The Future of Money: Financial Services in a Digital World

As part of the 2016 Future of Research Series, Ipsos brought together a panel of experts from across the industry to discuss how they are adapting to the future of money.

The world of money is changing ever faster

Are we at a tipping point? The sector seems on the verge, what about consumers?

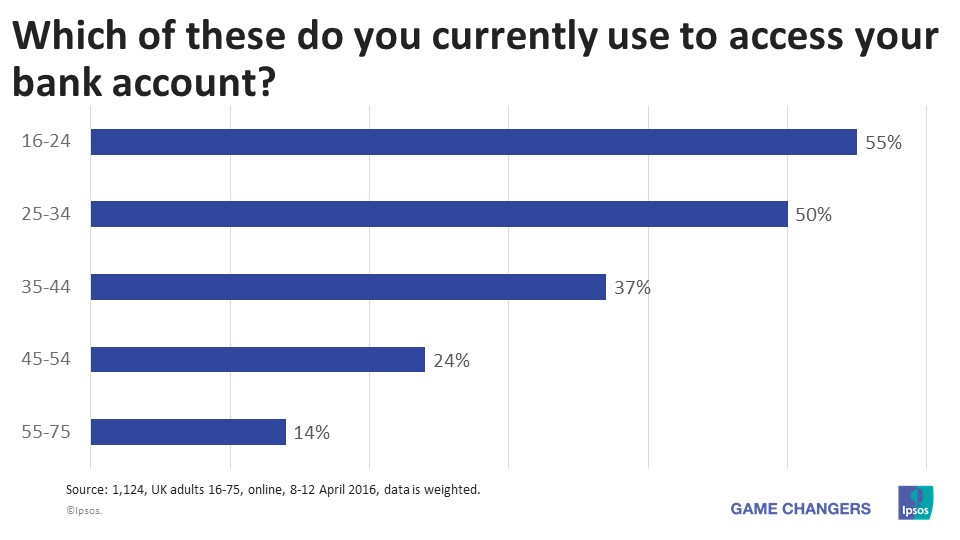

Especially for the next generation, 55% of the 16-24 year-old use their mobile personal banking to access their bank account.

Open API, a major facilitator?

Attractive even with a general benefit, 39% feel positive about data sharing.

Utility trumps security, 74% of those who say willing to pay extra for a service or a product to keep their details private havn't increased their privacy setting.

Money is mobile proposition:

- allow you to see a full picture of your personal finances in one place,

- be updated in real time,

- show all your financial products and services from different providers,

- present the information in an easy way to understand,

- allow you to manage money between accounts.

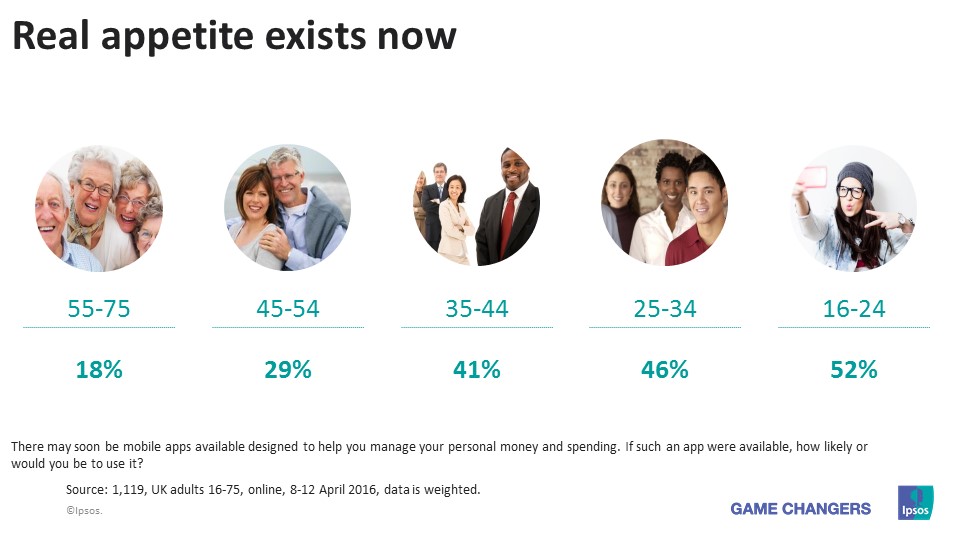

Real appetite exists now, 52% of the 16-24 year-old and 46% of the 25-34 year-old would likely use mobile apps designed to help them manage their personal money and spending.

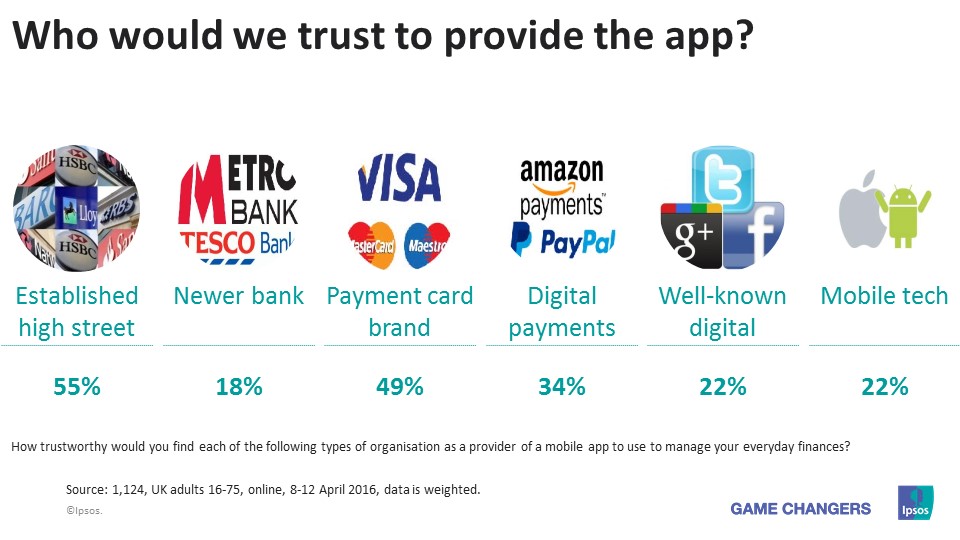

Who are the credible providers?

83% are confident about using established high street such as HSBC to help them manage and control their everyday personal finances and 80% are confident about using payment card brand.

Who would we trust to provide the app?

A little look into the future

Will we need branches?

In the year 2020, 35% think that their main bank account will be with an online-only bank (with no branches).

New products on my mobile?

In the year 2020, 41% think that they will have opened an account or purchased a financial product using just their mobile phone or tablet.

Is cash dying?

In the year 2020, 26% think that they will no longer carry any cash and 17% think that shops and retailers will have stopped accepting cash.

Have cards had their day?

In the year 2020, 31% think that they will be making payments using their mobile phone and have stop carrying plastic payment cards.

![[LinkedIn Live] Ipsos Global Trends: The Workplace Edition](/sites/default/files/styles/list_item_image/public/ct/event/2024-11/ipsos-global-trends-workplace-edition-thumb.jpg?itok=wucV_Pn4)