How Millennials Of The USA Will Shape Tomorrow's Payments Landscape

Ipsos was commissioned by VocaLink to conduct research across eight countries in order to understand how new technology and social media influences the lives of millennials. In this paper we explore trends in millennials’ current payment behaviour and look at how millennials see payments operating in the future. This initial paper focuses on US millennials, but subsequent publications will assess the attitudes of millennials in Europe and South East Asia and what this means for the next generation of payments.

The dramatic spread of mobile phone technologies around the world, in both developed and developing economies, and the rapid pace of development in the payments industry, prompt some important questions: how do millennials pay for goods and services? Why do they choose these methods? And, how do they see behaviours and preferences evolving as technology advances?

So, we set out to research how millennials are using the payment technologies and methods currently available to them.

Millennials and their tech

It should come as no surprise to anyone that millennials and mobile technology are inextricably linked: where one goes, the other follows. But we wanted to take a closer look at precisely which devices millennials are using, before going on to look at what they use them for:

- 98% use a smartphone

- 80% use a PC/ MAC

- 57% use a tablet

- 20% use a wearable

Social millennials

Millennials are the first truly digitally connected generation and they have embraced social media enthusiastically – to the extent that it has become an integral part of their daily lives.

- 78% of millennials use Facebook at least once a day

Millennials and their money

Our core purpose in conducting this study was to understand how millennials like to move their money, within the context of evolving financial technologies and an ever-more digitally connected world.

- 48% - nearly half of US millennials send international payments

- 60% of entrepreneurial millennials currently sell items online

- 87% have deposited a check in the last three months

How millennials like to pay

- 30% of those who pay for cabs use mobiles to pay

- 48% send international payments

- 84% pay for everyday eating out/drinking on card VS 44% using cash

How millennials like to be paid

When it comes to receiving money, there is equal complexity and nuance, with each transaction type telling its own tale.

- 45% of working millennials receive their salary by bank transfer / online banking

- 31% of working millennials receive their salary by check

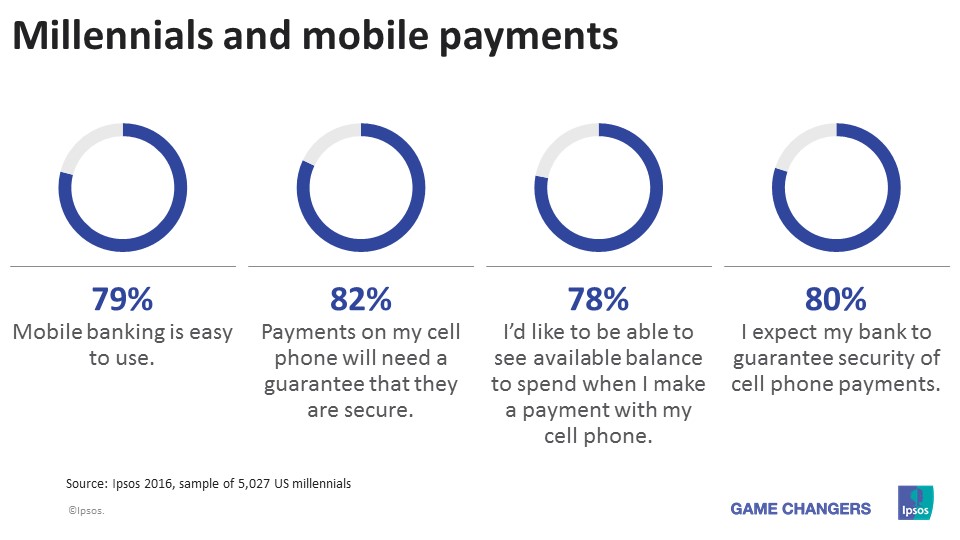

Millennials and mobile payments

Having looked at millennials’ financial behaviours and how they make and receive payments we wanted to take a closer look at their perceptions and use of the latest wave of payments technology – mobile payments, starting with which platforms they have heard of and which ones they actively use.

Millennials and the future

Instead of using a signature or pin, which would you prefer to verify your payments?

- 67% use fingerprint to pay using cell phone

- 67% use fingerprint to pay using payment cards

- 58% use eye scans to pay

- 47% use facial recognition to pay

- 46% use voice to pay

Design for life

As we have seen, concerns over security are one of the major obstacles to the adoption of mobile payments.

![[LinkedIn Live] Ipsos Global Trends: The Workplace Edition](/sites/default/files/styles/list_item_image/public/ct/event/2024-11/ipsos-global-trends-workplace-edition-thumb.jpg?itok=wucV_Pn4)