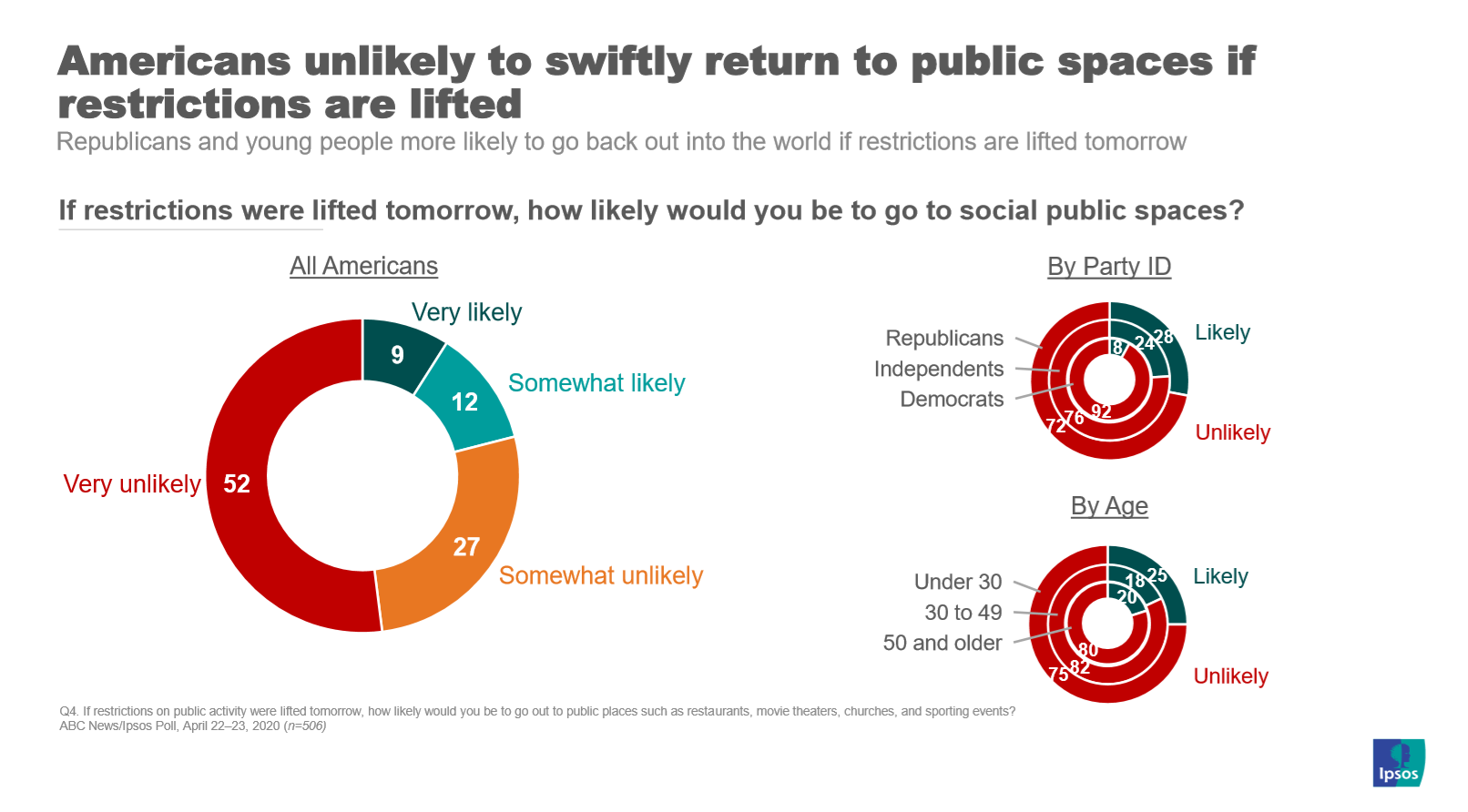

- America cautious even after things are eased up. Americans (79%) are extremely cautious about exposing themselves to physical space when restrictions are lifted. There are some differences by partisan persuasion and age. Even so, there still is supermajority caution across all demo cuts. In my mind, this is a possible leading indicator of a slow recovery as the health crisis may leave an indelible imprint on our decision-making calculus.

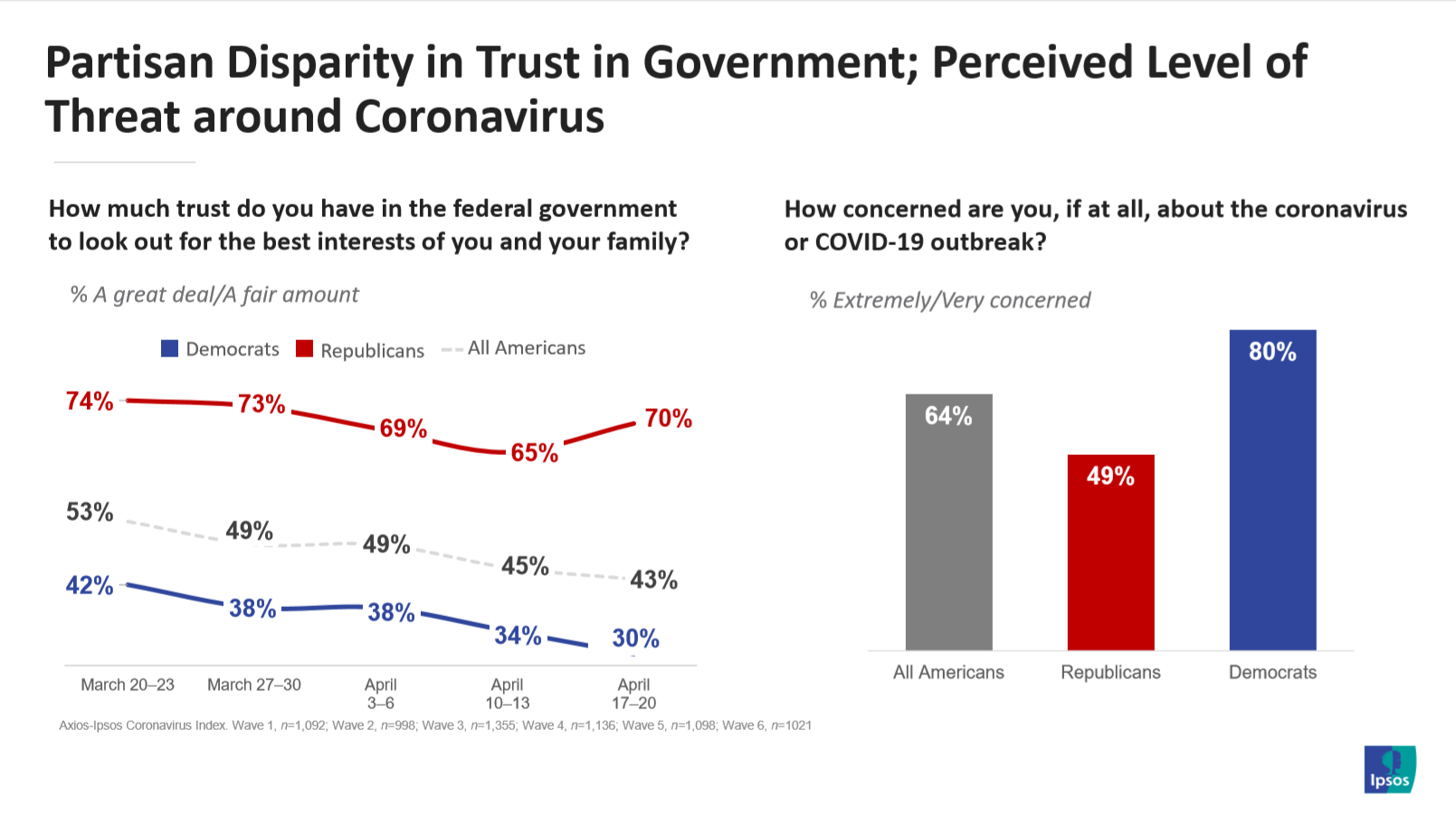

- Partisan division persists in our COVID-19 World. One of the most notable empirical facts of the Trump era is the profound partisan divide we see across multiple policy domains. This tribalism replicates itself in our COVID-19 world. Republicans see the pandemic as less of a risk than Democrats. And they also trust the federal government more to look out for their best interests compared to their fellow Democrat and Independent countrymen and women. Why? As quoted in Axios, “This is an example of tribalism and two very different narratives about the same facts.”

-

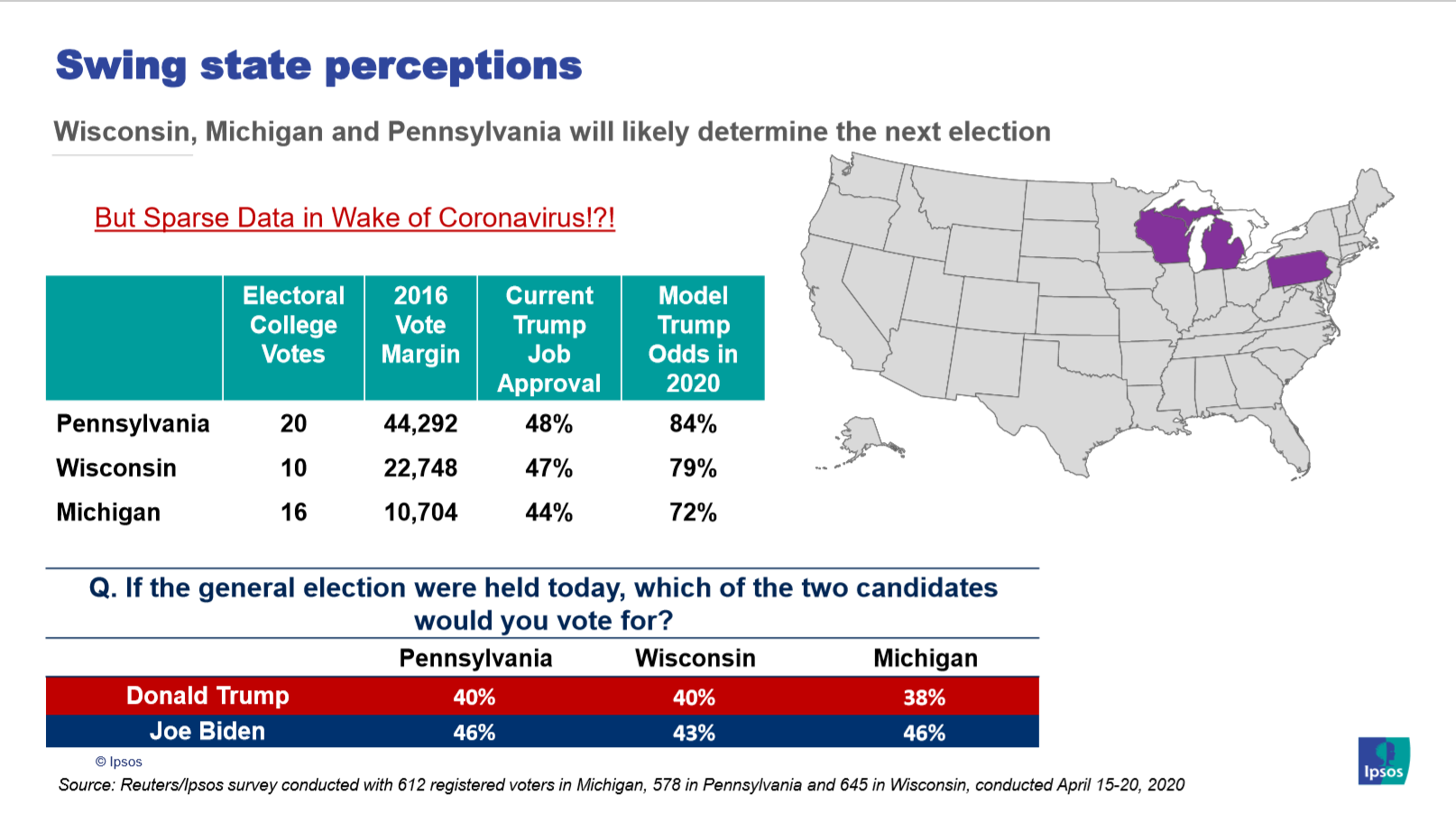

Contradictory indicators in key swing states. In my mind, the 2020 US presidential election depends on three states: Michigan, Wisconsin, and Pennsylvania. Trump won these states in 2016 and, with them, the White House. Recent Ipsos polling in these three states tell a contradictory tale. On the one hand, Biden leads Trump in all three in our horse race polls. The caveat here is that we are looking at registered, not likely, voters right now and are six months from election-day. Horse race polls are fuzzy at best today. On the other, Trump has solid approval numbers in each of these states. As I often say, approval ratings are the best leading indicator of electoral success—a sitting president at or better than an approval rating of 40% has a greater than 50/50 chance of winning the next election. So, in my mind, it is a wash—we are in a 50/50 election leaning a bit to Trump right now. But the unfolding COVID-19 economic calamity could change this scenario. We will see.

Take a look at my most recent Ipsos webinar “Ask us Anything: Adaptation to the Time of the Coronavirus” or most recent interview with Tim Farley for a good synthesis of my views on the present state of affairs. Again, stay safe and healthy.

For more information, please contact:

Clifford Young

President, U.S.

Public Affairs

+1 202 420-2016

[email protected]

About Ipsos

Ipsos is now the third largest market research company in the world, present in 90 markets and employing more than 18,000 people.

Our research professionals, analysts and scientists have built unique multi-specialist capabilities that provide powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data coming from our surveys, social media monitoring, and qualitative or observational techniques.

“Game Changers” — our tagline — summarizes our ambition to help our 5,000 clients to navigate more easily our deeply changing world.